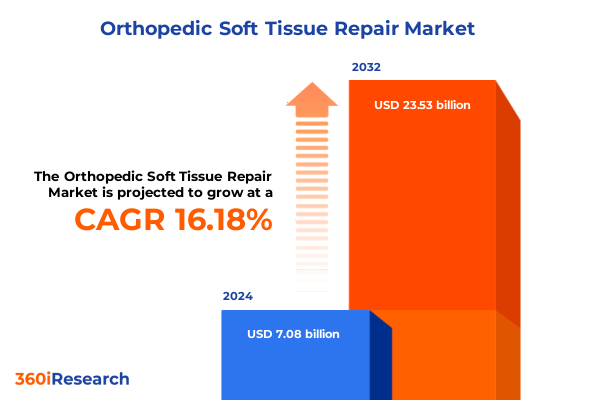

The Orthopedic Soft Tissue Repair Market size was estimated at USD 8.24 billion in 2025 and expected to reach USD 9.60 billion in 2026, at a CAGR of 16.15% to reach USD 23.53 billion by 2032.

Unveiling the Evolving Landscape of Orthopedic Soft Tissue Repair Fueled by Clinical Innovations, Patient-Centric Technologies, and Strategic Drivers

Orthopedic soft tissue injuries are a leading contributor to global disability, affecting muscles, tendons, and ligaments with profound implications for patient mobility and quality of life. Approximately 1.71 billion people worldwide live with musculoskeletal conditions, and the number is rising due to demographic shifts and lifestyle factors. As populations age and maintain active lifestyles longer, the demand for effective repair technologies continues to intensify.

Moreover, the incidence of sports-related orthopedic trauma among older adults has seen a marked increase in recent years. Data indicate that sports-related injuries in those aged 65 and older rose from 134 per 100,000 people in 2012 to 167 per 100,000 by 2021, reflecting both higher participation rates and expanded definitions of recreational activity. This trend underscores the urgency for solutions that restore function efficiently while minimizing recovery times.

Furthermore, the convergence of minimally invasive robotic platforms and regenerative therapies is transforming clinical approaches to soft tissue repair. Regulatory bodies such as NICE have approved multiple robotic systems for soft tissue and orthopedic procedures, enabling precision interventions that reduce hospital stays and enhance surgical outcomes. Concurrently, regenerative modalities like platelet-rich plasma (PRP) injections demonstrate significant promise in accelerating healing and improving patient satisfaction, offering a complementary pathway to traditional surgical repair.

Identifying Key Transformative Shifts in Orthopedic Soft Tissue Repair Driven by Technological Breakthroughs, Regulatory Adaptations, and Personalized Therapeutic Trends

The rise of robotic-assisted surgery represents a transformative shift in soft tissue repair techniques. With systems capable of micron-level movements and real-time imaging, surgeons can execute complex procedures with unprecedented accuracy. Early adopters report that robotic platforms not only enhance surgical precision but also enable intraoperative adjustments that optimize soft tissue tension and alignment, ultimately improving functional outcomes and reducing revision rates.

Simultaneously, regenerative medicine is reshaping the repair paradigm through therapies that focus on biological restoration rather than mechanical replacement. Emerging evidence from clinical trials demonstrates that PRP can significantly reduce pain and enhance tissue regeneration in chronic orthopedic conditions, offering a minimally invasive alternative for patients unresponsive to conventional treatments. As regulatory pathways adapt to support these therapies, investment in next-generation scaffolds and growth factor platforms continues to accelerate.

In parallel, novel implant designs such as anchorless soft tissue repair systems are gaining traction by addressing long-standing challenges associated with hardware complications and bone preservation. Anchorless technologies replicate native tendon-to-bone fixation with broad load-sharing compression, reducing risks of anchor migration and implant-related cysts while preserving bone stock for future interventions. Collectively, these technological and therapeutic breakthroughs are redefining clinical practice and driving an era of personalized, value-based care in orthopedic soft tissue repair.

Assessing the Cumulative Impact of United States Tariffs on Orthopedic Soft Tissue Repair Supply Chains, Material Costs, and Global Sourcing Dynamics in 2025

In early 2025, the imposition of a 25% tariff on all steel and aluminum imports introduced significant cost pressures on medical device manufacturers, amplifying material expenses for surgical instruments and implantable devices used in soft tissue repair. As steel and aluminum serve as foundational materials in many orthopedic products, these tariffs have reverberated through procurement strategies and pricing models across the industry.

Concurrently, the reinstatement of Section 301 tariffs on select medical device components sourced from China, affecting Class I and II devices, has further complicated global sourcing dynamics. The cumulative impact of these trade measures is evident in projected cost burdens, with major manufacturers reporting hundreds of millions in incremental expenses. For example, one leading healthcare technology company anticipates approximately $400 million in tariff-related costs in 2025, predominantly within its medical technology division.

These tariff escalations have prompted a strategic pivot toward supply chain diversification and near-shoring, as organizations seek to mitigate exposure and stabilize delivery timelines. Industry leaders are actively evaluating alternative suppliers in low-tariff zones and leveraging regional trade agreements to preserve access to high-precision components. As a result, the interplay between trade policy and operational resilience has become central to strategic planning for orthopedic soft tissue repair stakeholders.

Unlocking Essential Segmentation Insights in Orthopedic Soft Tissue Repair Spanning Product Innovation, Clinical Applications, End Users, Procedural Approaches, and Material Science Preferences

A nuanced understanding of market segmentation reveals critical insights for tailoring product development and commercialization strategies. Within the product type dimension, advanced patches span acellular dermal matrix, collagen-based designs, and emerging synthetic constructs, each targeting specific tissue healing profiles. Simultaneously, scaffold platforms encompass allograft, synthetic, and xenograft materials, reflecting varied biomechanical and biocompatibility requirements. Likewise, suture anchor solutions range from all-suture anchors to bioabsorbable and metal variants, while suture technologies advance through barbed, braided, and monofilament configurations. In this context, recognition of these sub-segments enables precise alignment of research and development efforts with clinical demands.

Moreover, clinical applications such as Achilles tendon repair, anterior cruciate ligament reconstruction, meniscal repair, and rotator cuff interventions define distinct procedural pathways and garner differential adoption rates. The end-user landscape spans ambulatory surgical centers, hospital networks, and specialty clinics, each with unique procurement cycles and procedural volumes. Concurrently, procedural approaches vary from arthroscopic and minimally invasive techniques to open surgeries, driving device usage patterns and shaping training imperatives.

Equally important is the material hierarchy, which includes bioabsorbable polymers-such as PGA, PLGA, and PLLA-as well as biological matrices like collagen and hyaluronic acid. Traditional metals like stainless steel and titanium coexist alongside nonabsorbable polymers including polyester and UHMWPE. This layered segmentation underscores the importance of material science in optimizing device performance, regulatory approval, and clinician acceptance. By integrating segmentation across these dimensions, stakeholders can craft targeted value propositions and prioritize investment in high-impact categories.

This comprehensive research report categorizes the Orthopedic Soft Tissue Repair market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Surgery Type

- Material

- Application

- End User

Analyzing Regional Nuances in Orthopedic Soft Tissue Repair Across the Americas, Europe Middle East Africa, and Asia Pacific to Inform Strategic Market Positioning

Regional dynamics in orthopedic soft tissue repair demand reflect diverse healthcare infrastructures, economic environments, and regulatory frameworks. In the Americas, robust reimbursement pathways and advanced hospital ecosystems support rapid adoption of minimally invasive and robotic techniques. Meanwhile, cost containment pressures and supply chain considerations have driven increased interest in domestic manufacturing and near-shoring initiatives, particularly in the United States.

Within Europe, the Middle East, and Africa, variability in regulatory processes and funding mechanisms results in a more heterogeneous landscape. Leading Western European markets benefit from streamlined approval frameworks and strong public health funding, enabling uptake of next-generation biological scaffolds and anchorless repair systems. Conversely, emerging markets in Eastern Europe and parts of the Middle East often prioritize cost-effective solutions and may face extended pathway timelines, necessitating tailored market entry strategies and localized partnerships.

In Asia-Pacific, manufacturing clusters across China, Japan, and Southeast Asia play a pivotal role in global supply chains, while regulatory harmonization efforts continue to evolve. However, ongoing trade measures-including reciprocal tariffs-introduce complexity for companies relying on component imports, motivating shifts toward regional production hubs and alternative sourcing arrangements. Despite these challenges, rapid digital health adoption and expanding surgical capacity in markets like India and Australia present significant growth avenues for innovative repair technologies.

This comprehensive research report examines key regions that drive the evolution of the Orthopedic Soft Tissue Repair market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Contenders Shaping the Orthopedic Soft Tissue Repair Sphere Through Technological Excellence and Strategic Initiatives

Major healthcare technology companies are strategically responding to evolving market and policy landscapes through diversified portfolios and operational agility. One global leader has announced substantial investments to modernize its domestic manufacturing footprint while absorbing tariff impacts, reflecting a proactive stance toward supply chain resilience and cost management.

Renowned orthopedic device manufacturers are also exploring supply chain diversification to mitigate geopolitical exposures. One industry heavyweight projects a multi-million dollar profit impact from proposed U.S. tariffs on imported instruments, prompting the implementation of supplier diversification and logistics optimization programs. At the same time, leading firms with nearshore production capabilities-particularly those with facilities in Mexico and Central America-are better positioned to maintain stable profit margins and service levels.

Innovation-driven companies are further differentiating through advanced surgical platforms and integrated care solutions. For example, one pioneer in surgical robotics has secured expanded clearance for hip revision applications, enhancing its market footprint in complex soft tissue procedures. Meanwhile, emerging entrants are gaining traction with anchorless repair systems and bioengineered scaffold technologies that address unmet clinical needs. The competitive landscape thus balances established multinationals’ scale advantages with agile innovators’ niche expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Orthopedic Soft Tissue Repair market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aroa Biosurgery Ltd.

- Artelon

- Arthrex, Inc.

- B. Braun Melsungen AG

- Becton, Dickinson & Co.

- Bioventus Inc.

- Boston Scientific Corporation

- ConMed Corporation

- CryoLife, Inc.

- DePuy Synthes, Inc.

- DJO Global, LLC

- Globus Medical, Inc.

- Integra LifeSciences Holdings Corporation

- LifeCell International

- LifeNet Health, Inc.

- Medtronic plc

- MTF Biologics

- Organogenesis Inc.

- Orthofix Medical Inc.

- Parcus Medical, LLC

- RTI Surgical Holdings, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Tissue Regenix Group plc

- Wright Medical Group N.V.

- Zimmer Biomet Holdings, Inc.

Implementing Actionable Strategies for Industry Leaders to Navigate Tariffs, Supply Chain Disruptions, and Innovation Roadmaps in Orthopedic Soft Tissue Repair

Industry leaders must prioritize supply chain diversification to mitigate the risks posed by evolving trade policies and material shortages. By evaluating alternative sourcing regions, leveraging regional trade agreements, and aligning procurement with low-tariff jurisdictions, organizations can reduce cost volatility and secure consistent access to critical components. Collaboration with logistics partners and investment in predictive analytics further enhance supply chain visibility and responsiveness.

In parallel, near-shoring and reshoring strategies offer pathways to insulate operations from cross-border tariff fluctuations. Establishing localized manufacturing hubs not only curbs import duties but also accelerates regulatory approvals and simplifies compliance. To maximize these benefits, companies should engage with policymakers and industry associations to advocate for targeted exemptions on essential medical technologies, supporting both national security and patient care objectives.

Finally, ongoing investment in R&D and clinician education remains fundamental to maintaining competitive advantage. Emphasizing modular design, bioresorbable materials, and data-driven procedural planning can unlock new therapeutic differentiation. By fostering partnerships with research institutions and embracing digital health tools-such as robotic navigation and advanced imaging-organizations will be better equipped to deliver high-quality, cost-effective solutions that meet evolving clinical demands.

Describing the Rigorous Research Methodology Underpinning Orthopedic Soft Tissue Repair Insights Through Comprehensive Data Collection and Analytical Frameworks

This analysis is underpinned by a holistic research framework that integrates quantitative trade data, clinical trial outcomes, and stakeholder insights. Supply chain impacts were examined through detailed review of trade policies, including USTR proclamations and Section 232 steel and aluminum tariff adjustments, to assess material cost implications. Concurrently, regulatory databases and public company disclosures provided insights into strategic investments and tariff-related expenditures.

Primary research consisted of structured interviews with orthopedic surgeons, supply chain executives, and regulatory affairs specialists to capture firsthand perspectives on technology adoption and operational resilience. These qualitative insights were triangulated with secondary data from peer-reviewed journals, healthcare association reports, and authoritative fact sheets on musculoskeletal health trends. Analytical modeling and cross-validation against multiple data sources ensured robust, unbiased conclusions that address both current realities and emerging trajectories in soft tissue repair.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Orthopedic Soft Tissue Repair market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Orthopedic Soft Tissue Repair Market, by Product Type

- Orthopedic Soft Tissue Repair Market, by Surgery Type

- Orthopedic Soft Tissue Repair Market, by Material

- Orthopedic Soft Tissue Repair Market, by Application

- Orthopedic Soft Tissue Repair Market, by End User

- Orthopedic Soft Tissue Repair Market, by Region

- Orthopedic Soft Tissue Repair Market, by Group

- Orthopedic Soft Tissue Repair Market, by Country

- United States Orthopedic Soft Tissue Repair Market

- China Orthopedic Soft Tissue Repair Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Critical Imperatives That Will Define the Future of Orthopedic Soft Tissue Repair Through Innovation, Collaboration, and Value-Driven Outcomes

As the orthopedic soft tissue repair landscape continues to evolve, stakeholders must remain agile in adapting to shifting clinical paradigms, policy environments, and material dynamics. The synergy between regenerative therapies, robotic innovation, and advanced implant designs promises to enhance patient outcomes, yet it also demands strategic alignment across R&D, supply chain, and regulatory functions.

Ultimately, the capacity to integrate segmentation insights, navigate regional disparities, and preempt trade-induced cost pressures will define market leadership. By embracing a holistic, evidence-based approach to decision-making, organizations can unlock the full potential of soft tissue repair innovations, driving sustainable value creation for patients, providers, and investors alike.

Empowering Decision Makers to Engage with a Customized Market Research Report Through Strategic Consultation and Tailored Insights with Ketan Rohom

To gain a comprehensive understanding of the opportunities and challenges within orthopedic soft tissue repair, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His tailored consultation will guide you through the depth of the report and ensure your organization leverages actionable insights specific to your strategic objectives. Reach out to discuss customized deliverables, secure early access to exclusive data sets, and initiate a partnership that will position your team at the forefront of market intelligence in soft tissue repair.

- How big is the Orthopedic Soft Tissue Repair Market?

- What is the Orthopedic Soft Tissue Repair Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?