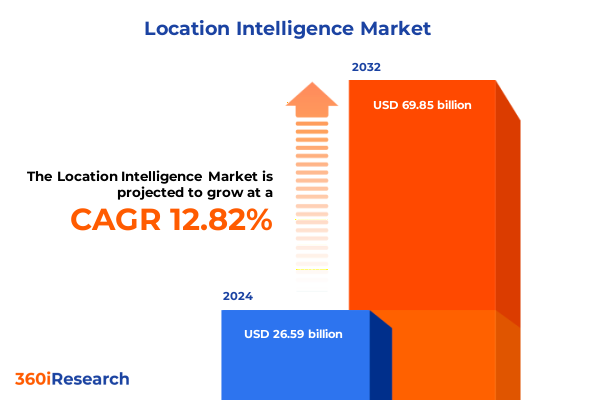

The Location Intelligence Market size was estimated at USD 29.96 billion in 2025 and expected to reach USD 33.75 billion in 2026, at a CAGR of 12.85% to reach USD 69.85 billion by 2032.

Framing the Emerging Location Intelligence Paradigm: Unveiling Market Drivers, Technological Evolution, and Strategic Imperatives Shaping Growth

Location intelligence has emerged as a cornerstone of modern decision-making, transcending traditional geospatial analysis to deliver strategic clarity across industries. At its core, this discipline integrates geographic data with business analytics to reveal contextual insights that drive smarter investments, operational efficiencies, and customer engagement. Recent technological advancements-ranging from high-precision satellite imaging to real-time sensor networks-have exponentially expanded the volume and granularity of available spatial data. As organizations seek to navigate increasingly complex environments, location intelligence offers a unified lens through which to interpret patterns, predict trends, and optimize resource allocation.

The convergence of cloud computing, artificial intelligence, and edge analytics has further accelerated the adoption of location intelligence solutions. By harnessing machine learning models tailored to geospatial datasets, enterprises can automate the detection of anomalies, forecast demand fluctuations, and personalize services at scale. This fusion of capabilities is reshaping industries as diverse as retail, transportation, and urban planning, enabling stakeholders to craft experiences that respond dynamically to shifts in consumer behavior and environmental conditions. Meanwhile, regulatory developments and data privacy frameworks are prompting solution providers to embed secure processing architectures and transparent governance mechanisms, ensuring responsible use without stifling innovation.

Against this backdrop, the imperative for businesses is clear: to embed location intelligence into strategic planning processes, invest in interoperable data infrastructures, and foster cross-functional collaboration between data scientists, GIS specialists, and business leaders. By doing so, organizations can anticipate emerging challenges, capture new revenue streams, and maintain resilience in an era defined by rapid technological change and heightened demand for actionable intelligence.

Navigating Pivotal Transformations in Location Intelligence: How AI, Edge Computing, and Data Democratization are Redefining the Landscape

The landscape of location intelligence is undergoing a profound metamorphosis, driven by the integration of artificial intelligence, the rise of edge computing, and the democratization of data analytics. AI-powered spatial algorithms now enable real-time routing optimization for logistics fleets, adaptive urban infrastructure planning, and personalized marketing based on hyper-local consumer insights. Concurrently, the proliferation of edge devices-from connected vehicles to IoT-enabled public spaces-facilitates the decentralized processing of geospatial information, reducing latency and enabling instant decision-making at the point of data capture.

Data democratization initiatives are also redefining access paradigms. Self-service platforms and intuitive visualization tools empower non-technical stakeholders to engage with complex geospatial datasets, fostering cross-departmental collaboration and accelerating time to insight. These platforms are increasingly augmented with natural language interfaces, enabling users to query spatial trends through simple conversational commands rather than traditional query languages.

Emerging open standards and interoperability frameworks are further eroding silos, allowing diverse datasets-ranging from demographic profiles to environmental sensors-to be integrated seamlessly. This shift not only fosters richer analysis but also catalyzes collaborative ecosystems in which public agencies, private enterprises, and research institutions co-create innovative solutions. As a result, location intelligence is evolving from a specialized function into a strategic imperative that underpins resilient supply chains, adaptive marketing strategies, and sustainable urban development.

Assessing the Layered Effects of 2025 United States Tariff Policies on Location Intelligence Ecosystem: Supply Chains, Cost Structures, and Competitive Dynamics

In 2025, a series of tariff adjustments by the United States government have introduced new cost variables that ripple through the location intelligence ecosystem. These measures, aimed at recalibrating trade balances and safeguarding domestic manufacturing, have led to increased import duties on critical hardware components such as high-precision sensors and specialized GIS processing servers. As a result, solution providers are grappling with elevated procurement costs, prompting a strategic pivot toward alternative sourcing strategies and intensified supplier negotiations.

Simultaneously, increased duties on select software licenses and development frameworks have compelled vendors to reevaluate pricing models and licensing structures. Some firms have responded by transitioning to subscription-based deployments hosted in domestic data centers, mitigating tariff impacts through localized cloud infrastructures. Others have accelerated investments in open-source geospatial platforms, leveraging community-driven innovation to offset rising costs and sustain feature roadmaps.

The cumulative effect of these tariff policies extends to service delivery as well. Integration and support teams are witnessing longer lead times for hardware rollouts, necessitating enhanced project planning and contingency reserves. Consulting practices are evolving to include tariff-impact assessments as a standard component of solution roadmaps, ensuring clients can anticipate cost fluctuations and maintain project timelines. Ultimately, the 2025 tariff environment is reinforcing the importance of agility and supplier diversification, driving the market toward more resilient operational frameworks.

Unlocking Market Potential Through Layered Segmentation Analysis: Component, Deployment, Enterprise Scale, Application, and Industry Vertical Perspectives

A nuanced understanding of market segmentation reveals the diverse pathways through which location intelligence solutions deliver value. When examining the component dimension, hardware deployments form the backbone of spatial data capture, complemented by services that encompass strategic consulting, systems integration, and ongoing support engagements. Underpinning these layers, software solutions range from data management platforms that ensure the integrity and accessibility of vast geospatial repositories to specialized GIS applications and advanced visualization environments that translate complex spatial relationships into intuitive dashboards.

Deployment type further delineates market dynamics, with cloud-hosted environments offering the scalability and rapid provisioning that modern enterprises demand, while on-premise installations continue to serve organizations with stringent security requirements or legacy system dependencies. Enterprise scale is also a critical axis of differentiation: large organizations frequently pursue multi-tiered strategies, blending enterprise-wide analytics with departmental pilots, whereas small and medium enterprises typically adopt modular solutions to address specific use cases with minimal upfront investment.

Application areas illuminate the breadth of potential impact, spanning emergency response scenarios where real-time mapping can save lives, to precision location-based marketing campaigns that boost customer engagement. Transportation planners leverage route-optimization engines to alleviate congestion, while urban development teams harness spatial simulation tools to model growth trajectories and infrastructure stressors. Finally, industry verticals introduce further granularity; government bodies at local, state, and national levels deploy these solutions to enhance public safety and service delivery, healthcare organizations streamline facility management across clinics and hospitals, real estate firms conduct portfolio analyses for commercial and residential assets, retail operators optimize inventory and store footprints in brick-and-mortar and e-commerce channels, and transportation network providers in aviation, rail, and roadways orchestrate end-to-end logistics with pinpoint accuracy.

This comprehensive research report categorizes the Location Intelligence market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Deployment Type

- Organization Size

Decoding Regional Footprints and Growth Catalysts in Location Intelligence: Unraveling Americas, EMEA, and Asia-Pacific Market Dynamics and Innovation Trajectories

Regional dynamics in the location intelligence market underscore distinctive adoption patterns, regulatory environments, and innovation drivers. In the Americas, a mature technology infrastructure and strong private-sector investment have fueled the rapid uptake of cloud-based analytics, particularly in North America’s advanced retail and logistics sectors. Policy initiatives aimed at modernizing transportation networks are fostering collaborative pilot programs in urban centers, while public safety agencies continue to integrate geospatial intelligence into emergency management workflows.

Europe, the Middle East, and Africa present a multifaceted landscape, where stringent data protection regulations in the European Union coexist with robust smart-city deployments in Gulf nations and emerging infrastructure projects across sub-Saharan Africa. This region’s emphasis on sustainability and regulatory compliance has accelerated the adoption of solutions that support carbon-emission monitoring, environmental impact assessments, and cross-border logistics optimization under evolving trade agreements.

In Asia-Pacific, the confluence of rapid urbanization, government digitization mandates, and a burgeoning technology services sector has created fertile ground for location intelligence expansion. From precision agriculture programs in Australasia to intelligent transport corridors in East Asia, organizations are leveraging both cloud and edge deployments to address high-velocity data streams and real-time decision requirements. Across all regions, the interplay between public-sector initiatives, private investment, and technological innovation continues to drive differentiated pathways for market expansion and solution evolution.

This comprehensive research report examines key regions that drive the evolution of the Location Intelligence market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Location Intelligence Sector: Competitive Positioning, Partnerships, and Differentiated Offerings

Leading technology providers in the location intelligence arena are distinguishing themselves through strategic partnerships, solution breadth, and domain expertise. Some firms have forged alliances with global cloud infrastructure vendors to deliver fully managed, secure geospatial platforms that combine scalable compute resources with pre-integrated mapping engines. Others excel in vertical-specific offerings, embedding advanced analytics within transportation and logistics workflows or integrating building management systems for healthcare and real estate applications.

A subset of companies is also pioneering next-generation capabilities by incorporating machine learning models that learn from historical spatial patterns to predict infrastructure stress points or consumer footfall trends. These organizations leverage robust data management pipelines and visualization modules to surface insights in executive dashboards, enabling rapid interpretation and action. Meanwhile, competition has intensified in the services domain, where consulting and integration specialists are expanding managed-service portfolios to deliver end-to-end support from initial proof-of-concept through enterprise-wide rollouts.

Innovation ecosystems are further enriched by emerging entrants that focus on open-source geospatial frameworks, driving cost efficiencies and fostering community-driven enhancements. As incumbent players respond with feature expansions and acquisition strategies, the competitive dynamic continues to evolve, offering buyers a spectrum of choices that range from turnkey cloud subscriptions to deeply customized, on-premise deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Location Intelligence market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alteryx Inc.

- Environmental Systems Research Institute, Inc.

- Google LLC

- HERE Global B.V.

- Hexagon AB

- IBM Corporation

- International Business Machines Corporation

- Mapbox Inc.

- Mapbox, Inc.

- Microsoft Corporation

- Oracle Corporation

- Pitney Bowes Inc.

- Pitney Bowes Inc.

- TomTom N.V.

- Trimble Inc.

Strategic Imperatives for Industry Leaders in Location Intelligence: Driving Scalable Innovation, Operational Excellence, and Sustainable Competitive Advantage

Industry leaders should pursue a multifaceted roadmap centered on embedding location intelligence at the core of strategic initiatives, rather than treating it as a standalone capability. This begins with cultivating executive sponsorship and establishing cross-functional governance teams that align geospatial goals with broader organizational objectives, ensuring sustained investment and clear accountability. Furthermore, prioritizing interoperability by adopting open standards and APIs will enable seamless integration with existing enterprise resource planning, customer relationship management, and IoT platforms, accelerating time to value while mitigating vendor lock-in risks.

To foster continuous innovation, organizations must invest in agile data architectures that support both cloud-native and edge computing paradigms, enabling dynamic workload distribution based on latency and security requirements. Building internal analytical competencies through targeted training programs and collaborative workshops will empower business users to derive insights without overreliance on specialized teams. In parallel, executives should champion data governance frameworks that uphold privacy regulations and ethical use, reinforcing trust with stakeholders and preempting compliance challenges.

Finally, forging ecosystem partnerships-whether with niche technology startups, academic institutions, or sector-specific consultancies-can unlock complementary capabilities and accelerate solution co-creation. By adopting this holistic strategy, industry leaders can transform location intelligence from a tactical tool into a strategic enabler that drives sustainable growth, operational resilience, and competitive differentiation.

Comprehensive Research Framework and Methodological Rigor Underpinning Our Location Intelligence Analysis: Data Sources, Analytical Techniques, and Statistical Validity

The insights presented in this report are underpinned by a rigorous research framework designed to ensure validity, reliability, and actionable relevance. Primary data collection involved structured interviews with senior executives, GIS specialists, and domain experts across key industry verticals, supplemented by workshops that yielded in-depth perspectives on emerging use cases and deployment challenges. Secondary research encompassed a comprehensive review of technical white papers, regulatory filings, and public-sector digital transformation roadmaps, providing contextual richness and trend confirmation.

Quantitative analysis was conducted using validated statistical techniques to identify correlations between technology adoption patterns and business outcomes, while qualitative thematic synthesis distilled key strategic narratives. Geographic coverage was intentionally broad, capturing regional nuances through localized market assessments and expert panels located in North America, Europe, the Middle East, Africa, and Asia-Pacific. Data triangulation methods were applied to cross-verify insights, ensuring that recommendations reflect a balanced synthesis of empirical evidence and practitioner experience.

This methodological rigor enables stakeholders to trust the findings, understanding both the underlying data sources and the analytical processes that drive conclusions. By blending quantitative robustness with qualitative depth, the research delivers a holistic perspective that equips decision-makers to navigate complexity and seize emerging opportunities with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Location Intelligence market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Location Intelligence Market, by Component

- Location Intelligence Market, by Application

- Location Intelligence Market, by Deployment Type

- Location Intelligence Market, by Organization Size

- Location Intelligence Market, by Region

- Location Intelligence Market, by Group

- Location Intelligence Market, by Country

- United States Location Intelligence Market

- China Location Intelligence Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesis and Strategic Outlook for Location Intelligence: Integrating Insights, Forecasting Future Trajectories, and Charting Pathways for Industry Leadership

The narrative of location intelligence is one of continuous evolution, shaped by technological breakthroughs, shifting regulatory landscapes, and dynamic market demands. From the proliferation of edge computing to the strategic implications of recent tariff policies, the ecosystem is becoming more intricate yet offers unparalleled potential for organizations willing to invest in geospatial capabilities. The segmentation insights-spanning hardware, services, software, deployment models, organizational scale, applications, and industry sectors-reveal the multifaceted nature of value creation and underscore the importance of targeted approaches that align with specific operational and strategic goals.

Regionally, the Americas lead with mature cloud adoption and innovative pilot programs, while EMEA balances regulatory rigor with sustainability initiatives, and Asia-Pacific accelerates urbanization projects through government digitization mandates. The competitive landscape is marked by a blend of established technology powerhouses and agile niche players, each contributing unique strengths that collectively expand the frontier of location intelligence solutions.

As the industry continues to mature, success will hinge on the ability to integrate spatial insights into core business processes, foster collaborative ecosystems, and maintain the agility to adapt to policy shifts and technological disruptions. Ultimately, location intelligence stands as a vital enabler of strategic clarity, operational efficiency, and sustainable growth across sectors.

Seize Strategic Advantage with Our In-Depth Location Intelligence Report: Engage with Ketan Rohom to Unlock Custom Insights, Drive Informed Decisions, and Accelerate Growth

Embark on an elevated strategic journey by securing the comprehensive location intelligence report that delves into the intricate market dynamics, segmentation nuances, competitive landscapes, and regional trends shaping this rapidly evolving domain. By collaborating with Ketan Rohom, Associate Director of Sales & Marketing, you can gain tailored guidance on leveraging data-driven insights to optimize investment priorities, refine go-to-market strategies, and accelerate innovation cycles. Reach out today to align your strategic objectives with actionable intelligence, unlock hidden growth opportunities, and empower your organization to stay ahead of emerging challenges and competitive pressures. Your next strategic advantage awaits; engage now to transform granular research findings into decisive business impact and sustained market leadership.

- How big is the Location Intelligence Market?

- What is the Location Intelligence Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?