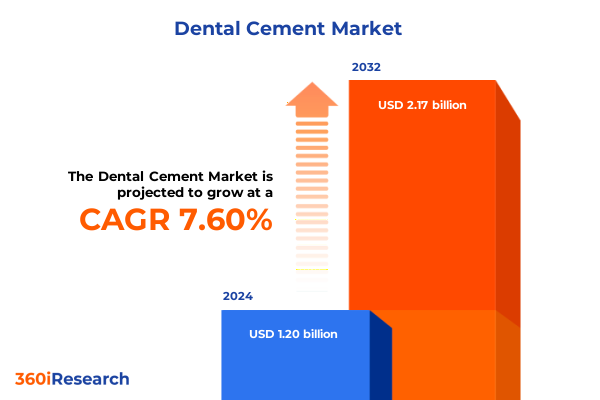

The Dental Cement Market size was estimated at USD 1.29 billion in 2025 and expected to reach USD 1.39 billion in 2026, at a CAGR of 7.66% to reach USD 2.17 billion by 2032.

Emerging dynamics of the dental cement market driven by technological advancement and evolving clinical practices shaping future opportunities

The dental cement market stands at the confluence of clinical necessity and technological innovation. In recent years, the demand for advanced restorative materials has surged as dental professionals seek solutions that deliver superior adhesion, marginal integrity, and biocompatibility. Growing patient awareness of oral health, coupled with increasing adoption of minimally invasive techniques, has further elevated the role of dental cements in everyday clinical practice.

Simultaneously, demographic shifts such as the aging global population have expanded the pool of patients requiring crown and bridge procedures, implant restorations, and other cement-retained applications. These drivers have been amplified by expanding insurance coverage in key regions and rising disposable incomes in emerging markets. As a result, manufacturers are under pressure to innovate and diversify their product portfolios, balancing cost-effectiveness with enhanced performance.

Amid these dynamics, the ongoing integration of digital dentistry workflows has introduced new expectations for material compatibility with CAD/CAM and 3D printing technologies. Dental cement formulations are evolving to meet the precision demands of digital impressions, offering customized viscosities and curing profiles that align with automated milling and printing processes. This introductory overview sets the stage for understanding how market participants are positioning themselves at the intersection of clinical requirements, patient preferences, and emerging technological trends.

Revolutionary trends reshaping the dental cement sector through digital restorations, sustainable formulations, and evolving patient care paradigms

The dental cement landscape is being reshaped by a series of transformative trends that extend well beyond incremental formulation improvements. Among these, the integration of nanotechnology has enabled the development of cements with enhanced mechanical properties and sustained release of therapeutic ions, offering clinicians materials that actively contribute to remineralization. Such bioactive formulations are redefining the cement category by merging passive bonding functions with proactive tissue support.

Parallel to material innovation, sustainability has become a core strategic priority. Suppliers are exploring eco-friendly packaging, reducing volatile organic compound emissions, and sourcing bio-based monomers to align with broader environmental goals. In turn, dental practices are seeking solutions that support green dentistry initiatives without compromising clinical outcomes.

Digital dentistry continues to exert a powerful influence on product design. Resin-based cements tailored for seamless integration with intraoral scanners and milling machines are gaining traction, while dual-cure options are optimized for compatibility with light-curing workflows. This digital alignment is accelerating chairside productivity and improving predictability in restoration longevity.

Finally, shifts in patient expectations toward faster treatment times and minimally invasive approaches are driving demand for self-adhesive cements that simplify steps and reduce procedural complexity. Collectively, these converging trends-from bioactivity and sustainability to digital compatibility and procedural efficiency-are charting a new course for the sector’s next phase of growth.

How United States tariffs enacted in 2025 are collectively reshaping dental cement supply chains, cost dynamics, and domestic manufacturing priorities

In 2025, the United States implemented additional tariff measures targeting specific raw materials and finished dental consumables, heightening cost pressures across the supply chain. These duties, imposed as part of broader trade policy adjustments, have affected critical inputs such as fluoroaluminosilicate glass powders, resin monomers, and zinc-based compounds. As import levies rose, manufacturers faced elevated input costs that have been transmitted through distribution channels, leading to modest price increases for end users.

The cumulative impact of these tariffs extends beyond headline price shifts. Supply chain volatility has intensified, prompting companies to seek alternative sourcing strategies. Some have negotiated longer-term contracts with domestic suppliers, while others are investing in regional manufacturing hubs to mitigate exposure to cross-border duties. This realignment has fostered a renewed emphasis on supply security, with several market participants announcing capacity expansions at U.S.-based production facilities.

Furthermore, smaller producers with limited hedging capabilities have encountered tighter margins, accelerating consolidation activity as they pursue partnerships or acquisitions to achieve scale efficiencies. In response, larger conglomerates are leveraging their global footprints to balance duties through diversified procurement strategies and localized logistics solutions.

Looking ahead, the interplay between tariff regimes and raw material availability is set to influence research and development priorities. Manufacturers are exploring substitute chemistries that are less susceptible to trade fluctuations, while regulatory bodies continue to monitor potential downstream impacts on patient access and treatment affordability.

Critical segmentation insights revealing how product type, material composition, formulation, application, end users, and distribution channels drive dynamics in the dental cement landscape

Segmentation analysis reveals nuanced performance drivers across multiple dimensions of the dental cement market. When considering the fundamental division between Permanent and Temporary types, the Permanent segment dominates due to its extensive use in definitive restorations. Meanwhile, Temporary cements continue to hold strategic importance for provisional applications, driven by growing adoption of staged treatment protocols that prioritize controlled adhesion and easy cleanup.

Material-based differentiation offers further insight into market behavior. Glass Ionomer Cement maintains a strong presence, particularly in pediatric and preventive dentistry, with its capacity to release fluoride and bond chemically to tooth structure. The subdivision into Type I (restorative), Type II (luting), and Type III (liner/base) reflects its versatility. Resin-Based Cements are gaining share, especially in implantology and all-ceramic restorations, supported by advanced formulations in Conventional and Self-Adhesive categories. Polycarboxylate Cements, though mature, retain a niche in biocompatibility-oriented procedures. Zinc Oxide-Eugenol Cements continue to serve as a go-to for temporary dressings, with Type I and Type II variants accommodating different viscosity and working-time requirements. Zinc Phosphate Cements persist in legacy markets, with Fine Grain and Medium Grain options preferred for their long-standing clinical performance.

Beyond composition, Product Form-Liquid versus Powder-affects handling and customization, with premixed liquid formulations emerging to streamline chairside procedures. Application-based use cases span cementing crowns and bridges, luting agents for inlays and onlays, pulp protection liners, surgical dressings, and temporary restorations, each requiring tailored viscosity, setting time, and biofunctionality.

End users range from academic and research institutes driving fundamental innovation, to high-volume dental clinics and hospitals where operational efficiency and cost management are paramount. Finally, Distribution Channels-Offline versus Online-illustrate a shift toward digital procurement platforms, offering practices improved access to specialty products, while traditional wholesale networks maintain their role in rapid replenishment and personalized service.

This comprehensive research report categorizes the Dental Cement market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Product Form

- Application

- End User

- Distribution Channel

Regional performance analysis highlighting varying growth trajectories, adoption patterns, and regulatory influences across the Americas, EMEA, and Asia-Pacific dental cement markets

Regional analysis underscores divergent growth patterns and market dynamics across the Americas, EMEA, and Asia-Pacific. In the Americas, robust healthcare infrastructure, high per capita dental expenditure, and widespread adoption of advanced restorative procedures have established this region as a mature yet steadily expanding market. Regulatory harmonization within North America, combined with sizable insurance coverage, supports consistent demand for innovative cements, especially those aligned with cosmetic dentistry trends.

Across Europe, Middle East & Africa, market performance is influenced by heterogeneous regulatory environments and varying healthcare access. Western Europe leads in premium product uptake, driven by stringent quality standards and a strong emphasis on minimally invasive treatments. Conversely, parts of the Middle East exhibit rapid investment in dental infrastructure, while segments of Africa address basic access challenges. Collectively, EMEA’s trajectory is shaped by a blend of high-value markets and areas prioritizing affordability and capacity-building.

Asia-Pacific stands out as the fastest-growing region, propelled by rising disposable incomes, government initiatives to improve oral healthcare access, and a burgeoning private practice sector. Markets such as China and India are witnessing significant clinic expansions and consolidations, driving volume demand for both permanent and temporary cements. Furthermore, increasing dental tourism in countries like Thailand and Malaysia serves as an additional catalyst, attracting international patients seeking cost-effective restorative services.

The interplay of regional reimbursement schemes, regulatory approvals, and infrastructure development continues to redefine competitive landscapes. Stakeholders are tailoring market entry and expansion strategies to align with local growth drivers, ensuring product portfolios and marketing approaches resonate with the distinct needs of each region.

This comprehensive research report examines key regions that drive the evolution of the Dental Cement market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive intelligence spotlighting leading dental cement manufacturers’ strategic initiatives, innovation pipelines, and partnerships shaping competitive positioning

A handful of global manufacturers and specialized regional players dominate the competitive arena with distinct strategic priorities. One industry leader has pursued extensive acquisitions to complement its adhesive dentistry portfolio, leveraging cross-selling opportunities to bolster its dental cement offerings. Another top-tier company has concentrated on developing bioactive cement technologies, positioning itself at the forefront of preventive and regenerative dentistry.

In parallel, a major dental equipment and consumables provider has integrated its cement formulations with proprietary digital workflow solutions, offering end-to-end systems that span imaging, design, milling, and cementation. This vertically integrated approach enhances clinical efficiency and creates barriers for standalone material suppliers.

Several heritage brands have reinforced their market positions through collaborative research partnerships with academic institutions, accelerating translation of novel chemistries and enhancing brand equity among practicing dentists. Others have prioritized emerging markets through targeted distributor alliances, optimizing supply chain footprints and tailoring product configurations to local price sensitivities.

Smaller agile players are carving niche positions by focusing on self-adhesive systems and eco-friendly packaging, capitalizing on emerging trends to differentiate from legacy solutions. Collectively, these strategic moves-spanning mergers and acquisitions, R&D investments, digital integration, and regional partnerships-are continuously reshaping competitive dynamics and raising the bar for innovation in the dental cement market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dental Cement market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- BISCO, Inc.

- Cosmedent, Inc.

- Dentsply Sirona Inc.

- DETAX GmbH

- DiaDent Group International Inc.

- Dline OU by UAB Medicinos linija

- DMG Chemisch-Pharmazeutische Fabrik GmbH

- Essential Dental Systems, Inc.

- FGM Dental Group

- GC Corporation

- Hoffmann Dental Manufaktur GmbH

- Ivoclar Vivadent AG

- Kerr Corporation

- Madespa S.A.

- Medental International, Inc.

- NuSmile Ltd.

- Prevest DenPro Limited

- Pulpdent Corporation

- Pyrax Polymars

- SDI Limited

- Septodont Holding

- Shandong Huge Dental Material Corporation

- Shofu Inc.

- Sun Medical Co., Ltd.

- Tokuyama Corporation

- Ultradent Products, Inc.

- VinciSmile Group LLC

- VOCO GmbH

- Yamakin Co., Ltd.

Strategic recommendations advising industry leaders on innovation investments, supply chain resilience, market expansion, and sustainable practices to capitalize on dental cement market opportunities

To thrive in the evolving dental cement market, industry leaders should prioritize investment in bioactive and antimicrobial cement research to meet growing clinical demand for restorative materials that actively support oral health. Complementary efforts in incorporating sustainable, low-emission chemistries will resonate with environmentally conscious practitioners and support broader green dentistry initiatives.

Optimizing supply chain resilience is equally critical. Companies should explore dual sourcing strategies for key raw materials and consider establishing regional production capacities to mitigate tariff-induced cost pressures. Leveraging predictive analytics to forecast demand fluctuations can further streamline inventory management and reduce operational risks.

Expanding channel strategies by strengthening digital procurement platforms will improve accessibility and enhance customer engagement. Tailored online training and promotional programs can deepen relationships with dental professionals and encourage trial of new formulations. In parallel, forging strategic alliances with dental laboratories and equipment providers can create integrated solutions that lock in customers and drive recurring revenue streams.

Finally, geographic diversification into high-growth emerging markets should be underpinned by localized marketing approaches and adaptable pricing models. By aligning product portfolios with regional clinical preferences and regulatory requirements, organizations can establish a competitive foothold and capitalize on the rapid expansion of private dental practices globally.

Comprehensive research methodology outlining data collection approaches, analytical frameworks, and validation techniques employed to ensure accuracy and reliability

This report’s insights are derived from a structured research framework combining both primary and secondary data sources. Primary research encompassed in-depth interviews with dental practitioners, key opinion leaders, and procurement specialists, ensuring direct perspectives on clinical needs, purchasing drivers, and emerging material preferences.

Secondary research involved systematic analysis of industry publications, regulatory filings, patent databases, and corporate reports to map historical trends, competitive landscapes, and technological advancements. Rigorous data triangulation techniques were applied to reconcile disparate information streams and validate key findings against multiple references.

Quantitative analysis included statistical modeling of consumption patterns, channel performance, and tariff impacts, while qualitative assessments explored strategic initiatives, innovation pipelines, and market positioning. The integration of both approaches enabled a holistic understanding of demand drivers and competitive forces.

Throughout the research process, methodological safeguards-such as sample representativeness checks, data integrity audits, and peer reviews-ensured accuracy and reliability. This multi-layered approach provides stakeholders with robust, actionable intelligence for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dental Cement market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dental Cement Market, by Type

- Dental Cement Market, by Material

- Dental Cement Market, by Product Form

- Dental Cement Market, by Application

- Dental Cement Market, by End User

- Dental Cement Market, by Distribution Channel

- Dental Cement Market, by Region

- Dental Cement Market, by Group

- Dental Cement Market, by Country

- United States Dental Cement Market

- China Dental Cement Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Conclusive perspectives on the future trajectory of the dental cement market emphasizing strategic imperatives and emergent opportunities for stakeholders

The dental cement market presents a compelling blend of tradition and transformation. Established material classes continue to deliver proven clinical performance, while next-generation formulations push the boundaries of bioactivity, aesthetics, and procedural efficiency. The evolving interplay of tariffs, supply chain strategies, and sustainability priorities highlights the importance of resilience and innovation in maintaining competitive advantage.

Segmentation analysis underscores the need for targeted approaches across materials, applications, and channels, while regional insights reveal distinct growth trajectories and market entry considerations. Competitive dynamics are being redefined by strategic alliances, digital integration, and focused R&D investments.

As the landscape continues to shift, stakeholders who embrace a forward-looking perspective-prioritizing bioactive innovation, reinforcing supply chain agility, and expanding into high-potential regions-will be best positioned to capture emerging opportunities. This report equips decision-makers with the clarity and context needed to navigate complex market forces and chart a sustainable growth path.

Engage with our research leadership to access the full in-depth dental cement market report and empower strategic decision-making with expert insights

To learn more about the comprehensive insights, detailed data, and strategic analyses presented in this report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engage with Ketan to explore customized licensing options, obtain exclusive executive summaries, or schedule a briefing that aligns with your organization’s specific priorities and timelines. His expertise in market dynamics and client-focused service will ensure you receive tailored support for your decision-making needs. Secure your copy of the full dental cement market research report today to empower your strategic planning with actionable intelligence and a clear roadmap for future growth.

- How big is the Dental Cement Market?

- What is the Dental Cement Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?