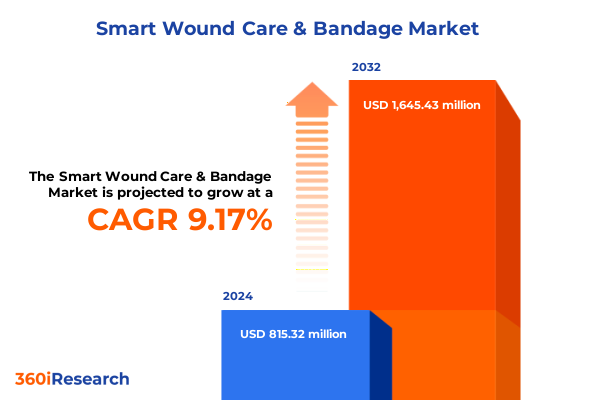

The Smart Wound Care & Bandage Market size was estimated at USD 887.54 million in 2025 and expected to reach USD 966.81 million in 2026, at a CAGR of 9.21% to reach USD 1,645.43 million by 2032.

Empowering Modern Healthcare with Cutting-Edge Smart Wound Care Technologies to Elevate Patient Healing and Clinical Efficiencies

In recent years, the healthcare sector has witnessed an unprecedented drive toward integrating intelligence into wound management, driven by escalating incidences of chronic conditions and the demand for more efficient care protocols. Smart wound care and advanced bandage technologies have emerged as pivotal innovations, redefining the way clinicians and patients approach healing. By embedding biosensors, responsive materials, and targeted drug delivery systems within traditional dressing formats, these solutions offer real-time monitoring and adaptive therapeutic responses that conventional dressings cannot match.

Moreover, the convergence of digital health platforms with embedded sensors has enabled clinicians to track wound parameters remotely, facilitating timely interventions and personalized treatment regimens. As a result, patient outcomes have improved through reduced healing times, minimized infection risks, and enhanced comfort. Regulatory bodies have responded by streamlining approval pathways for integrated medical devices, thereby accelerating market entry for novel smart dressings. Alongside technological advancements, strategic partnerships between material scientists, medical device manufacturers, and software developers have created a vibrant ecosystem poised for growth.

Consequently, stakeholders across hospitals, home healthcare settings, and specialized clinics are increasingly adopting these technologies to drive clinical efficiencies and improve patient satisfaction. This introduction sets the stage for exploring the transformative shifts, regulatory influences, segmentation dynamics, and regional variations that collectively shape the smart wound care and bandage market.

Revolutionary Dynamics Reshaping the Smart Wound Care Landscape through Integration of Digital Monitoring Biosensors and Advanced Therapeutic Systems

The smart wound care landscape is undergoing revolutionary change as traditional approaches yield to data-driven, responsive therapies. Digitalization has emerged as a cornerstone of this evolution, with connected bandages transmitting continuous wound metrics to cloud platforms. This real-time visibility allows clinicians to make swift, evidence-based adjustments that were once confined to periodic in-clinic assessments. Furthermore, advances in biosensing technologies-ranging from oxygen-permeable films to pH-sensitive hydrogels-have unlocked deeper insights into wound microenvironments, enabling targeted therapy and early detection of complications.

Meanwhile, negative pressure wound therapy (NPWT) systems have transitioned from bulky, stationary units to sleek, portable devices that empower patients to maintain mobility without sacrificing treatment efficacy. This shift reflects broader trends in portable healthcare, where convenience and continuous therapy intersect. In tandem, stimuli-responsive dressings leverage electroactive polymers, photoresponsive compounds, and thermoresponsive matrices to release therapeutics on demand, responding to changes in wound conditions.

Artificial intelligence is also beginning to influence smart wound care by predicting healing trajectories and recommending optimized dressing change intervals. Together, these transformative shifts emphasize an industry-wide pivot from passive protection to proactive healing. As a result, healthcare providers are realigning their procurement strategies, and research initiatives are prioritizing multifunctional materials that can seamlessly integrate monitoring, therapy, and patient comfort.

Evaluating the Comprehensive Ripple Effects of United States 2025 Tariff Measures on Smart Wound Care Product Supply Chains Innovations and Pricing

The introduction of new tariff measures by the United States in 2025 has added complexity to the supply chain dynamics of smart wound care technologies. These levies, targeting a range of imported medical polymers, advanced foams, and electronic sensor components, have exerted upward pressure on manufacturing costs. As importers grapple with these additional expenses, many have begun seeking alternative material sources, driving a realignment of global procurement strategies.

In response, manufacturers have expedited the development of domestic production capabilities for critical inputs. While this shift holds promise for long-term supply security, it has introduced short-term challenges in scaling specialized facilities and securing technical expertise. Concurrently, prolonged lead times have prompted companies to expand inventory buffers, heightening working capital requirements. As a result, some smaller innovators have faced delays in product launches, potentially slowing the adoption curve of next-generation smart dressings.

Despite these headwinds, the tariff environment has incentivized strategic collaborations between raw material suppliers and device manufacturers to co-develop cost-optimized formulations. Additionally, government incentives aimed at bolstering domestic manufacturing have partially offset the added duties, enabling key players to maintain competitive pricing. Collectively, these developments illustrate the complex, cumulative impact of 2025 level tariffs on the economics of smart wound care product innovation and distribution.

Unveiling Critical Market Segmentation Insights Highlighting Product Types Technologies Wound Categories Distribution Channels and End User Dynamics

A nuanced understanding of market segmentation reveals critical trends across product types, technologies, wound classifications, distribution channels, and end users. Within the advanced dressing category, alginate and hydrogel formats are gaining traction due to their inherent moisture-regulating properties and compatibility with embedded biosensors. Film and gauze variants continue to serve as versatile platforms for oxygen and temperature sensing, while hydrocolloid options balance patient comfort with barrier protection. Foam dressings, particularly those paired with integrated drug delivery reservoirs, are emerging as preferred solutions for exuding wounds.

Negative pressure wound therapy systems present two distinct paths: portable units that cater to outpatient and home healthcare settings, and stationary systems that dominate acute care environments due to their robust performance metrics. At the same time, traditional dressings composed of cotton gauze and non-woven fabrics remain essential for low-acuity cases, providing cost-effective baseline coverage without sensing capabilities.

From a technology perspective, biosensing segments-encompassing oxygen, pH, and temperature sensors-continue to expand, guiding therapy decisions in both acute and chronic wound types. Drug delivery mechanisms, whether hydrogel-based matrices or microneedle arrays, are refining local release profiles. Stimuli-responsive dressings leverage advances in electroactive, photoresponsive, and thermoresponsive materials to initiate therapeutic actions upon detecting specific physiological triggers.

Acute wounds such as burns and surgical incisions benefit from rapid-deployment smart dressings that accelerate initial tissue regeneration. Chronic wounds, including diabetic foot and pressure ulcers, require prolonged monitoring facilitated by smart materials to prevent escalating complications. Distribution channels reflect evolving buyer preferences, with hospitals and clinics remaining primary outlets while home healthcare providers and retail pharmacies broaden patient access. Online channels are increasingly influential for direct-to-patient offerings. Ultimately, end users-from care facilities to individual patients-drive adoption through demand for convenience, efficacy, and data visibility.

This comprehensive research report categorizes the Smart Wound Care & Bandage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Wound Type

- Technology Modality

- End User

Dissecting Regional Market Dynamics across the Americas Europe Middle East Africa and Asia-Pacific to Illuminate Growth Opportunities and Challenges

Regional distinctions play a pivotal role in shaping smart wound care adoption patterns and growth trajectories. In the Americas, robust reimbursement frameworks in the United States and Canada fuel investment in connected wound management platforms. Regulatory clarity around software-as-a-medical-device has further streamlined approvals, encouraging innovators to launch next-generation dressings that incorporate real-time data feedback.

Europe’s market is characterized by strong academic-industry collaboration, with key hubs in Germany, the United Kingdom, and the Nordic region driving materials science breakthroughs. CE marking requirements harmonize product standards across member states, enhancing cross-border commercialization. In Middle East and Africa, constrained healthcare infrastructure and uneven reimbursement policies have slowed uptake, although targeted government initiatives in the Gulf Cooperation Council are beginning to catalyze market development.

Asia-Pacific demonstrates a dual-speed landscape, where advanced economies such as Japan and Australia adopt smart dressings rapidly, leveraging government subsidies for digital health. Meanwhile, emerging markets in China and India are witnessing accelerated growth in home healthcare networks, creating fertile ground for portable negative pressure systems and over-the-counter smart bandages. Taken together, these regional insights underscore the importance of tailoring market entry strategies, pricing models, and product portfolios to local regulatory, economic, and clinical contexts.

This comprehensive research report examines key regions that drive the evolution of the Smart Wound Care & Bandage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Pioneering Industry Players Strategic Initiatives Product Innovations and Collaborative Efforts Driving Advancement in Smart Wound Care Market

Leading healthcare companies are actively shaping the smart wound care arena through targeted investments and strategic partnerships. A major diversified technology firm has committed to enhancing its hydrocolloid and foam dressing portfolio by integrating proprietary oxygen-sensing films. A global medical devices specialist has expanded its portfolio of portable negative pressure therapy systems, combining them with cloud-based monitoring platforms to optimize outpatient care.

Another key player, renowned for its antimicrobial and advanced drug delivery dressings, has formed alliances with materials startups to co-develop stimuli-responsive hydrogel systems. A Sweden-based healthcare company is advancing its line of thermoresponsive and photoresponsive dressings, emphasizing on-demand therapeutic activation. Meanwhile, a European medical device group has introduced an AI-driven wound assessment tool that pairs with wearable sensors, enabling predictive analytics and personalized treatment planning.

Collectively, these industry leaders are deploying a multifaceted approach: they are acquiring niche technology firms, forging joint ventures with biotechnologists, and reinforcing their clinical trial networks to validate product efficacy. Such moves not only broaden their technological capabilities but also cement their positions in core regional markets. These initiatives highlight the competitive intensity of the sector, where innovation speed and strategic collaboration determine market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Wound Care & Bandage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Accel-Heal Technologies Limited

- Atmos MedizinTechnik GmbH & Co. KG

- Cardinal Health, Inc.

- Carilex Medical Group

- Coloplast A/S

- ConvaTec Group PLC

- Grapheal

- Harro Höfliger Verpackungsmaschinen GmbH

- Hudson Medical Innovations

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- KOB GmbH

- Medela AG

- Medline Industries, Inc.

- MIMEDX Group, Inc.

- Mölnlycke Health Care AB

- Natrox Wound Care by Inotec AMD, Ltd.

- Organogenesis Inc.

- Pensar Medical, LLC

- Piomic Medical AG

- Redsense Medical AB

- SmartTRAK

- Smith & Nephew PLC

- Talley Group Ltd.

- Xsensio

Formulating Actionable Strategies for Industry Leaders to Harness Emerging Technologies Optimize Operations and Elevate Patient Care in Wound Management

To excel in the rapidly evolving smart wound care market, leaders must embrace a series of actionable strategies. First, investing in research and development of multifunctional biomaterials will create platforms capable of simultaneous sensing, therapy, and patient comfort enhancement. Second, diversifying supply chains through nearshoring critical component manufacturing can mitigate exposure to international tariff pressures and shorten lead times.

Furthermore, engaging in strategic collaborations with technology firms specializing in AI, materials science, and data security will accelerate product integration and interoperability. By co-developing proof-of-concept studies with leading clinical institutions, companies can generate robust clinical evidence to support reimbursement and regulatory approval. In addition, prioritizing the design of user-friendly interfaces and telehealth compatibility will enhance patient adherence and broaden market reach.

Finally, exploring emerging markets with tailored go-to-market models-such as subscription-based services and outcome-based contracting-can unlock new revenue streams. Committing to sustainable manufacturing practices and materials recyclability will not only appeal to environmentally conscious stakeholders but also reduce long-term operational costs. By implementing these strategies in concert, organizations can achieve sustainable growth, foster stronger stakeholder relationships, and ultimately improve patient outcomes.

Detailing Robust Research Methodologies Encompassing Data Collection Analytical Techniques Validation Processes and Segmentation Frameworks for Outcomes

This study employed a robust, multilayered research methodology to ensure the rigor and reliability of insights. Initially, an extensive desk research phase was conducted, encompassing peer-reviewed journals, patent databases, regulatory filings, and trade publications to establish a comprehensive technology baseline. During this phase, key material innovations, sensor architectures, and therapeutic mechanisms were cataloged to inform subsequent analysis.

Concurrently, primary research was undertaken through in-depth interviews with wound care specialists, biomedical engineers, regulatory experts, and procurement leaders from varied regions. Structured surveys among end users, including clinicians and patients, provided quantitative validation of adoption drivers and barriers. Expert panel workshops were convened to assess emerging trends and refine scenario projections.

Quantitative data were subjected to statistical analysis, segmentation validation, and sensitivity testing to ascertain the robustness of identified patterns. Findings were cross-verified through triangulation with field insights and secondary data sources. Finally, segmentation frameworks were meticulously mapped against market realities, ensuring alignment with evolving regulatory landscapes and healthcare delivery models. This comprehensive approach underpins the confidence stakeholders can place in the study’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Wound Care & Bandage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Wound Care & Bandage Market, by Product Type

- Smart Wound Care & Bandage Market, by Wound Type

- Smart Wound Care & Bandage Market, by Technology Modality

- Smart Wound Care & Bandage Market, by End User

- Smart Wound Care & Bandage Market, by Region

- Smart Wound Care & Bandage Market, by Group

- Smart Wound Care & Bandage Market, by Country

- United States Smart Wound Care & Bandage Market

- China Smart Wound Care & Bandage Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Concluding Perspectives on the Fusion of Advanced Smart Wound Care Innovations Market Trajectories and Strategic Imperatives for Sustained Healthcare Impact

Smart wound care stands at the intersection of advanced materials, digital technologies, and patient-centered clinical practice. The convergence of biosensing, drug delivery, and stimuli-responsive mechanisms has elevated wound management from passive dressing changes to proactive, data-driven care. Despite headwinds such as tariff-induced cost pressures and regional infrastructure disparities, the market exhibits strong momentum, propelled by favorable reimbursement policies and growing demand for remote monitoring solutions.

Strategic segmentation analysis has illuminated the diverse needs of acute and chronic wound types, guiding the development of tailored product portfolios. Regional insights further demonstrate that success hinges on adapting to local regulatory requirements and care delivery models. Industry leaders are responding with targeted innovations, collaborative partnerships, and agile supply chain strategies to maintain competitive advantage.

Ultimately, the integration of smart wound care solutions will redefine standards of care, offering clinicians unprecedented visibility into healing trajectories and empowering patients to participate actively in their treatment. As the industry continues to evolve, stakeholders who align technological potential with clinical imperatives will be best positioned to drive positive patient outcomes and sustainable growth.

Unlock Comprehensive Market Intelligence on Next-Generation Smart Wound Care Solutions by Engaging with Ketan Rohom to Secure Your Comprehensive Report Today

Elevating access to critical market analysis is now seamless. Engage with Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive smart wound care market research report. By contacting him, you will gain immediate insights into the latest technological breakthroughs, regulatory developments, and competitive dynamics that define this evolving landscape. His team will guide you through the purchasing process efficiently, tailoring the report scope to your organization’s strategic objectives. Begin unlocking actionable intelligence today by reaching out to Ketan Rohom and positioning your enterprise at the forefront of smart wound care innovation.

- How big is the Smart Wound Care & Bandage Market?

- What is the Smart Wound Care & Bandage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?