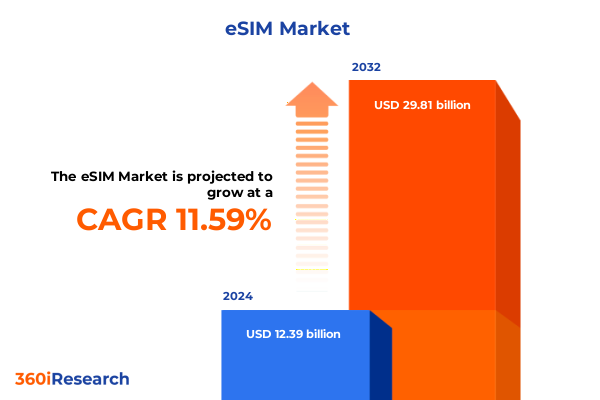

The eSIM Market size was estimated at USD 11.34 billion in 2025 and expected to reach USD 12.47 billion in 2026, at a CAGR of 10.98% to reach USD 23.53 billion by 2032.

Unleashing the Power of eSIM to Transform Global Connectivity Landscapes and Drive a New Era of Seamless Consumer and Enterprise Mobile Experiences

Embedded Subscriber Identity Module (eSIM) technology is rapidly reshaping the global connectivity landscape by replacing traditional physical SIM cards with remotely programmable digital credentials. As a fully integrated component within modern devices, eSIM enhances form factor efficiency, accelerates time to market, and eliminates logistical complexities associated with physical SIM distribution. Moreover, it underpins a new paradigm of seamless user experiences by enabling consumers and enterprises to switch mobile network profiles instantly without visiting retail outlets or waiting for SIM card delivery.

The momentum behind eSIM adoption is driven by the convergence of IoT proliferation, the rollout of 5G networks, and an increasing demand for device miniaturization. Consumer electronics manufacturers are embedding eSIM into smartphones, wearables, and tablets to deliver on-the-spot connectivity and ensure uninterrupted service, while enterprise deployments leverage eSIM’s remote provisioning capabilities to manage vast fleets of laptops, corporate devices, and IoT sensors more efficiently. Meanwhile, machine-to-machine (M2M) applications in industries such as automotive telematics and smart cities benefit from eSIM’s resilience and security features, which simplify global device roaming and lifecycle management.

Regulatory bodies and industry standards organizations have accelerated efforts to define interoperable eSIM specifications and certification processes. As carriers worldwide update their infrastructure to support remote SIM provisioning frameworks, partnerships between telecom operators, device manufacturers, and eSIM platform providers have become critical to unlocking seamless onboarding and management workflows. In this dynamic environment, stakeholders must understand the core drivers and ecosystem enablers that are propelling eSIM from a niche offering to a foundational technology for next-generation connected experiences.

Charting the Rapid Evolution of eSIM Adoption Amidst Technological Advances Regulatory Milestones and Shifting Consumer Expectations in 2025

Over the past year, the eSIM landscape has undergone transformative shifts fueled by accelerated 5G deployments, tightening global regulations, and shifting end-user expectations. Network operators have embraced network slicing and virtualization technologies that optimize SIM profile management through orchestration platforms, enabling dynamic allocation of connectivity resources for consumer and enterprise use cases alike. Furthermore, the maturation of GSMA-defined remote SIM provisioning specifications has led to a surge in interoperability testing initiatives, thereby reducing fragmentation across devices and carriers.

Consumer behavior has also evolved significantly. The proliferation of wearable devices and untethered IoT products has driven demand for instant and on-demand connectivity. Contemporary users expect seamless transitions between networks when traveling, the ability to manage multiple operator profiles from a single interface, and the confidence that their data privacy and security are assured by eSIM’s embedded hardware protections. Concurrently, enterprises are prioritizing scalable device management solutions to support distributed workforces and increasingly remote infrastructures, prompting a wave of digital transformation projects centered on eSIM-enabled fleet optimization.

In parallel, the broader digital economy has catalyzed demand for minimalistic device designs. As manufacturers strive to reduce board space and simplify assembly processes, integrating eSIM chips in lieu of mechanical SIM trays has become a critical enabler. Consequently, OEMs, chipset providers, and service platform vendors are collaborating on reference designs and turnkey provisioning services that accelerate time to market. This confluence of regulatory advancement, user-centric requirements, and streamlined product architectures marks a pivotal inflection point in the eSIM journey.

Analyzing the Cumulative Impact of 2025 United States Tariffs on eSIM Device Manufacturing Supply Chains and Cross-Border Connectivity Economics

In 2025, a series of cumulative tariff measures enacted by the United States has notably influenced the cost structures and supply chain strategies of eSIM module manufacturers and device OEMs. The extension of Section 301 duties on select Chinese electronic components has increased landed costs for embedded SIM chips, prompting many vendors to reassess their sourcing strategies. As a result, several key players have accelerated plans to diversify manufacturing footprints, exploring opportunities in Southeast Asia, Eastern Europe, and Latin America to mitigate import levies and maintain competitive pricing.

These tariff-induced headwinds have also spurred greater emphasis on nearshoring initiatives within North America. By relocating assembly operations closer to end markets, manufacturers aim to reduce exposure to duties and shorten logistics lead times, thereby enhancing responsiveness to carrier and enterprise demand. Moreover, the elevated cost environment has led original equipment manufacturers and module suppliers to engage in more aggressive cost-sharing or co-investment partnerships with network operators and platform providers, ensuring sustainable rollouts of new eSIM-enabled devices and service plans.

Despite the upward pressure on component expenditures, the underlying value proposition of eSIM-its ability to streamline provisioning, minimize inventory burdens, and offer differentiated service bundles-remains intact. Industry stakeholders have responded by optimizing product roadmaps, leveraging advanced packaging technologies to integrate eSIM functionality into multi-chip modules, and negotiating innovative tariff mitigation agreements. These strategic responses are positioning the ecosystem to navigate the current duty regime while preserving the long-term growth trajectory of global eSIM deployments.

Delving into Critical eSIM Market Segmentation Dimensions to Uncover Unique Opportunities Across Technology Type Network Service Provider and Deployment Modes

The eSIM market’s multifaceted nature emerges clearly when examining its key segmentation dimensions, each revealing distinct opportunity zones and competitive dynamics. Viewed through the lens of technology, the market spans consumer eSIM solutions tailored for smartphones, tablets and wearables; enterprise eSIM offerings designed for corporate laptops, communications equipment and IoT devices; and machine-to-machine (M2M) applications that support automotive telematics systems, utilities monitoring and smart city infrastructures. This triad underscores the importance of designing differentiated provisioning and management workflows to address unique performance and security requirements.

When assessed by service type, a compelling contrast surfaces between data-only eSIM profiles-which cater primarily to streaming, telemetry and internet access use cases-and combined voice, SMS and data packages that mirror traditional mobile contracts while providing enhanced flexibility. Meanwhile, scrutiny by network technology reveals a bifurcation between established 4G/LTE environments-where certified LTE modules and enhanced LTE solutions coexist to deliver reliable coverage-and emerging 5G-enabled architectures supporting both non-standalone eSIM profiles that leverage existing LTE anchors and standalone eSIM implementations built for full 5G core networks.

Further dissecting the ecosystem by service provider typology illuminates contributions from mobile network operators, mobile virtual network operators and original equipment manufacturers. Within the MVNO sphere, data-driven operators focus on high-bandwidth connectivity services for specialized markets, whereas voice-centric MVNOs maintain legacy telephony strength while integrating data capabilities. The analysis of deployment approaches differentiates local provisioning scenarios-encompassing dual-mode and single-mode activation methods-from remote provisioning frameworks that manage multiple operator profiles or single-profile configurations from centralized platforms. Lastly, exploring application segments brings to light opportunities in consumer electronics, enterprise settings, machine-to-machine scenarios and retail connectivity contexts, each with subsegments ranging from digital signage and interactive kiosks to corporate workstations and smart meters.

This comprehensive research report categorizes the eSIM market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- By Technology

- Type

- Network Technology

- Service Providers

- Deployment Mode

- Applications

Mapping Regional Dynamics and Growth Drivers Shaping the eSIM Market Across the Americas Europe Middle East Africa and Asia-Pacific in 2025

Regional dynamics play a pivotal role in shaping the trajectory of eSIM adoption, with each geography offering unique demand drivers and regulatory contexts. In the Americas, momentum is anchored by leading carriers in the United States and Canada that have rolled out expansive eSIM activation platforms, simplifying onboarding for end users and enterprise customers. With consumer devices increasingly shipped with embedded eSIM hardware, partnerships between handset manufacturers and North American network operators are accelerating integrated provisioning services, while regulatory agencies continue to refine guidelines around digital identity verification and cross-border data flows.

Turning to Europe, the Middle East and Africa region, cohesive regulatory frameworks across the European Union have fostered interoperability and driven consistent certification protocols. This has enabled a proliferation of eSIM-compatible wearables and industrial IoT deployments in sectors such as logistics, manufacturing and energy management. In the Middle East, sovereign initiatives to modernize city infrastructure have further catalyzed adoption, while operators in sub-Saharan Africa are exploring eSIM as a means to expand connectivity in remote areas and reduce dependency on legacy SIM card logistics.

Across the Asia-Pacific landscape, high mobile penetration rates and advanced digital economies have created fertile ground for eSIM-enabled innovations. Key markets like China, Japan and South Korea are leading the charge with comprehensive device ecosystems, 5G rollouts and regulatory support for remote provisioning. In Southeast Asia and Oceania, governments’ smart city visions and automotive telematics investments are driving demand for ruggedized eSIM modules in transportation and public safety applications. Consequently, regional stakeholders are forging cross-sector partnerships to capitalize on accelerated digital transformation agendas.

This comprehensive research report examines key regions that drive the evolution of the eSIM market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into Leading eSIM Industry Players Strategic Collaborations Technologies and Competitive Positioning Fueling Market Progression

The competitive arena of the eSIM market is characterized by strategic collaboration among chipset manufacturers, platform providers, telecom operators and device OEMs. Leading semiconductor firms have integrated embedded SIM functionality into multi-protocol chipsets that support both LTE and 5G profiles, streamlining design and certification processes for device makers. Simultaneously, specialist eSIM platform providers have expanded their portfolios to include end-to-end provisioning services, enabling seamless interoperability across a growing roster of network operators worldwide.

On the operator front, major carriers have launched white-label provisioning platforms to capitalize on enterprise connectivity projects and consumer roaming packages. These carriers are forging partnerships with leading global OEMs in consumer electronics and IoT segments, thus ensuring that a broad spectrum of devices ship with native eSIM support. Moreover, mobile virtual network operators are leveraging data-centric and voice-centric business models to target specific vertical markets, while securing wholesale agreements that grant access to tier-one network infrastructure without bearing full capex burdens.

Original equipment manufacturers are also playing a critical role by embedding eSIM solutions within diverse form factors-from ruggedized industrial modules to ultra-compact consumer wearables. Many are participating in consortia aimed at establishing unified test and certification standards, and engaging in mergers or joint ventures to augment their provisioning capabilities. As ecosystem players refine their go-to-market strategies, strategic alliances and technology licensing agreements are expected to intensify, thereby accelerating the proliferation of eSIM-enabled devices and services on a global scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the eSIM market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple, Inc.

- AT&T Inc.

- Deutsche Telekom AG

- Etisalat Group

- Giesecke+Devrient GmbH

- GSM Association.

- IDEMIA Group

- Infineon Technologies AG

- Kigen Ltd.

- Maya Virtual, Inc.

- Microsoft Corporation

- NTT Docomo Inc.

- NXP Semiconductors N.V.

- Oasis Smart SIM

- Orange S.A.

- Quectel Wireless Solutions Co., Ltd.

- Samsung Electronics Co., Ltd.

- Sierra Wireless, Inc.

- Singapore Telecommunications Limited

- STMicroelectronics N.V.

- TelcoVillage GmbH

- Telefónica, S.A.

- Telenor Connexion AB

- Telit Communications

- Thales Group

- Vodafone Group PLC

Strategic Roadmap for eSIM Industry Leaders Emphasizing Partnerships Standardization Security and Innovation to Capitalize on Emerging Market Opportunities

To thrive in the evolving eSIM ecosystem, industry leaders should prioritize securing strategic partnerships across the value chain. By aligning with forward-looking network operators and platform providers, device manufacturers can ensure seamless onboarding experiences and differentiated service offerings. Furthermore, investing in shared certification and interoperability initiatives will reduce time to market and foster broader carrier support for new device launches.

Establishing robust security and compliance frameworks is equally essential. Organizations should adopt hardware-backed secure elements and implement end-to-end encryption protocols that address emerging privacy regulations and protect against supply chain vulnerabilities. Additionally, designing modular provisioning architectures that support dynamic profile management will enable swift migration from 4G-enabled eSIM profiles to full 5G standalone configurations as network infrastructures evolve.

Finally, embracing customer-centric innovation and tailoring solutions to specific verticals will unlock untapped revenue streams. Whether targeting automotive telematics, consumer wearables or industrial IoT deployments, companies must develop specialized provisioning workflows, service bundles and analytics capabilities that address unique performance, regulatory and lifecycle management requirements. By combining technical excellence with strategic alliances and market-focused segmentation, industry leaders can capture the full potential of the global eSIM revolution.

Comprehensive Research Methodology Harnessing Qualitative and Quantitative Approaches Expert Interviews and Rigorous Data Validation for eSIM Market Insights

The research methodology underpinning this report integrates both qualitative and quantitative approaches to deliver comprehensive and actionable insights. Initially, secondary research was conducted by reviewing publicly available materials, including regulatory filings, standards body publications, industry white papers and vendor technical documents. This desk research provided a foundational understanding of global eSIM specifications, tariff regulations and ecosystem dynamics.

Subsequently, primary research was carried out through in-depth interviews with a cross-section of industry stakeholders. These included senior executives from chipset manufacturers, network operators, eSIM platform providers and device OEMs, as well as subject matter experts in regulatory compliance and supply chain management. These interviews were designed to validate secondary findings, uncover emerging trends and gauge future deployment priorities.

Data triangulation and rigorous validation steps were applied throughout the analysis. Quantitative data points were cross-checked against multiple independent sources to ensure consistency, and qualitative insights were corroborated through vendor briefings and expert panel reviews. This blended research framework guarantees that every conclusion and recommendation is grounded in a robust evidence base, making the report a reliable tool for strategic decision-making in the rapidly evolving eSIM market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our eSIM market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- eSIM Market, by By Technology

- eSIM Market, by Type

- eSIM Market, by Network Technology

- eSIM Market, by Service Providers

- eSIM Market, by Deployment Mode

- eSIM Market, by Applications

- eSIM Market, by Region

- eSIM Market, by Group

- eSIM Market, by Country

- United States eSIM Market

- China eSIM Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Synthesis of eSIM Market Trajectory Highlighting Key Drivers Barriers and Strategic Imperatives to Secure a Competitive Edge in a Rapidly Evolving Landscape

The global eSIM market continues on an upward trajectory, driven by technological innovations, evolving regulatory frameworks and the expanding demands of consumers, enterprises and machine-to-machine applications. As 5G networks mature and remote provisioning standards solidify, the foundational advantages of embedded SIMs-simplified logistics, enhanced security and seamless connectivity-are becoming indispensable for stakeholders across diverse industries.

While tariff pressures in 2025 have introduced cost complexities, they have also catalyzed strategic shifts toward supply chain diversification and nearshoring, ultimately reinforcing the resilience of the eSIM ecosystem. Through targeted segmentation analysis, stakeholders can tailor offerings to meet the nuanced requirements of consumer electronics, corporate communication channels, IoT deployments and retail connectivity solutions. Simultaneously, regional insights highlight the varied pace of adoption-from North America’s carrier-led activations to Europe’s regulatory harmonization and Asia-Pacific’s digital transformation agendas.

Looking ahead, the interplay between chipset innovation, platform interoperability and service provider partnerships will determine which organizations emerge as market leaders. By adhering to rigorous research-backed recommendations-prioritizing collaboration, security and vertical specialization-industry participants can navigate current challenges and capitalize on the transformative potential of eSIM technology to drive growth and competitive advantage.

Empowering informed strategic decisions in the eSIM domain with a direct invitation to unlock specialized market insights today

If you are ready to harness in-depth intelligence and strategic foresight to navigate the rapidly transforming eSIM ecosystem, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive eSIM market research report and empower your organization’s next growth leap

- How big is the eSIM Market?

- What is the eSIM Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?