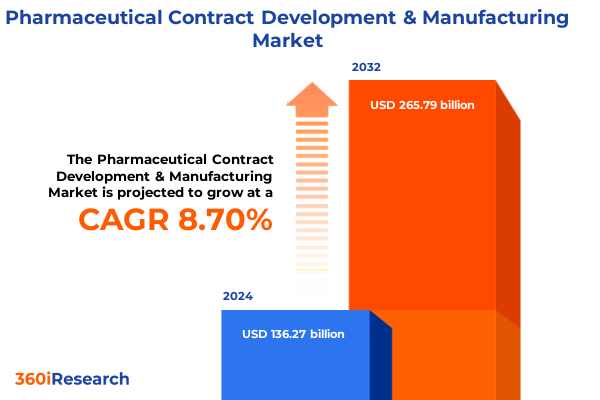

The Pharmaceutical Contract Development & Manufacturing Market size was estimated at USD 148.06 billion in 2025 and expected to reach USD 160.20 billion in 2026, at a CAGR of 8.71% to reach USD 265.79 billion by 2032.

Understanding the Evolving Contract Development and Manufacturing Environment Transforming Pharmaceutical Innovation and Collaboration Dynamics

The pharmaceutical contract development and manufacturing industry has experienced a profound evolution driven by accelerating innovation cycles, stringent regulatory expectations, and intensifying competitive pressures. As pharmaceutical and biotechnology companies strive to bring novel therapeutics to market with greater speed and efficiency, outsourcing critical development and manufacturing functions has become a strategic imperative rather than a discretionary choice.

Contract development services now encompass a wide spectrum of activities, from analytical method development and drug formulation design to process optimization and clinical trial material manufacturing. This expansion of scientific complexity has paralleled the maturation of contract manufacturing services, which range from active pharmaceutical ingredient (API) synthesis to finished dosage form production and specialized packaging solutions. Together, these offerings form an integrated ecosystem that enables sponsors to mitigate risk, access specialized expertise, and flexibly manage capacity demands.

Looking ahead, the contract development and manufacturing model is poised to further redefine pharmaceutical innovation by enabling seamless technology transfer, fostering collaborative development partnerships, and embedding quality by design principles throughout the product lifecycle. Consequently, stakeholders must anticipate shifts in service expectations, evolving regulatory frameworks, and emerging opportunities for differentiation to remain at the forefront of this dynamic landscape.

Exploring Major Technological, Regulatory, and Market-Driven Shifts Reshaping Contract Development and Manufacturing Strategies in Pharma

Recent years have witnessed transformative shifts reshaping the contract development and manufacturing landscape, driven by breakthroughs in continuous processing, digitalization, and biologics production. Advanced continuous manufacturing platforms have increasingly supplanted traditional batch processes, delivering enhanced throughput, reduced footprint, and superior process control. Simultaneously, digital solutions-from real-time analytics to artificial intelligence-driven process optimization-have moved from pilot initiatives to mainstream adoption, enabling CDMOs to offer predictive maintenance, adaptive control strategies, and streamlined regulatory submissions.

Moreover, the rise of complex biologics, gene and cell therapies has reshaped service portfolios, compelling CDMOs to invest heavily in single-use technologies, sterile fill-finish capabilities, and cold-chain logistics. On the regulatory front, accelerated approval pathways and heightened emphasis on quality by design have underscored the importance of robust analytical development and process validation services early in the development timeline. Consequently, CDMOs are forging deeper scientific collaborations, embedding regulatory intelligence, and aligning their capabilities to support expedited market access.

Further compounding these dynamics, market trends such as the proliferation of biosimilars, personalized medicine, and orphan drug development have broadened the scope of outsourcing, emphasizing flexibility, scalability, and end-to-end solutions. As a result, successful CDMOs are those that harmonize technological innovation with regulatory expertise and customer-centric service models to meet the evolving demands of pharmaceutical sponsors.

Assessing the Combined Impact of 2025 United States Tariff Measures on Pharmaceutical Contract Development and Manufacturing Ecosystem

The implementation of new United States tariff measures in 2025 has introduced a complex layer of cost and operational considerations for contract development and manufacturing organizations. Tariffs on select raw materials and intermediates have exerted upward pressure on input costs, compelling CDMOs to reevaluate sourcing strategies and renegotiate supplier contracts. This has had downstream effects on pricing structures and margin management, making cost transparency and supply-chain agility more critical than ever.

In response, many service providers have accelerated efforts to diversify their procurement networks, strategically blending domestic and international suppliers to mitigate tariff exposures. This rebalancing has often necessitated investment in alternative material suppliers, intensified due diligence on tariff classifications, and close collaboration with customs brokers and trade compliance experts. Consequently, organizations with robust trade management capabilities have been better positioned to navigate sudden policy shifts and maintain uninterrupted production flows.

Beyond cost implications, the tariff landscape has catalyzed broader discussions around reshoring and regionalization of manufacturing footprint. Certain sponsors and CDMOs are exploring new facilities or capacity expansions within tariff-exempt zones to preserve competitiveness. As the industry adapts, transparent communication and scenario-based planning have become indispensable tools for aligning customer expectations and safeguarding project timelines amidst policy volatility.

Unveiling Critical Insights from Service Type, Development Stage, End Use, and Customer Type Segmentation to Drive Strategic Decision-Making

Analyzing market behavior through the prism of service type segmentation reveals differentiated growth dynamics across contract development and contract manufacturing services. Within the development domain, advanced analytical development has gained prominence as regulatory agencies intensify focus on quality by design, while process development capabilities are increasingly valued for their role in scaling novel modalities from lab to pilot. Clinical trial material manufacturing remains a linchpin service, driving early-stage revenue stability and fostering long-term partnerships. Conversely, formulation development has emerged as a critical enabler of bioavailability optimization and patient-centric dosage forms.

Turning to manufacturing segmentation, active pharmaceutical ingredient production continues to attract investment in specialized reactors and continuous synthesis platforms, whereas finished dosage form manufacturing prioritizes flexible fill-finish technologies to accommodate small-batch and high-potency compounds. Packaging services have likewise evolved, integrating serialization, anti-counterfeiting features, and patient-centric designs to meet regulatory mandates and address market demands.

When market performance is viewed through development stage, preclinical work remains foundational for pipeline expansion, while clinical services spanning Phase I through Phase III chart the progression of sponsors’ outsourcing needs. At the commercial stage, CDMOs differentiate themselves with robust quality systems and scalable capacity. Segmenting by end use underscores the significance of oncology programs capturing substantial outsourcing budgets, while infectious disease initiatives continue to attract sustained attention. Cardiovascular and central nervous system projects represent steady demand streams. Finally, customer type segmentation highlights the distinct needs of biosimilar manufacturers seeking cost efficiencies, biotechnology firms requiring agile development support, generic pharma focusing on regulatory compliance, and innovator sponsors prioritizing speed to market.

This comprehensive research report categorizes the Pharmaceutical Contract Development & Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Development Stage

- End Use

- Customer Type

Highlighting Pivotal Regional Dynamics Across Americas Europe Middle East & Africa and Asia-Pacific Markets Transforming Pharma CDMO Engagements

Regional patterns in the contract development and manufacturing landscape reveal nuanced dynamics that influence strategic priorities across the globe. In the Americas, a robust innovation ecosystem in the United States and Canada underpins demand for high-complexity services, with a particular emphasis on biologics and advanced therapies. Latin American markets contribute incremental project volumes, driven by cost arbitrage and emerging biosimilar initiatives, yet the region’s capacity remains concentrated among specialized CDMOs catering to local generics and clinical trial support.

By contrast, the Europe, Middle East & Africa corridor distinguishes itself through established manufacturing legacy, deep regulatory expertise, and a dense network of quality-certified facilities. Western Europe’s mature infrastructure accommodates high-value production and end-to-end development partnerships, while emerging Eastern European hubs attract investments seeking skilled talent and competitive cost structures. In the Middle East & Africa, initiatives to bolster local pharma capabilities have begun to spur demand for contract services, although this remains an area of nascent growth.

Asia-Pacific markets continue to register the fastest capacity expansions, led by China and India’s large-scale API and formulation operations. Investments in single-use technologies and sterile fill-finish capabilities are proliferating across the region, fueled by ambitious state policies and favorable labor economics. In parallel, markets such as Japan and Australia maintain premium service offerings, particularly in advanced analytical and regulatory consultancy services, reflecting their strong tradition of quality and innovation.

This comprehensive research report examines key regions that drive the evolution of the Pharmaceutical Contract Development & Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Positioning and Strategic Initiatives of Leading Contract Development and Manufacturing Organizations Driving Industry Advancement

The competitive landscape of contract development and manufacturing is marked by a handful of global players alongside a diverse set of specialized innovators. Leading CDMOs distinguish themselves through strategic capacity expansions, targeted acquisitions, and integration of digital platforms that streamline end-to-end workflows. Some organizations have broadened their service portfolios to encompass cell and gene therapy capabilities, securing footholds in high-growth biologics segments and forging alliances with biotech sponsors.

Others have prioritized the advancement of continuous manufacturing and intensified investments in single-use processing technologies to meet increasing demand for flexibility and rapid scale-up. Collaboration models have also evolved, with several providers offering co-innovation hubs and open-access labs to deepen scientific engagement. In parallel, mid-tier and regional CDMOs leverage niche expertise in specialized chemistries, dosage forms, or geographic proximity to carve out defensible positions in crowded markets.

Furthermore, leading organizations are differentiating through sustainability initiatives, embedding green chemistry principles and energy-efficient operations into their service offerings. As environmental, social, and governance considerations gain prominence, companies that align sustainability with operational excellence are poised to enhance brand equity and foster long-term customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmaceutical Contract Development & Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akums Drugs & Pharmaceuticals Limited

- Aurobindo Pharma Limited

- Boehringer Ingelheim International GmbH

- Cambrex Corporation

- Catalent, Inc.

- Charles River Laboratories International, Inc.

- Cipla Limited

- Divi’s Laboratories Limited

- Dr. Reddy’s Laboratories Ltd.

- Fareva Holding SAS

- Fujifilm Diosynth Biotechnologies U.S.A., Inc.

- Lonza Group AG

- Lupin Limited

- Piramal Pharma Solutions Private Limited

- Recipharm AB

- Samsung Biologics Co., Ltd.

- Siegfried Holding AG

- Thermo Fisher Scientific Inc.

- WuXi AppTec Co., Ltd.

- WuXi Biologics Inc.

Delivering Practical Recommendations to Optimize Collaboration Innovation and Resilience across Pharmaceutical Contract Development and Manufacturing Operations

Industry leaders seeking to thrive in the evolving contract development and manufacturing environment should prioritize investments in agile technology platforms that support real-time analytics and adaptive process control. Establishing strategic partnerships with specialized technology providers can accelerate the adoption of continuous processing, digital twins, and artificial intelligence-driven optimization, fostering both operational efficiency and quality assurance.

Additionally, diversifying the supplier footprint and instituting robust trade compliance frameworks will mitigate risks associated with tariff volatility and geopolitical disruptions. Organizations are advised to develop dual-sourcing strategies and localized supply hubs, reducing lead times and preserving cost competitiveness. Concurrently, aligning regulatory intelligence with project planning through early-phase engagement can expedite submissions and foster greater alignment with evolving agency expectations.

To bolster resilience, CDMOs should cultivate cross-functional talent pools skilled in emerging modalities-particularly biologics, cell and gene therapies-and invest in continuous training programs. Integrating sustainability targets into service roadmaps, from material sourcing to waste management, will not only address stakeholder expectations but also unlock operational savings. By orchestrating these priorities in a cohesive strategic framework, industry leaders can navigate complexity, drive innovation, and maintain a distinct competitive edge.

Detailing Rigorous Research Methodology and Analytical Framework Underpinning Comprehensive Pharmaceutical Contract Development and Manufacturing Market Study

The research methodology underpinning this market study integrates comprehensive secondary and primary research to ensure robust, objective insights. Extensive secondary research encompassed analysis of industry publications, regulatory guidance documents, scientific journals, and corporate disclosures to map the competitive landscape and technological trends. This was complemented by primary research, including in-depth interviews with senior executives, operations leaders, and regulatory affairs specialists representing pharmaceutical sponsors, CDMOs, and supply-chain partners.

Quantitative data was triangulated by cross-referencing project case studies, proprietary databases, and industry surveys distributed across multiple regions. Qualitative insights were validated through expert panels and advisory board consultations, ensuring alignment with real-world operational challenges and strategic priorities. Key performance indicators, such as capacity utilization, technology adoption rates, and service mix evolution, were analyzed at both regional and global levels to capture nuanced market dynamics.

A structured approach to data synthesis enabled segmentation across service type, development stage, end use, and customer type, while regional analysis was informed by localized market assessments and regulatory frameworks. The methodology emphasizes transparency, reproducibility, and continuous validation to underpin the strategic recommendations and segmentation insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmaceutical Contract Development & Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmaceutical Contract Development & Manufacturing Market, by Service Type

- Pharmaceutical Contract Development & Manufacturing Market, by Development Stage

- Pharmaceutical Contract Development & Manufacturing Market, by End Use

- Pharmaceutical Contract Development & Manufacturing Market, by Customer Type

- Pharmaceutical Contract Development & Manufacturing Market, by Region

- Pharmaceutical Contract Development & Manufacturing Market, by Group

- Pharmaceutical Contract Development & Manufacturing Market, by Country

- United States Pharmaceutical Contract Development & Manufacturing Market

- China Pharmaceutical Contract Development & Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Articulating Final Observations on Strategic Implications and Future Trajectories in Pharmaceutical Contract Development and Manufacturing Ecosystems

The pharmaceutical contract development and manufacturing sector stands at an inflection point, where technological innovation, regulatory evolution, and geopolitical forces converge to redefine industry dynamics. Enhanced capabilities in continuous processing, biologics manufacturing, and digital analytics are reshaping partner expectations and elevating quality and speed-to-market considerations. Concurrently, trade policy developments such as the 2025 U.S. tariffs underscore the critical importance of supply-chain resilience and strategic sourcing.

Segmentation analysis highlights varied growth trajectories across service types, development stages, therapeutic areas, and customer profiles, reinforcing the necessity of tailored service models. Regional insights reveal that North America and Europe continue to command premium services, while Asia-Pacific’s expanded capacity and cost advantages create new opportunities for global collaboration. The competitive landscape is evolving, with leading CDMOs investing in end-to-end offerings, sustainability, and digital transformation to differentiate and capture emerging opportunities.

Looking forward, stakeholders who embrace collaborative innovation, data-driven decision-making, and agile operational frameworks will be best positioned to navigate uncertainties and capitalize on the next wave of pharmaceutical advancement. The strategic implications of these findings emphasize the need for proactive adaptation to maintain a competitive posture in this dynamic market environment.

Engage Directly with Ketan Rohom to Acquire the Definitive Market Research Report on Pharmaceutical Contract Development and Manufacturing

Engaging with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) offers direct access to tailored guidance on leveraging comprehensive insights across the pharmaceutical contract development and manufacturing landscape to drive strategic growth and competitive advantage. By partnering with his team, decision-makers can deepen their understanding of the nuanced drivers shaping today’s industry dynamics and position their organizations to capitalize on emerging opportunities.

Ketan Rohom’s expertise spans strategic client engagement, solution customization, and consultative support, ensuring that each interaction yields actionable intelligence aligned with unique business objectives. Readers are invited to secure the market research report to gain a holistic view of critical trends, regulatory shifts, and segmentation insights that underpin successful CDMO partnerships. With targeted analysis and expert recommendations, this report serves as the definitive resource for optimizing development pipelines, manufacturing strategies, and global supply chain resilience.

To initiate a conversation with Ketan Rohom and obtain exclusive access to the full report, reach out today and unlock the strategic roadmap necessary for navigating the evolving pharmaceutical contract development and manufacturing environment with confidence and clarity.

- How big is the Pharmaceutical Contract Development & Manufacturing Market?

- What is the Pharmaceutical Contract Development & Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?