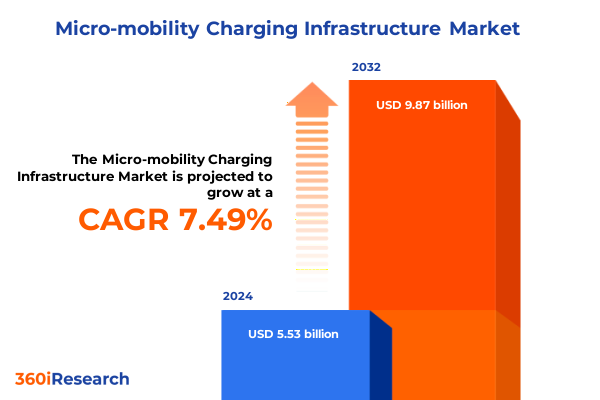

The Micro-mobility Charging Infrastructure Market size was estimated at USD 5.85 billion in 2025 and expected to reach USD 6.19 billion in 2026, at a CAGR of 7.74% to reach USD 9.87 billion by 2032.

Laying the Foundational Context for Micro-Mobility Charging Infrastructure Amidst Urbanization and Sustainability Imperatives

The surge in urban micro-mobility solutions has placed charging infrastructure at the forefront of the sustainability and transportation discourse. As cities grapple with congestion, pollution, and shifting commuter preferences, charging networks emerge as a critical enabler for electric bikes, scooters, and other lightweight electric vehicles. In this context, stakeholders spanning municipal authorities, private operators, and utilities must navigate a rapidly changing environment marked by policy reforms, evolving technology standards, and shifting consumer behaviors.

Against this backdrop, a coherent framework for evaluating infrastructure readiness and market viability becomes indispensable. This executive summary establishes the foundational context for understanding how charging stations, connectors and adapters, power converters, and integrated software platforms must coalesce to support the anticipated growth of micro-mobility fleets. By delineating the key drivers and barriers shaping deployment strategies, the introduction sets the stage for a detailed exploration of transformative developments that will define the industry’s trajectory.

Revolutionary Technological Advancements and Evolving Regulations Steering the Future of Micro-Mobility Charging Ecosystems

Technological breakthroughs and regulatory reforms have accelerated the pace of change within micro-mobility charging networks, reshaping expectations around performance, interoperability, and cost efficiency. On the technology front, rapid advancements in charging hardware now enable higher power densities and reduced latency, facilitating turn-around times that meet consumer expectations for convenience and reliability. Simultaneously, emerging communication protocols and cloud-based management platforms have introduced new levels of remote monitoring and predictive maintenance, paving the way for a seamless user experience and optimized uptime.

In parallel, governments and standards bodies have introduced policy frameworks that incentivize network expansion while mandating compliance with sustainability and safety guidelines. Incentive programs tied to zero-emission transportation, combined with evolving safety regulations for high-power electrical installations in public spaces, have compelled operators and equipment manufacturers to innovate rapidly. Harmonization efforts around connector standards and grid interactivity protocols are further reducing barriers to large-scale rollouts. As these technological and regulatory shifts converge, they are rapidly refashioning the competitive landscape and catalyzing opportunities for differentiated offerings.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Policies on Micro-Mobility Charging Infrastructure Operational and Financial Ramifications

The introduction of new tariff measures in 2025 has had profound implications for the procurement and deployment of critical charging infrastructure components within the United States. Imposed at elevated rates on imported battery cells, power converters, and select charging accessories, these duties have elevated landed costs and forced many operators to reevaluate sourcing strategies. For companies reliant on cross-border supply chains, the cumulative cost impact has necessitated a shift toward nearshoring and component standardization initiatives to preserve project economics.

Faced with compressed margins, original equipment manufacturers and network operators have accelerated partnerships with domestic suppliers and prioritized modular, upgradable station designs that can accommodate future tariff revisions. In turn, these strategic adjustments have influenced the pace of infrastructure rollout, prompting some stakeholders to phase network expansions while others seek creative financing models and public-private partnerships to defray increased capital requirements. The combination of immediate cost pressures and long-term supply chain realignment underscores the need for dynamic risk management in a market now characterized by greater policy vulnerability and competitive volatility.

Deriving Critical Insights from Diverse Component Vehicle Charger Power Integration Application and End-User Segmentation Patterns

Examining charging infrastructure requires a granular understanding of each segment’s unique dynamics. Within the component category, charging stations serve as the critical physical interface, while connectors and adapters ensure compatibility across diverse fleets; power converters provide voltage regulation to accommodate varying battery chemistries; and software solutions enable real-time network orchestration and billing capabilities. Each of these elements must align seamlessly to deliver a robust user experience and maintain system uptime.

Different types of micro-mobility vehicles further drive demand patterns. E-bikes often leverage lower-power charging architectures compared to e-scooters, while e-mopeds and e-skateboards each present distinct form-factor and power requirements that influence charger design. Similarly, the choice between fast chargers and standard chargers hinges on use-case considerations-fast chargers support quick turn-around in high-traffic urban zones, whereas standard chargers can suffice for overnight deployments in residential or workplace settings.

Power capacity divisions illuminate deployment priorities: capacity tiers above 500W cater to performance-oriented applications, mid-range systems between 250W and 500W strike a balance between cost and convenience, and sub-250W station configurations cater to light-duty or shared-fleet models. Integration strategies also vary: standalone solutions provide simple plug-and-play installations, integrated smart grid solutions enable demand-response and energy optimization, and emerging vehicle-to-grid architectures offer the promise of bidirectional energy flows that support grid resilience.

Usage scenarios encompass commercial charging at retail and workplace environments, public charging in parking lots and transit hubs, and residential installations in apartments and private homes. Each application domain imposes different design, permitting, and operational considerations. Finally, stakeholder categories ranging from large commercial enterprises and fleet operators to private individuals and public transport authorities shape procurement criteria, service level requirements, and financing models. Understanding these interdependent segmentation layers reveals where demand is intensifying and highlights opportunities for targeted product and service innovation.

This comprehensive research report categorizes the Micro-mobility Charging Infrastructure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Vehicle Type

- Charger Type

- Power Capacity

- Integration Type

- Application

- End-User

Uncovering Distinct Dynamics and Growth Drivers across the Americas Europe Middle East & Africa and Asia-Pacific Micro-Mobility Charging Markets

Regional market dynamics in micro-mobility charging infrastructure are shaped by distinct socio-economic drivers and regulatory environments. In the Americas, mature industry players in the United States and Canada benefit from established policy frameworks supporting clean transportation, supplemented by state and municipal incentives that accelerate network growth. Meanwhile, Latin American markets are in earlier stages of infrastructure development, contending with varied regulatory regimes and limited access to financing, yet presenting attractive potential for leapfrog deployments where grid challenges encourage off-grid and solar-integrated solutions.

Across Europe, Middle East & Africa, European cities lead with comprehensive urban mobility plans that prioritize integrated charging networks and standardized interoperability protocols. Governments there often mandate public-access benchmarks and collaborate with utilities to roll out smart-charging programs. In the Middle East, pilot projects in urban centers are testing advanced charging hubs powered by renewable energy, while in parts of Africa, infrastructure deployments contend with grid reliability issues and nascent regulatory frameworks.

In the Asia-Pacific region, China’s booming micro-mobility market drives aggressive expansion of local manufacturing and charging deployments, supported by national subsidies and municipal mandates. Advanced economies such as Japan and South Korea emphasize high-efficiency charging solutions and early adoption of vehicle-to-grid pilots, whereas Southeast Asian markets balance public network build-outs with portable charging solutions to address dense urban corridors and tourism-driven demand.

This comprehensive research report examines key regions that drive the evolution of the Micro-mobility Charging Infrastructure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategies and Innovations from Leading Players Shaping the Micro-Mobility Charging Infrastructure Landscape

A variety of industry leaders are shaping the micro-mobility charging ecosystem through differentiated strategies. Pioneers in charging station manufacturing are investing in modular architectures that can be upgraded with emerging connector standards and power electronics. At the same time, software providers are embedding advanced analytics and dynamic pricing algorithms to maximize station utilization and simplify customer engagement.

Strategic alliances between charging network operators and utility companies are facilitating pilot projects for demand-response integration, enabling charging loads to be coordinated with renewable energy generation and grid stability needs. Equipment providers are competing on total cost of ownership by offering end-to-end service contracts that bundle installation, maintenance, and software subscriptions under single agreements.

Market entrants are also exploring vehicle-to-grid functionality as a differentiator, collaborating with fleet operators and public transport authorities to aggregate distributed energy resources. This growing emphasis on bidirectional charging and energy storage integration is shifting the competitive focus from point-of-sale transactions toward holistic energy management solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Micro-mobility Charging Infrastructure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acton, Inc.

- Ather Energy Private Limited

- Beam Global

- Bikeep OÜ

- Charge Enterprises, Inc.

- Electrify America LLC

- Flower Turbines

- Gogoro Inc.

- Ground Control Systems

- Helbiz Inc.

- High-Tech Gründerfonds Management GmbH

- KNOT SAS

- KUHMUTE, Inc.

- LIme by Neutron Holdings, Inc.

- Magment GmbH

- Magna International Inc.

- Meredot LLC

- ONgineer GmbH

- PBSC Urban Solutions

- Perch Mobility, Inc.

- Robert Bosch GmbH

- SemaConnect Charging Infra Pvt Ltd by Blink Charging Co.

- Siemens AG

- SOLUM PHOTOVOLTAIC INNOVATION S.L.

- Swiftmile, Inc.

- Swobbee GmbH

- The Mobility House GmbH

- TIER Mobility SE

- WiTricity Corporation

Proposing Targeted Strategic Initiatives and Partnerships to Accelerate Adoption and Optimize Micro-Mobility Charging Networks

Industry leaders should prioritize the deployment of scalable, modular charging stations that can support multiple vehicle interfaces and power levels, thus reducing the need for costly retrofits as standards evolve. Forming strategic partnerships with software platform providers will enable the introduction of unified user experiences across networks, improving customer loyalty and utilization metrics.

Collaborating directly with utilities to integrate smart-charging capabilities will not only enhance grid resilience but also unlock revenue streams through demand-response programs. To mitigate tariff exposure and supply chain disruptions, stakeholders should diversify component sourcing by engaging local manufacturers and pursuing flexible design specifications that accommodate alternative suppliers.

Tailoring financing models to application segments-with options such as revenue-sharing agreements for commercial properties or subscription-based offerings for residential users-can accelerate adoption by lowering entry barriers. Embedding circular economy principles into station design and maintenance practices will further enhance sustainability credentials and support long-term operational efficiency.

Defining a Robust Mixed-Methodological Framework Incorporating Qualitative Expertise and Data-Driven Analysis for Comprehensive Insight

This analysis synthesizes findings from a robust mixed-methodology framework that integrates qualitative expertise with data-driven research. The approach began with an extensive review of publicly available industry documentation, regulatory filings, and technology white papers to establish a comprehensive secondary research foundation. This phase was complemented by a series of in-depth interviews with subject matter experts across charging equipment manufacturers, network operators, utility executives, and municipal planners.

Primary research insights were then triangulated with quantitative datasets related to infrastructure deployments, power capacity installations, and tariff structures to validate emerging trends. The methodology incorporated a segmentation analysis to ensure each component, vehicle type, charger specification, and end-user category was rigorously evaluated. By combining expert opinion with corroborating data, this research methodology delivers actionable intelligence while maintaining objectivity and transparency in interpretation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Micro-mobility Charging Infrastructure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Micro-mobility Charging Infrastructure Market, by Component

- Micro-mobility Charging Infrastructure Market, by Vehicle Type

- Micro-mobility Charging Infrastructure Market, by Charger Type

- Micro-mobility Charging Infrastructure Market, by Power Capacity

- Micro-mobility Charging Infrastructure Market, by Integration Type

- Micro-mobility Charging Infrastructure Market, by Application

- Micro-mobility Charging Infrastructure Market, by End-User

- Micro-mobility Charging Infrastructure Market, by Region

- Micro-mobility Charging Infrastructure Market, by Group

- Micro-mobility Charging Infrastructure Market, by Country

- United States Micro-mobility Charging Infrastructure Market

- China Micro-mobility Charging Infrastructure Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Key Takeaways and Charting the Path Forward in the Rapidly Evolving Micro-Mobility Charging Ecosystem While Leveraging Strategic Innovations

As the micro-mobility sector accelerates, charging infrastructure emerges as both the enabler and differentiator for sustainable urban transportation networks. The interplay of advanced hardware design, software-driven network management, and evolving regulatory landscapes underscores the complexity of market expansion. Stakeholders must remain vigilant in responding to tariff shifts and supply chain realignments while capitalizing on segmentation-specific opportunities spanning components, vehicle types, power tiers, and application contexts.

Regional variations highlight the need for localized strategies, whether targeting incentive-driven adoption in North America, compliance-oriented rollouts in Europe Middle East & Africa, or rapid, subsidy-driven deployments in Asia-Pacific. Leading companies are already forging partnerships to integrate charging infrastructure with broader energy management systems, signaling a shift toward holistic ecosystem solutions. By synthesizing these insights and acting on the recommended strategic imperatives, industry participants can secure competitive advantage and support the transition to equitable, low-carbon urban mobility.

Empower Your Strategic Decisions Today by Engaging with Associate Director Ketan Rohom to Unlock Comprehensive Insights and Partnership Opportunities

If you are seeking to deepen your understanding of the evolving micro-mobility charging infrastructure market or to develop bespoke strategies that align with your organizational goals and sustainability commitments, engaging directly with Associate Director Ketan Rohom offers an unparalleled opportunity. Ketan’s extensive expertise in market dynamics and technology trends empowers you to glean actionable insights tailored to your specific context. Whether you require a customized executive briefing, detailed competitive benchmarking, or a confidential consultation on tariff mitigation strategies and deployment roadmaps, Ketan can guide you through the complexities of implementation.

By connecting with Ketan, you can leverage our comprehensive repository of market intelligence and strategic frameworks to accelerate your project timelines and secure a competitive edge. Initiating this dialogue ensures that you will receive hands-on support in defining use-case-specific recommendations, validating supplier partnerships, and crafting compelling business cases for internal and external stakeholders. Reach out today to take the next step toward transforming micro-mobility charging infrastructure opportunities into measurable returns.

- How big is the Micro-mobility Charging Infrastructure Market?

- What is the Micro-mobility Charging Infrastructure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?