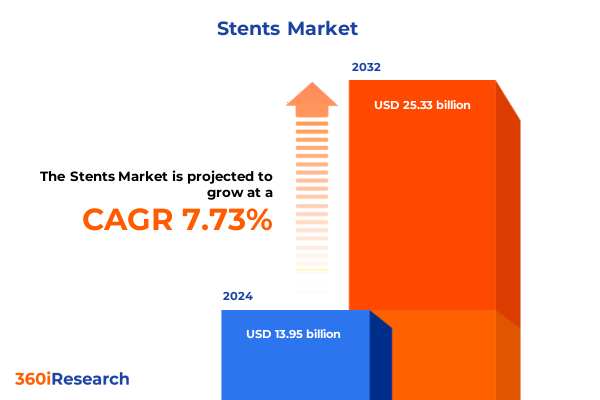

The Stents Market size was estimated at USD 15.01 billion in 2025 and expected to reach USD 16.11 billion in 2026, at a CAGR of 7.75% to reach USD 25.33 billion by 2032.

Understanding the Stents Landscape: Introduction to Innovations, Market Dynamics, and Strategic Importance of Advanced Implantable Devices

Advancements in interventional technologies have elevated stents from simple mechanical supports to sophisticated therapeutic platforms that play a pivotal role in treating cardiovascular, gastrointestinal, neurovascular, and urological conditions. In recent years, the integration of drug-eluting materials, bioresorbable polymers, and novel alloy compositions has reshaped procedural efficacy and broadened the clinical applicability of stents. As minimally invasive interventions continue to gain preference over open surgeries, the demand for devices that deliver optimal deployability, precise placement, and sustained patency has surged globally.

The executive summary provides a comprehensive overview of underlying market themes, emerging innovations, and the competitive forces that shape these implantable devices. Within this context, stakeholders across the value chain - including device manufacturers, healthcare providers, and regulatory bodies - must stay attuned to evolving clinical guidelines, shifting reimbursement frameworks, and the convergence of digital health modalities. By framing the strategic importance of advanced stent technologies against a backdrop of heightened patient expectations and rising healthcare costs, this introduction sets the stage for a deeper analysis of the transformative shifts and market dynamics that define the contemporary landscape.

Within this landscape, an executive summary serves as a critical tool to distill complex data into actionable intelligence. By synthesizing keen insights on supply chain resilience, regulatory landscapes, product segmentation, and regional dynamics, this document equips decision-makers with the clarity needed to navigate market uncertainties, prioritize R&D investments, and forge strategic alliances that align with both patient outcomes and commercial objectives.

Mapping the Transformative Shifts Reshaping the Stents Industry through Technological Advancements, Regulatory Evolutions, and Changing Clinical Practices

Over the past decade, the stents industry has experienced a wave of technological breakthroughs that extend beyond incremental device improvements. Materials science innovations have introduced cobalt-chromium alloys and platinum-chromium compositions that combine high radial strength with improved flexibility, enabling complex anatomies to be navigated with greater ease. Concurrently, the evolution of drug-eluting platforms and nano-engineered coatings has enhanced restenosis prevention, while early-stage bioresorbable scaffolds promise temporary vessel support without the long-term foreign body footprint.

Regulatory landscapes have likewise undergone significant change, with harmonization initiatives between major jurisdictions expediting clinical approvals but imposing more rigorous post-market surveillance requirements. These shifts demand agile regulatory strategies and comprehensive real-world evidence generation to validate both safety and long-term efficacy. At the same time, clinical practice has trended toward personalized medicine, leveraging advanced imaging modalities for patient-specific stent selection and placement guidance, as well as integrating remote monitoring to assess endothelial healing and vessel patency in real time.

As a result, the industry is moving toward a convergence of device innovation, data analytics, and patient-centric care pathways. Manufacturers that can integrate robust digital ecosystems to support procedural planning, outcome tracking, and iterative device optimization will be poised to outpace competitors and set new standards in interventional therapy.

Evaluating the Cumulative Impact of United States Tariffs Introduced in 2025 on Supply Chains, Costs, and Competitive Dynamics in the Stents Sector

The introduction of new United States tariffs in early 2025 has compounded pre-existing global supply chain challenges and reverberated across multiple tiers of the stents ecosystem. Steel and specialty alloy imports now face increased duties, driving raw material costs upward and prompting device manufacturers to reexamine sourcing strategies. As a cumulative effect, procurement teams have been forced to identify alternative suppliers in regions not subject to tariff escalations or to negotiate localized forging agreements to stabilize supply volumes and maintain production continuity.

These cost pressures have translated into margin compression, particularly for smaller manufacturers and contract suppliers that lack the scale to absorb duty increases. In response, leading companies have accelerated vertical integration efforts, acquiring or partnering with domestic alloy processors to secure tariff-exempt feedstocks. While such initiatives incur upfront capital outlays, they have mitigated cost volatility and preserved pricing flexibility in contract negotiations with healthcare providers.

Moreover, the tariffs have reshaped the competitive landscape, tilting advantage toward organizations with established regional manufacturing footprints and robust distribution networks. By relocating final assembly sites closer to major end-markets, some players have reduced exposure to import duties on finished devices, while also improving responsiveness to local regulatory changes and clinical demand shifts. Looking ahead, sustained engagement with policy-makers will be essential for industry leaders aiming to influence long-term trade frameworks and safeguard the viability of advanced stent therapies.

Unveiling Key Market Segmentation Insights by Product Type, Material Composition, Delivery Mode, Clinical Application, and End User Profiles in Stents Industry

A nuanced understanding of stents market segmentation reveals differentiated growth trajectories and investment priorities across device categories, materials, delivery mechanisms, clinical applications, and point of care. When analyzed by product type, coronary stents continue to represent a core focus area, driven by procedural volumes in percutaneous coronary interventions; meanwhile, gastrointestinal variants target strictures and leaks, and neurovascular scaffolds address both extracranial carotid artery and intricate intracranial anatomies. Peripheral stents extend treatment to carotid, femoral, iliac, and renal vessels, while urological stents maintain patency in both prostatic and ureteral pathways.

Material composition further stratifies the market into metallic and polymeric constructs, where advanced cobalt chromium, nitinol, platinum chromium, and stainless steel alloys compete alongside biodegradable and durable polymer matrices. These choices affect device flexibility, deliverability, and patient compatibility, prompting R&D teams to calibrate performance profiles against clinical endpoints. The comparison between balloon-expandable and self-expanding delivery modes highlights trade-offs in deployment precision versus chronic radial force maintenance, necessitating tailored device selection for each anatomical territory.

Diverse clinical applications - ranging from cardiovascular disease management to neurovascular interventions, oncology-related stent placements, peripheral artery disease treatment, and urological obstructions - underscore the imperative for specialized design features and supportive care pathways. Finally, end users such as ambulatory surgical centers, dedicated cardiology units, hospitals, and specialty clinics each exhibit distinct purchasing behaviors, procedural workflows, and reimbursement models, guiding suppliers toward differentiated commercialization strategies and value propositions.

This comprehensive research report categorizes the Stents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Mode of Delivery

- Application

- End User

Examining Regional Dynamics across Americas, EMEA, and Asia Pacific Stents Markets to Reveal Growth Drivers and Strategic Opportunities

Regional analysis of the stents market uncovers unique dynamics across the Americas, Europe Middle East & Africa, and Asia Pacific, each shaped by local healthcare infrastructures, regulatory environments, and demographic trends. In the Americas, advanced reimbursement frameworks coupled with high procedural volumes in North America sustain robust demand for next-generation coronary and peripheral devices, while Latin American markets exhibit growing interest in cost-effective urological and gastrointestinal solutions as public and private payers expand interventional capacity.

Within Europe Middle East & Africa, diverse regulatory regimes and heterogeneous purchasing models require tailored market entry strategies. Western Europe’s emphasis on clinical outcome data and health technology assessments contrasts with emerging Gulf states’ strategic investments in cutting-edge interventional facilities. Similarly, Africa’s nascent market for advanced vascular and endoluminal therapies is catalyzed by partnerships that bolster local clinical training and device registration support.

In Asia Pacific, the combination of high population density, rising healthcare expenditure, and increasing awareness of minimally invasive treatments has propelled strong uptake of self-expanding neurovascular stents and balloon-expandable coronary scaffolds. Countries such as China, Japan, and India leverage domestic manufacturing capabilities to compete on cost and scale, while Southeast Asian markets prioritize affordability and dealer network expansion. Across all regions, regulatory harmonization efforts and digital reimbursement pilots are shaping the pace at which advanced stent technologies diffuse into mainstream practice.

This comprehensive research report examines key regions that drive the evolution of the Stents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Portfolios of Leading Companies Driving the Evolution of the Stents Market Amidst Dynamic Pressures

A survey of leading companies provides a window into the competitive strategies that drive innovation and market leadership in stents. Medtronic has expanded its portfolio by integrating advanced imaging guidance systems with hybrid coronary scaffolds, securing cross-functional synergies between device and digital health offerings. Abbott continues to dominate the drug-eluting segment through iterative refinements in polymer technologies and surface coatings that target specific restenosis pathways, while its global distribution channels sustain broad clinical adoption.

Boston Scientific has focused on neurovascular interventions, introducing low-profile, highly flexible stents optimized for delicate intracranial vasculature and fostering collaborations with neurointerventional centers to validate clinical outcomes. B. Braun’s investments in peripheral stent development have yielded dedicated solutions for iliac and femoral lesions, complemented by training initiatives that accelerate interventional proficiency in emerging markets. Biosensors International has carved a niche in gastrointestinal and oncology-related applications, leveraging proprietary nitinol designs to deliver tumor-occlusive therapies with minimal migration risk.

Several newer entrants and regional champions are also reshaping competitive dynamics through strategic alliances and targeted acquisitions. Terumo’s self-expanding platform enhancements and Nipro’s regional manufacturing alliances illustrate the diverse pathways through which mid-tier players secure market share and cultivate differentiated value propositions in the ever-expanding stents ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Stents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- Cook Medical LLC

- Cordis Corporation

- Elixir Medical Corporation

- Endologix LLC

- InspireMD, Inc.

- Lepu Medical Technology Co., Ltd

- Medinol Ltd.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd

- MicroPort Scientific Corporation

- Sahajanand Medical Technologies Pvt. Ltd

- Shanghai MicroPort Medical (Group) Co., Ltd

- STENTYS SA

- Terumo Corporation

- W. L. Gore & Associates, Inc.

Empowering Industry Leaders with Actionable Recommendations to Navigate Innovation, Regulatory Shifts, and Market Volatility in Stents Domain

To thrive in an increasingly complex stents market, industry leaders must adopt an integrated approach that balances innovation, operational resilience, and stakeholder engagement. Strengthening supply chain resilience through dual sourcing of critical alloys and establishing regional manufacturing hubs will shield organizations from tariff shocks and logistical disruptions. Concurrently, prioritizing R&D investments in bioresorbable polymers and multifunctional coatings can unlock new therapeutic value while differentiating product portfolios.

Engagement with regulatory bodies at early development stages-supported by robust real-world evidence programs-will expedite market entry and ensure compliance with evolving safety and performance requirements. Tailoring commercialization strategies to regional nuances, including adapting pricing models and clinical support services, will maximize market penetration in both developed and emerging geographies. Leveraging digital health platforms to augment pre-procedural planning, outcome tracking, and patient follow-up can elevate care pathways and foster long-term partnerships with healthcare providers.

Finally, fostering collaborative networks with key opinion leaders, academic institutions, and specialty clinics will accelerate clinical validation and enhance brand credibility. By coupling data-driven insights with agile strategic planning, industry stakeholders can navigate regulatory shifts, cost pressures, and competitive threats, thereby securing their leadership position in the rapidly evolving stents domain.

Detailing Robust Research Methodology Including Primary Interviews, Secondary Data Analysis, and Rigorous Validation Techniques

The research methodology underpinning this executive summary combines rigorous secondary data collection with comprehensive primary engagements to ensure robust validation of findings. Secondary research encompassed peer-reviewed journals, clinical trial registries, regulatory filings, and company disclosures to map technological trends, regulatory frameworks, and competitive landscapes. Market intelligence portals and proprietary databases were also leveraged to track tariff schedules, pricing benchmarks, and merger-and-acquisition activity.

Primary research involved structured interviews with over 50 stakeholders, including key opinion leaders in interventional cardiology, gastrointestinal endoscopy, and neurovascular surgery, as well as procurement managers at leading healthcare institutions and executives from major device manufacturers and distributors. Insights from these interviews were triangulated against secondary data to identify convergence points and reconcile discrepancies.

A multi-stage validation process included cross-functional workshops with industry advisors to challenge underlying assumptions and refine scenario analyses. Quality assurance protocols were applied throughout, ensuring data integrity, methodological transparency, and reproducibility of insights. This comprehensive approach provides stakeholders with high-confidence intelligence to inform strategic decisions and guide future investment priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Stents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Stents Market, by Product Type

- Stents Market, by Material

- Stents Market, by Mode of Delivery

- Stents Market, by Application

- Stents Market, by End User

- Stents Market, by Region

- Stents Market, by Group

- Stents Market, by Country

- United States Stents Market

- China Stents Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspective on Strategic Imperatives and Future Directions for Stakeholders in the Continuously Evolving Stents Market Landscape

The stents market is poised at the convergence of technological innovation, shifting policy frameworks, and evolving clinical needs. Strategic imperatives for stakeholders include accelerating next-generation material development, enhancing supply chain adaptability in light of tariff uncertainties, and deepening stakeholder collaborations to validate long-term outcomes. Precision deployment techniques and digital integration will further differentiate therapeutic value and drive adoption across diverse clinical settings.

Looking ahead, the fusion of bioresorbable scaffold research with artificial intelligence – enabled procedural planning and outcome prediction – represents a frontier for device innovation. Similarly, expanded indications in oncology-related stenting and neurovascular interventions underscore the importance of cross-disciplinary partnerships. As regional regulators refine approval pathways and reimbursement models adapt to patient-centered care paradigms, market entrants must maintain agility and data-driven rigor to stay ahead of the curve.

By synthesizing segmentation, regional dynamics, and competitive positioning, organizations can identify high-impact investment opportunities, mitigate operational risks, and deliver differentiated value to patients and providers alike. This conclusive perspective underscores the need for proactive strategy calibrations and sustained innovation to drive performance in the continuously evolving stents landscape.

Contact Associate Director Sales & Marketing to Secure Your Comprehensive Copy of the Latest Stents Market Research Report and Gain Strategic Advantage

Ketan Rohom, as the Associate Director of Sales & Marketing, stands ready to guide you through the breadth and depth of this comprehensive stents market research report. By partnering directly with Ketan, you can secure your copy of the report and gain immediate access to actionable insights on supply chain strategies, tariff impacts, technological advancements, and competitive intelligence. His expertise in translating complex data into strategic recommendations will empower your team to make informed decisions, identify partnership opportunities, and chart a course toward sustainable growth in the fast-evolving stents ecosystem. Reach out to Ketan Rohom today to unlock the full suite of findings and position your organization at the forefront of innovation within the stents market.

- How big is the Stents Market?

- What is the Stents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?