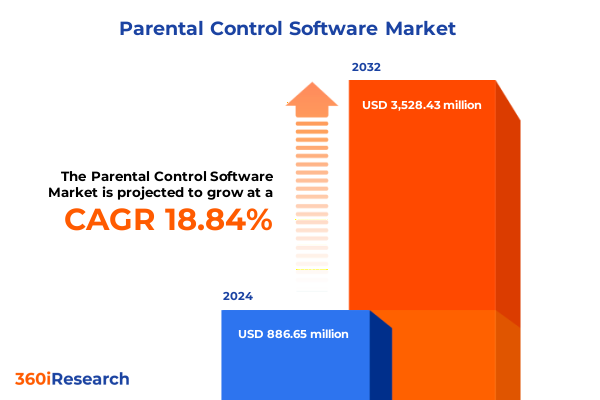

The Parental Control Software Market size was estimated at USD 1.05 billion in 2025 and expected to reach USD 1.23 billion in 2026, at a CAGR of 18.83% to reach USD 3.52 billion by 2032.

Establishing the Critical Need for Advanced Parental Control Software to Safeguard Digital Well-Being in a Rapidly Evolving Connected World

Parental control software has emerged as a pivotal tool in safeguarding the well-being of children in an environment where digital interaction is constant and ever-evolving. As households embrace an increasingly connected lifestyle, the exposure of minors to inappropriate content, online predators, and excessive screen time has intensified the need for sophisticated solutions that offer both protection and parental visibility. Consequently, families, educators, and corporate guardians are seeking advanced tools that balance safety with autonomy, reflecting a broader societal demand for responsible digital stewardship.

In this context, the introduction to parental control software underscores not only its technical capabilities but also its role in supporting developmental and educational objectives. Parents no longer view these tools solely as gatekeepers; instead, they regard them as enablers of healthy digital habits and constructive learning experiences. Therefore, the software’s ability to filter content, monitor usage, and facilitate meaningful dialogue between caregivers and children becomes central to its adoption. Understanding this evolving dynamic between protection and empowerment sets the stage for a deeper exploration of the landscape ahead.

Unveiling the Pivotal Technological and Societal Shifts Redefining Parental Control Effectiveness and User Expectations Across Digital Ecosystems

The parental control software landscape has undergone a transformation driven by rapid technological advances and shifting user expectations. Artificial intelligence and machine learning have moved beyond experimental features to become indispensable elements for real-time content filtering and context-sensitive alerts. Simultaneously, the proliferation of mobile devices and Internet of Things integrations has redefined how families interact with digital environments, necessitating solutions that seamlessly traverse multiple platforms and device types.

Moreover, the societal impact of global events, such as remote learning mandates and telecommuting trends, has elevated the importance of unified monitoring across home networks. Parents now require consolidated dashboards that present holistic views of a child’s digital footprint, bridging the gap between academic, social, and recreational activities. This trend has encouraged vendors to innovate around centralized management consoles and cloud-based synchronization, replacing legacy stand-alone applications.

In addition, heightened privacy regulations and consumer awareness around data protection have prompted software developers to adopt more transparent policies and user-centric design. The emphasis has shifted toward granular parental controls that respect a family’s privacy preferences while maintaining robust oversight capabilities. Together, these transformative shifts underscore the need for adaptable, intelligent solutions capable of evolving alongside technology and cultural trends.

Assessing the Compounded Effects of United States 2025 Tariff Measures on Software Supply Chains and Parental Control Technology Accessibility

The implementation of United States tariffs in 2025 has had a cumulative effect on the parental control software market by influencing both hardware integration costs and the broader technology supply chain. Although software itself is not directly subject to import duties, many parental control solutions are bundled or enhanced through hardware devices such as routers, home security hubs, and wearables. Elevated tariffs on networking components and IoT sensors have increased the landed cost of these bundled appliances, prompting vendors to adjust pricing strategies or shift toward software-only subscription models to maintain competitive offerings.

As a result, several providers have prioritized cloud-native architectures that minimize reliance on region-specific hardware. This shift toward purely digital deployment has mitigated the direct cost increases associated with tariffs and aligned with growing customer preferences for software-as-a-service models. Additionally, some organizations have relocated hardware production to domestic or tariff-exempt jurisdictions, incurring upfront operational changes but ensuring long-term supply chain resilience.

Furthermore, tariff-induced volatility encouraged partnerships between software vendors and telecommunication companies to integrate parental control features directly into home broadband services, thus bypassing hardware distribution challenges. This collaborative approach has reinforced the market’s move toward embedded network-level protection, offering families a seamless experience without hardware procurement complexities. Consequently, the market’s response to tariff pressures underscores the adaptability and strategic agility of leading solution providers.

Revealing Strategic Segmentation Dynamics by License, Platform, Feature, User, and Deployment to Illuminate Parental Control Software Adoption Patterns

Diving into the market through the lens of license type reveals a clear dichotomy between one-time purchases and subscription-based models. While one-time license options continue to appeal for their simplicity, the subscription category, particularly annual and monthly plans, has gained momentum by offering continuous updates and support. This evolution reflects users’ desire for evergreen protection against emerging threats and evolving content risks.

Looking at the platform dimension underscores the importance of seamless cross-device integration, as families increasingly rely on both desktop environments for academic productivity and mobile devices for social engagement. Solutions optimized for multi-platform usage boost user satisfaction by enabling consistent policy enforcement and synchronized monitoring across all endpoints.

Considering feature types, app blocking and content filtering remain foundational functionalities, but advanced location tracking and screen time management have become critical differentiators. Together, these capabilities form a comprehensive safety net that empowers parents to shape healthy usage patterns while ensuring real-time awareness of a child’s whereabouts and digital behavior.

Examining end-user categories highlights that corporates and educational institutions demand enterprise-grade scalability and compliance reporting, while individual and family use cases prioritize intuitive interfaces and personalized control levels. Finally, deployment modes range from cloud-based solutions-with distinctions between private and public cloud infrastructures optimized for data privacy and scalability-to on-premise installations favored by organizations with stringent security requirements. These segmentation insights collectively inform a nuanced understanding of adoption drivers and competitive positioning within the parental control software market.

This comprehensive research report categorizes the Parental Control Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- License Type

- Platform

- Feature Type

- End User

- Deployment Mode

Deciphering Regional Variations in Adoption Drivers and Regulatory Impact Across Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional differentiation markedly influences the trajectory of parental control software adoption, starting with the Americas where a combination of high internet penetration rates, robust consumer awareness, and stringent child protection regulations drive demand. In North America, federal guidelines around online security and educational initiatives reinforce the perceived value of monitoring and filtering solutions, while Latin American markets are increasingly recognizing the role of parental control tools in balancing digital engagement with offline well-being.

Moving to Europe, Middle East & Africa, the regulatory landscape around data privacy-shaped by the General Data Protection Regulation (GDPR) and related frameworks-has been instrumental in shaping vendor strategies. Here, compliance with stringent data handling norms and transparent user consent mechanisms is paramount, giving rise to feature enhancements that prioritize privacy by design. Meanwhile, in the Middle East and select African nations, rapid smartphone adoption coupled with burgeoning youth populations is fueling an uptick in demand, albeit at varying price sensitivities and infrastructure readiness.

In Asia-Pacific, the vibrant expansion of mobile-first economies, supported by high-speed broadband rollouts and digital literacy campaigns, has triggered a surge in parental control software uptake. Markets such as China, India, and Southeast Asian nations showcase diverse use cases, from academic performance tracking to social media regulation, reflecting a mosaic of cultural expectations and technological proficiencies. As a result, the region stands out for its appetite for localized content filtering, multi-lingual support, and integration with popular messaging platforms.

Overall, this regional mosaic underscores the need for differentiated strategies, localized feature sets, and adaptive pricing models to capture the nuances of diverse customer bases.

This comprehensive research report examines key regions that drive the evolution of the Parental Control Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players and Competitive Strategies Shaping Innovation and Market Positioning in the Parental Control Software Domain

The competitive landscape is characterized by a diverse array of players ranging from established cybersecurity firms to innovative startups that specialize exclusively in family safety solutions. Key firms have differentiated themselves through proprietary algorithms for content classification, partnerships with educational content providers, and strategic bundling with wireless carriers to expand distribution channels. Collaboration with network operators has enabled some market leaders to embed control features directly into consumer-grade routers and gateways, delivering out-of-the-box protection without separate installations.

Innovation has also been driven by advances in artificial intelligence, enabling companies to refine context-aware filtering and predictive alert systems that reduce false positives. This precision enhances user trust and reduces administrative overhead for families and institutions. In parallel, several organizations have adopted open API frameworks to facilitate integration with smart home ecosystems, voice assistants, and third-party wellness platforms, broadening the utility of their offerings beyond traditional desktop and mobile environments.

Furthermore, strategic alliances and acquisitions have reshaped the industry’s competitive contours. Larger technology conglomerates have absorbed specialized startups to accelerate time to market for new features, while nimble newcomers leverage venture funding to focus on niche requirements such as gaming management and influencer-driven content moderation. This dynamic interplay between scale and specialization underscores the market’s robust innovation pipeline and sets the stage for continued evolution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Parental Control Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- AT&T Inc.

- Bark Technologies Inc.

- Bitdefender SRL

- Boomerang Parental Controls

- Circle Media Inc.

- CleanRouter LLC

- ESET spol. s r.o.

- Google LLC

- K9 Web Protection LLC

- Kaspersky Lab

- KidLogger LLC

- McAfee LLC

- Microsoft Corporation

- MMGuardian LLC

- Mobicip LLC

- Net Nanny Software International Inc.

- NortonLifeLock Inc.

- OurPact LLC

- Qustodio LLC

- SafeDNS Inc.

- Screen Time Labs Ltd.

- Verizon Communications Inc.

Strategizing Next-Level Industry Leadership with Actionable Insights to Drive Growth, Collaboration, and Enhanced User Trust in Parental Control Solutions

Industry leaders seeking to capitalize on market momentum should prioritize the development of next-generation content analytics powered by machine learning, enabling deeper sentiment analysis and contextual understanding of multimedia content. By investing in research that refines these algorithms, organizations can offer more precise filtering without compromising user privacy.

In addition, forging partnerships with educational institutions and child psychology experts can produce collaboratively designed features that support developmental milestones and digital literacy. Such alliances reinforce the credibility of solutions while opening avenues for co-branded offerings tailored to school and home environments.

Moreover, executives should consider operator-level integration strategies with telecommunication providers to embed parental control as a value-added service. This approach not only simplifies deployment for end users but also creates recurring revenue streams through bundled subscriptions. Equally important is the adoption of modular pricing models that allow customers to select and pay for only the features they require, thereby increasing market accessibility and reducing friction in the sales cycle.

Finally, staying ahead of emerging privacy regulations by embedding consent management and data anonymization frameworks into product roadmaps will bolster compliance readiness and strengthen consumer trust. These actionable recommendations collectively serve as a blueprint for industry leadership in a competitive and rapidly evolving market.

Outlining Rigorous Research Methodology Ensuring Comprehensive Data Integrity and Insightful Analysis for Parental Control Software Market Intelligence

The research underpinning this analysis employed a multi-faceted methodology designed to ensure data reliability, market relevance, and actionable insights. Initially, secondary research was conducted through the systematic review of publicly available regulatory filings, technology white papers, and recognized cybersecurity publications to establish a foundational understanding of market dynamics and regulatory frameworks. This phase was supplemented by financial and patent database reviews to identify key corporate strategies and innovation trajectories.

Subsequently, primary research was conducted via structured interviews with a spectrum of stakeholders, including product managers at leading solution providers, network operators integrating parental controls, and representatives from educational institutions implementing these tools. Insights gathered during these interviews were triangulated with digital usage data from industry-consortium reports and anonymized user behavior metrics to validate qualitative findings and identify emerging trends.

Data segmentation and analysis were performed using both statistical tools and scenario planning workshops, which helped quantify adoption drivers across distinct customer categories and deployment models. Quality assurance procedures involved cross-checking insights against multiple data sources, while peer reviews by independent experts ensured that interpretations remained objective and actionable. This rigorous methodological framework underpins the credibility and depth of the insights presented throughout this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Parental Control Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Parental Control Software Market, by License Type

- Parental Control Software Market, by Platform

- Parental Control Software Market, by Feature Type

- Parental Control Software Market, by End User

- Parental Control Software Market, by Deployment Mode

- Parental Control Software Market, by Region

- Parental Control Software Market, by Group

- Parental Control Software Market, by Country

- United States Parental Control Software Market

- China Parental Control Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Drawing Comprehensive Conclusions on Market Trajectories, Technological Innovations, and Strategic Imperatives for Parental Control Software Stakeholders

In summary, the parental control software market is at a critical juncture where technological innovation, regulatory evolution, and shifting consumer behaviors converge to redefine the parameters of digital safety. The introduction of AI-driven filtering, real-time location tracking, and integrated screen time management underscores the move toward holistic solutions that address both security and well-being. Meanwhile, external pressures such as United States tariff adjustments have catalyzed strategic shifts toward cloud-native architectures and network-level integrations.

Segmentation analysis reveals that subscription models, multi-platform compatibility, and advanced feature sets resonate across diverse end-user groups, from families to educational institutions and corporate environments. Regional nuances further highlight the importance of compliance with data protection regulations in Europe Middle East & Africa, the mobile-first imperative in Asia-Pacific, and the regulatory support and consumer awareness driving adoption in the Americas.

Competitive dynamics are shaped by a blend of established cybersecurity leaders and agile startups leveraging AI, partnerships, and flexible deployment strategies. To maintain an edge, organizations must focus on precision content analytics, educational partnerships, operator collaborations, modular pricing, and proactive privacy compliance. This cohesive understanding of market forces and strategic imperatives provides a clear blueprint for stakeholders aiming to harness growth opportunities and deliver trusted parental control solutions.

Seize Your Competitive Edge Today by Engaging Ketan Rohom to Acquire the Definitive Parental Control Software Market Research Report

Engaging directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, is the most effective way to gain immediate access to the full parental control software market research report. Through a brief consultation, you can explore the detailed insights, proprietary data, and in-depth analyses that will empower your organization to make strategic decisions. Ketan’s expert guidance will ensure you receive the tailored deliverables, complementary executive briefing, and customized data extracts needed to align with your specific objectives.

By reaching out to Ketan Rohom, you will unlock the complete findings around emerging consumer behaviors, regulatory shifts, and competitive dynamics that define the current landscape. His role ensures swift coordination with our research teams, expediting report delivery and facilitating any necessary clarifications. Take the next step toward fortifying your position in the parental control software market by contacting Ketan today.

- How big is the Parental Control Software Market?

- What is the Parental Control Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?