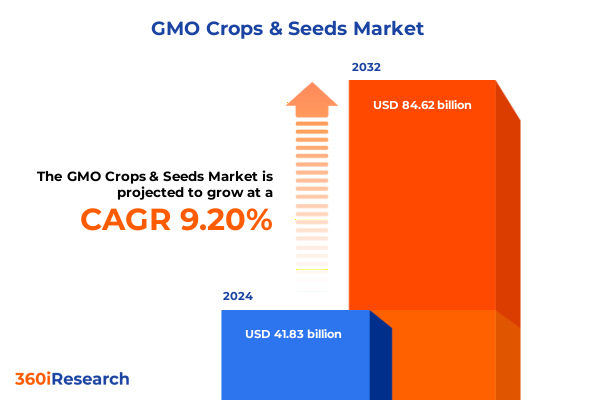

The GMO Crops & Seeds Market size was estimated at USD 45.49 billion in 2025 and expected to reach USD 49.47 billion in 2026, at a CAGR of 9.27% to reach USD 84.62 billion by 2032.

Exploratory Overview of Genetically Engineered Crop and Seed Innovations Shaping Global Food Security and Agricultural Biotechnology Evolution

The proliferation of genetically modified organisms in agricultural production has emerged as a cornerstone in addressing the dual imperatives of global food security and sustainable farming practices. As the worldwide population continues to surge toward nearly 10 billion by 2050, the pressure on existing arable land and freshwater resources intensifies. Genetically engineered seeds-designed to exhibit enhanced traits such as herbicide tolerance and insect resistance-have rapidly evolved from experimental trials to mainstream adoption. This technological leap has redefined the role of biotechnology in modern agriculture, transitioning it from a supplementary tool to a strategic imperative for crop yield resilience and resource optimization.

Amid shifting consumer perceptions and evolving regulatory landscapes, the biotechnology sector has witnessed unprecedented investments from multinational agribusinesses and government research bodies alike. Public and private R&D endeavors have converged to refine gene editing techniques, streamline trait stacking methodologies, and accelerate field trial approvals. Consequently, genetically modified seeds are no longer confined to a handful of staple crops; the arena now spans cereals and grains, oilseeds, fiber crops, and specialty horticultural varieties. This introduction establishes the context for understanding how innovation, policymaking, and market forces collectively shape the trajectory of GMO crops and seeds, setting the stage for deeper analysis in subsequent sections.

Revolutionary Advances and Regulatory Milestones Driving the Rapid Adoption of Next Generation Genetic Modification in Crop Production

Over the past decade, agriculture has undergone a profound transformation driven by breakthroughs in gene editing tools, most notably CRISPR-Cas systems. These precision technologies have democratized the modification of plant genomes, enabling researchers to enhance drought tolerance, refine quality traits, and develop novel resistance profiles with unprecedented speed. Concurrently, regulatory agencies across major markets have begun adopting tiered oversight frameworks that balance biosafety concerns with expedited review processes, thereby reducing time to market for new cultivars. The confluence of these scientific advances and regulatory streamlining has catalyzed a paradigm shift, positioning transgenic and cisgenic approaches alongside traditional breeding methods within the same innovation pipeline.

Moreover, consumer engagement has shifted markedly over recent years, with increasing transparency initiatives and traceability solutions fostering greater public confidence in GMO products. Blockchain-based supply chain platforms, coupled with digital labeling, now allow end users to track seed origin and trait composition throughout the production lifecycle. Therefore, transformative shifts in both scientific methodologies and stakeholder ecosystems are reshaping the competitive landscape of GMO crops and seeds, ushering in an era where agility and compliance determine market leadership.

Comprehensive Examination of United States Tariff Implementations in 2025 and Their Far Reaching Effects on Global Seed Supply and Trade Dynamics

The implementation of a new tariff structure by the United States in early 2025 has introduced significant cost pressures across the global seed supply chain. These tariffs, applied to a broad spectrum of imported genetic materials and trait licensing agreements, have increased the landed cost of proprietary transgenic and gene edited seeds for domestic producers. As a direct consequence, U.S.-based seed distributors have been compelled to reevaluate sourcing strategies, with some pivoting toward in-house breeding programs to mitigate exposure to punitive duties. Additionally, export competitiveness for American biotech traits has encountered headwinds in key overseas markets, where reciprocal tariffs and stringent phytosanitary requirements have been imposed.

The ripple effects of these trade policies extend beyond immediate pricing impacts. Research collaborations involving U.S. institutions and international partners have experienced delays in material transfer agreements, complicating precommercial trials and regulatory submissions. In response, agronomic stakeholders are exploring alternative pathways, such as expanding local seed multiplication hubs and leveraging marker assisted breeding techniques that rely less on imported genetic constructs. Collectively, the cumulative result is a reconfiguration of supply chain resilience, compelling industry players to adopt adaptive sourcing and regulatory strategies to sustain innovation momentum.

InDepth Analytical Perspective on How Diverse Crop Types Combined with Trait Driven Technologies and Distribution Channels Determine Industry Growth Trajectories

A nuanced understanding of market segmentation illuminates the heterogeneous drivers shaping adoption rates and value perceptions across the GMO seed ecosystem. Within crop type segmentation, the cereals and grains category encompasses foundational staples like corn, rice, and wheat, each benefiting from distinct trait priorities; insect resistance dominates corn programs, while quality traits command attention in rice breeding. Fiber crops, forage crops, and fruits and vegetables present specialized challenges, ranging from pest management to postharvest shelf life, whereas oilseeds such as canola, soybean, and sunflower remain focal points for herbicide tolerance improvements.

Trait type segmentation further clarifies investment emphases. Drought tolerance innovations are gaining urgency amid climate volatility, while herbicide tolerance bifurcates into glufosinate and glyphosate chemistries that must contend with evolving weed resistance. Insect resistance strategies, including bollworm and corn borer targeting, continue to advance through stacked trait portfolios. Quality traits address nutritional content and processing performance, reflecting downstream industry demands. On the technology front, cisgenic products that use genes from sexually compatible species attract less regulatory friction, whereas transgenic approaches deliver more transformative trait incorporations. Marker assisted breeding serves as an intermediate pathway to expedite varietal development. Seed type influences genetic uniformity and farmer adoption dynamics; hybrid seeds achieve maximal yield gains, open pollinated lines offer seed saving benefits, and self pollinated varieties simplify breeding cycles. End users range from large-scale farmers seeking turnkey solutions to research institutions driving next wave innovations. Finally, distribution channels are evolving as offline networks adapt digital touchpoints, even as online platforms expand direct-to-farm delivery models.

This comprehensive research report categorizes the GMO Crops & Seeds market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Crop Type

- Trait Type

- Technology

- Seed Type

- End User

- Distribution Channel

Differentiated Regional Adoption Patterns and Regulatory Shifts Across Americas Europe Middle East & Africa and Asia Pacific Illuminating GMO Seed Utilization

Across the Americas, market participants benefit from well-established regulatory pathways and expansive commercial cultivation of genetically modified crops. The United States maintains robust trait approval systems, while Brazil and Argentina continue to ramp up local breeding programs. North American infrastructure supports vertically integrated supply chains, facilitating rapid scalability of new seed varieties and trait stacks. In contrast, Europe, Middle East & Africa exhibit a more fragmented landscape, where stringent EU directives limit commercial transgenic approvals and encourage marker assisted methods as lower-risk entry points. Meanwhile, selective EMEA markets like South Africa and Israel pursue targeted trait rollouts addressing region-specific agronomic challenges, such as heat stress and pest proliferation.

In Asia-Pacific, regulators are increasingly receptive to gene edited cultivars, with countries like China and Australia introducing tiered regulatory classifications that expedite low-risk trait varieties. Policymakers in India have approved research trials for drought tolerance and herbicide tolerance traits, yet commercial deployment remains tightly controlled. Supply chain considerations, including seed certification and intellectual property enforcement, vary significantly within the region, prompting multinational seed houses to establish local production facilities. Ultimately, regional divergence in regulatory philosophy, climatic stressors, and farm economics governs the relative pace and scope of GMO crop adoption.

This comprehensive research report examines key regions that drive the evolution of the GMO Crops & Seeds market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Innovation Portfolios of Leading Agritech Corporations Shaping Competitive Dynamics in the GMO Seed Industry Landscape

Major agritech and biotechnology corporations have solidified their market positions through a combination of strategic acquisitions, proprietary trait development, and targeted R&D alliances. One leading player has leveraged a deep pipeline of transgenic herbicide tolerance traits to secure licensing agreements across multiple geographies, while another competitor focuses on integrating advanced gene editing platforms to deliver drought tolerance solutions tailored for emerging markets. A third industry titan has invested heavily in downstream digital agronomy services, using precision data analytics to optimize field performance of its GMO seed offerings.

Smaller specialist firms and non-profit research consortia are also reshaping competitive dynamics. By concentrating on niche segments-such as quality traits for specialty fruits or cisgenic modifications for local varieties-these players challenge incumbents to diversify their trait portfolios. Collaborative ventures between technology start-ups and large seed distributors have accelerated market entry of novel products, underscoring the importance of cross-sector partnerships. Therefore, innovation leadership increasingly depends on the ability to bridge proprietary science with scalable commercialization networks across global markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the GMO Crops & Seeds market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Bayer AG

- Beijing DaBeiNong Biotechnology Co Ltd

- Bioceres S.A.

- Corteva Agriscience

- FuturaGene Group

- GreenLab Inc

- Groupe Limagrain Holding SA

- J.R. Simplot Co

- JK Agri Genetics Limited

- KWS SAAT SE

- Land O' Lakes Inc

- Mahindra Hybrid Seed Co Private Limited

- Nuseed Pty Ltd

- Okanagan Specialty Fruits Incorporated

- Origin Agritech Limited

- Sakata Seed Corporation

- Stine Seed Farm Inc

- Syngenta AG

- Takii & Co Ltd

- UPL Limited

- Verdeca

- Yuan Longping High-Tech Agriculture Co Ltd

Operational Strategies and Strategic Imperatives for Agribusiness Executives to Navigate Complex Regulatory Landscapes and Accelerate Biotechnology Integration

To thrive amid intensifying regulatory scrutiny and market complexity, agribusiness executives should prioritize diversified trait pipelines that balance high-value stress tolerance innovations with consumer-friendly quality enhancements. Establishing modular breeding platforms-capable of switching between cisgenic and transgenic approaches-can streamline approvals and reduce development bottlenecks. Furthermore, building strategic alliances with regional distributors and local research institutions will enhance supply chain resilience, particularly in markets subject to abrupt tariff shifts or biosafety reclassifications.

Executives should also invest in digital agronomy tools that integrate field data with predictive analytics, ensuring that GMO seed offerings deliver demonstrable yield gains under real-world conditions. Proactive engagement with policymakers and public stakeholders through transparent communication initiatives can mitigate opposition risks and foster supportive regulatory environments. Lastly, agile sourcing strategies-such as setting up localized seed multiplication hubs-will minimize exposure to international trade disruptions. Collectively, these actions will empower industry leaders to navigate evolving landscapes, drive adoption of advanced biotech solutions, and secure sustained competitive advantage.

Rigorous Methodological Framework Combining Qualitative Primary Interviews Secondary Data Sources and Multilayered Validation Techniques for Market Clarity

The research methodology underpinning this report combines both qualitative and quantitative approaches to ensure robust insights. Initially, an exhaustive secondary research phase was conducted, encompassing peer-reviewed journals, patent filings, regulatory agency publications, and reputable trade association data. Building on this foundational knowledge, primary interviews were undertaken with senior R&D managers at leading seed developers, policy experts from government agencies, and key opinion leaders in academic institutions. These interviews were designed to capture nuanced perspectives on trait prioritization, regulatory trajectories, and commercial deployment strategies.

Data triangulation techniques then aligned findings from multiple sources to validate emerging trends and reconcile discrepancies. Comparative analysis frameworks were applied to assess regional regulatory frameworks, tariff impacts, and technology adoption curves. Finally, iterative stakeholder feedback sessions refined the draft insights, ensuring that the final recommendations reflect practical considerations and strategic imperatives. This multilayered methodology provides a transparent and replicable foundation for the report’s conclusions and guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our GMO Crops & Seeds market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- GMO Crops & Seeds Market, by Crop Type

- GMO Crops & Seeds Market, by Trait Type

- GMO Crops & Seeds Market, by Technology

- GMO Crops & Seeds Market, by Seed Type

- GMO Crops & Seeds Market, by End User

- GMO Crops & Seeds Market, by Distribution Channel

- GMO Crops & Seeds Market, by Region

- GMO Crops & Seeds Market, by Group

- GMO Crops & Seeds Market, by Country

- United States GMO Crops & Seeds Market

- China GMO Crops & Seeds Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of Critical Insights and Strategic Imperatives Illuminating Future Outlooks in the Evolving Landscape of Genetically Modified Crop Development

This report synthesizes critical insights on the evolving landscape of genetically modified crops and seeds, highlighting how scientific breakthroughs, regulatory realignments, and trade dynamics intersect to shape strategic imperatives. The integration of precision gene editing tools with adaptive regulatory frameworks has accelerated trait commercialization, while new tariff regimes necessitate agile supply chain responses. Segmentation analysis underscores the diverse trait and crop type requirements across end users, and regional perspectives reveal how local policies and climatic challenges influence adoption rates.

Looking ahead, the trajectory of GMO seed development will be defined by collaborative innovation models, digital agronomy integration, and stakeholder engagement that fosters public trust. Decision-makers must align product portfolios with both global megatrends-such as climate resilience-and localized market needs. Through strategic partnerships, modular breeding platforms, and transparent communication, industry participants can harness the full potential of biotechnology to deliver sustainable agricultural solutions. Ultimately, proactive adaptation will be the key determinant of long-term success in this dynamic ecosystem.

Engage with Associate Director Ketan Rohom for Customized GMO Crops and Seeds Market Intelligence Empowering Data Driven Strategic Investments

To secure a tailored deep dive into the complex dynamics transforming the genetically modified crop and seed space, reach out to Ketan Rohom at the associate director level for bespoke market intelligence. His expertise in sales and marketing strategy will ensure you receive comprehensive insights, meticulously aligned with your organization’s unique goals. Engaging his guidance will empower your team to seize emerging opportunities, mitigate regulatory risks, and optimize product portfolios. Invest in this research today to elevate your strategic decision-making with data-backed clarity and actionable foresight.

- How big is the GMO Crops & Seeds Market?

- What is the GMO Crops & Seeds Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?