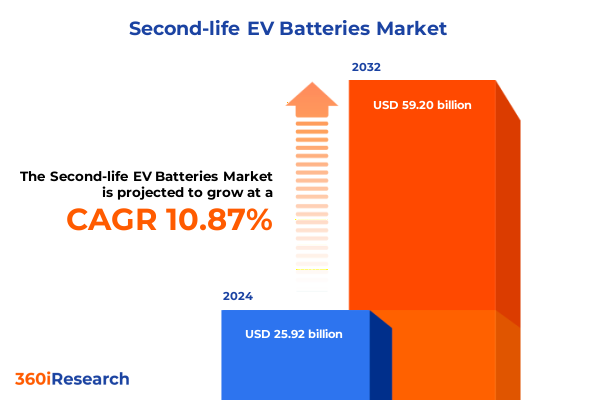

The Second-life EV Batteries Market size was estimated at USD 1.31 billion in 2025 and expected to reach USD 1.43 billion in 2026, at a CAGR of 9.38% to reach USD 2.46 billion by 2032.

Unveiling the Critical Role of Second-Life Electric Vehicle Batteries in Driving Sustainable Energy Storage Innovation Across Global Industries

The accelerating global transition to electric mobility has created an unprecedented volume of used batteries reaching end of service in passenger vehicles, commercial fleets, and public transit systems. Rather than treating these assets as waste, industry pioneers and policymakers alike are seizing the opportunity to repurpose electric vehicle battery modules for stationary energy storage applications. This shift not only extends the economic lifespan of lithium-ion cells and other chemistries but also addresses critical sustainability goals by reducing reliance on virgin raw materials and curbing electronic waste generation.

Amid tightening environmental regulations and intensified corporate commitments to circular economy principles, second-life battery solutions have emerged as a cornerstone of next-generation energy infrastructure. Energy providers, equipment manufacturers, and technology integrators are collaborating to establish robust value chains that seamlessly integrate battery collection, testing, reconditioning, and redeployment. Consequently, the second-life segment is evolving from a niche pilot phase into a scalable market poised to influence grid reliability, off-grid electrification, and distributed energy resources across diverse sectors.

How Evolving Sustainability Standards Advanced Battery Technologies and Collaborative Ecosystems Are Redefining Second-Life EV Battery Markets Worldwide

Recent years have witnessed transformative shifts in the second-life battery landscape driven by stringent sustainability benchmarks, the maturation of advanced battery chemistries, and the proliferation of collaborative ecosystem models. Regulatory frameworks in multiple jurisdictions now mandate lifecycle tracking and extended producer responsibility, compelling original equipment manufacturers and remanufacturers to integrate end-of-first-life strategies at the design stage. Consequently, enhanced cell balancing, predictive diagnostics, and standardized module configurations have streamlined the repurposing process while ensuring operational reliability in secondary applications.

Furthermore, digitalization has played a pivotal role in elevating transparency across second-life value chains. Cloud-based asset management platforms enable real-time monitoring of state-of-health metrics, thereby optimizing repackaging workflows and minimizing performance degradation in commercial and grid-scale deployments. At the same time, collaborative consortiums-comprising automakers, utility operators, and recycling specialists-are co-developing open protocols for data interoperability, paving the way for interoperable reuse solutions that can be deployed across multiple geographies and market verticals.

Assessing the Multifaceted Consequences of the 2025 United States Tariff Adjustments on Second-Life EV Battery Supply Chains and Cost Dynamics

The implementation of targeted tariffs on imported battery cells and critical raw materials by the United States in early 2025 has produced a cascade of effects throughout the second-life battery sector. By increasing the landed cost of new cells imported from overseas, these duties have indirectly enhanced the competitive positioning of locally sourced and domestically repurposed modules. At the same time, higher component prices have exerted upward pressure on reconditioning expenses, prompting remanufacturers to intensify automation investments and optimize reuse yields to maintain attractive pricing structures for end users.

Moreover, the tariff regime has accelerated discussions around nearshoring of battery dismantling and repackaging facilities, with stakeholders weighing the trade-off between elevated domestic labor costs and the strategic benefit of supply chain resilience. Energy providers and large industrial buyers have also begun negotiating volume commitments and long-term offtake agreements with local second-life integrators to hedge against potential import fluctuations. As a result, the 2025 tariff adjustments have catalyzed both short-term cost realignments and medium-term supply chain reconfigurations.

Decoding Market Diversity Through Battery Chemistry, Storage Capacities, Sales Channels, and Application-Specific Deployment Scenarios Driving Demand Variability

Diving into the diverse make-up of the second-life battery market reveals a complex tapestry of chemistries, capacities, distribution pathways, and end-use applications that collectively drive variability in adoption and performance outcomes. Cell technology spans established lead-acid systems through advanced lithium-ion formulations, while the evolving presence of nickel-metal hydride and sodium sulfur chemistries illustrates the market’s openness to specialized solutions targeting unique use cases. Each chemistry presents distinct recharge profiles, thermal management requirements, and end-of-life considerations that stakeholders must address during repurposing.

Analysis by energy storage capacity underscores that modules rated below fifty kilowatt-hours often find homes in low-power residential settings, whereas units within the fifty-to-one-hundred kilowatt-hour range attract demand from telecommunications providers seeking backup reliability. Mid-sized packs between one-hundred-and-two-hundred kilowatt-hours have become favored for modular commercial installations such as office buildings and small shopping centers, benefiting from flexible rack configurations. Meanwhile, high-capacity systems exceeding two-hundred kilowatt-hours are increasingly deployed in critical grid stabilization and large industrial sites, where performance consistency and lifecycle durability are paramount.

Distribution dynamics further delineate market pathways, as offline channels remain dominant for large-scale integration projects requiring site-specific engineering support, while online platforms offer rapid lead times for smaller commercial and residential orders. In turn, application-driven demand reflects intricate segmentation: commercial energy storage applications span office towers and retail complexes, grid storage solutions underpin renewable integration and peak shaving needs, industrial energy storage secures data center uptime and manufacturing continuity, residential installations empower both multi-tenant buildings and single-family homes, and telecommunication networks leverage repurposed modules to safeguard network reliability.

This comprehensive research report categorizes the Second-life EV Batteries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Type

- Battery Capacity

- Source

- Sales Channel

- Application

Mapping the Strategic Regional Variances and Adoption Drivers for Second-Life EV Batteries Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in the second-life battery market display nuanced adoption patterns shaped by regulatory regimes, infrastructure maturity, and policy incentives. In the Americas, strong federal and state-level clean energy targets, coupled with robust venture capital financing for circular economy startups, have cultivated a vibrant ecosystem for repurposed battery solutions. Early mover programs in California and New York have demonstrated the viability of second-life deployments in both off-grid microgrids and utility-scale energy arbitrage services, setting benchmarks for other states to follow.

Across Europe, the Middle East, and Africa, harmonized EU regulations on battery lifecycle assessment and material traceability have catalyzed pan-regional collaborations, leading to centralized repurposing hubs along major logistics corridors. At the same time, ambitious renewable energy integration targets in the Gulf states have driven interest in large-scale grid stabilization projects using second-life batteries. In sub-Saharan Africa, pilot initiatives are exploring telecom backup applications to bridge rural connectivity gaps, showcasing the technology’s versatility.

In the Asia-Pacific region, rapid growth in electric vehicle fleets, especially across China, Japan, and South Korea, has resulted in an abundant feedstock of end-of-first-life modules. Cost competitiveness and government procurement policies favoring local battery reuse have spurred the emergence of numerous repurposing facilities, while private sector alliances are piloting cross-border exchange frameworks to optimize resource utilization and drive economies of scale.

This comprehensive research report examines key regions that drive the evolution of the Second-life EV Batteries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Shaping Second-Life EV Battery Commercialization and Circular Economy Integration Globally

A cadre of forward-thinking companies has taken the lead in forging second-life battery solutions that bridge the gap between automotive retirement and stationary energy storage deployment. Major OEMs have launched dedicated programs to reclaim and repurpose cells from flagship electric vehicle models, integrating these modules into energy storage products tailored for commercial and utility-scale customers. Innovative technology firms complement this effort by providing advanced diagnostics, remanufacturing automation, and proprietary algorithms that extend cycle life and enhance safety margins in secondary applications.

Strategic partnerships between battery recyclers and energy developers have further accelerated market momentum. These alliances leverage synergistic capabilities-from material recovery and cell disassembly to system integration and operations management-creating vertically integrated offerings that streamline technical validation and deployment. In parallel, select startups have distinguished themselves by developing modular, plug-and-play second-life battery units that simplify adoption for small to midsize enterprises, opening new channels in the industrial and telecom segments.

Capital investment in research and pilot facilities continues to shape competitive dynamics, as companies race to validate next-generation chemistries and circular manufacturing techniques. This wave of innovation is underscored by growing interest from institutional investors seeking exposure to sustainable infrastructure assets, solidifying the long-term viability of the second-life battery market ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Second-life EV Batteries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Hyundai Motor Company

- Mercedes-Benz Group AG

- Nissan Motor Co., Ltd.

- Renault Group

- Enel X S.r.l.

- Bayerische Motoren Werke AG

- Toyota Motor Corporation

- Moment Energy Inc.

- MG Motor

- Proterra, Inc.

- Fortum Oyj

- RWE AG

- BYD Company Ltd.

- BeePlanet Factory

- Connected Energy Ltd.

- EcarACCU

- Li-Cycle Corp.

- Nunam Technologies India Pvt. Ltd.

- Nuvation Energy

- ReJoule Inc.

- RePurpose Energy Inc.

- Rivian Automotive, Inc.

- Second Life EV Batteries Ltd.

- Zenobē Energy Limited

Strategic Imperatives for Industry Stakeholders to Enhance Second-Life EV Battery Value Chains, Maximize Sustainability Gains, and Foster Market Expansion

To capitalize on the burgeoning opportunity within second-life electric vehicle batteries, industry stakeholders must prioritize standardized protocols for module testing, certification, and data exchange to reduce barriers to entry and foster interoperability across geographies. Investments in automated remanufacturing lines and advanced analytics platforms will be critical to driving down processing costs, improving throughput, and ensuring consistent performance in high-volume deployments. Engaging policymakers early to align on incentive structures and safety frameworks can further unlock market potential by mitigating regulatory uncertainty.

Moreover, cultivating strategic alliances between automakers, energy service providers, and technology vendors can accelerate time to market for innovative second-life solutions. Joint ventures or consortium models offer a pathway to share infrastructure investments, harmonize technical standards, and co-develop turnkey offerings that address both off-grid electrification and grid resiliency use cases. Finally, educating commercial and residential end users about the economic and environmental advantages of repurposed battery systems will be essential to expanding adoption and building long-term confidence in second-life assets.

Comprehensive Methodological Framework Combining Quantitative Analysis, Stakeholder Interviews, and Case Studies to Illuminate Second-Life EV Battery Trends

This research draws on a mixed-methods approach to ensure a holistic understanding of second-life EV battery market dynamics. Primary research comprised in-depth interviews with key decision-makers within original equipment manufacturers, energy utilities, remanufacturing specialists, and regulatory agencies, providing firsthand insights into evolving technology requirements and policy considerations. Parallel quantitative analysis leveraged proprietary datasets and transaction records to delineate adoption curves across chemistry types, capacity tiers, sales channels, and application segments.

Complementing these efforts, multiple case studies of early-adopter projects in North America, Europe, and Asia-Pacific were conducted to evaluate performance outcomes, economic viability metrics, and operational challenges. Findings were validated through expert workshops and stakeholder roundtables, ensuring that the interpretations reflect real-world experiences and capture emerging best practices. Throughout the research cycle, data integrity was maintained through rigorous cross-referencing, audit trails, and peer review by industry specialists.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Second-life EV Batteries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Second-life EV Batteries Market, by Battery Type

- Second-life EV Batteries Market, by Battery Capacity

- Second-life EV Batteries Market, by Source

- Second-life EV Batteries Market, by Sales Channel

- Second-life EV Batteries Market, by Application

- Second-life EV Batteries Market, by Region

- Second-life EV Batteries Market, by Group

- Second-life EV Batteries Market, by Country

- United States Second-life EV Batteries Market

- China Second-life EV Batteries Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights and Emerging Opportunities to Guide Strategic Decision-Making in the Second-Life Electric Vehicle Battery Sector

The confluence of environmental imperatives, technological advancements, and supportive policy measures has established second-life electric vehicle batteries as a transformative force within the broader energy storage landscape. Through a combination of chemistry diversification, capacity optimization, and digitalized asset management, repurposed battery solutions are poised to deliver reliable, cost-effective services across residential, commercial, industrial, and grid applications. Moreover, evolving trade policies and tariff structures have reshaped supply chain strategies, incentivizing near-site integration and bolstering supply resilience.

Ultimately, the second-life battery market represents more than an extension of EV cell economics-it embodies a shift toward a circular energy paradigm where assets are continuously redeployed to extract value across multiple lifecycles. Organizations that embrace standardized practices, forge collaborative partnerships, and invest in scalable remanufacturing infrastructure will be best positioned to harness this opportunity. As market maturity accelerates, stakeholders should remain agile, adapting to dynamic regulatory landscapes and technological breakthroughs to maintain competitive advantage.

Contact Associate Director Ketan Rohom to Access the In-Depth Market Research Report and Unlock Strategic Insights on Second-Life EV Batteries Today

To explore the full depth of this market research report and gain access to comprehensive analyses, tailored insights, and strategic recommendations, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who stands ready to guide you through subscription options and customization opportunities. Engaging with this study will equip your organization with the knowledge needed to capitalize on emerging trends in second-life electric vehicle batteries, refine partnership strategies, and drive tangible value across your operations. Take the next step in securing a competitive edge by contacting Ketan Rohom and unlocking the essential intelligence that will shape your sustainable energy initiatives.

- How big is the Second-life EV Batteries Market?

- What is the Second-life EV Batteries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?