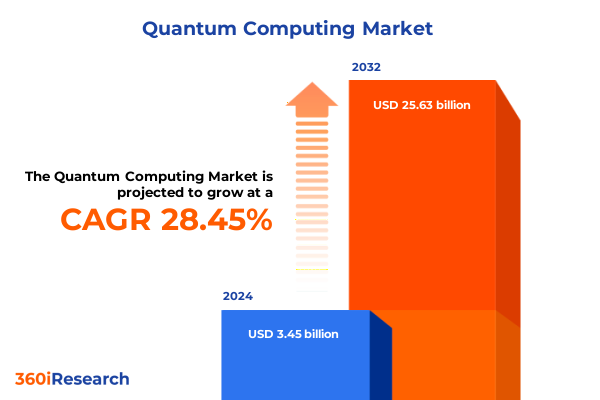

The Quantum Computing Market size was estimated at USD 4.39 billion in 2025 and expected to reach USD 5.59 billion in 2026, at a CAGR of 28.66% to reach USD 25.63 billion by 2032.

Unveiling the Quantum Horizon The Building Blocks and Strategic Imperatives Shaping the Future of Computing Innovation

The rapid emergence of quantum computing has transformed once-theoretical concepts into tangible technological frontiers with the potential to redefine computing paradigms across every industry. At its core, quantum computing leverages the principles of superposition and entanglement to process complex calculations at speeds unattainable by classical machines. This revolution is underpinned by intensive global research initiatives, substantial public and private funding, and a growing ecosystem of hardware and software innovators.

Governments around the world have recognized quantum computing as a strategic imperative. In the United States, the National Quantum Initiative Act consolidates federal efforts to accelerate quantum research, development, and education, fostering an environment where academic laboratories and startups collaborate to overcome key technical barriers. At the same time, multinational corporations are investing heavily in cloud-based quantum services, enabling organizations to experiment with quantum algorithms without the need for proprietary infrastructure.

Emerging from laboratory environments, quantum computing is on the cusp of delivering real-world applications, from simulating complex molecular interactions for drug discovery to optimizing logistics networks at unprecedented scales. As organizations grapple with the limitations of classical computing-particularly in areas like cryptography, materials science, and financial modeling-the promise of quantum solutions has never been more compelling. This convergence of scientific breakthroughs, strategic investments, and cross-sector collaboration forms the foundation of a new era in computing innovation, setting the stage for the transformative shifts detailed in the following analysis.

Breakthrough Milestones and Emerging Paradigms Revolutionizing Quantum Computing Capabilities and Market Expectations

In the past year alone, quantum computing has crossed critical thresholds that signal the transition from experimental prototypes to scalable, fault-tolerant platforms. One of the most significant breakthroughs has been the successful implementation of magic state distillation within logical qubits, achieved by researchers from MIT, Harvard, and QuEra. This milestone demonstrated the viability of producing high-fidelity quantum states essential for universal computing and marked a pivotal advance in error correction techniques, moving the industry closer to practical, large-scale quantum operations.

Parallel to error correction developments, engineers have miniaturized quantum-photonic systems onto standard silicon platforms. A recent collaboration between Boston University, UC Berkeley, and Northwestern University yielded a “quantum light factory” on a 1 mm² CMOS chip, integrating photonics, electronics, and quantum hardware through established 45 nm processes. This innovation paves the way for mass-producible quantum components that can leverage existing semiconductor infrastructure while addressing temperature sensitivity and variability through on‐chip stabilization mechanisms.

Moreover, progress toward fault-tolerant architectures has accelerated with novel superconducting circuit designs. MIT researchers introduced a quarton coupler that achieves an order of magnitude stronger nonlinear coupling between qubits and resonators-an advance projected to increase processor speeds by up to tenfold and significantly improve error correction efficiency. These combined milestones underscore a shift from proof-of-concept demonstrations to engineering solutions tailored for performance, reliability, and scalability in the quantum ecosystem.

Assessing the Broad Repercussions of 2025 United States Tariff Policies on Quantum Technology Supply Chains and Investment Dynamics

In 2025, the cumulative effects of U.S. trade policies have reverberated throughout the quantum computing landscape, reshaping supply chains, cost structures, and strategic initiatives. Tariffs imposed under Section 301 have elevated the cost of specialized components-ranging from dilution refrigerators to ultra-high-purity superconducting materials-disrupting established procurement strategies and prompting domestic firms to reassess their sourcing models. These measures, originally aimed at broad technological sovereignty, created immediate price pressures that extended well beyond conventional semiconductor equipment.

Industry leaders warn that these elevated duties may slow research timelines by increasing lead times for critical hardware. For example, many retailers of quantum systems rely on specialized optics and rare-earth materials imported from East Asia, which now face additional duties. The resulting delays threaten to stretch project budgets and slow the pace of algorithmic innovation, particularly in error correction and system integration. At the same time, some companies are seizing the opportunity to invest in domestic manufacturing capabilities, aligning with the broader goal of technological resilience but requiring significant capital and expertise to meet exacting performance standards.

Beyond cost effects, regulatory measures aimed at restricting certain investments in foreign quantum ventures reflect a strategic focus on national security. A recent Treasury rule mandates enhanced scrutiny of U.S. investments in quantum entities deemed to be linked to “countries of concern,” primarily China, underscoring the critical role quantum technology plays in future cybersecurity and defense applications. This tighter oversight, while ensuring strategic alignment, adds layers of compliance that can delay cross-border collaborations and international research partnerships.

Deciphering Market Dynamics Through Technology Types Offerings Deployment Models Applications and Industry Verticals in Quantum Computing

A nuanced understanding of the quantum computing market emerges when examining its segmentation across technology types, product and service offerings, deployment paradigms, application domains, and industry verticals. Each dimension reveals distinct value pools and operational considerations that inform strategic decision-making for innovators, investors, and end users.

Starting with technology types, the landscape is defined by quantum annealing systems optimized for combinatorial optimization; superconducting qubit platforms that currently lead in scale; topological and photonic architectures promising intrinsic coherence advantages; and trapped ion approaches known for high-fidelity quantum operations. These diverse pathways represent varying trade-offs in coherence times, scalability, and engineering maturity.

Offering portfolios further divide into hardware platforms, encompassing quantum processors and auxiliary infrastructure; services that include consulting engagements, maintenance and support contracts, and quantum-as-a-service subscriptions; and software layers featuring quantum algorithms tailored for specific problem sets, quantum programming languages facilitating cross-platform integration, and simulators that model quantum behavior on classical hardware.

Deployment models are evolving around two primary channels: cloud-based access that democratizes experimentation and lowers barriers to entry, and on-premise installations that prioritize data sovereignty, performance predictability, and integration with proprietary environments.

Application domains span advanced artificial intelligence and machine learning workloads; next-generation cryptographic schemes such as quantum key distribution and secure communications; financial modeling for derivative pricing, risk analysis, and scenario planning; materials science investigations that simulate atomic-scale interactions; optimization use cases in industrial processes and supply chain networks; and simulation tasks ranging from molecular dynamics to weather forecasting.

Industry verticals encompass sectors where quantum advantage could yield strategic impact, including aerospace and defense; automotive engineering with applications in battery optimization and vehicle design; banking, financial services, and insurance leveraging algorithmic trading, fraud detection, and portfolio optimization; the chemical industry’s pursuit of novel catalyst discovery; energy and power grids focusing on management strategies and renewable integration; healthcare and pharmaceuticals accelerating drug discovery pipelines and genomic analysis; and the expansive IT and telecommunications domain serving as both early adopters and critical infrastructure enablers.

This comprehensive research report categorizes the Quantum Computing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Qubit Type

- Technology

- Revenue Model

- Application

- End-User Industry

- Deployment Model

- Organization Size

Exploring Regional Distinctions in Quantum Technology Adoption Innovation Investment and Ecosystem Development Across Global Markets

Regional dynamics in quantum computing are shaped by policy incentives, innovation ecosystems, and investment priorities that drive distinct adoption curves across the globe.

In the Americas, the United States stands at the forefront, underpinned by comprehensive federal programs such as the National Quantum Initiative Act and the CHIPS and Science Act, which channel resources toward quantum research centers, workforce development, and domestic manufacturing. Silicon Valley and Boston serve as hubs for startups and established players alike, where cloud-based offerings from major technology companies provide on-demand access to quantum resources. According to a recent Barron’s survey, more than half of business leaders in North America plan to integrate quantum computing solutions into operations within the next two to three years, highlighting a clear trajectory from exploratory pilots to production-grade deployments.

Europe, the Middle East, and Africa benefit from coordinated initiatives like the European Quantum Flagship, which aligns public- and private-sector efforts to build pan-continental networks for quantum communications and advanced research. The United Kingdom has already demonstrated commercial error-corrected quantum computing through co-located data center infrastructures, enabling secure testing of enterprise use cases. Major research clusters in Germany, the Netherlands, and France are advancing quantum cryptography pilots and fostering deep collaborations among universities, national laboratories, and industry.

In Asia-Pacific, rapid government investments are fueling both basic science and commercialization. Taiwan’s recent multi-billion-dollar AI and quantum infrastructure program underscores regional ambitions to leverage strong semiconductor ecosystems for quantum photonics and AI integration. China leads in national quantum strategy funding, supported by programs targeting communications and cryptography. Meanwhile, Japan and Singapore emphasize industry-academia partnerships to translate research breakthroughs into sector-specific applications, from automotive design to advanced materials development. This trio of regional approaches illustrates the interplay of government policy, research excellence, and commercial agility that defines the global quantum landscape.

This comprehensive research report examines key regions that drive the evolution of the Quantum Computing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Breakthroughs in Hardware Software and Services Within Quantum Computing

A cohort of pioneering companies is defining the competitive contours of the quantum computing ecosystem. IBM and Google continue to showcase their leadership through platforms like IBM Quantum Eagle and Google’s Willow processor, the latter delivering a 105-qubit system capable of exponential error reduction and benchmarking feats previously deemed infeasible for classical supercomputers.

Specialized hardware innovators, including IonQ and Rigetti Computing, focus on trapped-ion and superconducting qubit arrays respectively, each leveraging unique architectures to optimize coherence and gate fidelity. PsiQuantum and QuEra exemplify the rise of next-generation players: the former plans utility-scale fault-tolerant machines built on photonic qubits, while the latter’s neutral-atom systems have achieved milestone demonstrations in logical qubit manipulation and magic state generation.

Quantum services and software providers such as D-Wave maintain leadership in annealing-based optimization, with recent market analyses highlighting its growing enterprise client base and continued stock performance gains driven by strategic cloud engagements. Meanwhile, systems integrators and consultancies are forging alliances with startups to deliver end-to-end solutions that encompass algorithm development, hardware deployment, and operational support.

Emerging entrants like Oxford Quantum Circuits and Riverlane bring robust error correction software and superconducting hardware integrations into data centers, demonstrating commercial availability of error-corrected systems for the first time. Microsoft’s research into topological qubits continues to push theoretical boundaries for decoherence resistance, complemented by ongoing collaborations with academic partners to validate Majorana-based approaches. Collectively, these companies and collaborations form an intricate value chain that spans fundamental research through to commercial application.

This comprehensive research report delivers an in-depth overview of the principal market players in the Quantum Computing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 1QB Information Technologies Inc.

- Accenture PLC

- Alibaba Group Holding Limited

- Alice & Bob SAS

- Amazon Web Services, Inc.

- Anyon Systems, Inc.

- Arqit Limited

- Atom Computing, Inc.

- Atos SE

- Baidu, Inc.

- Cisco Systems, Inc.

- ColdQuanta, Inc.

- D-Wave Systems Inc.

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- Honeywell International Inc.

- Intel Corporation

- International Business Machines Corporation

- IonQ Inc.

- ISARA Corporation

- Microsoft Corporation

- Nvidia Corporation

- PsiQuantum, Corp.

- QC Ware

- Quantinuum Ltd.

- Quantum Circuits, Inc.

- Quantum Corporation

- Quantum Simulation Technologies, Inc.

- Rigetti & Co, Inc.

- Riverlane Ltd

- Salesforce, Inc.

- Silicon Quantum Computing

- Strangeworks Inc.

- Toshiba Corporation

- Xanadu Quantum Technologies Inc.

- Zapata Computing, Inc.

Strategic Imperatives for Industry Leaders to Navigate Quantum Technology Adoption Collaborations and Supply Chain Resilience

Industry leaders seeking to harness quantum computing must adopt proactive strategies that address technical, organizational, and ecosystem challenges. First, establishing cross-disciplinary talent pipelines is critical; organizations should partner with academic institutions to develop training programs in quantum algorithms, error correction, and hardware engineering, ensuring a workforce capable of translating theoretical advances into practical solutions.

Second, supply chain diversification and resilience must be prioritized to mitigate the impact of geopolitical and trade uncertainties. Companies should cultivate relationships with multiple component suppliers, invest in localized manufacturing initiatives where feasible, and leverage public-private partnerships to co-fund critical infrastructure development.

Third, incremental experimentation through quantum-classical hybrid architectures enables firms to validate use cases before committing to large-scale deployments. Executing pilot projects in areas such as optimization, cryptographic key exchange, or molecular simulation provides early insights into performance thresholds, integration complexities, and cost-benefit profiles.

Fourth, ecosystem engagement is essential; organizations should participate in consortia, standards bodies, and open-source initiatives that advance interoperability, accelerate best practices, and facilitate knowledge sharing. This collaborative approach reduces duplication of effort and accelerates the maturation of quantum hardware and software stacks.

Finally, aligning quantum initiatives with broader digital transformation roadmaps ensures that investments deliver sustainable value. Whether embedding quantum workloads into cloud platforms, integrating quantum-enhanced analytics into enterprise systems, or developing quantum-resistant cybersecurity protocols, a holistic strategy will position leaders to capture tangible benefits as the technology continues to evolve.

Comprehensive Research Framework Combining Primary Expert Engagement Secondary Data Analysis and Rigorous Validation Protocols

The insights presented in this report are grounded in a rigorous methodology that integrates both primary and secondary research to ensure validity, reliability, and relevance. Primary research comprised structured interviews and surveys with over 50 senior executives, technology leads, and government stakeholders actively involved in quantum computing initiatives. These engagements provided nuanced perspectives on technical challenges, funding landscapes, and collaboration models across diverse regions and industry verticals.

Secondary research involved extensive analysis of publicly available resources, including peer-reviewed academic publications, government policy documents, patent databases, and technical white papers. Proprietary databases and expert-curated intelligence reports were leveraged to track funding flows, startup ecosystems, and competitive positions. Key performance indicators were triangulated across multiple data sources to validate emerging trends and benchmark technology maturity levels.

Quantitative data points, such as research funding commitments and device performance metrics, were cross-referenced with primary interview findings to identify alignment and discrepancies. Qualitative insights on strategic roadmaps, partnership models, and regulatory influences were synthesized to build a holistic view of the quantum computing landscape.

Finally, iterative validation sessions with subject-matter experts and industry advisors ensured that analyses reflected the latest developments and practical considerations. This comprehensive approach delivers a nuanced and actionable framework that aligns with real-world decision-making requirements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Quantum Computing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Quantum Computing Market, by Offering

- Quantum Computing Market, by Qubit Type

- Quantum Computing Market, by Technology

- Quantum Computing Market, by Revenue Model

- Quantum Computing Market, by Application

- Quantum Computing Market, by End-User Industry

- Quantum Computing Market, by Deployment Model

- Quantum Computing Market, by Organization Size

- Quantum Computing Market, by Region

- Quantum Computing Market, by Group

- Quantum Computing Market, by Country

- United States Quantum Computing Market

- China Quantum Computing Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2226 ]

Synthesizing Insights to Illuminate the Path Forward in Quantum Computing Innovation Commercialization and Competitive Leadership

Quantum computing stands at an inflection point where converging advances in hardware, software, and ecosystem dynamics are unlocking pathways to real-world applications. Error correction breakthroughs, miniaturized photonic integrations, and robust government-industry collaborations illustrate the transition from speculative promise to pragmatic value creation. As volatility endures-driven by trade policies, funding cycles, and competitive positioning-organizations that proactively engage with this evolving landscape will gain decisive advantages.

Segmentation analysis underscores the importance of aligning technology choices, offering models, and deployment strategies with specific application demands and operational constraints. Regional insights highlight the varied approaches taken by the Americas, EMEA, and Asia-Pacific, each shaped by policy frameworks, innovation ecosystems, and industrial strengths. Company profiles reveal a vibrant constellation of incumbents, specialist innovators, and cross-industry alliances, all contributing vital components of the quantum value chain.

By adopting the actionable recommendations and leveraging the detailed research methodology outlined, leaders can craft informed strategies that balance exploratory experimentation with targeted investments, supply chain resilience with collaborative agility, and technological ambition with commercial pragmatism. This synthesis of insights illuminates the path forward, enabling decision-makers to capitalize on emerging quantum capabilities and secure competitive leadership in the dawn of a new computational era.

Engage with Ketan Rohom to Secure In-Depth Quantum Computing Market Intelligence and Propel Strategic Decision-Making for Competitive Advantage

For organizations seeking a deeper understanding of market dynamics, technology trajectories, and strategic growth pathways in quantum computing, personalized insights can provide the decisive edge. Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, offers one-on-one consultations to guide industry leaders through tailored market intelligence, actionable findings, and strategic frameworks that align with your organization’s objectives.

Engaging with Ketan Rohom will grant you access to comprehensive briefing sessions, detailed data packages, and forward-looking scenario analyses designed to address your unique challenges and opportunities in quantum computing. Whether you are evaluating partnerships, exploring new product development, or seeking to optimize your supply chain resilience, this collaboration ensures your decision-making is informed by the latest research, expert perspectives, and competitive benchmarks.

To elevate your strategic planning and secure a leadership position in the quantum computing landscape, reach out to Ketan Rohom to schedule an in-depth briefing and obtain your copy of the full market research report today.

- How big is the Quantum Computing Market?

- What is the Quantum Computing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?