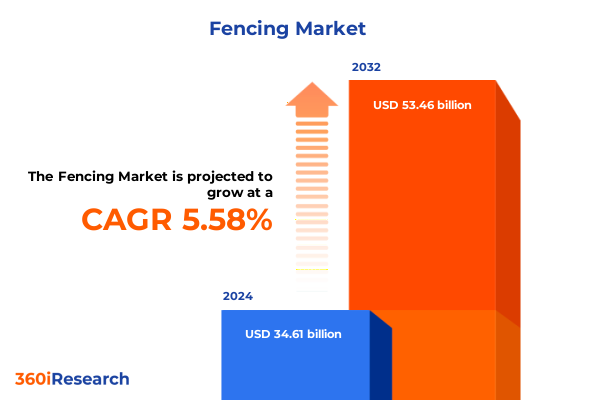

The Fencing Market size was estimated at USD 36.47 billion in 2025 and expected to reach USD 38.50 billion in 2026, at a CAGR of 5.61% to reach USD 53.46 billion by 2032.

Navigating the Future of Perimeter Security with Comprehensive Insights into Market Trends and Innovative Solutions to Protect Assets

The perimeter security sector has evolved far beyond mere barrier installation into a dynamic ecosystem where innovation, regulation, and customer preferences intersect. Today, stakeholders from large-scale agricultural operations to urban residential developers depend on fencing solutions that not only provide demarcation but also incorporate elements of safety, aesthetics, and environmental responsibility. In this landscape, discerning market participants prioritize an understanding of how emerging materials, advanced fabrication technologies, and shifting end-user requirements are reshaping opportunities across all segments.

Against a backdrop of tightening regulations on material sourcing and heightened interest in acoustic and privacy applications, decision-makers must weigh factors such as installation complexity, lifecycle durability, and total cost of ownership. As capital expenditures come under increased scrutiny, insights into comparative performance between fixed and portable systems become critical for planning and procurement. By framing the conversation around actionable intelligence rather than raw data points, this introduction sets the stage for a deep dive into the forces steering the modern fencing industry, equipping leaders with the contextual awareness necessary to anticipate disruptions and harness emerging growth vectors.

Reimagining Boundary Solutions with Technological Advances Sustainability Focus and Evolving Customer Expectations Shaping Market Dynamics

The past few years have ushered in transformative shifts that are redefining how fencing is designed, manufactured, and deployed. Foremost among these is the surge in material innovation, with lightweight polymers and composite blends beginning to rival traditional wood and metal options in terms of strength and longevity. At the same time, eco-minded customers are driving demand for sustainably sourced hardwoods and recycled plastics, prompting manufacturers to integrate circular-economy principles into their supply chains.

Meanwhile, digital tools are accelerating change on the installation front. Augmented reality site-mapping and modular panel systems are streamlining project workflows, reducing labor hours and installation errors. This movement toward turnkey solutions has lowered barriers to adoption for smaller contractors, expanding the competitive landscape. Moreover, as acoustic fencing becomes integral to urban development projects, noise-reduction technologies once confined to specialized industries are now being incorporated into mainstream product portfolios. Together, these trends underscore a broader shift toward fencing solutions that seamlessly blend performance, aesthetics, and sustainability, underscoring the need for continuous innovation and agile business models.

Assessing the Aggregate Consequences of 2025 United States Tariff Measures on Supply Chains Cost Structures and Industry Resilience

In 2025, a series of tariff adjustments imposed by the United States government have significantly altered the economics of several core fencing materials. In particular, steel and aluminum imports are subject to higher duties, driving domestic producers to adjust their pricing strategies and renegotiate supply agreements. This tariff environment has had the dual effect of inflating upstream costs for raw materials while simultaneously creating a competitive edge for local steel and aluminum fabricators.

As a consequence, manufacturers and distributors are recalibrating sourcing plans by incorporating alternative materials such as engineered hardwoods and composite polymers that remain outside the tariff scope. This substitution strategy has catalyzed R&D investments to enhance the mechanical performance of non-metal offerings. Furthermore, end-users are re-evaluating their procurement cycles, shifting away from bulk import orders toward more agile, just-in-time purchasing models that mitigate inventory holding costs amid duty volatility. Regulatory uncertainty around future adjustments underscores the importance of flexible supply chain configurations and strategic partnerships with domestic mills and molderies to safeguard margins and maintain service-level commitments.

Uncovering Nuanced Market Segmentation Insights from Product Types to Application Use Cases Driving Divergent Growth Pathways

A granular review of segmentation reveals distinct demand patterns shaping competitive dynamics. Fixed fencing systems continue to dominate large-scale boundary applications due to their structural robustness, whereas portable fencing is gaining traction in events, construction sites, and emergency response scenarios where rapid assembly and disassembly are paramount. Material preferences also diverge sharply; concrete and masonry remain indispensable for high-security installations, while metal variants-particularly aluminum for its corrosion resistance and steel for its tensile strength-are preferred across both residential and industrial use cases. Plastic polymer solutions have emerged as cost-effective, low-maintenance alternatives, and sustainably sourced hardwoods are being selected for decorative and privacy applications where visual appeal is equally critical.

Functionality drives further differentiation: agricultural fencing prioritizes extensibility and ease of repair, whereas noise-reduction barriers require integrated acoustic panels. Privacy and decorative fences lean on surface finishes and customizable designs, and safety-oriented barriers incorporate engineered heights and tamper-resistant fixtures. Speaking to installation methods, DIY kits have unlocked a new homeowner segment, even as professional installation services retain primacy for high-value commercial and government contracts. Distribution channels are similarly bifurcated, with e-commerce marketplaces appealing to smaller orders, while manufacturer websites and offline networks serve larger, project-based purchases. Finally, the broad spectrum of applications-from transportation infrastructure projects to residential estates-underscores the need for tailored product development and targeted go-to-market strategies.

This comprehensive research report categorizes the Fencing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Function

- Height

- Installation Method

- Distribution Channel

- Application

Exploring Regional Variances in Fence Demand Across Americas Europe Middle East Africa and Asia Pacific Highlights and Drivers

Regional dynamics exert a profound influence on fencing demand profiles. In the Americas, stringent building codes and a growing emphasis on perimeter security have driven uptake of high-durability steel and acoustic fences in metropolitan areas. Meanwhile, agricultural expanses across the United States and South America continue to depend on traditional wood and wire mesh systems, with innovation focused on reducing installation time in remote locations.

Europe, the Middle East, and Africa present a mosaic of regulatory landscapes that affect material choices and product standards. In Western Europe, sustainability mandates and heritage conservation requirements have elevated the market for reclaimed wood and powder-coated metals. The Gulf states feature high demand for security-rated barriers and decorative fencing in luxury developments, while sub-Saharan regions exhibit growing interest in cost-effective prefab solutions that can withstand challenging climatic conditions.

The Asia-Pacific region is characterized by divergent growth drivers: rapid urbanization in Southeast Asian cities has spurred demand for acoustic and privacy fencing in mixed-use developments, whereas Australia and New Zealand emphasize bushfire-resistant materials and wind-load testing. Across all markets, digital ordering platforms and local fabrication partnerships are streamlining procurement, helping stakeholders navigate complex logistics and regulatory hurdles.

This comprehensive research report examines key regions that drive the evolution of the Fencing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies Innovations and Collaborative Efforts of Market Leaders Shaping the Future of Fencing Solutions

Key industry participants have adopted a spectrum of growth strategies, from vertical integration to strategic partnerships, to strengthen their market positioning. Some leading manufacturers have invested heavily in in-house production facilities for advanced composite panels, enabling tighter quality control and faster innovation cycles. Others have forged alliances with technology startups to embed sensing and IoT-enabled monitoring capabilities into security fencing, creating differentiated offerings for critical infrastructure clients.

Several incumbents are expanding their footprints through targeted acquisitions of regional fabrication specialists, seeking to bolster their geographic reach and capitalize on local market nuances. Mergers with distribution networks have also allowed companies to optimize last-mile delivery and installation support. Collaboration with material science firms has fueled the development of proprietary coatings that extend fence lifespan in corrosive or UV-intense environments. Moreover, multiple players are piloting subscription-based service models that include scheduled maintenance and remote performance monitoring, signaling a shift toward lifecycle-oriented business frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fencing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A1 Fence Products

- Albert Kerbl GmbH

- Ametco Manufacturing Corporation

- Assa Abloy Group

- Bekaert Corporation

- Blecha GmbH

- CELSA OPCO, S.A.U.

- CertainTeed

- CLD Fencing Systems LLP

- Coastal Screen & Rail

- Direct Metals Company, LLC

- Eastman Aluminum Inc.

- F H Brundle

- Gregory Industries Inc.

- Gust. Alberts GmbH & Co. KG

- Long Fence, Inc.

- Niles Fence & Security Products, LLC

- OMAF srl

- Ply Gem Industries, Inc.

- Praesidiad Group Limited

- Promallas Ind España

- Saint-Gobain Group

- Spantek/ UMI Company, Inc.

- Specrail by Porcelen LLC

- Tiemann Schutz-Systems GmbH

- Winrise Enterprises

Strategic Imperatives for Fencing Industry Leaders to Enhance Competitiveness Adapt to Shifts and Capitalize on Emerging Opportunities

To capitalize on the evolving fencing landscape, industry leaders should prioritize supply chain diversification, incorporating both domestic and international suppliers to mitigate tariff and logistics risks. Investing in modular product lines that support rapid assembly will address growing demand from event management, construction, and emergency response sectors. Equally important is the acceleration of R&D efforts focused on sustainable materials and advanced coatings to meet tightening environmental standards and extend product lifecycles.

In parallel, organizations must embrace digitization across the customer journey. Enhanced online configurators and AR-based site-planning tools can reduce specification errors and shorten sales cycles. Establishing strategic partnerships with last-mile installation networks will ensure that professional services remain scalable as order volumes shift between DIY and project-based channels. Finally, integrating after-sales service portfolios-ranging from preventive maintenance subscriptions to remote monitoring-will transform fencing from a one-time capital purchase into an ongoing, value-added engagement, driving customer retention and recurring revenue streams.

Defining Rigorous Research Framework and Methodological Approaches That Ensure Robustness Validity and Actionability of Fencing Market Intelligence

The research underpinning this analysis combines both primary and secondary data collection methodologies to ensure robustness and validity. Primary research consisted of in-depth interviews with executives, engineers, and procurement professionals representing a cross-section of the fencing ecosystem, including manufacturers, distributors, installers, and end-users. These conversations provided firsthand perspectives on material performance, installation challenges, and emerging customer requirements.

Complementing these insights, secondary research drew on public filings, industry journals, patent databases, and regulatory documents to map out competitive landscapes and technological trends. The study deployed a multi-step validation process, triangulating quantitative findings with qualitative feedback to resolve any discrepancies. Analytical frameworks such as SWOT and Porter’s Five Forces were applied at the segment and regional levels to identify key growth drivers and potential barriers to entry. This rigorous approach ensures that the strategic recommendations are grounded in both empirical evidence and actionable market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fencing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fencing Market, by Product Type

- Fencing Market, by Material Type

- Fencing Market, by Function

- Fencing Market, by Height

- Fencing Market, by Installation Method

- Fencing Market, by Distribution Channel

- Fencing Market, by Application

- Fencing Market, by Region

- Fencing Market, by Group

- Fencing Market, by Country

- United States Fencing Market

- China Fencing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Critical Insights and Strategic Implications to Guide Decision Making and Foster Sustainable Growth in the Fencing Industry

The fencing industry stands at a pivotal juncture where traditional barriers intersect with cutting-edge innovations to redefine perimeter security and boundary management. As material technologies diversify and digital tools streamline both sales and installation workflows, companies that balance agility with strategic foresight will gain a competitive edge. Sustainability and resilience have emerged as non-negotiable criteria, compelling organizations to rethink sourcing strategies and invest in circular-economy solutions.

Given the complexity introduced by shifting tariffs and regional nuances, stakeholders must adopt a data-driven mindset, leveraging advanced analytics to anticipate cost fluctuations and demand shifts. Strategic collaboration-whether through M&A, joint ventures, or technology partnerships-will be critical for expanding geographic footprints and broadening product portfolios. Looking ahead, the convergence of physical barriers with IoT-based monitoring and service-oriented business models promises to transform fencing from a commoditized asset into a continuously evolving platform for security and asset management.

Connect with Ketan Rohom to Access Comprehensive Fencing Market Research and Uncover Tailored Insights That Drive Competitive Advantage

To explore the full breadth of insights and trends shaping the fencing sector today, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a wealth of industry knowledge and can guide you to the specific research modules that address your strategic questions around product innovation, competitive benchmarking, and regional dynamics. By leveraging his expertise, you can gain tailored perspectives on how fixed and portable fencing solutions, material innovations, and emerging distribution channels are converging to redefine perimeter security. Connect with Ketan to schedule a personalized consultation and secure priority access to the comprehensive report, ensuring you stay ahead of evolving trade impacts, sustainability imperatives, and digital transformation pathways. This direct engagement will empower your organization to translate rich data and analyses into actionable strategies for competitive advantage and long-term resilience.

- How big is the Fencing Market?

- What is the Fencing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?