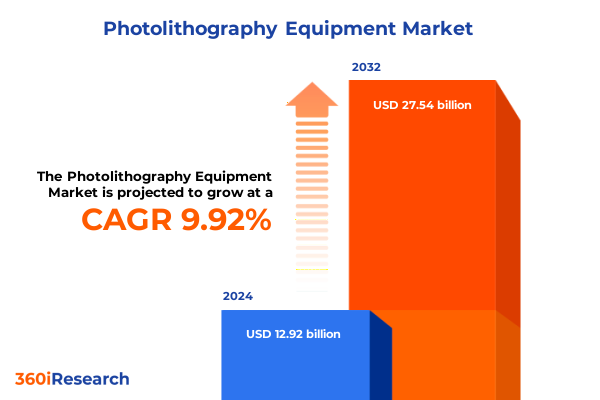

The Photolithography Equipment Market size was estimated at USD 14.19 billion in 2025 and expected to reach USD 15.59 billion in 2026, at a CAGR of 9.93% to reach USD 27.54 billion by 2032.

Unveiling the foundational role and evolving technological imperatives of photolithography systems in advanced semiconductor manufacturing

Photolithography stands at the heart of semiconductor fabrication, translating intricate design patterns onto silicon wafers with nanometer precision. By leveraging optics, photoresist chemistry, and advanced alignment systems, photolithography equipment enables the production of microprocessors, memory chips, and sensors that power modern electronics. As semiconductor nodes shrink further into the single-digit nanometer regime, lithography systems must evolve to deliver higher resolution, greater throughput, and enhanced overlay accuracy.

In recent years, the photolithography landscape has been reshaped by intensifying demand for artificial intelligence and high-performance computing applications. Manufacturers are compelled to adopt extreme ultraviolet (EUV) systems to meet the stringent resolution requirements of sub-7nm processes, while immersion immersion deep ultraviolet (DUV) scanners continue to serve mature nodes with high-volume production. Consequently, equipment suppliers are charting dual roadmaps-one focused on high numerical aperture EUV for cutting-edge nodes and another enhancing ArF immersion scanners to extend their viability.

Looking ahead, emerging trends in multi-beam e-beam lithography, directed self-assembly, and computational lithography promise to augment traditional optical methods. This introduction sets the stage for a comprehensive examination of market shifts, tariff impacts, segmentation nuances, regional dynamics, leading companies, and strategic recommendations that will define the photolithography equipment domain in the coming years.

Navigating the seismic technological advancements and policy-driven realignments reshaping photolithography equipment landscapes globally

Over the last decade, the photolithography landscape has undergone transformative change driven by the convergence of technological breakthroughs and geopolitical imperatives. The adoption of extreme ultraviolet lithography has progressed from experimental trials to mainstream deployment at leading-edge foundries, marking a pivotal shift in node scaling capabilities. Simultaneously, deep ultraviolet immersion scanners have been optimized to deliver cost-effective patterning solutions for mature process geometries, enabling manufacturers to sustain high-volume production across diverse application portfolios.

Concurrently, government initiatives such as the U.S. CHIPS and Science Act and the European Chips Act have intensified domestic capacity-building efforts, accelerating investments in localized manufacturing and equipment development. These policy drivers have spurred collaboration between public institutions, equipment suppliers, and chipmakers, fostering innovation ecosystems that prioritize supply chain resilience and technological sovereignty. As a result, suppliers are diversifying manufacturing footprints and engaging in strategic partnerships to mitigate the risks of geopolitical disruptions.

Furthermore, sustainability imperatives are redefining process architectures, with a growing emphasis on energy-efficient optics, solvent recovery systems, and eco-friendly photoresists. Digital twins, machine learning-driven process control, and in-line metrology are increasingly integrated into lithography platforms, delivering predictive maintenance, yield optimization, and reduced carbon footprints. Together, these transformative shifts underscore the dynamic interplay between technological advancement and strategic realignment across the photolithography equipment landscape.

Analyzing how new U.S. import duties in 2025 have reshaped supply chain economics, procurement behaviors, and strategic localization efforts in photolithography

The introduction of new U.S. tariffs on imported semiconductor manufacturing equipment in 2025 has had a pronounced cumulative impact on photolithography system economics and supply chain strategies. In the first quarter of 2025, the leading lithography supplier reported a notable decline in machine orders, attributing this shortfall to heightened uncertainty over tariff implementation and potential sector-wide duties; orders fell to €3.9 billion against analyst projections of €4.8 billion, signaling dampened procurement momentum among chipmakers weighing higher import costs. This contraction reflected broader caution as foundries and integrated device manufacturers assessed the implications of a baseline 20% tariff on Dutch equipment and up to 24% on Japanese imports, which directly increased the sticker prices of both EUV and DUV scanners.

In subsequent quarters, the anticipated adverse effects of the tariff regime were mitigated by strategic machine upgrades and onshore manufacturing adjustments. The same supplier reported that tariff headwinds were "a bit less negative than anticipated," driven by strong demand for AI-centric lithography solutions and one-off cost savings measures; second quarter sales rose by 23% year-on-year to €7.7 billion, with net bookings of €5.5 billion. Despite this resilience, the company maintained a conservative outlook for the latter half of 2025, citing ongoing macroeconomic volatility and uncertainties around potential retaliatory measures, which could further influence capital expenditure cycles across the semiconductor ecosystem.

Looking beyond order volumes, the tariff environment has accelerated efforts by key equipment manufacturers to localize critical components and diversify supply chains. Production of EUV light sources and optical assemblies is increasingly being established in U.S. facilities to circumvent duties, while collaborative research programs are exploring alternative photoresist chemistries that may alleviate exposure wavelength constraints associated with tariff-sensitive equipment imports. These adaptive strategies underscore the industry’s agility in navigating a complex trade landscape while safeguarding long-term node roadmap execution.

Illuminating nuanced photolithography market dynamics through detailed analyses across technology, service, customer and application spectrums

Photolithography equipment market dynamics are shaped by multiple segmentation dimensions, each revealing distinct performance and adoption patterns. When examining product type, scanners and steppers present divergent growth trajectories. Scanners-divided into dry and immersion variants-dominate advanced node processing, with immersion scanners extending the capabilities of deep ultraviolet systems at sub-10nm geometries, while dry scanners maintain critical roles in mid-range applications. Service delivery models further differentiate vendor offerings through in-house implementation services or outsourced maintenance and optimization, enabling chipmakers to tailor support structures according to operational preferences.

Wavelength segmentation underscores the technological continuum between deep ultraviolet approaches and emerging extreme ultraviolet platforms. Within the DUV category, ArF dry and ArF immersion systems are complemented by legacy I-line and KrF tools, sustaining high-volume production in logic and memory fabs. Shifting to EUV, leading equipment providers continue to enhance throughput and reliability, unlocking the next frontier of patterning resolution. Customer types reflect this progression, with foundries, integrated device manufacturers, and assembly and testing service providers exhibiting varying intensity of capital allocation toward lithography upgrades based on process node strategies and volume requirements.

From an application standpoint, photolithography systems serve distinct end-market demands. Foundry services leverage the full spectrum of DUV and EUV capabilities to offer contract manufacturing for fabless firms, while logic producers invest heavily in immersion and EUV scanners to enable cutting-edge microprocessor architectures. Memory manufacturers, particularly within DRAM and NAND Flash segments, balance advanced immersion scanners for high-density cell patterning against cost-effective DUV platforms for commodity production. Across each segmentation lens, vendors must align their technology roadmaps and service ecosystems to address nuanced customer requirements and maintain competitive differentiation.

This comprehensive research report categorizes the Photolithography Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Implementation Mode

- Wavelength

- Customer Type

- Application

Exploring how regional policy incentives, manufacturing initiatives and ecosystem collaborations drive photolithography equipment demand varied by geography

Regional insights into photolithography equipment demand reveal differentiated adoption drivers and strategic priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, sustained government incentives and domestic machinery investments underpin robust uptake of both immersion DUV and EUV systems. Foundry expansions in the U.S. benefit from CHIPS Act subsidies, while Canadian research partnerships drive pilot deployments of next-generation metrology and process control integrations.

Across Europe, Middle East & Africa, policy frameworks such as the European Chips Act catalyze localized equipment manufacturing and R&D collaborations. European wafer fab expansions prioritize sustainable lithography platforms, integrating solvent recycling and energy recovery systems. Meanwhile, Middle Eastern and African stakeholders, often in nascent semiconductor hubs, focus on dual sourcing strategies that balance cost-efficient imported steppers with emerging regional service centers for maintenance and training.

In Asia-Pacific, leading-edge node production in Taiwan, South Korea, and Japan continues to propel demand for high-NA EUV and advanced immersion scanners. Significant expansion projects in China’s IDM and foundry sectors intensify uptake of DUV scanners, particularly ArF systems, while regional equipment manufacturers invest heavily in next-generation optical components. Together, these regional narratives underscore the importance of localized policy support, infrastructure readiness, and ecosystem collaboration in shaping photolithography equipment trajectories.

This comprehensive research report examines key regions that drive the evolution of the Photolithography Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing how leading technology vendors leverage innovation partnerships and service excellence to fortify their photolithography market leadership

Industry leaders in photolithography equipment continue to define competitive dynamics through differentiated technology roadmaps, strategic partnerships, and service portfolios. The foremost supplier in EUV systems maintains a commanding position by advancing high numerical aperture platforms and securing capacity expansions in U.S. facilities to mitigate tariff burdens. Concurrently, established Japanese vendors emphasize incremental improvements in ArF immersion scanner throughput and overlay precision, reinforcing their relevance for mature node production.

Complementing these optics-centric players, specialized metrology and inspection tool providers are deepening integrations with lithography systems through in-line process control solutions leveraged by major IDM and foundry customers. Equipment manufacturers with comprehensive service offerings, including predictive maintenance, spare parts logistics, and performance optimization, gain a competitive edge by reducing downtime and ensuring consistent yield performance.

Collaborative R&D agreements between key vendors and semiconductor foundries further accelerate innovation cycles. Such alliances focus on co-developing resist materials tailored for high-NA exposures, implementing advanced pellicle designs for EUV mask protection, and trialing multi-beam direct-write technologies. Through these strategic initiatives, leading companies reinforce their market leadership and position themselves to capitalize on evolving node scaling requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Photolithography Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Applied Materials, Inc.

- ASML Holding N.V.

- Canon Inc.

- Carl Zeiss AG

- Eulitha AG

- EV Group GmbH

- Holmarc Opto-Mechatronics Ltd.

- HORIBA Group

- JEOL Ltd.

- KLA Corporation

- Lam Research Corporation

- Micro Electronics Equipment (Group) Co., Ltd.

- Neutronix Quintel, Inc.

- Newport Corporation

- Nikon Corporation

- NuFlare Technology, Inc.

- Shanghai Micro Electronics Equipment (Group) Co., Ltd.

- SÜSS MicroTec SE

- Veeco Instruments Inc.

Empowering industry leaders with strategic imperatives for technology investment, supply chain resilience and sustainable digital transformation

Industry stakeholders seeking to thrive amid accelerating technological complexity and geopolitical shifts must prioritize a multifaceted strategy. First, deepening investments in high-NA EUV and next-generation DUV immersion tools will secure access to sub-5nm process nodes, while simultaneously extending the lifecycle of existing systems through incremental throughput and overlay enhancements. Aligning capital allocation with node roadmap milestones ensures competitive positioning at each production tier.

Second, diversifying the supply chain by establishing regional assembly capabilities and localizing critical component production will mitigate the risks associated with import duties and logistic disruptions. Collaborative ventures with domestic optics manufacturers and semiconductor foundries can facilitate technology transfer and foster resilient ecosystems aligned with government incentive programs. Moreover, cultivating flexible service models-including hybrid in-house and outsourced maintenance offerings-will optimize operational expenditure and system uptime across global fab networks.

Finally, forging cross-industry collaborations on sustainable practices and digitalization will yield long-term benefits. Embracing solvent recovery technologies, adopting AI-driven process control, and deploying digital twin frameworks will enhance yield stability, reduce environmental impact, and lower total cost of ownership. By integrating these actionable steps, photolithography equipment stakeholders can navigate evolving market dynamics and deliver differentiated value to end customers.

Detailing the comprehensive secondary and primary research processes that underpin robust photolithography equipment market intelligence

This research report is grounded in a rigorous methodology that synthesizes extensive secondary research, primary interviews, and data triangulation. Initially, a comprehensive literature review was conducted, encompassing technical white papers, academic publications, and publicly disclosed company filings to map technology evolutions, policy initiatives, and equipment roadmaps. Industry databases and proprietary publications provided supplemental insights into historical product deployments and service adoption trends.

Subsequently, primary research consisted of in-depth interviews with key stakeholders across semiconductor foundries, integrated device manufacturers, equipment suppliers, and government agencies. These discussions validated secondary findings, uncovered emerging use cases for photolithography technologies, and clarified decision-making processes related to capital investments and service engagements. Stakeholder feedback informed the identification of critical segmentation dimensions, regional dynamics, and competitive strategies.

Finally, quantitative and qualitative data were triangulated to ensure analytical rigor. Cross-referencing interview inputs with published equipment performance metrics and trade data enabled the derivation of credible insights. Throughout the process, subject matter experts reviewed interim findings to confirm technical accuracy and relevance, resulting in a research framework that delivers robust, actionable intelligence for industry decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Photolithography Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Photolithography Equipment Market, by Product Type

- Photolithography Equipment Market, by Implementation Mode

- Photolithography Equipment Market, by Wavelength

- Photolithography Equipment Market, by Customer Type

- Photolithography Equipment Market, by Application

- Photolithography Equipment Market, by Region

- Photolithography Equipment Market, by Group

- Photolithography Equipment Market, by Country

- United States Photolithography Equipment Market

- China Photolithography Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing technological evolutions, segmentation nuances and regional policies to chart photolithography equipment strategic imperatives ahead

In summary, photolithography equipment continues to evolve at the nexus of technological innovation and strategic realignment. The progression from deep ultraviolet scanners to advanced immersion and extreme ultraviolet platforms underscores the industry’s relentless pursuit of finer patterning and higher throughput. Concurrently, geopolitical forces and policy incentives drive supply chain diversification and localized manufacturing investments, ensuring resilience in an increasingly complex trade environment.

Segmentation analyses reveal nuanced dynamics across product types, service delivery models, wavelength technologies, customer archetypes, and end-market applications. Regional insights highlight the interplay between incentives, infrastructure readiness, and ecosystem collaborations in shaping equipment demand. Leading companies strengthen their market positions through innovation partnerships, service excellence, and strategic localization initiatives that mitigate tariff headwinds.

Ultimately, stakeholders that embrace advanced technologies, fortify supply chain strategies, and commit to sustainable digital transformation will be best positioned to capitalize on emerging opportunities. By aligning investment decisions with long-term node roadmaps and ecosystem partnerships, industry players can navigate uncertainty and deliver differentiated value in the evolving photolithography landscape.

Engage directly with Associate Director Ketan Rohom to secure expert guidance and gain unparalleled photolithography market insights

Seize the opportunity to deepen your understanding of photolithography equipment market dynamics and make data-driven strategic decisions by purchasing the comprehensive market research report. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through tailored solutions, answer your queries, and ensure you receive a report aligned with your organizational objectives. Engage directly with Ketan to unlock detailed insights into product innovations, emerging market drivers, and competitive positioning, empowering your team to stay ahead in a rapidly evolving landscape. Contact him today to arrange a personalized consultation, discuss licensing options, and access executive summaries, detailed analyses, and forecasting modules that will inform your next move in semiconductor manufacturing.

- How big is the Photolithography Equipment Market?

- What is the Photolithography Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?