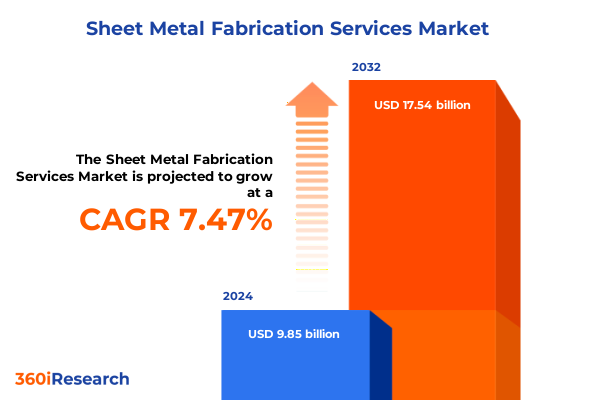

The Sheet Metal Fabrication Services Market size was estimated at USD 10.56 billion in 2025 and expected to reach USD 11.32 billion in 2026, at a CAGR of 7.51% to reach USD 17.54 billion by 2032.

Unveiling the Critical Role of Sheet Metal Fabrication Services in Modern Manufacturing Ecosystems and Strategic Business Operations

Sheet metal fabrication stands at the core of modern manufacturing, underpinning a vast array of industries from automotive assembly lines to aerospace engineering projects. Its versatility emerges from the ability to transform flat metal sheets into complex three-dimensional structures through processes such as bending, cutting, forming, and joining. This adaptability enables manufacturers to meet stringent design specifications while balancing material strength, weight, and cost considerations. As a result, fabricated sheet metal components have become foundational elements in producing durable yet lightweight vehicle frames, high-precision electronic enclosures, and architectural facades for commercial buildings

Beyond traditional industries, sheet metal fabrication services have become increasingly integral in emerging sectors such as renewable energy and medical device manufacturing. Wind turbine housings, solar mounting systems, and precision medical instrument panels all rely on the same fabrication principles that have driven manufacturing efficiencies for decades. Moreover, the customization inherent in sheet metal processes allows fabricators to rapidly respond to changing product requirements, ensuring that new designs can be prototyped and iterated with minimal lead times. This agility not only supports innovation but also enhances manufacturers’ ability to mitigate supply chain disruptions and adapt to evolving market demands

Navigating the Dynamic Evolution of Sheet Metal Fabrication Amidst Technological Disruption and Industry Paradigm Shifts

The sheet metal fabrication industry is undergoing a profound transformation fueled by digital technologies, automation, and sustainability imperatives. At the forefront of this evolution is the integration of artificial intelligence for quality control and process optimization. AI-powered monitoring systems now analyze streams of operational data in real time, identifying potential defects during cutting, bending, and forming stages to reduce scrap rates and improve yield. Predictive maintenance driven by machine learning algorithms anticipates equipment failures before they occur, minimizing unplanned downtime and extending the lifespan of critical assets

Simultaneously, robotics and automated guided vehicles are reshaping shop floor dynamics by handling repetitive or hazardous tasks. Robotic welding cells deliver consistent weld integrity, while cobots collaborate safely with human operators to perform nuanced assembly and inspection procedures. These advancements have unlocked the possibility of lights-out manufacturing, where facilities operate around the clock with minimal human intervention. Digital twin technology further accelerates this shift by enabling virtual simulation of production workflows, allowing engineers to optimize process parameters and prototype complex geometries before physical execution

Moreover, as end-use industries demand greater sustainability, fabricators are embracing energy-efficient machines, closed-loop recycling of metal scrap, and eco-friendly finishing techniques. Combined with IoT-driven data analytics, these green initiatives enhance resource utilization and traceability across the value chain, positioning sheet metal fabrication as a strategic enabler in corporate environmental, social, and governance agendas

Assessing the Far-Reaching Consequences of United States Tariffs on Sheet Metal Fabrication and Supply Chains in 2025

U.S. tariffs on steel and aluminum have progressively reshaped the economics of sheet metal fabrication, creating ripple effects that persist through 2025. Initially imposed in 2018 under Section 232 of the Trade Expansion Act at rates of 25 percent for steel and 10 percent for aluminum, the policy framework expanded in early 2025 when the government eliminated all country-specific exemptions. As of March 12, 2025, nearly all steel and aluminum imports face a uniform 25 percent duty, with some products of Russian origin subject to even higher rates; at the same time, derivative items such as stamped parts and tubing were added to the tariff schedule, broadening the cost impact across downstream supply chains

This broad application of tariffs has shielded domestic producers from international competition but has also triggered higher input prices for fabricators. Many U.S. mills responded to reduced import pressure by raising their domestic pricing floors, compressing margins for small and mid-sized shops that lack the purchasing scale of larger service centers. At the same time, domestic capacity constraints have emerged: U.S. aluminum smelters and steel mini-mills cannot immediately ramp output to replace all imports, resulting in longer lead times and unpredictable material availability. Fabricators have thus been compelled to reevaluate supplier networks, carry higher safety stock levels, and pass on increased costs to downstream OEMs to maintain operational continuity

Internationally, retaliatory measures and ongoing negotiations with key trading partners have introduced additional uncertainty. The European Union’s recent attempt to secure tariff reductions on 50 percent steel duties stumbled in July 2025, leaving the U.S. levies intact and perpetuating competitive imbalances for exporters and importers alike. As trade dialogues continue without clear timelines, fabrication businesses must remain vigilant, agile, and prepared to adjust sourcing, pricing, and production strategies in response to evolving policy landscapes

Illuminating Critical Segmentation Perspectives to Drive Strategic Decision Making in the Sheet Metal Fabrication Landscape

A nuanced understanding of market segmentation is critical for targeting growth opportunities and optimizing service portfolios within the sheet metal fabrication sector. Material type delineates core market dynamics, with aluminum offerings further subdivided into alloys and pure variants, while brass demand splits between C260 and C280 grades. Copper innovations hinge on deoxidized and electrolytic tough pitch variants, and steel services range across alloy, carbon, and stainless mill options. Each material subset possesses distinct performance characteristics and cost profiles that influence application suitability across industries.

Fabrication form also shapes value propositions. Bend sheet processing aligns with structural and architectural uses, cut sheet volumes feed high-precision electronics and automotive panels, and punch sheet specialization supports rapid prototyping and small batch customization. Thickness tiers introduce further granularity, as thin gauge under 0.5 mm up to 1.5 mm meets lightweight enclosure needs, while medium gauges from 1.5 mm to 5 mm and thick sections beyond 5 mm address load-bearing and heavy equipment requirements. Service types-from design and engineering through cutting, forming, joining, finishing, assembly, and quality assurance-map to different stages of the manufacturing lifecycle, enabling fabricators to offer end-to-end solutions or niche expertise.

End-use segmentation clarifies industry drivers: aerospace and defense components, automotive body and chassis systems, building and construction facades, consumer electronics housings, and heavy equipment assemblies each rely on tailored fabrication services. Application segmentation highlights mass production for component manufacturing, bespoke small-batch runs in custom manufacturing, assembly lines and cutting equipment builds in equipment fabrication, and agile rapid prototyping of functional and visual models. These overlapping dimensions guide strategic investment in specialized equipment, talent, and process optimization to meet diverse customer expectations.

This comprehensive research report categorizes the Sheet Metal Fabrication Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Form

- Thickness

- Service Type

- End-Use Industry

- Application

Exploring Regional Variations and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia Pacific in Sheet Metal Fabrication

Regional dynamics exert a profound influence on sheet metal fabrication operations, reflecting variations in economic maturity, regulatory frameworks, and infrastructure investments. In the Americas, the United States and Canada benefit from extensive service center networks and advanced automation adoption, supporting sectors from automotive assembly to oil and gas. Latin American markets, while smaller in scale, are experiencing modernization drives in construction and energy, creating demand for both commodity sheet metal products and higher-value fabricated components.

Within Europe, the Middle East & Africa region, stringent environmental standards and green manufacturing incentives spur investments in low-carbon processes and recycled metal streams. Established fabrication hubs in Germany, France, and the UK lead in high-precision aerospace components and luxury automotive body panels, while emerging Middle Eastern economies are scaling up industrial diversification efforts, investing in fabrication capacity to support domestic infrastructure and defense programs.

Asia-Pacific showcases some of the fastest growth trajectories, driven by rapid industrialization and burgeoning electronics, automotive, and construction industries. Japan and South Korea remain at the technological forefront, integrating robotics and digital twin methodologies into production, whereas China, India, and Southeast Asian nations are expanding capacity to serve both local demand and export markets. Supply chain diversification efforts across the region also seek to mitigate geopolitical risks, positioning Asia-Pacific as a dynamic center of innovation and volume production in sheet metal fabrication.

This comprehensive research report examines key regions that drive the evolution of the Sheet Metal Fabrication Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Pioneers Shaping the Sheet Metal Fabrication Industry Through Strategic Differentiation

Leading companies in sheet metal fabrication differentiate through scale, technical innovation, and integrated service offerings. Reliance, Inc., formerly known as Reliance Steel & Aluminum Co., is the largest metals service center operator in North America, leveraging over seventy brands to provide broad material portfolios and processing capabilities to more than 125,000 customers across industries. Its extensive network and investments in digital ordering platforms enable rapid response to client needs and supply chain agility.

O’Neal Industries, a privately held entity headquartered in Birmingham, Alabama, operates ninety facilities globally and specializes in carbon, alloy, stainless steel, and aluminum distribution for heavy industries, aerospace, and OEMs. The company’s decentralized structure empowers local management to tailor services while benefiting from shared technology platforms and a legacy of over a century in metals expertise.

Equipment providers such as Messer Cutting Systems drive industry advancement through high-precision laser and plasma cutters, robotic integration, and automation solutions that elevate throughput and quality. RK Industries and other niche fabricators focus on specialized assemblies, erosion control, and infrastructure projects, demonstrating the breadth of services and differentiated capabilities that shape competitive positioning in this sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sheet Metal Fabrication Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Action Fabricating, Inc.

- All Metals Fabricating, Inc.

- ARKU Maschinenbau GmbH

- Astro Metal Craft.

- BTD Manufacturing

- CAMM Metals Inc.

- Chain-Ray Corporation

- Classic Sheet Metal, Inc.

- Decimal Engineering, Inc.

- Deltametal doo

- Estes Design & Manufacturing, Inc.

- H&S Manufacturing Co.

- Harry Burrows Fabrications Ltd.

- Ironform Corporation

- Kakade Laser

- Kapco Metal Stamping

- Marlin Steel Wire Products LLC

- Mayville Engineering Company, Inc.

- Ryerson Holding

Formulating Actionable Strategies for Industry Leaders to Enhance Competitiveness and Resilience in Sheet Metal Fabrication Operations

Manufacturers and service providers must proactively align their strategies with the evolving market and policy environments. Establishing cross-functional trade monitoring teams ensures that leadership stays ahead of tariff developments, allowing rapid adjustments in sourcing, pricing, and inventory policies to mitigate cost disruptions. Implementing dual-sourcing arrangements and strategic inventory buffers for critical alloys can further insulate operations from sudden supply shocks.

Digital investment remains imperative: fabricators should prioritize adoption of AI-enabled quality control, digital twin simulation tools, and integrated IoT platforms to optimize process flows and reduce downtime. These technologies deliver measurable improvements in yield and capacity utilization while supporting continuous improvement programs. Concurrently, strengthening partnerships with equipment suppliers and software providers accelerates technology deployment and fosters competitive advantage.

Sustainability and talent development also warrant focused attention. Incorporating scrap recycling initiatives and energy-management systems into facility upgrades addresses ESG goals and can unlock incentive funding in jurisdictions prioritizing green manufacturing. Equally, upskilling workforces through digital training modules and collaborative robotics programs enhances productivity, safety, and employee retention in an increasingly automated environment.

Outlining Rigorous Research Methodology Underpinning the Analysis of Sheet Metal Fabrication Services and Industry Insights

This analysis combines primary interviews with fabrication executives, plant managers, and trade association experts to capture firsthand perspectives on operational challenges and growth strategies. Complementing these insights, secondary research draws on industry publications, public financial disclosures, and trade press reports from sources such as the Fabricators & Manufacturers Association to validate technology adoption trends and policy impacts.

Data triangulation involved cross-referencing tariff schedules from the U.S. Department of Commerce with market intelligence from commercial software providers and supplier networks to quantify cost shifts and lead time variations. A structured framework aligned segmentation dimensions-material type, form, thickness, service offering, end-use industry, and application-to qualitative feedback, enabling a granular assessment of service center capabilities and regional market nuances.

Rigorous quality controls, including expert peer review and iterative scenario modeling, ensure robustness and relevance. The methodology emphasizes transparency and replicability, enabling stakeholders to adapt frameworks for ongoing market monitoring and strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sheet Metal Fabrication Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sheet Metal Fabrication Services Market, by Material Type

- Sheet Metal Fabrication Services Market, by Form

- Sheet Metal Fabrication Services Market, by Thickness

- Sheet Metal Fabrication Services Market, by Service Type

- Sheet Metal Fabrication Services Market, by End-Use Industry

- Sheet Metal Fabrication Services Market, by Application

- Sheet Metal Fabrication Services Market, by Region

- Sheet Metal Fabrication Services Market, by Group

- Sheet Metal Fabrication Services Market, by Country

- United States Sheet Metal Fabrication Services Market

- China Sheet Metal Fabrication Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3657 ]

Drawing Comprehensive Conclusions on Emerging Trends, Challenges, and Opportunities in the Sheet Metal Fabrication Services Market

The sheet metal fabrication services industry in 2025 is characterized by a convergence of technological innovation, trade policy complexity, and evolving end-use requirements. Digital transformation, led by AI and automation, is unlocking new levels of efficiency and precision, while sustainability imperatives drive investments in energy-saving and recycling initiatives. Simultaneously, U.S. tariff measures continue to influence material pricing and supply chain configurations, underscoring the importance of agility and diversified sourcing strategies.

Segmentation analysis highlights that material specialization-whether in advanced aluminum alloys, high-tensile steels, or niche copper grades-remains a key differentiator, as does the ability to deliver integrated end-to-end services from design engineering to final assembly. Regional insights reveal distinct growth pathways: mature markets are optimizing for value and sustainability, whereas high-growth regions are focused on capacity expansion and technology catch-up.

In this intricate landscape, success will favor those organizations that meld strategic foresight with operational excellence. By embracing data-driven decision-making, fortifying supply networks, and nurturing talent for a digital era, fabricators can capitalize on emerging opportunities and navigate uncertainties with confidence.

Take the Next Step Toward Strategic Advantage by Engaging with Our Detailed Sheet Metal Fabrication Market Research Report Today

We trust this comprehensive analysis provides invaluable insights for enhancing your strategic positioning within the sheet metal fabrication landscape. To delve deeper into the data, trends, and recommendations, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By connecting with Ketan, you’ll gain exclusive access to the full report, tailored client support, and ongoing market updates. Take the next step toward securing a competitive edge in sheet metal fabrication by reaching out today

- How big is the Sheet Metal Fabrication Services Market?

- What is the Sheet Metal Fabrication Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?