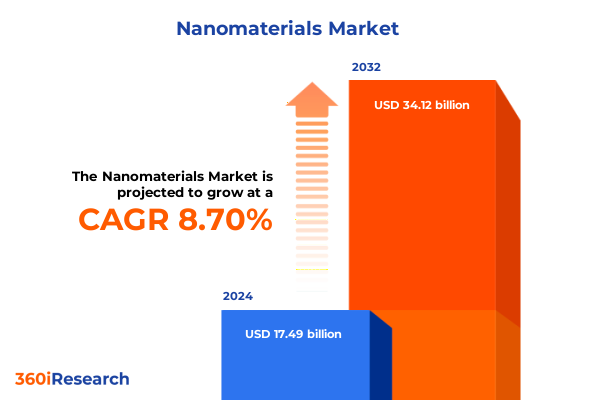

The Nanomaterials Market size was estimated at USD 19.05 billion in 2025 and expected to reach USD 20.57 billion in 2026, at a CAGR of 8.68% to reach USD 34.12 billion by 2032.

Unleashing the Power of Nanomaterials: Exploring Cutting-Edge Innovations That Are Redefining Industries With Unprecedented Precision and Performance

Nanomaterials have emerged as a transformative force across a broad spectrum of industries, harnessing the unique properties of matter at atomic and molecular scales. Over the past decade, relentless advances in synthesis techniques and characterization tools have enabled researchers to tailor materials with unprecedented precision, giving rise to innovations in electronics, energy storage, healthcare, and environmental remediation. As these engineered nanoscale structures continue to permeate commercial applications, stakeholders are focused on bridging the gap between laboratory breakthroughs and scalable manufacturing processes.

Furthermore, the convergence of multidisciplinary expertise-spanning chemistry, materials science, engineering, and biotechnology-has accelerated the pace of discovery. From graphene’s remarkable conductivity to quantum dots’ tunable optical properties, the portfolio of functional nanomaterials is expanding rapidly. This expansion is driven not only by the promise of enhanced performance but also by the pressing need for sustainable solutions. Consequently, companies and research institutions are increasingly collaborating to optimize synthesis routes that minimize environmental impact while ensuring economic viability. As the industrial ecosystem evolves, it becomes essential to understand the core principles guiding these developments and their broader implications for innovation strategy.

Revolutionary Paradigm Shifts in Nanomaterials Research and Application That Are Propelling Collaborative Breakthroughs Across Multiple Technology Sectors

Recent years have witnessed a profound shift in how nanomaterials are conceptualized and deployed, heralding a new era of scalable, high-throughput production. Traditionally, the field centered on fundamental research aimed at elucidating nanoscale phenomena, but today the focus has pivoted toward integration with advanced manufacturing systems and digital design frameworks. For instance, additive manufacturing platforms now incorporate nanoparticle inks to print devices with superior electrical and mechanical properties, reflecting a shift from batch processing to continuous, on-demand fabrication.

Simultaneously, the drive toward sustainable innovation has catalyzed the development of greener synthesis methodologies and life-cycle assessments that account for end-of-use recyclability. Emerging digital tools, including machine learning algorithms and high-performance computing, are playing a pivotal role in predicting structure–property relationships and guiding experimental design. These transformative dynamics are fostering agile supply chains, where real-time analytics and adaptive process controls enable rapid adjustments to material composition and performance. As a result, the nanomaterials landscape is transitioning from isolated proof-of-concepts to interconnected ecosystems that span research institutions, equipment providers, and end-users.

Assessing the Far-Reaching Cumulative Consequences of United States Nanomaterial Tariffs in 2025 on Global Supply Chains and Innovation Dynamics

The imposition of new tariffs on imported nanomaterials by the United States in early 2025 has introduced significant strategic considerations for suppliers and consumers alike. While the policy aimed to protect domestic manufacturing capabilities, it has also elevated the cost of key inputs such as carbon nanotubes, metal oxides, and quantum dots. Consequently, organizations have been forced to reassess their sourcing strategies, balancing cost pressures against the imperative to maintain product performance and delivery timelines.

In response to these developments, many companies are diversifying supply chains to mitigate exposure to regions subject to the highest duties. This shift includes expanding partnerships with domestic producers as well as exploring emerging markets in Southeast Asia and Eastern Europe. Although these adjustments have alleviated some immediate challenges, they have also underscored the importance of supply-chain resilience and strategic inventory management. Looking ahead, market players are increasingly investing in localized production facilities and forging long-term agreements to stabilize input costs and ensure consistent access to advanced nanomaterials.

Unlocking Market Intricacies Through Multifaceted Nanomaterials Segmentation Based on Type, Synthesis Technique, Morphology, Application, and Industry End Use

A nuanced understanding of nanomaterials segmentation illuminates the diverse technological pathways and application spaces that define this market. When classifying by type, carbon-based materials such as carbon nanotubes and graphene coexist alongside dendrimer families like PAMAM and PPI, each offering distinct functionality. Metal oxides, spanning aluminum to zinc variants, find increasing utility in catalysis and sensors, while polymeric nanostructures such as polyethylene glycol bring biocompatibility to biomedical platforms. Meanwhile, quantum dots composed of CdSe, PbS, or ZnS demonstrate exceptional promise in next-generation displays and diagnostics.

Delving into synthesis techniques reveals the contrast between bottom-up strategies-like chemical vapor deposition and sol-gel processes-and top-down methods such as ball milling and lithography. This methodological diversity enables researchers to fine-tune particle size, shape, and surface chemistry, thereby optimizing performance for targeted applications. Moreover, the morphological dimension provides further granularity: from spherical nanoparticles and tubular nanowires to two-dimensional nanosheets and capsular architectures, each form factor presents unique surface area and aspect ratio characteristics that influence functional behavior.

Application segmentation underscores the adaptability of nanomaterials across consumer goods, electronics, energy, environmental, and healthcare arenas. Conductive inks and sensors in the semiconductor sector stand in stark relief to drug-delivery vehicles and tissue engineering scaffolds in the biomedical domain. Within energy, the integration of nanoengineered electrodes in batteries, fuel cells, and solar cells exemplifies the drive toward decarbonization technologies. Separately, environmental applications focus on air purification catalysts and water treatment adsorbents that capitalize on high surface area and reactive sites.

Finally, end-use industry segmentation paints a vivid picture of end-market demand pockets. Aerospace coatings and advanced components leverage the lightweight strength of nanocomposite materials, whereas automotive OEMs explore both passenger and commercial vehicle applications for enhanced durability and fuel efficiency. In construction, nanomaterial-infused coatings and concrete additives promise improved longevity and reduced maintenance. Consumer and industrial electronics alike harness nanoscale precision to miniaturize and augment device functionality, while the healthcare industry capitalizes on nano-enabled medical devices and pharmaceutical formulations to drive therapeutic innovation.

This comprehensive research report categorizes the Nanomaterials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Synthesis Technique

- Morphology

- Application

- End Use Industry

Revealing Distinct Regional Dynamics in Nanomaterials Adoption Shaped by Economic, Regulatory, and Technological Drivers Across Global Markets

Regional dynamics in the nanomaterials landscape are shaped by a confluence of economic maturity, regulatory frameworks, and technological infrastructure. In the Americas, North American leadership in innovation stems from robust R&D ecosystems, substantive government funding, and a concentration of start-ups pushing envelope-defining discoveries. With a clear emphasis on aerospace and biomedical applications, this region continues to attract strategic investments aimed at scaling laboratory successes into commercial realities.

Meanwhile, Europe, the Middle East, and Africa are distinguished by stringent environmental regulations and a strong commitment to sustainability. This regulatory backdrop has spurred the development of eco-friendly synthesis processes and circular-economy initiatives. In Western Europe, research collaborations across academic and industrial sectors have advanced applications in air purification and water treatment, aligning with policy goals around clean air and water standards. The Middle East has seen nascent growth in energy-related nanomaterials for solar and fuel cell technologies, while select African markets are exploring low-cost water-disinfection solutions.

In Asia-Pacific, rapid manufacturing scale-up and electronics prowess serve as primary growth drivers. Robust supply chains in East Asia support high-volume production of quantum dots for display technologies, while Southeast Asian hubs are emerging as cost-effective centers for metal oxide and polymer-based materials. Government incentives and partnerships with multinational corporations have accelerated capacity expansions, positioning this region at the vanguard of next-generation battery and sensor development.

This comprehensive research report examines key regions that drive the evolution of the Nanomaterials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Driving Nanomaterials Advancements Through Strategic Collaborations, Proprietary Technologies, Market Diversification Initiatives

The competitive landscape in nanomaterials is defined by a handful of leading companies that combine proprietary platforms with strategic alliances. Major chemical conglomerates have invested heavily in pilot-scale facilities, leveraging deep process expertise to produce high-purity carbon nanotubes, oxide nanoparticles, and tailored quantum dots. Through joint ventures with equipment manufacturers and end-users, these integrators ensure seamless incorporation of nanomaterials into complex product assemblies.

Simultaneously, agile start-ups and specialized manufacturers are carving out niches by focusing on breakthrough synthesis techniques and niche application domains. By securing patents on novel surface-modification strategies and hierarchical composite architectures, these innovators attract significant venture capital and establish long-term supply agreements with electronics and pharmaceutical players. Strategic mergers and acquisitions have further solidified the positions of these companies, facilitating rapid entry into adjacent markets and accelerating product commercialization.

Collaboration remains a central theme as firms seek to bridge technological gaps and expand market reach. From co-development projects with academic research centers to participation in international standardization bodies, these entities nurture ecosystems that accelerate validation, scale-up, and adoption. As a result, the competitive playing field is characterized by both vertical integration and open innovation, underscoring the multifaceted approaches companies employ to stay ahead in a dynamic market environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nanomaterials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ACS Material

- Advanced Nano Products Co., Ltd.

- American Carbon

- American Elements

- Applied Nanotech, Inc.

- Arkema

- Asahi Kasei Corporation

- BASF SE

- Bruker Corporation

- Cabot Corporation

- DuPont de Nemours, Inc.

- Evonik Industries AG

- LG Chem

- Merck KGaA

- NanoCo Group PLC

- Nanocyl SA

- Nanophase Technologies Corporation

- Nanosys Inc.

- OCSiAl

- QuantumSphere, Inc.

- Resonac Holdings Corporation

- Thermo Fisher Scientific Inc.

- US Research Nanomaterials, Inc.

- Zyvex Technologies

Implementing Strategic Roadmaps and Sustainable Practices to Harness Nanomaterials Innovations While Mitigating Risks and Maximizing Competitive Advantage

Organizations aiming to secure a competitive edge must adopt a multifaceted strategy that aligns innovation with sustainability and risk mitigation. First, investing in green synthesis pathways and closed-loop material recovery systems will not only reduce environmental footprint but also build resilience against raw material price volatility. By prioritizing renewable feedstocks and minimizing hazardous byproducts, companies can preempt tightening regulations and cater to increasing consumer demand for eco-friendly solutions.

Equally important is the diversification of supply chains to avoid over-reliance on single geographies or suppliers. Cultivating relationships with regional producers, establishing dual-sourcing agreements, and maintaining strategic inventory levels will safeguard operations against geopolitical uncertainties and tariff fluctuations. Complementing these efforts with real-time supply-chain visibility and predictive analytics can further enhance responsiveness to market disruptions.

Moreover, fostering cross-sector partnerships can catalyze new application areas while distributing development costs. Collaborative frameworks that bring together materials scientists, device engineers, and end-user OEMs enable rapid prototyping and iterative testing. Finally, embedding digital tools-from machine learning-driven design of experiments to blockchain-enabled traceability-will optimize R&D workflows, ensure regulatory compliance, and unlock new dimensions of product differentiation.

Detailing Rigorous Research Methodology Integrating Quantitative and Qualitative Approaches for Comprehensive Nanomaterials Insights and Validation

This research integrates both primary and secondary methodologies to ensure a comprehensive understanding of the nanomaterials landscape. Primary data were gathered through in-depth interviews with industry executives, technology leaders, and academic researchers, providing firsthand insights into emerging trends, supply-chain dynamics, and application drivers. Complementing these qualitative inputs, surveys of end-users across key sectors revealed adoption barriers and performance expectations.

Secondary research encompassed a thorough review of peer-reviewed journals, patent filings, regulatory filings, and publicly available technical whitepapers. Data triangulation was achieved by cross-referencing production capacity reports, corporate press releases, and conference proceedings. An iterative validation process, involving expert panels and scenario-planning workshops, ensured that findings reflect market realities and future possibilities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nanomaterials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nanomaterials Market, by Type

- Nanomaterials Market, by Synthesis Technique

- Nanomaterials Market, by Morphology

- Nanomaterials Market, by Application

- Nanomaterials Market, by End Use Industry

- Nanomaterials Market, by Region

- Nanomaterials Market, by Group

- Nanomaterials Market, by Country

- United States Nanomaterials Market

- China Nanomaterials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Synthesizing Key Takeaways to Illuminate the Transformative Trajectory of Nanomaterials and Catalyze Informed Strategic Decision Making

The evolving nanomaterials ecosystem underscores the transformative potential of nanoscale engineering to redefine performance benchmarks, innovate product functionalities, and address global challenges. From enhanced energy storage architectures to next-generation diagnostics platforms, the interplay of material science and advanced manufacturing is reshaping industry paradigms. These developments call for strategic agility and a forward-looking mindset among stakeholders.

Ultimately, success in this dynamic environment depends on the ability to anticipate regulatory shifts, harness emerging synthesis routes, and forge collaborative networks that span the value chain. By synthesizing key takeaways around supply-chain resilience, segmentation intricacies, and regional nuances, decision-makers can chart informed pathways that balance innovation imperatives with operational pragmatism.

Engage With Our Associate Director of Sales and Marketing to Unlock Exclusive Nanomaterials Market Intelligence and Drive Your Business Growth Today

For exclusive access to in-depth nanomaterials insights and personalized guidance on leveraging emerging trends, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly, you can explore tailored purchasing options, discuss customized research packages that align with your strategic goals, and secure access to actionable data that will drive your innovation pipeline. Connect now to gain a competitive edge and unlock the full potential of this dynamic market.

- How big is the Nanomaterials Market?

- What is the Nanomaterials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?