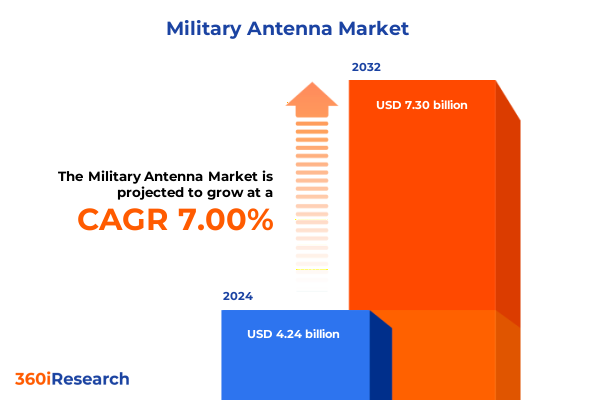

The Military Antenna Market size was estimated at USD 4.53 billion in 2025 and expected to reach USD 4.83 billion in 2026, at a CAGR of 7.05% to reach USD 7.30 billion by 2032.

Understanding the Strategic Imperative and Evolution of Military Antenna Technologies Driving Modern Defense Communications and Electronic Warfare Superiority

The military antenna domain stands at the intersection of national security imperatives and rapid technological evolution, demanding a nuanced understanding of communications, electronic warfare, surveillance, and navigation requirements. In this environment, antennas are more than simple signal transmitters and receivers; they act as critical force multipliers that enable real-time situational awareness, secure communications, and precision engagement across air, land, naval, and space platforms. As defense budgets prioritize digital connectivity and networked operations, the role of antennas evolves from legacy hardware components to advanced systems enabling distributed sensing and command-and-control architectures.

In parallel, the proliferation of unmanned platforms, proliferation of peer adversaries, and the drive toward multi-domain operations have heightened the demand for antennas capable of multi-band, multifunction, and adaptive capabilities. This shift underscores the strategic imperative for defense planners and procurement agencies to understand the technological landscape and anticipate future integration challenges. Through this executive summary, we embark on a comprehensive exploration of the military antenna ecosystem, uncovering the forces driving innovation and strategic decision-making in this critical segment.

Deciphering the Emerging Technological and Strategic Shifts Redefining the Military Antenna Landscape Across All Defense Domains

The last decade has witnessed transformative shifts in the military antenna landscape, propelled by advancements in materials science, digital signal processing, and software-defined architectures. Traditional fixed-frequency, single-function antennas are being replaced by agile, tunable arrays that operate seamlessly across multiple bands. This trend reflects the convergence of communication and electronic warfare requirements, where threat environments necessitate antennas that can dynamically switch roles between secure voice/data transmission and jamming or signal intelligence roles.

Simultaneously, antenna form factors are shrinking while capabilities expand, thanks to breakthroughs in metamaterials and embedded sensors. Platforms across all domains-airborne, land, naval, and space-now integrate conformal or low-observable antennas that preserve stealth characteristics. These systems leverage the rapid proliferation of digital beamforming techniques to enhance range, resolution, and resilience against electronic countermeasures. Consequently, defense architects must reconcile competing demands for miniaturization, power efficiency, and multifunctionality within constrained envelope and weight budgets.

Moreover, network-centric operations and the emphasis on resilient, mesh-connected force structures are driving the adoption of portable and fixed deployment models that offer plug-and-play connectivity. As alliances deepen interoperability requirements, antennas certified across different platforms and allied cryptographic standards gain preference. These shifts collectively underscore a new era in which adaptability and integration with advanced communication infrastructures define competitive advantage.

Unveiling the Comprehensive Economic and Operational Impacts of the 2025 United States Tariff Measures on Military Antenna Supply Chains and Procurement

In 2025, newly enacted tariff measures in the United States have introduced significant headwinds to defense procurement cycles and supply chain logistics associated with military antennas. While these measures aim to protect domestic industries and secure critical technology supply lines, they have also accelerated cost pressures for raw materials and finished components sourced from traditional overseas suppliers. The resulting price escalations reverberate through defense budgets, compelling agencies to reassess lifecycle cost structures and explore alternate sourcing strategies.

At the same time, the uncertainty introduced by fluctuating tariff rates has created challenges for long-term contract negotiations. Defense prime contractors and subsystem integrators are now factoring in potential tariff volatility when structuring master service agreements and vendor roadmaps. This has prompted a shift toward greater emphasis on domestic production capabilities and vertical integration of certain antenna subcomponents. In parallel, cross-border joint ventures and technology transfer agreements with allied nations have emerged as risk mitigation pathways, albeit at the expense of extended certification and compliance lead times.

Operationally, the cumulative impact has prompted a renewed focus on standardizing antenna designs to minimize part variations and streamline qualification processes. Consolidated platforms that utilize modular, scalable antenna suites can more readily adapt to shifting tariff landscapes by enabling component reuse across multiple vehicle classes. This approach not only buffers against material cost swings but also enhances readiness by reducing the administrative overhead associated with multiple qualification streams.

Leveraging Multi-Dimensional Segmentations to Extract Actionable Insights Within the Diverse Military Antenna Ecosystem Dynamics

The military antenna market can be dissected through four core segmentation dimensions, each revealing critical insights into demand patterns and performance requirements. Based on platform type, defense systems span airborne platforms-ranging from fixed wing and rotary wing to unmanned aerial vehicles-land vehicles that include field deployable, tracked, and wheeled systems, naval assets from submarines and surface ships to unmanned surface vessels, and space assets encompassing ground stations and satellites. This segmentation highlights the diversity of form factor and frequency challenges that system integrators must address when provisioning antennas across such varied envelopes and operational profiles.

Examining deployment type further distinguishes between fixed installations and portable systems. Fixed antennas, such as those integrated into naval superstructures or ground-based communication posts, prioritize high-power, high-gain performance, while portable variants focus on rapid deployability, resilience to environmental extremes, and ease of operator handling in austere conditions. When evaluating application-specific requirements, communications links must balance bandwidth and encryption needs, electronic warfare antennas demand rapid scanning and jamming capabilities, navigation arrays emphasize precision and redundancy, radar systems require high power and low sidelobe performance, signal intelligence sensors prioritize sensitivity, and surveillance systems combine wide area coverage with target discrimination capabilities.

Finally, end-user segmentation illuminates procurement drivers among the Air Force, Army, Coast Guard, defense agencies, homeland security, and Navy. Each stakeholder group emphasizes different performance criteria-airborne communications suites will drive broad bandwidth and low weight for fixed wing platforms, while surface ship radars on naval vessels demand robust power handling and multipath mitigation. By integrating these segmentation perspectives, decision-makers can pinpoint R&D investments and configuration strategies that align with the unique operational imperatives of each platform and user community.

This comprehensive research report categorizes the Military Antenna market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Deployment Type

- Polarization

- Frequency

- Application

- End User

Illuminating Regional Variations and Strategic Drivers Shaping the Military Antenna Market Dynamics Across Key Global Regions

Regional market dynamics reflect both geopolitical considerations and localized procurement strategies. In the Americas, defense modernization initiatives continue to bolster investments in next-generation airborne systems and networked ground forces, driving demand for antennas optimized for joint operations and allied interoperability. The sustained focus on domestic manufacturing incentives has also stimulated local supplier ecosystems, reducing reliance on imported subassemblies.

Across Europe, the Middle East & Africa, the emphasis is on integrated air and maritime surveillance architectures to address asymmetric threats and territorial defense needs. Collaborative programs under alliance frameworks are fostering standardization of antenna interfaces and encryption protocols, enabling seamless data exchange across multinational task forces. Investment in coastal and border security assets further expands requirements for high-mobility, portable antenna systems capable of withstanding harsh environmental conditions.

In the Asia-Pacific region, rapid fleet expansions and modernization of airborne assets drive high-volume antenna procurements. Strategic tensions in maritime zones reinforce demand for multifunctional naval antennas with extended range and electronic warfare countermeasures. Meanwhile, space domain awareness initiatives are spurring investments in ground station infrastructure, where satellite antennas must deliver precise tracking and robust uplink/downlink performance under congested orbital traffic conditions.

This comprehensive research report examines key regions that drive the evolution of the Military Antenna market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positions and Competitive Advantages of Leading Military Antenna Developers and Technology Providers

Leading defense contractors and technology providers are strategically positioning themselves to capture growth opportunities in the military antenna segment. L3Harris, for example, has invested heavily in software-defined antenna systems that enable on-the-fly reconfiguration for multi-role applications, emphasizing modular open system architectures to facilitate rapid upgrades. BAE Systems focuses on digital beamforming research to enhance signal fidelity and resilience, leveraging collaborations with allied R&D institutes to accelerate technology adoption.

Lockheed Martin and Northrop Grumman are developing integrated electronic warfare suites that combine antenna arrays with on-board processing, reducing system footprints on aircraft and naval vessels. These efforts underscore the trend toward convergence of communications and EW capabilities. Raytheon leverages its heritage in advanced radar technologies to produce antennas capable of fused modes-simultaneous radar, communications, and electronic intelligence-while Thales explores partnerships in Asia-Pacific to localize production of phased array systems, catering to regional offset agreements.

Mid-tier suppliers and niche innovators are also playing pivotal roles. Specialized companies focusing on metamaterials and additive manufacturing techniques are enabling lightweight, conformal antennas for emerging platforms. These collaborations with prime contractors help tailor solutions for unmanned systems and small satellite constellations, bridging capability gaps in areas where traditional manufacturing approaches are less agile.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Antenna market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Alaris The RF Technology Group Ltd.

- Amphenol Corporation

- Antcom Corporation

- Antenna Products Corporation

- AvL Technologies, Inc.

- BAE Systems plc

- Ball Corporation

- Barker & Williamson

- Chelton Limited

- Cobham Advanced Electronic Solutions

- Comrod Communication AS

- Eylex Pty Ltd.

- Hascall-Denke Engineering and Manufacturing

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Mobile Mark, Inc.

- MTI Wireless Edge Ltd.

- Pulse Power and Measurement Ltd.

- Rami

- Rantec Microwave Systems, Inc.

- Raytheon Technologies Corporation

- Rohde & Schwarz GmbH & Co. KG

- Sensor Systems, Inc.

- Shakespeare Company, LLC

- Thales Group

- TRIVAL ANTENE d.o.o.

Actionable Strategic Recommendations to Guide Industry Leaders in Navigating Market Disruptions and Harnessing Emerging Opportunities in Military Antenna Sector

Industry leaders should prioritize flexible manufacturing strategies that blend domestic production with strategic partnerships to navigate tariff uncertainties. Establishing dual-sourcing agreements for critical antenna subcomponents can mitigate supply chain disruptions while maintaining program timelines. In tandem, pursuing investments in digital twin simulations and virtual prototyping will shorten development cycles and reduce qualification costs associated with multiple platform integrations.

From a technology standpoint, embedding agile waveform processing capabilities and advanced signal analytics into antenna subsystems will enable rapid role switching between communications, electronic warfare, and intelligence functions. Companies should collaborate with systems integrators early in the design phase to ensure seamless integration within open architectures and allied data networks. Strengthening interoperability testing protocols across different platform families will further enhance readiness and reduce field retrofit requirements in coalition deployments.

On the commercial engagement front, defense contractors can leverage insights from end-user segmentation to tailor value propositions. For homeland security clients, emphasize portable, rapid-deploy solutions with minimal operator training. For naval customers, highlight high-power, multi-band naval arrays resilient to saltwater corrosion and extreme sea states. By aligning product roadmaps with the specific mission profiles and procurement cycles of each user community, industry leaders can secure long-term framework agreements and incremental upgrade contracts.

Comprehensive Research Methodology Detailing Data Collection Sources Analytical Frameworks and Validation Processes Underpinning the Executive Summary

This executive summary is underpinned by a rigorous, multi-stage research methodology combining primary and secondary data sources. Initial desk research involved the review of open-source defense procurement databases, government tariff filings, and technical whitepapers from leading defense research laboratories. This phase established baseline understanding of regulatory changes, technological roadmaps, and platform modernization plans.

Complementing desk analysis, primary interviews were conducted with senior engineers, procurement officers, and systems integrators across key allied nations. These discussions provided qualitative insights into platform-specific antenna performance challenges, certification requirements, and strategic sourcing objectives. Triangulation of interview findings with public contract award notices and trade association reports ensured a robust validation of emerging trends.

Finally, the data was synthesized through a segmentation lens, incorporating platform type, deployment mode, application, and end-user perspectives. Each insight was stress-tested against regional defense strategies and tariff scenarios to surface actionable implications. Validation workshops with subject matter experts refined the final narrative, ensuring that the strategic recommendations and conclusions reflect current operational realities and anticipate future defense communication demands.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Antenna market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Antenna Market, by Platform Type

- Military Antenna Market, by Deployment Type

- Military Antenna Market, by Polarization

- Military Antenna Market, by Frequency

- Military Antenna Market, by Application

- Military Antenna Market, by End User

- Military Antenna Market, by Region

- Military Antenna Market, by Group

- Military Antenna Market, by Country

- United States Military Antenna Market

- China Military Antenna Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Synthesis Highlighting Key Strategic Takeaways and Future Outlook for Stakeholders in the Global Military Antenna Landscape

The analysis reveals that military antennas are at the forefront of defense modernization, evolving into versatile, multifunctional assets integral to networked operations. Technological advances in digital beamforming, metamaterials, and software-defined architectures are redefining platform capabilities and battlefield connectivity. However, emerging tariff measures require a recalibration of sourcing and production strategies to ensure program continuity and cost efficiency.

Regional dynamics underscore the importance of alliance-based standardization and localized supply chains to enhance resilience and interoperability. Key players are responding by deepening partnerships, investing in modular open system architectures, and pioneering digital twin methodologies to accelerate development cycles. Industry leaders who proactively blend strategic sourcing with advanced capabilities integration will be best positioned to meet the operational imperatives of tomorrow’s multi-domain environments.

In conclusion, the military antenna market presents significant opportunities for differentiated offerings that address the dual challenges of technological complexity and procurement volatility. By leveraging the segmentation insights, regional nuances, and actionable recommendations outlined herein, defense stakeholders can make informed decisions that drive mission success and sustain competitive advantage.

Connect with Associate Director for Tailored Insights and Secure Your Comprehensive Military Antenna Market Intelligence Report Today

Unlock unparalleled strategic clarity and operational advantage by engaging directly with Ketan Rohom, the Associate Director, Sales & Marketing. Your tailored consultation will provide a deep dive into key antenna technologies, evolving procurement environments, and competitive positioning. This one-on-one engagement ensures you receive targeted recommendations to refine procurement strategies, mitigate supply chain disruptions, and capitalize on emerging electronic warfare and communications capabilities. Secure your comprehensive military antenna market intelligence report today to stay ahead of evolving threats and technological trends with confidence and precision.

- How big is the Military Antenna Market?

- What is the Military Antenna Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?