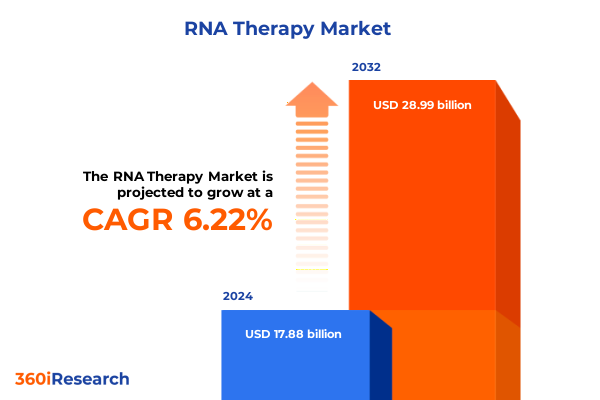

The RNA Therapy Market size was estimated at USD 18.77 billion in 2025 and expected to reach USD 19.70 billion in 2026, at a CAGR of 6.40% to reach USD 28.99 billion by 2032.

Unveiling the Potential of RNA Therapeutics as Game-Changers in Personalizing Medicine and Addressing Unmet Clinical Needs on a Global Scale

The field of RNA therapeutics has swiftly transitioned from a conceptual framework into a cornerstone of modern drug development, harnessing the intrinsic ability of RNA molecules to modulate gene expression with unprecedented specificity. This paradigm shift builds upon decades of foundational research in molecular biology, culminating in the rapid development and regulatory approval of messenger RNA vaccines. As the scientific community advances beyond prophylactic vaccines, attention has turned to a diverse array of modalities including small interfering RNA, antisense oligonucleotides, and microRNA-based therapeutics. These platforms offer promise in addressing previously intractable targets, thereby redefining the contours of personalized medicine and enabling tailored treatment regimens for complex and rare diseases.

Transitioning from proof-of-concept studies to clinically validated therapies, the momentum behind RNA-centric interventions has been propelled by breakthroughs in sequence optimization, chemical modifications, and targeted delivery strategies. Pivotal clinical successes have stimulated significant investment across biopharmaceutical sectors, drawing new entrants and fostering collaborations among academic institutions, contract research organizations, and established pharmaceutical companies. This convergence of expertise and capital underscores the transformative potential of RNA therapies to disrupt conventional drug discovery and pave the way for next-generation interventions across a spectrum of therapeutic areas.

Unprecedented Advancements in RNA Delivery Technologies and Regulatory Alignments Are Reshaping the Therapeutic Landscape for Next-Generation Interventions

In recent years, the RNA therapy ecosystem has undergone seismic transformations driven by technological innovations and evolving regulatory frameworks. Breakthroughs in nonviral and viral vector delivery have markedly improved the stability, biodistribution, and cellular uptake of RNA cargo, thereby broadening the therapeutic index and expanding applicability to challenging targets. Simultaneously, advancements in lipid nanoparticle formulations and emerging exosome-based delivery systems have yielded greater precision in tissue tropism, reducing off-target effects and enhancing safety profiles. These platform enhancements enable a more agile response to genetic mutations and disease heterogeneity, facilitating rapid adaptation to emerging variants and patient-specific biomarkers.

Beyond delivery, regulatory authorities have demonstrated increasing receptivity to RNA modalities by streamlining pathways for emergency use and accelerated approvals. Harmonized guidances on chemical characterization, manufacturing controls, and nonclinical safety assessments have reduced uncertainty and enabled earlier engagement between developers and regulators. Moreover, strategic partnerships between public agencies, academic centers, and private enterprises have bolstered translational research capabilities, forging a collaborative ecosystem that accelerates bench-to-bedside timelines. Consequently, the RNA therapy landscape has evolved from nascent experimentation to a robust development pipeline poised for clinical and commercial maturation.

Evaluating the Compound Effects of US Tariff Policies Implemented in 2025 on Supply Chains Research Costs and Access to Critical RNA Therapeutic Components

The United States’ tariff landscape in 2025 has exerted cumulative pressures on the supply chain dynamics of RNA therapeutic development, influencing the cost structure of raw materials, reagents, and delivery system components. Tariff adjustments on key inputs such as lipids, polymers, and viral vector substrates have necessitated re-evaluation of sourcing strategies and spurred shifts toward domestic manufacturing partnerships. As a result, biopharmaceutical companies are balancing short-term cost increases against the long-term benefits of supply chain resilience, integrating dual-sourcing models and leveraging tariff exemptions for research-use-only materials when possible.

In response to these elevated import costs, developers have increasingly invested in localized production clusters, optimizing manufacturing footprints to mitigate exposure to fluctuating trade policies. This strategic realignment has encouraged collaborative ventures among raw material suppliers, contract manufacturing organizations, and end-users to co-develop tariff-efficient processes. Furthermore, the cumulative impact of U.S. tariff measures has underscored the importance of proactive policy engagement; industry leaders are working with trade associations and government stakeholders to refine tariff classifications and secure preferential treatment for critical RNA therapy inputs. Through these collective efforts, the sector aims to safeguard the integrity of the innovation pipeline while attenuating the financial burdens imposed by evolving trade dynamics.

Deciphering Core Market Segments by Therapeutic Application Delivery Modalities and End-User Profiles to Illuminate Strategic Growth Frontiers

A nuanced understanding of market segmentation is instrumental in charting strategic priorities and resource allocation across the RNA therapy continuum. Analysis by therapeutic area reveals that applications targeting cardiovascular diseases and metabolic disorders are gaining traction due to high prevalence rates and clear biomarker-driven endpoints, while oncology segments focused on hematological malignancies and solid tumors benefit from well-established clinical trial frameworks and sizable patient populations. Rare diseases, spanning Gaucher disease, neuromuscular disorders, and sickle cell disease, remain a focal point for precision interventions given the life-threatening nature of these conditions and the regulatory incentives for orphan drug designation. Infectious disease modalities, bifurcated into bacterial and viral infections, leverage rapid sequence redesign capabilities to address antimicrobial resistance and emergent viral threats.

In parallel, delivery system segmentation underscores the maturation of lipid nanoparticles as the de facto standard for mRNA platforms, while polymer carriers and exosome-based vectors are emerging as viable alternatives for targeted tissue delivery. Viral vectors continue to play a pivotal role in gene silencing and gene editing strategies, particularly in contexts requiring sustained expression or in vivo genome integration. End-user segmentation highlights the critical interplay between biotechnology companies driving early-stage innovation, pharmaceutical companies scaling commercialization, and hospitals, clinics, and research institutes serving as trial sites and academic collaborators. These distinct end-user dynamics inform go-to-market strategies and partnership models, ensuring that development pipelines align with the operational capabilities and regulatory credentials of each stakeholder group.

This comprehensive research report categorizes the RNA Therapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Area

- Delivery System

- End User

Analyzing Regional Disparities and Growth Drivers Across the Americas Europe Middle East Africa and Asia-Pacific in the RNA Therapeutics Ecosystem

Regional dynamics within the RNA therapeutics market reflect diverse growth drivers and infrastructural capacities. In the Americas, particularly in North America, robust funding ecosystems and a supportive regulatory climate have fostered a dense network of biotech clusters and contract manufacturing hubs. The convergence of public research institutions and private investment has accelerated translational projects, while the presence of leading academic medical centers ensures early clinical trial deployment and real-world data capture.

Across Europe, the Middle East, and Africa, a mosaic of regulatory regimes and heterogeneous healthcare infrastructures presents both challenges and opportunities. European Union harmonization efforts streamline cross-border approvals, enabling multinational trial designs, whereas select Middle Eastern countries have launched national genomics initiatives to position themselves as regional innovation centers. Africa’s growing biotech sector is gradually leveraging international partnerships to build local manufacturing capabilities and expand access to RNA-based therapies.

In the Asia-Pacific region, government-led precision medicine programs in countries such as Japan, South Korea, and Singapore are driving targeted investments in RNA research. China’s rapidly expanding biopharmaceutical industry is fueling scale-up of RNA manufacturing capacity, supported by favorable intellectual property frameworks and strategic collaborations with Western partners. Meanwhile, emerging markets within Southeast Asia are strengthening regulatory infrastructures and bolstering talent pools to capture spillover benefits from global RNA therapy advancements.

This comprehensive research report examines key regions that drive the evolution of the RNA Therapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Who Are Pioneering RNA Therapy Development and Commercialization Efforts

A cohort of pioneering companies is spearheading innovation across the RNA therapy landscape, each leveraging unique technological assets and strategic alliances. Early-stage biotechnology firms specializing in lipid nanoparticle platforms and advanced polymer chemistries are partnering with academic institutions to refine delivery technologies and expand therapeutic reach. Simultaneously, established pharmaceutical companies are integrating RNA modalities into their pipelines through targeted acquisitions and in-licensing agreements, thereby diversifying their portfolios and accelerating time-to-market.

Contract development and manufacturing organizations play a critical facilitative role, providing scalable production capabilities and regulatory support for both clinical and commercial stages. Their investments in modular, single-use facilities and digital manufacturing systems have enhanced capacity to manage diverse RNA modalities with stringent quality controls. Moreover, research institutes and hospital consortia are acting as innovation catalysts, offering access to patient cohorts and real-world evidence generation. Cross-sector collaborations-spanning device manufacturers, data analytics providers, and immunology specialists-have further enriched the ecosystem, driving holistic approaches to therapeutic design, development, and patient monitoring.

This comprehensive research report delivers an in-depth overview of the principal market players in the RNA Therapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alnylam Pharmaceuticals, Inc.

- Arcturus Therapeutics Holdings, Inc.

- Arrowhead Pharmaceuticals, Inc.

- BioNTech SE

- CureVac N.V.

- Eli Lilly and Company

- Ionis Pharmaceuticals, Inc.

- Moderna, Inc.

- Sarepta Therapeutics, Inc.

- Silence Therapeutics plc

- Stoke Therapeutics

Strategic Imperatives for Industry Stakeholders to Accelerate Innovation Optimize Operations and Navigate a Complex Regulatory Environment in RNA Therapy

To sustain momentum and navigate the complexities of the RNA therapeutics arena, industry leaders must prioritize a set of strategic imperatives. First, investing in next-generation delivery platforms-such as targeted exosomes and stimulus-responsive polymers-will be essential to overcome tissue barriers and enhance therapeutic indices. Second, forging deeper alliances with regulatory bodies and standard-setting organizations can accelerate pathway clarity and optimize clinical trial design, ensuring that novel modalities progress with minimal regulatory friction.

Furthermore, stakeholders should embed resilience in their supply chains through diversification of raw material sources and the adoption of digital traceability tools. Collaborative frameworks that align incentives between raw material suppliers, contract manufacturers, and developers will mitigate risks associated with trade policy volatility. Lastly, companies must embrace data-driven decision-making by integrating advanced analytics, real-world evidence, and artificial intelligence in target identification, trial stratification, and post-market surveillance. By focusing on these actionable priorities, organizations can not only refine their operational agility but also solidify their position at the vanguard of RNA-based innovation.

Employing a Robust Mixed-Method Research Methodology Blending Primary Interviews Secondary Data and Quantitative Analyses to Ensure Insightful Market Intelligence

The research methodology underpinning this analysis combined a rigorous blend of primary and secondary data sources. Primary inputs were obtained through in-depth interviews with senior executives from biotechnology companies, pharmaceutical manufacturers, and contract development and manufacturing organizations. These interviews provided qualitative insights into platform development challenges, regulatory engagement strategies, and emerging partnership models.

Secondary research encompassed a systematic review of scientific publications, patent filings, regulatory submissions, and industry conference proceedings. Quantitative analyses were performed on publicly available datasets related to clinical trial registries, intellectual property landscapes, and trade data to elucidate supply chain patterns and tariff implications. Triangulation of these data streams ensured the validity and reliability of key findings, while continuous cross-validation with industry experts reinforced the relevance of strategic recommendations. This robust methodological framework delivers a comprehensive perspective on the RNA therapeutics market’s trajectory and stakeholder dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our RNA Therapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- RNA Therapy Market, by Therapeutic Area

- RNA Therapy Market, by Delivery System

- RNA Therapy Market, by End User

- RNA Therapy Market, by Region

- RNA Therapy Market, by Group

- RNA Therapy Market, by Country

- United States RNA Therapy Market

- China RNA Therapy Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Highlight the Evolution Trajectory of RNA Therapeutics and Implications for Stakeholders Across the Value Chain

The evolution of RNA therapeutics underscores a broader shift toward precision medicine paradigms, wherein customizable interventions can be rapidly developed and adapted to meet diverse clinical needs. Recent advancements in delivery technologies and supportive regulatory frameworks have lowered barriers to entry, enabling a vibrant ecosystem of innovators to emerge. At the same time, trade policy fluctuations and geopolitical considerations highlight the importance of resilient supply chain strategies and proactive stakeholder engagement.

Segment-level analysis reveals that while cardiovascular, metabolic, and infectious disease applications dominate near-term pipelines, rare disease and oncology segments offer high-value opportunities driven by regulatory incentives and clear clinical unmet needs. Regional disparities emphasize the need for localized strategies, as North America and select Asia-Pacific markets continue to lead investment and development efforts, while Europe, the Middle East, Africa, and emerging Asia markets present a mix of regulatory hurdles and untapped potential.

Collectively, these insights coalesce into a clear narrative: RNA therapeutics are poised to redefine modern healthcare, contingent upon sustained technological innovation, strategic collaboration, and adaptive policy engagement. Stakeholders equipped with comprehensive market intelligence and forward-looking recommendations will be best positioned to navigate this dynamic landscape and deliver transformative therapies to patients worldwide.

Take the Next Step in RNA Therapeutics Insight by Engaging Ketan Rohom to Access the Comprehensive Market Research Report

To gain a comprehensive understanding of the evolving RNA therapeutics landscape and capitalize on emerging opportunities, industry leaders are invited to connect with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with him will unlock tailored insights, detailed market analytics, and strategic guidance necessary to refine development pathways and commercial strategies. By collaborating with an expert who possesses nuanced knowledge of both scientific innovation and market dynamics, stakeholders can accelerate decision-making and secure competitive advantages. Reach out today to arrange a personalized briefing and access the full, in-depth market research report that will empower your organization to lead in the RNA therapy revolution

- How big is the RNA Therapy Market?

- What is the RNA Therapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?