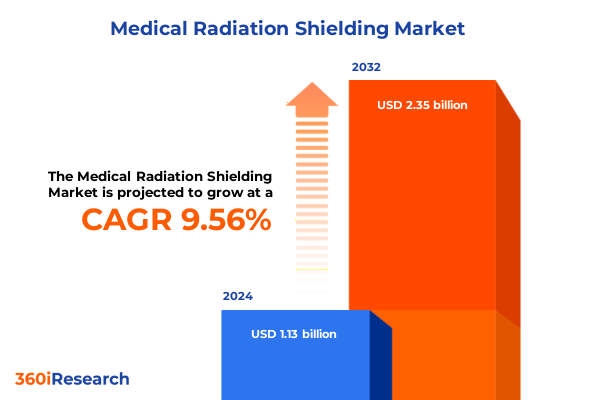

The Medical Radiation Shielding Market size was estimated at USD 1.23 billion in 2025 and expected to reach USD 1.34 billion in 2026, at a CAGR of 9.66% to reach USD 2.35 billion by 2032.

Understanding the Critical Role of Radiation Shielding in Modern Healthcare Environments and the Innovation Imperative Driving Market Dynamics

The rapid expansion of diagnostic and therapeutic imaging has intensified the need for robust radiation protection measures within healthcare environments. In 2023, approximately 93 million CT scans were performed on 62 million patients across the United States, raising concerns about cumulative ionizing radiation exposure despite the life-saving benefits of these procedures. This high volume of imaging underscores the dual imperative to uphold diagnostic excellence while minimizing radiation risk through advanced shielding solutions.

As healthcare providers balance escalating procedural demand with stringent safety requirements, radiation shielding emerges as a critical enabler of both clinical efficacy and regulatory compliance. Projected imaging utilization through 2030 indicates a 5.6% to 45.2% increase across modalities, driven primarily by population growth and aging demographics. Within this context, effective shielding design not only safeguards patients and practitioners but also underpins sustainable growth of imaging services by ensuring operational resilience under evolving dose constraints.

Examining the Paradigm Shift to Lead-Free and Advanced Composite Shielding Materials Transforming Medical Radiation Protection Practices Worldwide

The landscape of medical radiation shielding is undergoing a transformational shift as stakeholders move beyond traditional lead-based systems toward high-performance, eco-friendly alternatives. Innovations in polymer matrix composites have unlocked new frontiers in material science, leveraging high atomic number fillers such as gadolinium, tungsten, and bismuth to achieve attenuation efficiencies exceeding 93% at diagnostic energy ranges, all while reducing weight and minimizing toxic waste disposal burdens. At the same time, layered composite architectures that combine low- and high-Z materials are demonstrating superior shielding performance compared to monolithic metals, offering enhanced flexibility for wearable garments and modular barrier designs.

Collaborative efforts between research institutions and industry leaders are accelerating commercialization of non-lead shielding products. Regulatory pressures, exemplified by the EU’s Restriction of Hazardous Substances directive and tightening occupational dose limits such as the reduction of the crystalline lens threshold from 150 mSv/year to 50 mSv/year, have catalyzed investment in lead-free solutions. As a result, composite shields are not only gaining traction in diagnostic radiology but also proving their worth in therapeutic applications where high-energy modalities demand robust protection with minimal material thickness.

Analyzing the Complex Interplay of United States Tariff Policies and Their Multi-Dimensional Impact on Medical Radiation Shielding Supply Chains

Recent U.S. trade policies have imposed sweeping import tariffs that reverberate through the medical radiation shielding sector, reshaping supply chains and sourcing strategies. A universal 10% tariff on most imported goods introduced in April 2025 was swiftly followed by country-specific levies, including a cumulative 145% duty on Chinese lab and imaging equipment, intensifying cost pressures for shielding material components such as high-density polymers and tungsten particulates. These measures have compelled domestic distributors and hospital procurement teams to reevaluate inventory approaches and prioritize suppliers with U.S.-based manufacturing capabilities to mitigate exposure to fluctuating tariff regimes.

Furthermore, Section 301 tariffs targeting essential medical device imports such as syringes, gloves, and steel-containing products introduce an additional layer of complexity for manufacturers of shielding barriers and accessories. The prospect of up to 100% duties on rubber and polymer intermediates underscores the urgency for industry collaboration with policymakers to seek exemptions for radiation safety equipment. In parallel, organizations are exploring materials diversification, including domestically sourced barium rubber and locally produced polymer composites, to shield operations from future trade disruptions and ensure uninterrupted protection for clinical users.

Unveiling Critical Insights into Market Segmentation by Product, Application, End User, and Sales Channels Shaping the Future of Radiation Shielding Solutions

Diverse product types define the spectrum of radiation shielding solutions, ranging from conventional lead aprons, vests, glass, and rubber to cutting-edge non-lead alternatives like barium rubber, fiber and polymer composites, and tungsten polymer blends. Within this framework, each subcategory demands distinct manufacturing processes, disposal protocols, and performance considerations, shaping competitive positioning and adoption rates across healthcare settings.

Applications of shielding products span the breadth of radiology disciplines, from analog and digital dental radiology to sophisticated CT, fluoroscopy, mammography, and X-ray diagnostics. In interventional suites, cardiovascular and neurovascular procedures rely on wearable aprons and mobile barriers, while nuclear medicine modalities such as PET and SPECT necessitate specialized isotope attenuation solutions. Therapeutic radiology, encompassing brachytherapy and external beam therapy, further extends the shielding mandate to room design and surgical instrument protection.

End users, including academic institutes, diagnostic centers, hospitals, outpatient clinics, and research laboratories, evaluate shielding requirements through the lens of workflow integration, regulatory adherence, and cost management. Meanwhile, sales channels-direct enterprise contracts, traditional distribution networks, and emerging online retail platforms-are redefining market access and customer engagement models, driving both product customization and experiential buying journeys.

This comprehensive research report categorizes the Medical Radiation Shielding market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Sales Channel

Illuminating Regional Dynamics across the Americas, Europe Middle East & Africa and Asia-Pacific Markets Driving Demand for Radiation Shielding Technologies

The Americas region benefits from advanced healthcare infrastructure and substantial R&D investment, enabling rapid uptake of novel shielding technologies in both diagnostic imaging and radiation therapy environments. Cancer incidence in North America, which accounted for over 1.4 million new cases in 2020, heightens demand for protective solutions across growing oncology service lines. Meanwhile, robust reimbursement frameworks and stringent FDA and NRC regulations underscore the region’s role as a trendsetter in safety standards and material innovation.

In Europe, Middle East & Africa, sustainability imperatives and harmonized directives like the EU’s Restriction of Hazardous Substances have catalyzed the shift to green shielding alternatives. Europe’s elevated age-standardized cancer incidence rate of 1419.6 per 100,000 appears alongside proactive policy measures aimed at reducing institutional lead waste and enhancing worker protection under revised ICRP dose constraints.

Asia-Pacific markets are witnessing surging demand driven by demographic shifts, rising cancer prevalence, and stepped-up healthcare expenditure. With Asia accounting for nearly half of global new cancer cases in 2020, regional players are investing in local manufacturing of barium and tungsten composites to achieve cost-effective scale and reduce reliance on imports, particularly under evolving trade and supply chain landscapes.

This comprehensive research report examines key regions that drive the evolution of the Medical Radiation Shielding market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators and Their Strategic Initiatives Fueling Competitive Advantage in the Fast-Evolving Medical Radiation Shielding Sector

Industry stalwarts are strengthening their competitive positions through targeted product innovations and strategic collaborations. ESCO Technologies has expanded its non-lead apron portfolio, leveraging advanced antimony and tungsten elastomer matrices to deliver lightweight, recyclable protective garments that comply with rigorous European and U.S. safety benchmarks. Burlington Medical’s introduction of the XENOLITE 800 NL series underscores the shift towards eco-friendly materials, combining antimony and tungsten in flexible Dow elastomer constructions suited for interventional radiology and mobile shielding needs.

Concurrently, Mirion Technologies, Nelco Worldwide, and MarShield are investing in automated manufacturing platforms and in-house composite development to shorten lead times and enhance material performance. Ray-Bar Engineering’s recent partnerships with polymer suppliers aim to integrate high-Z fillers into standardized injection molding processes, reducing production complexity for lead-free barriers. Meanwhile, global partnerships and distribution agreements are enabling these companies to extend their footprints into emerging markets, meeting the nuanced demands of academic institutes, outpatient centers, and research laboratories across diverse geographies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Radiation Shielding market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Canon Medical Systems Corporation

- Corning Incorporated

- Eckert & Ziegler AG

- GE HealthCare Technologies Inc.

- Halma plc

- Koninklijke Philips N.V.

- Radiation Protection Products, Inc.

- Shimadzu Corporation

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Varian Medical Systems, Inc.

- Veritas Medical Solutions, LLC

Delivering Actionable Strategic Recommendations for Healthcare Leaders to Navigate Market Complexity and Drive Adoption of Advanced Shielding Practices

Healthcare providers should prioritize diversification of raw material sources to mitigate exposure to tariff volatility and ensure continuity of supply. Partnering with domestic polymer composite manufacturers and exploring recyclable filler options can reduce dependency on high-tariff imports without compromising shielding efficacy.

Investing in next-generation composite research and development is essential to achieving competitive differentiation. Organizations that integrate nanofiller science and layered hybrid architectures will unlock weight savings and performance enhancements that resonate with sustainability goals and regulatory compliance demands.

Stakeholders must actively engage with regulatory bodies to advocate for tariff exemptions on critical radiation protection equipment. Collaborative industry coalitions can amplify the case for shield-specific trade relief, safeguarding access to life-critical protective solutions.

Finally, developing modular shielding platforms and digital design tools will empower clinical engineers and hospital planners to customize barrier, booth, and garment configurations swiftly, optimizing workflow integration and capital utilization.

Outlining the Rigorous Research Methodology Combining Primary Interviews and Secondary Data Sources Ensuring Robust Insights into Radiation Shielding Markets

This analysis integrates stakeholder interviews with leading shielding manufacturers, radiology directors, and materials scientists, complemented by an extensive review of regulatory documents, patent filings, and peer-reviewed publications. Quantitative data from healthcare utilization studies and tariff notices were triangulated with expert insights to map technology adoption curves and supply chain risks.

Secondary research encompassed examination of white papers, conference proceedings, and industry association reports, while primary engagements involved in-depth consultations with device engineers, safety officers, and procurement specialists. The resulting synthesis delivers a holistic view of market dynamics, regulatory influences, and innovation trajectories within the medical radiation shielding sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Radiation Shielding market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Radiation Shielding Market, by Product Type

- Medical Radiation Shielding Market, by Application

- Medical Radiation Shielding Market, by End User

- Medical Radiation Shielding Market, by Sales Channel

- Medical Radiation Shielding Market, by Region

- Medical Radiation Shielding Market, by Group

- Medical Radiation Shielding Market, by Country

- United States Medical Radiation Shielding Market

- China Medical Radiation Shielding Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Summarizing Key Findings and Concluding Perspectives on Market Evolution and Future Directions for Medical Radiation Shielding Innovations

Effective radiation shielding is paramount to sustaining the growth of diagnostic imaging and radiation therapy services amid rising procedural volumes and stricter dose constraints. Material innovations, from lead-free nanocomposites to tungsten-infused polymers, are reshaping product portfolios and enabling safer, more ergonomic protection solutions. Regional nuances-from regulatory drivers in North America and Europe to rapid adoption patterns in Asia-Pacific-underscore the importance of tailored go-to-market strategies.

Industry leaders must navigate a complex interplay of trade policies, regulatory mandates, and technological advancements. Those who strategically diversify supply chains, invest in R&D, and engage with policymakers will be best positioned to deliver next-generation shielding systems that meet the evolving needs of healthcare professionals and patients alike.

Connect with Ketan Rohom to Secure Your Comprehensive Medical Radiation Shielding Market Report and Empower Your Strategic Decision-Making Process Today

For personalized guidance and to secure a copy of the comprehensive Medical Radiation Shielding Market report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s deep expertise in radiology and shielding technologies will ensure you obtain actionable insights tailored to your business needs. Contact Ketan to explore customized licensing options, unlock detailed competitive intelligence, and fuel your strategic decision making. Engage with Ketan Rohom today to drive your next phase of growth in the radiation shielding sector.

- How big is the Medical Radiation Shielding Market?

- What is the Medical Radiation Shielding Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?