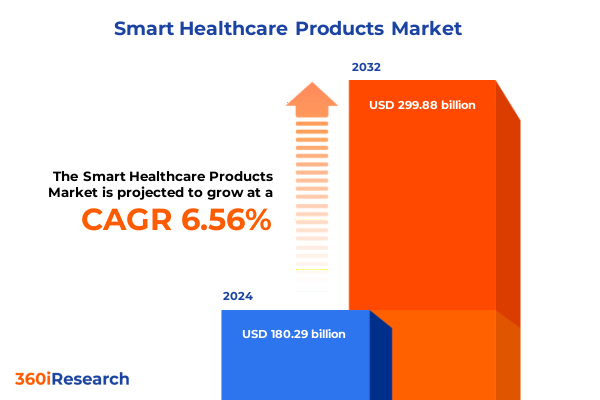

The Smart Healthcare Products Market size was estimated at USD 190.37 billion in 2025 and expected to reach USD 201.01 billion in 2026, at a CAGR of 6.70% to reach USD 299.88 billion by 2032.

Emerging smart healthcare products are reshaping diagnostics and patient care through cutting-edge integrated technologies and advanced analytics

The landscape of healthcare delivery is undergoing a profound transformation driven by the urgent need to improve patient outcomes, manage rising costs, and address the challenges of aging populations and chronic disease burdens. Against this backdrop, smart healthcare products-ranging from advanced diagnostic imaging systems to connected therapeutic devices and wearable sensors-have emerged as critical enablers of proactive and personalized care. These solutions harness the power of data, connectivity, and automation to shift the paradigm from reactive interventions to predictive and preventive health management. As hospitals, clinics, and home care providers embrace digital integration, the market for smart medical technologies has become both highly dynamic and intensely competitive.

In response to evolving clinical needs, regulatory shifts, and technological breakthroughs, manufacturers are developing a new generation of devices that seamlessly integrate artificial intelligence, the Internet of Things, and advanced analytics. This evolution is underpinned by a broader healthcare ecosystem that prioritizes value-based care, real-time monitoring, and remote engagement. Stakeholders across the value chain-including device makers, software developers, payers, and care providers-are now collaborating to unlock the full potential of connected health solutions. This report delves into the key drivers, challenges, and strategic imperatives defining the smart healthcare products market, offering a comprehensive view of how innovation is reshaping the delivery of care across diverse settings.

Quantum leaps in digital health AI machine learning and connected care technologies are driving a paradigm shift in patient monitoring and treatment

The smart healthcare products market has been propelled by a convergence of technological breakthroughs and shifting care delivery models. Artificial intelligence and machine learning algorithms have moved from proof-of-concept to widespread clinical adoption, powering diagnostic imaging enhancements and real-time decision support. Big data analytics and cloud computing have unlocked new dimensions of population health insights, enabling providers to stratify risk, tailor interventions, and monitor outcomes across dispersed patient cohorts. Concurrently, the expansion of high-bandwidth networks and edge computing has facilitated the deployment of connected devices in inpatient, outpatient, and home environments, bridging gaps between clinical encounters.

Moreover, the COVID-19 pandemic served as a catalyst for accelerated deployment of telehealth platforms and remote monitoring solutions, highlighting the importance of resilient and scalable digital infrastructures. Regulatory agencies have responded by streamlining approval pathways for digital therapeutics and software as a medical device, further lowering barriers to market entry. As a result, the ecosystem has shifted from siloed devices to interoperable platforms, enabling seamless data exchange among diagnostic systems, therapeutic equipment, and patient-centric wearables. These transformative shifts are redefining how care is accessed, delivered, and evaluated, establishing a new foundation for value-based and outcomes-driven healthcare models.

Evaluating the cumulative impact of United States tariffs on smart healthcare product supply chains innovation costs and global access dynamics

Since January 1, 2025, the United States Trade Representative has enacted new Section 301 tariffs targeting a wide range of Class I and II medical devices and components, including syringes, needles, medical gloves, surgical masks, imaging equipment, and electronic health monitoring devices. These tariffs, which raised import duties on products such as disposable textile facemasks from 7.5 percent to 25 percent and on rubber medical gloves to 50 percent, have significantly altered the cost structure for global medtech supply chains. As many of these devices rely on intricate global manufacturing networks, immediate cost pressures and supply chain complexities have emerged for providers and manufacturers alike.

Major industry players have reported tangible financial impacts from these tariff measures. Philips has revised its 2025 profit margin guidance downward, citing an estimated net tariff burden between €250 million and €300 million, despite mitigation efforts such as production localization and pricing adjustments. Similarly, GE HealthCare anticipates tariff-related losses approaching $500 million, reflecting the elevated costs of imported imaging components and therapeutic devices. Zimmer Biomet, which sources a significant portion of its orthopedic instruments from China, projects a reduction in 2025 profits by $60 million to $80 million due to these duties.

These cumulative tariff impacts have prompted companies and healthcare providers to delay capital-intensive procurements and reassess vendor agreements. Hospitals have reported budgetary uncertainties and extended equipment replacement cycles, while manufacturers are accelerating supply chain diversification strategies, including nearshoring and development of alternative component sources to mitigate ongoing tariff risks. Although the primary policy goal is to bolster domestic manufacturing capabilities, the near-term effect has been higher device costs, potential delays in technology upgrades, and heightened complexity in regulatory compliance for cross-border trade.

Looking ahead, these tariff pressures will likely persist through 2025 and into 2026 as phased increases take effect on respirators, face masks, and battery-related products integral to smart healthcare solutions. Device makers are expected to continue investing in regional manufacturing hubs and buffer inventory strategies, balancing the imperative of cost containment against the need to maintain innovation momentum and patient access to advanced technologies.

Uncovering key segmentation insights across product types technologies distribution channels end users and applications shaping the smart healthcare market

The smart healthcare products market can be dissected through multiple segmentation lenses that reveal distinct growth levers and strategic priorities. When viewed by product type, diagnostic devices comprise advanced imaging systems such as MRI and ultrasound, complex laboratory diagnostics platforms, and point-of-care diagnostic tools. Complementing these are smart equipment offerings, including digitally connected beds and automated medication dispensers, which enhance operational workflows. Therapeutic devices further diversify the landscape with infusion pumps, insulin delivery pens, and neurostimulators that deliver precision therapies. Lastly, wearable devices extend care beyond traditional settings, enabling continuous patient monitoring and data collection in real time.

Equally pivotal are the underlying technologies that power this market. Artificial intelligence and machine learning algorithms drive automated image analysis, predictive analytics, and clinical decision support. Big data analytics platforms aggregate and interpret vast patient datasets to identify population health trends and optimize resource allocation. Cloud computing infrastructure ensures scalable, secure data storage and facilitates collaborative research and remote diagnostics. The Internet of Things interconnects devices across the care continuum, enabling seamless communication between sensors, gateways, and analytics engines.

Distribution channels play a critical role in market accessibility, with traditional offline channels comprising direct hospital and clinic sales augmented by medical distributors, while online sales channels offer streamlined ordering, digital demonstrations, and virtual support services. End-user segmentation highlights clinics that deploy compact diagnostic tools, home care environments that integrate remote monitoring solutions, hospitals that invest in full-scale imaging suites and connected operating theatres, and research institutes that adopt cutting-edge platforms for translational studies. Finally, the application landscape spans disease management workflows, fitness and wellness tracking systems, continuous patient monitoring solutions, and remote imaging services that leverage telehealth networks. This multifaceted segmentation framework underscores the interdependencies among product innovation, technology adoption, distribution strategies, end-user requirements, and clinical use cases.

This comprehensive research report categorizes the Smart Healthcare Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Distribution Channel

- End User

- Application

Analyzing regional dynamics across the Americas Europe Middle East and Africa and Asia Pacific driving varied adoption patterns of smart healthcare innovations

Regional dynamics within the smart healthcare products market reflect divergent regulatory environments, infrastructure maturity levels, and healthcare funding models. In the Americas, North American markets are characterized by high reimbursement rates for advanced diagnostics and established telehealth frameworks, fueling investment in integrated imaging systems and AI-enabled monitoring platforms. Latin American countries, while facing budget constraints, are beginning to pilot remote patient monitoring programs to extend specialty care to underserved areas, catalyzing adoption of low-cost wearable sensors and point-of-care diagnostics.

Europe, the Middle East, and Africa (EMEA) present a complex tapestry of market conditions. Western Europe benefits from unified regulatory standards under the EU’s Medical Device Regulation, which has accelerated digital health approvals and cross-border device utilization. In the Middle East, national healthcare visions and sovereign wealth fund investments are driving procurement of next-generation imaging and smart therapeutic solutions. African markets exhibit nascent digital health ecosystems, but targeted donor-funded initiatives are expanding mobile diagnostics and telemedicine services in rural communities.

The Asia-Pacific region is marked by rapid growth fueled by government incentives, robust mobile network penetration, and rising private healthcare expenditures. China’s domestic champions are scaling production of affordable IoT-connected devices, while Japan and South Korea focus on precision imaging technologies and robotics-enabled care solutions. Southeast Asian nations are increasingly partnering with global vendors to localize manufacturing and distribution, ensuring that wearable health monitors and remote imaging kits become accessible across both urban centers and remote islands.

This comprehensive research report examines key regions that drive the evolution of the Smart Healthcare Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic movements and competitive dynamics of leading smart healthcare product companies shaping the global market landscape

Key industry participants are engaging in strategic maneuvers to capitalize on the converging forces of digital transformation, value-based care, and evolving trade policies. GE HealthCare has intensified its focus on AI-driven imaging and monitoring platforms, forging partnerships with cloud providers to deliver scalable analytics solutions directly to health systems. This has enabled seamless integration of point-of-care ultrasound and critical care monitoring across diverse clinical workflows.

Philips has responded to tariff pressures by accelerating localization of manufacturing in the United States and expanding capacity in China to mitigate duty costs and shorten supply chains. The company’s dual strategy of cost containment and product innovation ensures continuity in the delivery of advanced diagnostic imaging equipment and patient monitoring devices. Meanwhile, Siemens Healthineers is advancing its photon-counting CT technology, touting enhanced imaging clarity and reduced radiation exposure, while navigating global tariff headwinds through advocacy for medical exemptions and tariff deferral programs.

Competitors such as Medtronic and Abbott are leveraging complementary portfolios to extend their market reach. Medtronic has integrated neurostimulation and infusion pump technologies into remote monitoring platforms, offering clinicians unified dashboards for managing chronic conditions. Abbott is expanding its wearable glucose monitoring systems and integrating them with mobile health applications to provide real-time feedback for diabetic care. Collectively, these companies illustrate a strategic balance between localized manufacturing adaptations, rapid product innovation, and partnerships that fortify distribution networks across key markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Healthcare Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abbott Laboratories

- AirStrip Technologies, Inc.

- Apple Inc.

- AT&T Inc.

- Becton, Dickinson and Company

- Boston Scientific Corporation

- CapsoVision, Inc.

- Cisco Systems Inc.

- eClinicalWorks

- Epic Systems Corporation

- General Electric Company

- Honeywell International Inc.

- International Business Machines Corporation

- Johnson & Johnson

- Koninklijke Philips N.V.

- Logi-Tag Systems Ltd.

- Medtronic plc

- Omron Healthcare Co., Ltd.

- ResMed Inc.

- Siemens Healthineers AG

Providing actionable recommendations for industry leaders to navigate technological integration supply chain resilience and complex regulatory landscapes

To thrive amid technological convergence and geopolitical uncertainties, industry leaders must adopt a multifaceted strategy that emphasizes agility, collaboration, and regulatory foresight. First, diversifying supply chains by establishing regional manufacturing hubs and cultivating alternative component suppliers can mitigate the risks of tariff fluctuations and logistical disruptions. Such an approach not only enhances resilience but also accelerates delivery timelines and fosters closer collaboration with local stakeholders.

Second, investing in interoperable platforms and open application programming interfaces will enable seamless integration of smart devices with electronic health record systems and telehealth networks. By prioritizing data security and privacy through robust encryption and compliance with global standards, organizations can build trust with providers and patients, driving broader adoption of connected care solutions.

Third, engaging proactively with regulatory agencies to shape emerging digital health policies and secure timely approvals can create competitive differentiation. This involves participating in policy forums, contributing to standards development, and leveraging early access programs to pilot innovative technologies. Finally, cultivating strategic partnerships with cloud providers, analytics firms, and clinical research organizations will unlock new value streams, from real-time remote monitoring to predictive maintenance of medical equipment. Through these targeted actions, companies can position themselves at the forefront of the smart healthcare evolution.

Detailing the comprehensive research methodology employed to derive insights and validate findings for the smart healthcare products market analysis

The insights presented in this report are grounded in a rigorous research methodology that combines both primary and secondary research streams. Primary research includes in-depth interviews with C-suite executives, clinical stakeholders, and regulatory experts across key markets, providing firsthand perspectives on adoption drivers, innovation priorities, and policy impacts. Supplementing these qualitative insights, an extensive survey of healthcare providers was conducted to quantify usage patterns and unmet needs for smart diagnostics and therapeutic devices.

Secondary research encompassed the review of company filings, regulatory databases, industry white papers, and trade association publications to map market developments and technology roadmaps. Additional analysis of tariff schedules, import-export data, and regional reimbursement policies provided a comprehensive view of financial and operational drivers shaping market dynamics. Data triangulation techniques were employed to validate findings, reconcile discrepancies, and ensure the robustness of segmentation models.

Finally, advanced analytics tools were utilized to synthesize large volumes of quantitative and qualitative data, generating actionable visualizations and enabling scenario planning. This methodological framework ensured that the report delivers both strategic depth and practical relevance, equipping stakeholders with a reliable evidence base for decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Healthcare Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Healthcare Products Market, by Product Type

- Smart Healthcare Products Market, by Technology

- Smart Healthcare Products Market, by Distribution Channel

- Smart Healthcare Products Market, by End User

- Smart Healthcare Products Market, by Application

- Smart Healthcare Products Market, by Region

- Smart Healthcare Products Market, by Group

- Smart Healthcare Products Market, by Country

- United States Smart Healthcare Products Market

- China Smart Healthcare Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding insights that synthesize key findings underscore strategic imperatives and emphasize the evolution trajectory of smart healthcare solutions

Throughout this report, we have examined the key forces transforming the smart healthcare products market-from the rise of AI-powered diagnostics and interconnected therapeutic platforms to the emerging challenges of trade policy shifts and regional adoption disparities. Segmentation analysis has illuminated the nuanced pathways through which product types, underlying technologies, distribution channels, end-user contexts, and clinical applications intersect to drive innovation and market expansion.

Moreover, the cumulative impact of United States tariff measures in 2025 has underscored the critical importance of supply chain resilience and strategic localization for major device manufacturers. As global leaders adjust production footprints, optimize pricing strategies, and engage with policymakers, the agility to navigate evolving regulatory landscapes will remain a defining factor in sustaining competitive advantage and ensuring patient access to lifesaving technologies.

Looking forward, industry stakeholders who embrace an open, collaborative approach-grounded in interoperable platforms, data-driven insights, and proactive regulatory engagement-will be best positioned to shape the next chapter of digital health. By leveraging the strategic recommendations and regional insights outlined herein, organizations can chart a course toward a more connected, efficient, and patient-centric healthcare ecosystem.

Inviting stakeholders to connect with Ketan Rohom Associate Director Sales & Marketing at 360iResearch to purchase the smart healthcare products report

To gain a deeper understanding of how these strategic shifts, tariff dynamics, and technological advancements are reshaping the smart healthcare products market, decision makers are encouraged to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging with Ketan will provide customized guidance on how to leverage these insights within your organization’s unique context. By purchasing the comprehensive smart healthcare products report, stakeholders will receive a detailed blueprint for navigating emerging opportunities and overcoming market challenges with a data-driven approach.

- How big is the Smart Healthcare Products Market?

- What is the Smart Healthcare Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?