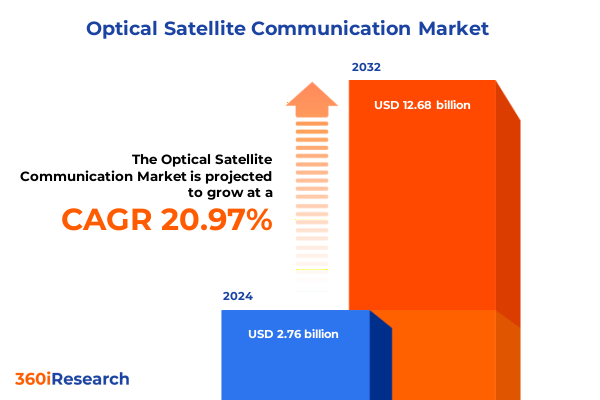

The Optical Satellite Communication Market size was estimated at USD 3.32 billion in 2025 and expected to reach USD 4.00 billion in 2026, at a CAGR of 21.08% to reach USD 12.68 billion by 2032.

Unlocking the Future of Global Connectivity Through Ultra-High-Speed Optical Satellite Communication Technologies that Redefine Bandwidth, Latency, and Security Standards Across Terrestrial and Space Networks

Optical satellite communication is ushering in a new era of connectivity, enabling data transfer speeds and security paradigms previously thought impossible. This cutting-edge technology harnesses laser-based links to deliver ultra-high-bandwidth transmissions with latency measured in mere milliseconds, dramatically outperforming traditional radio frequency systems. As applications ranging from global broadband internet to secure defense networks demand greater throughput, optical links are emerging as the backbone of next-generation space infrastructure.

This executive summary lays the foundation for understanding the critical drivers propelling optical satellite communication-from the proliferation of large constellations in low Earth orbit to the integration of quantum key distribution for unbreakable security. By contextualizing the current landscape against recent technological breakthroughs, readers will gain clarity on the forces shaping market dynamics. Subsequent sections will dissect transformative shifts, regulatory impacts, segmentation nuances, regional trends, competitive benchmarks, and actionable recommendations-all designed to equip industry leaders with the insights necessary to navigate this rapidly evolving field.

How Converging Innovations in Laser Links, Quantum Encryption, and AI-Driven Network Management Are Redefining Global Satellite Communication Capabilities

The optical satellite communication landscape is undergoing profound transformation as innovations converge to deliver unprecedented performance and capability. Mega-constellations in low Earth orbit are now designed with laser inter-satellite links at their core, enabling networks of thousands of nodes to route data autonomously across space with sub-20 millisecond latency. Hybrid payloads combining radio frequency and optical channels are becoming the norm, ensuring flexible, redundant communications that maintain integrity even in challenging orbital environments. These developments are underpinned by terminal miniaturization efforts that have reduced the size of laser communication modules by over 30 percent in recent years, accommodating integration into small and micro-satellites while driving down launch and production costs.

Simultaneously, security considerations are catalyzing the adoption of quantum key distribution over optical channels. Milestones such as China’s satellite-to-ground QKD demonstration over 1,200 kilometers have illuminated the path toward unhackable links, propelling governments and enterprises to invest in quantum-resistant infrastructures. Artificial intelligence is progressively woven into network management, enabling real-time optimization of beam alignment, predictive routing, and anomaly detection for secure, resilient data flows. Collectively, these shifts herald a new paradigm where optical and quantum technologies coalesce to redefine the boundaries of global communications.

Assessing the Far-Reaching Implications of Elevated Reciprocal and Section 301 Tariffs on the Optical Satellite Communication Supply Chain and Sourcing Strategies in 2025

In early 2025, the U.S. government enacted significant reciprocal and product-specific tariffs that have reverberated across the optical communication supply chain. Under Section 301 provisions, tariffs on Chinese-origin wafers and polysilicon rose to 50 percent, while certain tungsten products faced a 25 percent levy effective January 1, 2025. Simultaneously, country-specific reciprocal duties were recalibrated: non-retaliating nations saw a temporary return to 10 percent, whereas China’s rate surged to 145 percent, inclusive of preexisting fentanyl-related duties.

These escalated duties have compelled satellite operators and subsystem manufacturers to reassess global sourcing strategies. Optical modules, predominantly manufactured in Asia, now encounter tariffs ranging from 24 percent in Malaysia to 145 percent for Chinese inputs, translating to an estimated blended rate of 27 percent excluding Chinese-origin goods. The heightened cost pressure has accelerated diversification efforts into Mexico and Vietnam, and catalyzed onshore production initiatives for critical components. Moreover, U.S. diplomatic channels have leveraged tariff policy as a negotiation tool to facilitate regulatory approvals for domestic satellite ventures, illustrating the intersection of trade policy and strategic space ambitions.

Unveiling Core Technological Categories and Application-Driven Differentiators Underpinning the Optical Satellite Communication Industry’s Diverse Market Segments

Understanding the market requires a nuanced examination of the component ecosystem driving optical satellite links. Key subsystems such as amplifiers, antennas, modulators, demodulators, and optical transmitters paired with TOSA and receiver assemblies form the technological backbone of every laser-based communication terminal. These intricate modules must interface seamlessly to achieve the precise beam pointing and signal integrity demanded in space.

Communication pathways bifurcate into ground-to-satellite and satellite-to-satellite links, each presenting unique engineering and regulatory considerations. The former addresses the challenge of atmospheric disturbances and ground station network densification, while the latter emphasizes inter-orbital routing capabilities essential for global mesh architectures.

Laser sources such as CO₂, gallium arsenide, microwave, and Nd:YAG lasers each offer distinct performance profiles, influencing link budgets and thermal management strategies aboard satellites. On the technology front, solutions span from fiber-based optical backbones to free-space optical terminals, with emerging domains like laser communication arrays and nascent quantum communication payloads enriching the portfolio.

Applications range from deep space probes requiring long-haul relay through optical repeaters, to Earth observation constellations deploying hyperspectral imaging, and high-speed internet and broadband services revolutionizing connectivity for underserved regions. Earth observation missions further subdivide into agricultural monitoring, disaster response, environmental surveillance, and urban planning, showcasing the multifaceted utility of optical sensors.

End users encompass defense organizations seeking secure data paths, governmental and space agencies orchestrating national infrastructure, private enterprises driving commercial services, and research institutions pioneering the next wave of photonic innovations.

This comprehensive research report categorizes the Optical Satellite Communication market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Laser Type

- Technology

- Application

- End User

Exploring How Divergent Regional Strategies and Collaborative Funding Models Are Shaping Optical Satellite Communication Infrastructure Across the Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the adoption trajectory and infrastructure investments within the optical satellite communication sphere. In the Americas, established satellite operators and government initiatives are driving early deployments of laser-interlinked constellations, supported by domestic manufacturing expansions and strategic partnerships aimed at enhancing hemispheric connectivity.

Across Europe, the Middle East, and Africa, regulatory frameworks and collaborative funding mechanisms under programs such as Horizon Europe and regional defense co-investment are accelerating demonstration projects and pilot networks. European aerospace groups are leading the charge in developing standardized laser communication protocols to foster interoperability across multinational fleets.

The Asia-Pacific region is emerging as a crucible of innovation, with countries like Japan and Australia prioritizing optical ground station networks and quantum link trials. Concurrently, significant investments by China and India in advanced optical payloads reflect national imperatives for secure communications and independent satellite navigation capabilities. Together, these regional markets form a tapestry of competitive and cooperative ventures that will define the global optical satellite communications landscape moving forward.

This comprehensive research report examines key regions that drive the evolution of the Optical Satellite Communication market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Integration Specialists Redefining Performance and Scalability in Optical Satellite Communication Through Strategic Contracts and Advanced Laser Terminal Deployments

The competitive landscape is anchored by entities demonstrating deep expertise in photonic systems and aerospace integration. SpaceX has distinguished itself through rapid deployment of an optical mesh network in low Earth orbit, equipping its Starlink constellation with second-generation laser terminals capable of 200 Gbps throughput and sub-20 ms latency for global broadband services.

German powerhouse Tesat-Spacecom, an Airbus subsidiary, commands a leadership position in space-qualified laser communication terminals. Its LCT portfolio underpins major initiatives such as Europe’s Data Relay System, delivering precise auto-alignment and sustained link performance with micro-radian accuracy.

Pure-play innovators like Mynaric AG have secured strategic contracts with U.S. defense programs, supplying scalable CONDOR Mk3 laser terminals for low Earth orbit tracking networks. The company’s emphasis on cost-efficient serial production positions it as a key enabler of commercial and government optical constellations.

Aerospace integrators such as Airbus Defence and Space, Ball Aerospace, General Atomics, and Space Micro round out the ecosystem, each bringing specialized capabilities in ground station technologies, inter-satellite modems, and hybrid RF-optical payload designs. Together, these firms drive ongoing R&D investments that push throughput boundaries and system resilience for future network deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Satellite Communication market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Al Yah Satellite Communications Company P.J.S.C.

- ALCAD ELECTRONICS SL

- Aperture Optical Sciences Inc.

- Astrogate Labs

- ATLAS Space Operations, Inc.

- BAE Systems PLC

- BridgeComm, Inc.

- Coherent Corp.

- Exail SAS

- FSO Instruments

- G&H Group

- General Atomics

- General Dynamics Mission Systems, Inc.

- Gomspace A/S

- Hangzhou DAYTAI Network Technologies Co.,Ltd.

- Hangzhou Softel Optic Co., Ltd.

- HENSOLDT AG

- Hisdesat Servicios Estrategicos S.A.

- Honeywell International Inc.

- Intelsat

- KEPLER

- Kongsberg Gruppen ASA

- Laser Light Communications Inc.

- LightPath Technologies, Inc.

- Maxar Technologies Inc.

- Mitsubishi Electric Corporation

- Mynaric AG

- NanoRacks

- Safran S.A.

- Space Micro Inc. by Voyager Space Holdings, Inc.

- SpaceX

- Telesat Corporation

- Tesat-Spacecom GmbH & Co. KG

- Thales Group

- UGrid Network Inc.

- Viasat, Inc.

Implementing Integrated Manufacturing, Collaborative Development Alliances, and AI-Orchestrated Network Strategies to Enhance Resilience and Drive Scalable Optical Satellite Services

Industry leaders should prioritize vertical integration of optical subsystem assembly to mitigate tariff vulnerabilities and secure supply chains. By cultivating domestic manufacturing for critical components such as wafers, laser diodes, and precision optics, organizations can reduce exposure to fluctuating import duties and geopolitical risks.

Strategic alliances between satellite operators and photonics firms will be essential to accelerate the development of hybrid RF-optical terminals, ensuring seamless failover capabilities within mixed-mode networks. Coordinated R&D consortia can drive standards for interoperability, fostering ecosystem scalability and reducing duplication of effort across commercial and government domains.

Investment in artificial intelligence for end-to-end network orchestration will enhance system resilience through predictive beam alignment, dynamic routing, and anomaly detection. These capabilities will be crucial for maintaining global connectivity during atmospheric disturbances and space weather events.

Finally, leadership teams should engage proactively with regulatory bodies to shape spectrum allocation and standardization frameworks for quantum key distribution and laser safety. Influencing policy early will enable faster market entry for novel services, from secure financial communications to real-time remote surgery and advanced Earth observation analytics.

Employing a Hybrid Research Methodology Integrating Primary Industry Consultations, Secondary Data Validation, and Quantitative Tariff-Impact Modelling for Comprehensive Market Analysis

This analysis is grounded in a rigorous hybrid research approach combining primary interviews with C-suite executives, system architects, and technical directors alongside comprehensive secondary data reviews. Proprietary insights were augmented by academic publications, patent filings, and regulatory filings sourced from trade agencies and standardization bodies.

Quantitative modelling of component supply chains and tariff scenarios was performed using publicly available trade data and tariff schedules issued by the Office of the United States Trade Representative. Qualitative validation was obtained through expert roundtables and peer workshops focusing on emerging laser and quantum communication technologies.

To ensure data integrity, triangulation methods cross-referenced OEM press releases, contract award announcements, and third-party analyst briefings. Regional market assumptions were corroborated with local industry associations and government procurement records. This multi-layered methodology ensures a balanced, fact-based perspective on the market’s technological and regulatory evolution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Satellite Communication market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Satellite Communication Market, by Component

- Optical Satellite Communication Market, by Type

- Optical Satellite Communication Market, by Laser Type

- Optical Satellite Communication Market, by Technology

- Optical Satellite Communication Market, by Application

- Optical Satellite Communication Market, by End User

- Optical Satellite Communication Market, by Region

- Optical Satellite Communication Market, by Group

- Optical Satellite Communication Market, by Country

- United States Optical Satellite Communication Market

- China Optical Satellite Communication Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Converging Technological Innovation, Strategic Policy Engagement, and Agile Supply Chain Resilience to Shape the Future of Global Optical Satellite Communications Infrastructure

Optical satellite communication stands at the threshold of mainstream adoption, driven by unparalleled gains in bandwidth, security, and network intelligence. The confluence of mega-constellation architectures, quantum encryption, and AI-enabled link management has created a fertile environment for disruptive service models that transcend terrestrial limitations.

While elevated tariffs have introduced near-term cost pressures, they have also catalyzed supply chain diversification and onshore manufacturing initiatives that will strengthen domestic capabilities over the long term. Regional market dynamics further underscore the importance of collaborative frameworks, where public-private partnerships and multinational standardization efforts converge to accelerate deployment.

As market participants refine their strategic focus around integrated technology stacks, the imperative for agile business models and proactive regulatory engagement has never been clearer. Organizations that align R&D investments with evolving policy environments and cultivate resilient supply chains will be best positioned to capitalize on the optical satellite communication revolution.

Empower Your Strategic Decisions by Connecting with Ketan Rohom to Secure the Ultimate Optical Satellite Communication Market Research Report

Elevate your strategic vision and drive transformative outcomes by securing the comprehensive Optical Satellite Communication market research report. Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore tailored insights and unlock competitive leverage. Engage directly to discuss how this authoritative analysis can inform your investment decisions, guide your technology roadmap, and empower your organization to capitalize on emerging opportunities. Reach out today to acquire the full report and position your enterprise at the forefront of this rapidly evolving domain.

- How big is the Optical Satellite Communication Market?

- What is the Optical Satellite Communication Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?