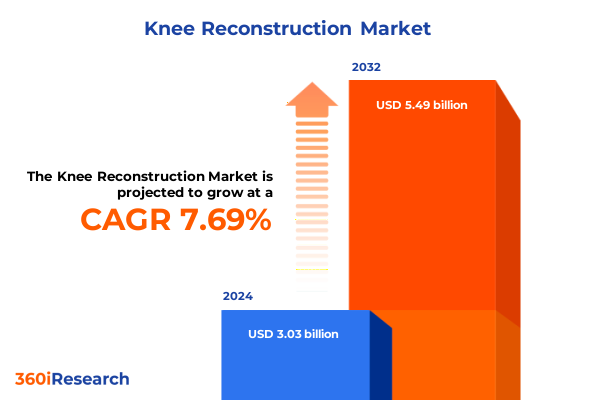

The Knee Reconstruction Market size was estimated at USD 3.24 billion in 2025 and expected to reach USD 3.46 billion in 2026, at a CAGR of 7.82% to reach USD 5.49 billion by 2032.

A concise and compelling introduction to the evolving knee reconstruction ecosystem integrating clinical drivers, technology advances, and care delivery shifts

Knee reconstruction has moved from a series of isolated technical procedures into an interconnected ecosystem where clinical evidence, technology platforms, and care-delivery models intersect to influence patient outcomes and provider economics. Over the past decade procedural refinements have narrowed the variance in surgical technique while the introduction of digital planning tools and intraoperative guidance has shifted emphasis toward precision, reproducibility, and recovery optimization. This evolution is not purely clinical; it reshapes procurement decisions, training priorities, and capital allocation across hospitals and ambulatory surgical centers.

The current landscape is defined by concurrent trends: the aging population and rising prevalence of osteoarthritis continue to sustain demand for reconstructive solutions; technological innovation-ranging from enhanced navigation to full robotic assistance-raises expectations for alignment, soft-tissue balancing and functional recovery; and care-site migration toward outpatient settings is changing the operational calculus for implants, instrumentation, and perioperative pathways. Taken together, these dynamics create a complex set of strategic levers for device manufacturers, health systems, and surgical teams, requiring an integrated view of clinical evidence, regulatory signals, and commercial execution to translate innovation into durable clinical and financial value.

An incisive overview of transformative clinical, technological, and care-delivery shifts reshaping knee reconstruction procedures and strategic priorities

The knee reconstruction arena is experiencing transformative shifts that reach beyond single-device innovations to alter the shape of surgical workflows, hospital economics, and patient expectations. Robotics and digital planning have become more than niche adjuncts; they are being used to standardize bone preparation, visualize patient anatomy in three dimensions, and reduce intraoperative variability. At the same time, computer-assisted navigation persists as a clinically validated pathway to improve alignment accuracy, while patient-specific instrumentation offers a tailored surgical plan that can reduce operative time when applied selectively.

Concurrently, care pathways are decentralizing. Ambulatory surgical centers are increasingly positioned to receive joint arthroplasty cases that meet defined clinical criteria, driven by evidence of comparable short-term safety and lower total episode costs in selected patients. This shift compels manufacturers and hospital systems to re-evaluate device logistics, kit sizing, and rapid-turnaround sterilization and replenishment strategies. Lastly, regulatory scrutiny and lifecycle management expectations have elevated the importance of post-market surveillance and real-world evidence, prompting companies to embed outcomes data collection into devices and digital platforms to demonstrate value to payers, surgeons and procurement teams. These combined shifts favor integrated solutions that align clinical performance with operational efficiency, and they reward organizations that can execute cross-functional change management between clinical, supply chain, and commercial stakeholders.

A focused analysis of how recent U.S. tariff modifications have created supply, sourcing, and procurement pressures across knee reconstruction value chains

In 2024 and into 2025 policy actions affecting tariffs and trade have become a material factor for manufacturers, providers, and supply-chain planners operating in knee reconstruction. U.S. modifications to Section 301 tariff actions broadened the set of product categories subject to elevated duties and explicitly included certain medical products, creating immediate sourcing and cost implications for medical device supply chains. These changes prompted healthcare trade associations and provider groups to publicly request carve-outs or exemptions, noting that medical products often rely on complex cross-border inputs and that rapid tariff changes risk supply interruptions and elevated procurement costs. The reaction from manufacturers has been mixed: some are advocating for exemptions or pragmatic staging to avoid patient-care disruptions, while others are accelerating regional sourcing strategies to mitigate exposure.

Operationally, tariffs have pushed procurement teams to re-examine supplier footprints, inventory buffers, and the feasibility of nearshoring versus multi-sourcing. For many suppliers, the most practical near-term responses have been tactical: reallocating production to lower-duty jurisdictions, qualifying alternate contract manufacturers, and increasing transparency across bill-of-materials to identify tariff-sensitive components. For health systems, the consequence has been heightened advocacy to preserve access to essential implants and instruments, given the interdependence of global manufacturing networks. While tariffs are only one of several economic pressures facing the sector, their cumulative effect has accelerated conversations about supply-chain resilience, price transparency, and the need for contractual flexibility to absorb episodic trade policy volatility.

A comprehensive breakdown of technology, end-user, product-type, and fixation segments revealing clinical implications and commercial considerations for knee reconstruction

Segment-level realities in knee reconstruction reveal distinct clinical and commercial drivers that influence product design, go-to-market approaches, and care-site adoption. When considering technology segmentation-spanning computer-assisted navigation, conventional manual techniques, patient-specific instrumentation, and robotics-assisted platforms-each pathway carries implications for capital intensity, workflow integration, and training. Computer-assisted navigation retains clinical value for alignment and has robust mid-term evidence supporting modest functional improvements, which keeps it relevant for systems prioritizing outcome consistency while managing capital deployment. Conventional manual techniques remain the baseline for most surgeons and sites because they are equipment-light and familiar, which preserves access in lower-resource settings and community hospitals. Patient-specific instrumentation can compress intraoperative steps for a subset of anatomies and cases, whereas robotics-assisted solutions deliver a broader suite of intraoperative analytics and reproducibility but require higher upfront investment and a coordinated adoption program.

End-user segmentation-split between ambulatory surgical centers and hospitals-creates divergent requirements for device kits, sterilization cycles, and perioperative support. Ambulatory surgical centers emphasize turnover efficiency, standardized implant inventories, and protocols that enable safe same-day discharge, which favors implants and instrumentation sets that are streamlined and compatible with outpatient pathways. Hospitals, by contrast, typically handle a wider clinical complexity mix-including revisions and higher-acuity cases-and therefore place a premium on implant versatility, availability of revision systems and intraoperative imaging or robotic adjuncts that support complex reconstructions.

Product-type segmentation-partial knee replacement, patellofemoral arthroplasty, revision knee replacement, and total knee replacement-shapes clinical decision-making, implant design and lifecycle considerations. Partial and patellofemoral options prioritize bone preservation, zonal fixation strategies and quicker rehabilitation, making them attractive for carefully selected patients and for settings seeking shorter stays. Revision knee replacement drives distinct supply-chain requirements, extended instrumentation and heightened sterilization demands because of case complexity and variability. Total knee replacement remains the workhorse clinical pathway and consequently influences broad portfolio investments, from implant geometry to instrumentation ergonomics.

Fixation strategies-cemented, cementless and hybrid-further influence implant selection across patient age groups and bone-quality profiles. Cemented fixation retains a long track-record of immediate mechanical stability and remains prevalent in populations with osteoporotic bone, while cementless and hybrid constructs are prioritized in younger, more active patients where biologic fixation and longer-term osseointegration are strategic goals. The intersection of fixation approach with product type and the chosen technology platform (for example, a robotic plan that targets optimal press-fit positioning for cementless stems) determines both intraoperative steps and downstream inventory requirements.

This comprehensive research report categorizes the Knee Reconstruction market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Fixation

- End User

Region-by-region perspectives on adoption drivers, reimbursement realities, and operational barriers across the Americas, Europe Middle East and Africa, and Asia-Pacific

Regional dynamics materially influence technology adoption, regulatory pathways, and commercial models. In the Americas the ecosystem is characterized by concentrated adoption of advanced surgical adjuncts, a high concentration of capital-equipped tertiary centers and an expanding role for ambulatory surgical centers in selected knee arthroplasty pathways. This mix incentivizes integrated offerings that reduce operating-room time, simplify logistics for high-volume outpatient workflows, and provide evidence packages that align with payer and hospital procurement priorities. The result is a regional environment where clinical champions and demonstration programs strongly influence adoption curves.

Europe, the Middle East and Africa present a heterogeneous landscape in which national reimbursement frameworks, hospital budgeting cycles, and health-technology assessment processes determine uptake speed. Western European systems often require robust health-economic evidence and alignment with national assessment bodies before large-scale adoption of capital-intensive technologies, while pockets of private-sector investment in the Middle East and selective markets across Africa are accelerating access to advanced robotic and navigation platforms. This variety demands flexible commercial models that can pair clinical training and outcomes tracking with phased investment approaches.

Asia-Pacific shows rapid momentum driven by expanding hospital capacity, targeted government investments in advanced healthcare infrastructure and growing private-sector purchases of high-tech surgical platforms. Several markets in the region are rapidly scaling installations of navigation and robotic systems, and local manufacturers have begun to offer competitive alternatives that are shaped for regional pricing and service models. Across regions, supply-chain resilience, regulatory timelines for device clearance and the availability of trained surgical teams remain the dominant operational constraints for technology deployment.

This comprehensive research report examines key regions that drive the evolution of the Knee Reconstruction market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

An evidence-driven overview of how incumbent and emerging companies are differentiating through robotics, digital services, and ecosystem-based commercial strategies

Competitive dynamics in knee reconstruction are anchored by established orthopedic OEMs as well as focused innovators delivering software, robotics and digital-service layers. Several legacy orthopedic companies have reinforced their portfolios with robotic or digital navigation capabilities, broadening the array of integrated offerings and making clinical support, training and service networks core differentiators. At the same time, new entrants and platform-specialist companies are introducing lighter-footprint systems and subscription-based service models that lower the barrier to entry for smaller hospitals and high-volume outpatient centers.

Manufacturers are differentiating not only on implant geometry and fixation chemistry but increasingly on connected systems that capture intraoperative metrics, facilitate postoperative outcomes tracking, and support value-based dialogues with payers. Strategic responses among companies have included targeted acquisitions of digital competitors, expanded investment in surgeon education programs, and the development of modular instruments that are compatible across multiple product lines. These tactical moves highlight a market that prizes ecosystem control-devices plus data-over stand-alone product sales, and they reward organizations that can align clinical evidence generation with scalable commercial support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Knee Reconstruction market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arthrex, Inc.

- B. Braun Melsungen AG

- ConforMIS, Inc.

- Corin Group Limited

- DePuy Synthes, Inc.

- Exactech, Inc.

- MicroPort Scientific Corporation

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Actionable recommendations for manufacturers and providers to strengthen supply resilience, align commercial models with care sites, and accelerate evidence-based technology adoption

Industry leaders should prioritize a set of actionable responses to sustain growth, protect margins, and accelerate clinical adoption. First, supply-chain resilience must be elevated from a procurement task to a strategic investment; this includes mapping tariffs and duty exposure across bill-of-materials, qualifying geographically diversified contract manufacturers, and building transparent multi-tier supplier visibility so that rapid policy shifts can be absorbed without compromising care delivery. Second, commercial strategies must align product offerings with the needs of ambulatory surgical centers and hospital systems differently: streamlined kits, reusable instrumentation and rapid-service contracts work well for high-throughput outpatient centers, while hospitals require versatile revision-capable systems and integrated digital-service contracts.

Third, manufacturers and providers should co-invest in surgeon training and in-room workflow optimization to reduce the friction associated with new technologies. Evidence generation must be deliberate: clinical registries and real-world outcome studies should be embedded from launch to demonstrate comparative effectiveness and support payer conversations. Fourth, pricing and contracting should evolve to include outcomes-linked terms and flexible commercial models-subscription licences for digital tools, outcome-based pricing for new surgical adjuncts, and bundled services for high-volume centers. Finally, proactive engagement with policy stakeholders is essential: companies and trade associations should coordinate to pursue medical-product exemptions where tariffs threaten supply continuity, while simultaneously advancing transparent cost-of-goods narratives that help payers and providers understand the drivers of device pricing. These measures, taken together, create a resilient commercial pathway that balances innovation with operational pragmatism.

A transparent research methodology combining peer-reviewed evidence, regulatory review, primary interviews, and supply-chain analysis to validate strategic conclusions

The underlying research approach blends systematic secondary analysis of peer-reviewed clinical literature, regulatory filings and public company disclosures with targeted primary outreach to clinician leaders, procurement professionals and surgical services administrators. Clinical evidence was reviewed with attention to randomized trials, meta-analyses and large registry studies addressing alignment, functional outcomes and safety of navigation and robotic systems. Regulatory signals and device clearances were examined through public 510(k) and CE pathways to identify indications expansions and timing of market entries.

Complementing evidence review, primary qualitative interviews provided context on adoption barriers, capital approval dynamics, and operating-room workflow changes required for new technologies. Supply-chain analysis included mapping of common bill-of-material exposures and an assessment of tariff-sensitive components based on public tariff notices and industry commentary. Findings were triangulated across data sources to ensure that clinical claims, commercial behavior and policy impacts were evaluated from multiple perspectives, improving the confidence of insights and the relevance of strategic recommendations for senior leaders and procurement teams.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Knee Reconstruction market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Knee Reconstruction Market, by Product Type

- Knee Reconstruction Market, by Technology

- Knee Reconstruction Market, by Fixation

- Knee Reconstruction Market, by End User

- Knee Reconstruction Market, by Region

- Knee Reconstruction Market, by Group

- Knee Reconstruction Market, by Country

- United States Knee Reconstruction Market

- China Knee Reconstruction Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

A succinct conclusion synthesizing clinical, operational, and strategic imperatives that will determine leadership in knee reconstruction going forward

Knee reconstruction today sits at a crossroads between proven surgical principles and a rapid wave of enabling technologies that promise greater precision and standardized outcomes. The practical challenge for stakeholders is not solely choosing the ‘‘best’’ device or platform but aligning product roadmaps, training investments, and commercial models with the distinct needs of ambulatory and hospital settings, while simultaneously safeguarding supply chains against policy shocks. When technology adoption is paired with robust evidence generation and pragmatic operational design, it creates not only improved technical outcomes but also a scalable proposition for payers and health systems.

Looking forward, the organizations most likely to lead are those that treat device innovation as part of a broader systems problem: they will integrate clinical training, data capture, service economics and supply-chain flexibility into end-to-end solutions. By following an evidence-led commercialization path and proactively engaging with reimbursement and policy stakeholders, leaders can convert the current period of disruption into an opportunity for differentiation and sustainable value creation.

Clear next steps to acquire the detailed knee reconstruction market report and secure a tailored briefing with the associate director of sales and marketing

To obtain the full market research report, contact Ketan Rohom, Associate Director, Sales & Marketing, who can arrange report access, licensing options, and tailored briefing packages to meet executive decision-making timelines and procurement requirements. The report purchase path includes a confidential briefing with the research team to review methodology, scope exclusions, and any requested custom analyses so buyers can validate fit-for-purpose coverage before finalizing procurement. For institutional buyers seeking enterprise licensing, multi-user access, or tailored country-level extracts, Ketan can coordinate commercial terms, delivery schedules, and post-purchase advisory workshops to accelerate internal adoption and deployment of insights.

- How big is the Knee Reconstruction Market?

- What is the Knee Reconstruction Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?