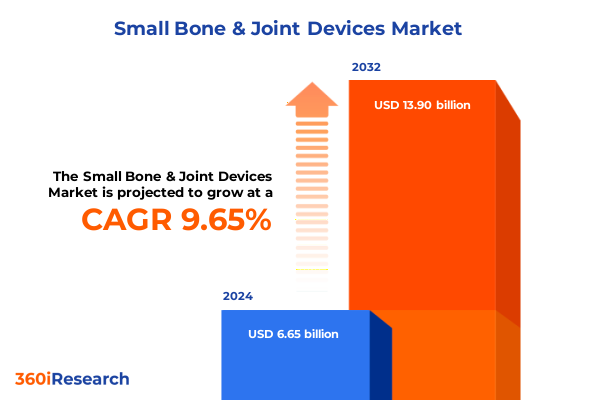

The Small Bone & Joint Devices Market size was estimated at USD 7.22 billion in 2025 and expected to reach USD 7.85 billion in 2026, at a CAGR of 9.79% to reach USD 13.90 billion by 2032.

Unlocking the Future of Small Bone and Joint Medical Devices with Unparalleled Insights into Innovation, Applications, and Market Drivers

Unlocking the future of small bone and joint medical devices requires not only an appreciation of current market dynamics but also a clear vision for the innovations set to redefine treatment paradigms. This executive summary offers a concise yet comprehensive overview of the driving forces behind the industry’s evolution, spanning technological breakthroughs, regulatory shifts, and emergent clinical applications. It lays the groundwork for a deeper examination of the catalysts shaping stakeholder strategies and underscores the value of data-driven decision making in an increasingly complex healthcare landscape.

Through a structured exploration of transformative shifts, regulatory and tariff influences, segmentation nuances, regional variations, and key corporate activities, readers will gain a holistic understanding of the small bone and joint device ecosystem. The subsequent sections are designed to equip executives and thought leaders with actionable insights that facilitate strategic planning, foster innovation, and ultimately support improved patient outcomes. By synthesizing diverse data sources and expert perspectives, this summary charts a roadmap for navigating current challenges and capitalizing on future opportunities.

Revolutionary Trends Redefining Small Bone and Joint Care Landscape through Technological Breakthroughs, Patient-Centric Solutions, and Emerging Therapies

Over the past decade, the landscape for small bone and joint devices has been reshaped by a confluence of revolutionary trends that underscore the industry’s capacity for rapid transformation. Advances in precision instrumentation have not only enhanced surgical accuracy but also accelerated the adoption of minimally invasive techniques, reducing patient recovery times and expanding the applicability of complex reconstructive procedures. Concurrently, the integration of navigation systems and robotic platforms has introduced unprecedented levels of consistency and reproducibility, enabling surgeons to execute intricate procedures with enhanced confidence.

Beyond hardware innovations, the emergence of biologic therapies and next-generation materials has broadened the therapeutic arsenal. Bioactive composites and advanced polymers now complement traditional metals, delivering tailored mechanical properties and promoting accelerated osseointegration. Simultaneously, the emphasis on patient-centric solutions has spurred the development of customizable implants that address unique anatomical and functional requirements. Taken together, these transformative shifts highlight an industry in motion-one that is redefining the boundaries of what small bone and joint care can achieve for clinicians and patients alike.

Assessing the Comprehensive Consequences of Recent United States Tariff Adjustments on Small Bone and Joint Device Supply Chains and Stakeholder Strategies

In 2025, changes to United States tariffs have exerted a pronounced influence on the small bone and joint device supply chain, prompting stakeholders to reassess sourcing strategies and cost structures. Imports of key components, including precision-manufactured screws, plates, and intramedullary nails, experienced elevated duties that reverberated across distribution channels. Manufacturers reliant on offshore production facilities for specialized alloys and instrumentation faced immediate inflationary pressures, accelerating conversations around reshoring and nearshoring to mitigate exposure to future trade policy shifts.

Consequently, device makers and healthcare providers have begun exploring alternative supply networks within domestic and regional markets. Strategically, some industry leaders have renegotiated supplier contracts to secure more favorable terms or to incorporate shared risk clauses. Meanwhile, smaller firms have pursued collaborative models that leverage joint purchasing agreements, seeking to offset tariff-driven cost increases. As the landscape continues to evolve, the ability to adapt procurement frameworks and embrace flexible manufacturing partnerships will prove essential for maintaining operational resilience and safeguarding patient access to critical small bone and joint therapies.

Unveiling Critical Segmentation Insights in the Small Bone and Joint Device Market Spanning Product Types, End Users, Applications and Technologies

A nuanced understanding of market segmentation reveals the diverse pathways through which small bone and joint devices deliver clinical value. Within the category of product types, implants range from interlocking and intramedullary nails that stabilize long-bone fractures to compression, locking, and reconstruction plates that address complex anatomical reconstructions. Likewise, screws-whether cannulated, locking, or nonlocking-serve as versatile anchors in an array of fracture repair and spinal fusion applications, while wires and pins provide provisional fixation in both acute and elective settings.

End users span ambulatory surgical centers, clinics, and hospitals, each of which presents distinct procedural volumes and reimbursement environments. Fracture repair dominates the clinical use case alongside joint reconstruction interventions, spinal fusion operations tailored to degenerative conditions, and sports injury treatments that prioritize rapid recovery. Device types further extend from external fixators employed in staged trauma care to internal fixators engineered for permanent load bearing, as well as prosthetic components designed specifically for hip, knee, and shoulder replacement.

Materials science enriches this landscape through the application of ceramic, composite, metal, and polymer substrates, each selected to optimize biocompatibility, mechanical strength, and imaging compatibility. Technological classifiers-ranging from advanced biologics that stimulate bone regeneration to precision instrumentation, navigation systems, and robotic platforms-underscore the market’s technical sophistication. Finally, procedural distinctions between minimally invasive and open surgeries shape product design and perioperative planning, reinforcing the imperative for device innovation aligned with evolving clinical protocols.

This comprehensive research report categorizes the Small Bone & Joint Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Device Type

- Material

- Technology

- Procedure Type

- End User

- Application

Understanding Regional Dynamics Shaping Small Bone and Joint Device Adoption Across Americas, Europe Middle East Africa and Asia Pacific Markets

Geographic dynamics play a pivotal role in driving the adoption and evolution of small bone and joint devices. In the Americas, robust healthcare infrastructure and favorable reimbursement policies in the United States and Canada have fostered early uptake of robotic systems and advanced fixation solutions. In parallel, Latin American markets exhibit rising demand for cost-effective implants, prompting manufacturers to tailor offerings that balance performance with economic considerations.

The Europe, Middle East & Africa region reflects a heterogeneous landscape. Strong regulatory frameworks in Western Europe streamline approval pathways, encouraging innovation in navigation-guided and minimally invasive technologies, whereas emerging markets in Eastern Europe and parts of the Middle East are increasingly prioritizing investments in orthopedic capacity expansion. Across Africa, access challenges persist, but donor-supported programs and public-private partnerships are catalyzing the introduction of essential fracture repair and joint replacement devices.

Asia-Pacific stands out for its rapid market growth, particularly in China, Japan, India, and Southeast Asian nations. High procedural volumes, expanding hospital networks, and government initiatives to modernize orthopedic care have propelled adoption of next-generation materials and biologics. Additionally, local manufacturing clusters are maturing, offering competitive alternatives to imports and reshaping regional supply dynamics.

This comprehensive research report examines key regions that drive the evolution of the Small Bone & Joint Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Driving Innovation and Competitiveness in the Small Bone and Joint Device Sector Through Strategic Collaborations

Leading corporations have been instrumental in advancing both incremental and disruptive innovations within the small bone and joint domain. Strategic partnerships between established medical technology firms and specialized robotics or software developers have accelerated product pipelines, integrating artificial intelligence-driven planning tools with precision delivery platforms. At the same time, targeted acquisitions of niche biomaterials enterprises have bolstered portfolios, enabling faster time to market for composite and bioactive implants tailored to specific clinical indications.

Competitive differentiation has also emerged through collaborative research initiatives with academic medical centers and healthcare systems. These alliances facilitate real-world validation of novel device designs and procedural workflows, fostering data-rich evidence that underpins regulatory submissions and payer negotiations. Furthermore, a number of key players have embraced digital health solutions-from remote surgical assistance platforms to cloud-based analytics-that extend the value proposition beyond the operating room and into long-term postoperative care. This convergence of hardware, software, and biologic expertise underscores the strategic imperative for companies to cultivate multidisciplinary ecosystems that anticipate clinician needs and patient expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Small Bone & Joint Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acumed, LLC

- Arthrex, Inc.

- Auxein Medical Pvt. Ltd.

- BioPro, Inc.

- Catalyst OrthoScience Inc.

- CONMED Corporation

- Enovis

- Exactech, Inc.

- Flower Orthopedics Corporation

- Globus Medical, Inc.

- Hanger Clinic

- Integra Lifesciences Holdings Corporation

- Johnson & Johnson Services, Inc.

- Nextremity Solutions, Inc.

- Novastep Inc.

- Orthofix Medical Inc.

- Paragon 28, Inc.

- Shoulder Innovations

- Smith & Nephew PLC

- Stryker Corporation

- Tecomet Inc.

- TriMed Inc.

- Zimmer Biomet Holdings, Inc.

- Össur hf

Actionable Strategies for Industry Leaders to Enhance Market Position and Drive Sustainable Growth in Small Bone and Joint Medical Devices

Industry leaders aiming to secure sustainable growth must prioritize supply chain flexibility and cost optimization. Establishing dual sourcing arrangements for critical materials and components can mitigate risk associated with tariff fluctuations and geopolitical pressures. Moreover, investing in regional manufacturing partnerships enhances responsiveness to local market demands while controlling production costs. Simultaneously, organizations should deepen engagement with regulatory bodies to streamline approval pathways for advanced technologies, particularly in navigation systems and biologics.

Additionally, embracing digital integration initiatives-such as remote monitoring solutions and predictive analytics for surgical planning-can unlock new revenue streams and reinforce provider relationships. By aligning commercial strategies with value-based care models, companies can demonstrate the clinical and economic benefits of minimally invasive robotics and patient-specific implants. Finally, cultivating training programs and Centers of Excellence ensures that surgeons and clinical teams are proficient in emerging techniques, promoting device adoption and reinforcing long-term partnerships across healthcare networks.

Comprehensive Research Methodology Employed to Deliver Rigorous Analysis and Authoritative Insights into Small Bone and Joint Device Developments

This research leveraged a rigorous mixed-methodology approach to deliver comprehensive insights. Primary data collection encompassed in-depth interviews with orthopedic surgeons, procurement managers, and clinical specialists across diverse healthcare settings. These firsthand perspectives informed the identification of critical trends in procedural preferences, clinical outcomes, and technology adoption curves.

Secondary research drew upon peer-reviewed journals, regulatory filings, and industry white papers to contextualize market drivers and competitive strategies. Company disclosures and patent databases were systematically analyzed to track innovation pipelines and strategic partnerships. Data triangulation and cross-validation processes ensured the accuracy of thematic findings, while quality assurance protocols, including peer reviews and editorial oversight, reinforced the credibility of conclusions. This layered methodology supports a robust foundation for strategic decision making and future research initiatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Small Bone & Joint Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Small Bone & Joint Devices Market, by Product Type

- Small Bone & Joint Devices Market, by Device Type

- Small Bone & Joint Devices Market, by Material

- Small Bone & Joint Devices Market, by Technology

- Small Bone & Joint Devices Market, by Procedure Type

- Small Bone & Joint Devices Market, by End User

- Small Bone & Joint Devices Market, by Application

- Small Bone & Joint Devices Market, by Region

- Small Bone & Joint Devices Market, by Group

- Small Bone & Joint Devices Market, by Country

- United States Small Bone & Joint Devices Market

- China Small Bone & Joint Devices Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Summarizing Critical Findings and Strategic Imperatives to Guide Stakeholders in the Small Bone and Joint Device Industry Toward Future Success

The convergence of precision instrumentation, biologics, and digital health is setting the stage for a new era in small bone and joint device therapies. As the landscape continues to evolve under the influence of tariff adjustments and shifting trade policies, stakeholders must remain agile in their procurement and manufacturing strategies. Segmentation analysis highlights the critical role of diverse product types, end-user settings, and clinical applications, underscoring the importance of targeted innovation and market alignment.

Regional insights reveal both established and emerging markets with unique regulatory, economic, and infrastructure characteristics. Meanwhile, leading companies are forging partnerships and acquiring specialized capabilities to sustain competitive advantage. The actionable recommendations provided herein offer a clear roadmap for operational resilience, regulatory engagement, and technology integration. Collectively, these findings equip executives with the strategic imperatives needed to navigate complexities, capitalize on growth opportunities, and ultimately deliver enhanced patient care in the small bone and joint domain.

Engage with Associate Director Ketan Rohom to Secure In-Depth Market Intelligence and Propel Strategic Decision-Making in Small Bone & Joint Devices

For professionals seeking deeper understanding and competitive edge in small bone and joint devices, engaging directly with Ketan Rohom will bridge the gap between high-level insights and strategic implementation. As Associate Director, Sales & Marketing, he offers tailored guidance to navigate the complexities of supply chain resilience, technology adoption, and regulatory alignment. By collaborating on a customized briefing or presentation, stakeholders can pinpoint opportunities unique to their portfolios and operational footprints and optimize their investment in emerging modalities such as minimally invasive robotics and advanced biomaterials.

Reach out to explore how an in-depth market research report can serve as a catalyst for informed decision making and sustainable growth. Ketan will facilitate seamless access to comprehensive analyses, executive summaries, and detailed insights that align with your priorities. Secure clarity on the transformative trends, tariff impacts, and regional dynamics shaping small bone and joint medical devices, and empower your organization to lead in a competitive environment.

- How big is the Small Bone & Joint Devices Market?

- What is the Small Bone & Joint Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?