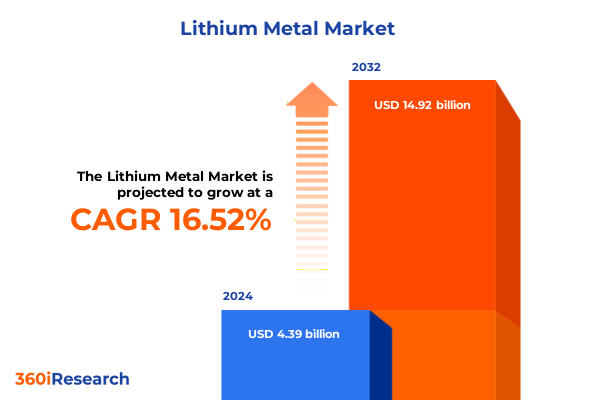

The Lithium Metal Market size was estimated at USD 5.11 billion in 2025 and expected to reach USD 5.95 billion in 2026, at a CAGR of 16.54% to reach USD 14.92 billion by 2032.

Revealing the Expansive Importance of Lithium Metal as the Foundation for Next-Generation Energy Storage, Defense Solutions, and Advanced Industrial Applications

Lithium metal has emerged as a pivotal material in the modern technological landscape, underpinning breakthroughs in energy storage, aerospace, and high-performance industrial applications. Historically recognized for its exceptional electrochemical properties, it is now experiencing unparalleled demand driven by global decarbonization agendas and the electrification of transportation. As governments and private enterprises race to meet sustainability targets, lithium metal’s role has expanded from niche research to mainstream deployment, powering next-generation batteries and enabling lightweight, high-strength components in aerospace and defense platforms.

The increasing intersection of advanced battery technologies with critical sectors highlights lithium metal’s transformative potential. Innovations in solid-state and lithium-oxygen batteries promise extraordinary energy density gains, while emerging manufacturing processes such as direct lithium extraction are reshaping supply paradigms. Amidst this backdrop of rapid technological evolution, stakeholders must navigate complex regulatory environments, geopolitical influences, and supply chain bottlenecks. This introduction establishes a foundation for understanding how lithium metal is not merely a commodity but a strategic resource whose dynamics will shape innovation curves, market structures, and policy frameworks in the coming decade.

Examining the Watershed Moment in Lithium Metal Demand Fueled by Breakthrough Battery Technologies and Diversification Across Critical Industries

The lithium metal landscape has undergone seismic transformations, particularly with the advent of advanced battery chemistries that leverage its low electrochemical potential and high energy density. Solid-state batteries have transitioned from laboratory curiosities to pilot-scale production, demonstrating safety and performance benefits that traditional liquid electrolytes cannot match. Meanwhile, lithium-oxygen cells are advancing through multilayered cathode architectures, promising weight and capacity improvements critical for electric aviation and grid-scale applications.

Concurrently, shifts in end-use industries have diversified demand beyond electric vehicles to include aerospace and defense components, smart wearables, and medical monitoring devices. These transformative trends are underpinned by refinements in product forms, with innovations in foil, powder, and granule production enabling specialized designs for thick and thin applications. Such diversification signals a maturation of the lithium metal market, where stakeholders are compelled to adapt to fast-evolving technology roadmaps and cross-sector collaborations that redefine traditional supply and demand dynamics.

Assessing the Cascading Consequences of New United States Tariffs on Lithium Metal Supply Chains and Market Dynamics in 2025

In early 2025, the United States implemented new tariffs on imported lithium metal products, aiming to bolster domestic production and secure critical mineral supply chains. These duties, set at progressive rates depending on product form and grade, have immediately influenced cost structures for downstream manufacturers. Companies reliant on foil, powder, and sheet formats have faced higher input prices, compelling a reassessment of sourcing strategies and inventory management practices. In response, several battery developers and defense contractors have initiated dual-sourcing frameworks and explored vertical integration to mitigate exposure to trade-related cost volatility.

The cumulative impact extends beyond pricing pressures: tariffs have triggered ripple effects across allied industries, from primary cell producers specializing in coin and cylindrical cells to high-purity lithium applications in glass, ceramics, and pharmaceuticals. Domestic producers utilizing advanced extraction and electrolysis processes stand to gain competitive advantage, attracting fresh investments and forging public-private partnerships. Yet, the imposition of duties has also stimulated international negotiations, as key trade partners seek relief measures and reciprocal adjustments that could reshape future tariff schedules. This section underscores the breadth of 2025 tariff consequences, articulating how regulatory shifts are recalibrating global lithium metal economics.

Interpreting Multi-Dimensional Lithium Metal Market Insights by Application, Product Form, End Use Industry, Purity Levels, and Production Processes

A nuanced understanding of market segmentation reveals opportunities and constraints unique to each category. When analyzing applications, it becomes evident that aerospace and defense demand precision-engineered lithium metal, while the batteries segment bifurcates into advanced solid-state and lithium-oxygen systems, alongside primary cells encompassing coin, cylindrical, and prismatic formats. Furthermore, diversified end uses span consumer electronics-ranging from laptops and smartphones to wearables-and electric vehicles, which are segmented into commercial and passenger variants, as well as specialized industrial and medical device implementations.

Examining product forms exposes further granularity: foil technologies differentiate into thick and thin varieties for flexible cell designs; granules present distinct coarse and fine morphologies for uniform packing density; powders are refined into flake and spherical shapes to optimize electrode deposition; and sheet materials vary in thickness to suit structural and conductive requirements. Purity gradients from technical to ultra-high purity directly influence performance in battery grade and high-purity niches, while manufacturing processes, from direct lithium extraction and molten salt electrolysis to thermal reduction and vacuum distillation, define cost, environmental impact, and feedstock viability. This multi-dimensional segmentation analysis illuminates the competitive landscape and highlights emerging intersections where innovation and customization accelerate product differentiation.

This comprehensive research report categorizes the Lithium Metal market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Purity

- Manufacturing Process

- Application

- End Use Industry

Exploring Regional Dynamics Shaping the Global Lithium Metal Market Across the Americas, EMEA, and Asia-Pacific Growth Hubs

Regional dynamics in the lithium metal market are shaped by resource endowments, regulatory environments, and industrial infrastructure. In the Americas, North and South American jurisdictions benefit from established mining operations and growing electrolyzer capacities, with downstream battery manufacturing clusters expanding to capitalize on tariff incentives and EV mandates. Public policy initiatives emphasizing critical minerals security have spurred joint ventures between mining firms and technology developers, reinforcing regional supply chain integration and resilience against import disruptions.

Conversely, Europe, the Middle East, and Africa exhibit a mosaic of market drivers. European decarbonization policies and EMEA’s strategic mineral partnerships cultivate a robust ecosystem for high-purity and technical grade lithium. Technological hubs in Germany, France, and the United Kingdom have accelerated research into direct lithium extraction and recycling, while Middle Eastern nations leverage abundant solar resources to power electrolysis and evaporation processes. In Africa, emerging projects are laying the groundwork for future extraction, though infrastructure and capital constraints remain challenges.

Asia-Pacific continues to dominate production and consumption, driven by leading battery manufacturers in China, Japan, and South Korea. Advanced metallurgical-grade processing, coupled with integrated refining and cell production facilities, reinforces the region’s leadership in lithium metal downstream value chains. Investment in alternative extraction technologies and recycling initiatives is intensifying, as regional players seek to reduce reliance on traditional spodumene and brine sources and fulfill sustainability commitments. This geographic overview underscores the importance of regional strategies in shaping competitive advantage and market access.

This comprehensive research report examines key regions that drive the evolution of the Lithium Metal market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Lithium Metal Producers and Innovators Driving Competitive Strategies, Technological Advances, and Collaborative Ecosystems

Leading companies in the lithium metal arena are distinguished by their technological prowess, strategic partnerships, and scalable production capabilities. Established extractors deploying direct lithium extraction and molten salt electrolysis are increasingly entering joint ventures with battery OEMs to secure off-take agreements. At the same time, specialty chemical producers are investing in thin foil and high-purity powder ramp-ups to capture value in emerging solid-state and lithium-oxygen applications. These collaborations blend core competencies and foster agile responses to shifting market demands.

Simultaneously, battery manufacturers and cell designers are deepening backward integration efforts, acquiring stakes in mining operations or forging exclusive processing contracts to protect against raw material scarcity. Defense-focused firms are also forging alliances with purveyors of technical and ultra-high purity lithium, ensuring material compliance with rigorous quality standards. In parallel, startups pioneering thermal reduction and vacuum distillation techniques are attracting venture capital and government grants, propelling novel processes from pilot to commercial scale. Collectively, these strategic maneuvers underscore a competitive landscape defined by cross-sector collaboration, technological differentiation, and a relentless quest for more efficient, cost-effective production platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithium Metal market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Allkem Limited

- Altura Mining Limited

- American Lithium Metals, Inc.

- AMG Lithium GmbH

- Bacanora Lithium Plc

- Cornish Lithium Ltd

- Energy Exploration Technologies, Inc.

- Ganfeng Lithium Co., Ltd.

- Ioneer Ltd

- Lake Resources N.L.

- Liontown Resources Limited

- Lithium Americas Corp.

- Livent Argentina S.A.

- Livent Corporation

- Mineral Resources Limited

- Mitsui Mining & Smelting Co., Ltd.

- Nemaska Lithium Inc.

- Novalith Technologies Pty Ltd

- Pilbara Minerals Limited

- Sayona Mining Limited

- Sigma Lithium Corporation

- Sociedad Química y Minera de Chile S.A.

- Tianqi Lithium Corporation

- Zhejiang Huayou Cobalt Co., Ltd.

Delivering Strategic Action Plans for Industry Leaders to Navigate Volatility, Capitalize on Innovation, and Strengthen Supply Chain Resilience

Industry leaders should prioritize resilient supply chain architectures by diversifying feedstock sources across geographic regions and extraction methods. Embracing direct lithium extraction alongside traditional salt lake brine and hard rock mining can mitigate geopolitical risks and stabilize input costs. Furthermore, forging strategic alliances with battery fabricators and end-use manufacturers will secure off-take commitments and facilitate co-development of application-specific material grades.

Investment in pilot-scale production of advanced product forms-such as ultra-thin foil for solid-state cells and spherical powder optimized for additive manufacturing-can position companies at the forefront of innovation. To capture emerging opportunities in aerospace, defense, and medical device markets, tailored purity adjustments and rigorous quality assurance protocols are imperative. Finally, advocating for balanced trade policies through industry consortiums and government engagement will ensure that tariff regimes support domestic investment without stifling innovation or inflating end-user costs. By executing these strategic initiatives, stakeholders can strengthen market position, capitalize on technological advancements, and navigate an increasingly complex regulatory landscape.

Detailing a Robust Methodological Framework Integrating Primary, Secondary, and Advanced Analytical Techniques for Lithium Metal Market Insight

This research employs a structured approach combining primary interviews, secondary data aggregation, and advanced analytical frameworks to deliver robust market insights. Primary research involved detailed consultations with executives from mining firms, battery manufacturers, and end-use industry representatives to capture qualitative perspectives on supply chain challenges and technological trajectories. Secondary research encompassed public filings, patent databases, industry journals, and regulatory publications to construct a comprehensive view of process innovations and market regulations.

Quantitative analyses were conducted using bottom-up and top-down methodologies, mapping production capacities, material flows, and trade statistics to validate market segmentation and regional dynamics. Advanced techniques such as SWOT analysis, Porter’s Five Forces, and cross-sectional techniques provided strategic evaluation of competitive landscapes, while scenario modeling assessed the impact of tariffs, policy shifts, and technology adoption rates. By triangulating these methods, the study ensures data reliability, mitigates biases, and offers actionable insights that drive strategic decision-making for stakeholders across the lithium metal value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithium Metal market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithium Metal Market, by Product Form

- Lithium Metal Market, by Purity

- Lithium Metal Market, by Manufacturing Process

- Lithium Metal Market, by Application

- Lithium Metal Market, by End Use Industry

- Lithium Metal Market, by Region

- Lithium Metal Market, by Group

- Lithium Metal Market, by Country

- United States Lithium Metal Market

- China Lithium Metal Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding Reflections on Lithium Metal’s Evolving Role in Future Technologies, Regulatory Landscapes, and Sustainable Energy Transitions

Lithium metal’s trajectory is inexorably linked to the evolution of sustainable energy and high-performance applications. As solid-state and lithium-oxygen batteries approach commercial viability, the material’s unparalleled electrochemical properties will unlock new horizons in electric aviation, grid energy storage, and portable electronics. Concurrently, advancements in extraction and processing technologies promise to alleviate supply constraints and environmental burdens, forging a more resilient and responsible value chain.

Looking ahead, the interplay of regulatory measures-such as tariffs and critical mineral policies-and regional strategic initiatives will shape competitive landscapes. Stakeholders who integrate diversified sourcing, agile manufacturing, and collaborative R&D will be best positioned to capitalize on the lithium metal revolution. Ultimately, the convergence of innovation, policy, and market demand will define the next chapter of global energy transitions, with lithium metal at its core as a catalyst for transformative change.

Connect with Ketan Rohom to Unlock Comprehensive Lithium Metal Market Intelligence and Drive Informed Strategic Decisions

To explore the full breadth of strategic insights and market intelligence on lithium metal, you are invited to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through tailored offerings that align precisely with your organizational objectives, whether you aim to benchmark against competitors, secure in-depth analyses of emerging applications, or chart a resilient supply chain roadmap. His expertise in high-value B2B engagement ensures that every interaction is geared toward unlocking actionable market data that drives revenue growth and competitive advantage.

By reaching out, you will gain access to our most comprehensive market research report, covering critical topics such as advanced battery chemistries, tariff impacts, and regional supply dynamics in rigorous detail. This collaboration will empower decision-makers to make high-confidence strategic investments, optimize product portfolios, and anticipate regulatory shifts. Contact Ketan today to schedule a personalized consultation and obtain exclusive insights that position your organization at the vanguard of the lithium metal revolution.

- How big is the Lithium Metal Market?

- What is the Lithium Metal Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?