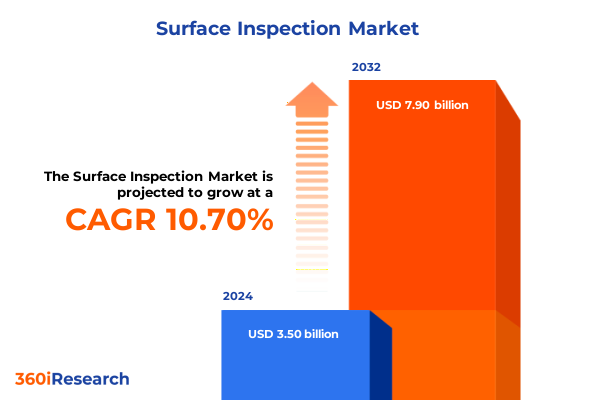

The Surface Inspection Market size was estimated at USD 3.87 billion in 2025 and expected to reach USD 4.28 billion in 2026, at a CAGR of 10.71% to reach USD 7.90 billion by 2032.

Unlocking Precision Quality Assurance with Advanced Surface Inspection Technologies Shaping Modern Manufacturing Processes

In highly competitive manufacturing environments, achieving impeccable quality control is non-negotiable. Surface inspection has emerged as an essential discipline, ensuring that flaws invisible to the naked eye are identified and addressed before products reach end-users. Manufacturers across aerospace, automotive, electronics, medical devices, and oil and gas increasingly rely on sophisticated inspection technologies to maintain brand reputation, minimize costly recalls, and uphold rigorous safety standards.

Modern surface inspection encompasses a range of techniques tailored to specific quality objectives. Defect detection systems pinpoint cracks, inclusions, and porosity in materials, while dimension measurement tools verify critical tolerances. Surface finish sensors assess texture and smoothness to meet aesthetic and functional requirements, and weld inspection solutions guarantee structural integrity in metal assemblies. Each of these approaches plays a distinct role in quality assurance workflows, intersecting with production automation to deliver real-time feedback and corrective action.

As global supply chains grow more complex and customer expectations rise, the surface inspection market is poised for a wave of innovation. Technological advancements are driving performance higher, enabling faster cycle times and more precise results. In response to emerging challenges-from tariff-driven cost pressures to evolving regulatory mandates-this executive summary unpacks the transformative forces reshaping the landscape and highlights strategic imperatives for stakeholders seeking to harness the next generation of inspection capabilities.

Revolutionary Technological and Operational Shifts Driving a New Era of Comprehensive Surface Inspection Excellence across Industry Verticals

The surface inspection domain is experiencing a profound technological renaissance fueled by advancements in robotics and artificial intelligence. In 2023 alone, global industrial robot installations reached a remarkable 541,000 units, sustaining a high operational stock of over 4.28 million machines worldwide. Asia accounted for 70 percent of new deployments, Europe 17 percent, and the Americas 10 percent-underscoring a shift toward automated inspection in every major market. Robotics platforms integrated with deep learning visual inspection modules now adapt in real time, continuously optimizing inspection paths and defect recognition criteria without human intervention.

Concurrently, digital twin frameworks are forging a tighter bond between physical inspection assets and their virtual counterparts. Enterprises are leveraging these virtual replicas to simulate inspection workflows, refine sensor placements, and anticipate maintenance needs before disruptions occur. According to Gartner projections, the global digital twin engineering market will surpass $16.5 billion in 2025, with manufacturing deployments alone comprising over 30 percent of total use cases. By unifying sensor data streams, machine vision outputs, and process metadata, digital twin solutions enable predictive quality control and accelerated innovation cycles.

Moreover, the rise of multi-modal sensor fusion is expanding the boundaries of defect detection. Cutting-edge inspection systems now integrate high-resolution cameras with complementary sensors such as thermal imagers, ultrasonic probes, and spectral analyzers. A 2025 study from MIT’s Manufacturing Innovation Lab found that incorporating multi-modal inputs led to a 23 percent increase in defect coverage compared to vision-only approaches. This comprehensive view of surface and subsurface attributes empowers manufacturers to catch elusive anomalies, streamline root cause analysis, and elevate overall product reliability.

Assessing the Compound Effects of Recent United States Tariff Policies on Surface Inspection Equipment and Operations in 2025

Recent tariff policies in the United States have introduced complex dynamics that extend into the surface inspection sector, altering cost structures and investment timelines. In June 2025, U.S. orders for core capital goods unexpectedly declined by 0.7 percent, contrasting sharply with earlier growth trends as firms accelerate purchases to preempt tariff hikes. While shipments edged up modestly, the broader picture reveals businesses pausing or scaling back new equipment acquisitions due to elevated input costs and policy uncertainty.

Manufacturing revenue projections for 2025 remain largely flat, reflecting the ripple effects of levies on imports of inspection systems and their components. Industry survey data indicates that capital expenditures among manufacturing technology users are expected to fall by approximately 1.3 percent this year, reversing earlier optimism. Companies report that tariffs are driving up landed costs and squeezing margins, leading many to defer modernization plans for inspection lines despite growing quality demands.

The prevailing uncertainty around tariff longevity is further exacerbating strategic planning challenges. A recent analysis from DirectIndustry highlights that prolonged ambiguity in trade policy can reduce long-term industrial production by over 1 percent, as measured by the Economic Policy Uncertainty Index. With global competitors adjusting supply chains and alternative sourcing options under consideration, surface inspection equipment providers and end users alike must navigate a labyrinth of regulatory shifts and cost pressures.

Unveiling Critical Insights from Diverse Market Segmentation to Inform Strategic Positioning in Surface Inspection Solutions

Insight into market segmentation reveals the nuanced ways that surface inspection technologies address specific industry needs. When examining the spectrum of inspection types-ranging from defect detection methods like crack, inclusion, and porosity analysis to dimension measurement, surface finish assessment, and weld evaluation-each capability aligns with unique quality assurance scenarios. Providers are tailoring algorithmic approaches to match material characteristics, thus ensuring that automotive body panels, aerospace composites, and precision-machined components all receive appropriate scrutiny.

Beyond inspection modality, application context shapes technology adoption patterns. Aerospace manufacturers prioritize ultra-high sensitivity in orbital weld inspections and composite surface checks, while automotive producers emphasize high-speed dimension verification to maintain production throughput. Electronics and semiconductor firms integrate laser-based surface finish tools to detect microsecond anomalies on wafers, and medical device companies leverage multi-angle imaging to verify biocompatible coatings. In the oil and gas sector, remote or robotic inspection units survey pipeline weld integrity in harsh environments, minimizing risk and operational downtime.

Deployment mode also plays a decisive role in market dynamics. Portable systems deliver flexibility for field inspections in sectors such as energy and construction, enabling engineers to assess critical assets on-site without interrupting operations. Conversely, stationary inspection stations are optimized for high-volume production lines in factory environments, offering robust performance and seamless integration with manufacturing execution systems. Understanding these segmentation dimensions helps stakeholders craft targeted strategies for product development, channel prioritization, and customer support.

This comprehensive research report categorizes the Surface Inspection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Inspection Type

- Application

- Deployment Mode

Exploring Critical Regional Dynamics Across the Americas EMEA and Asia-Pacific Shaping Adoption and Evolution of Surface Inspection Technologies

North America remains a pivotal region for surface inspection innovation and commercialization. In the inspection and maintenance robot market, North America accounted for roughly 40 percent of total revenue in 2023, spurred by robust investment in oil and gas, aerospace, and semiconductor facilities. Although the Americas represented just 10 percent of new industrial robot installations in 2023, manufacturers across the United States and Canada continue to deploy advanced imaging and robotic inspection cells to uphold strict regulatory and safety standards.

In Europe, Middle East, and Africa, strong digital transformation initiatives are driving steady uptake of surface inspection systems. The European Union’s digital strategy and smart manufacturing programs have fueled rapid adoption of digital twins within quality control workflows, with Europe projected to grow at over 30 percent CAGR for digital twin deployments through 2025. Meanwhile, established industrial hubs in Germany and Italy are integrating cobot-based inspection units to meet stringent precision standards in automotive and industrial equipment sectors.

Asia-Pacific continues to lead in volume growth, with China alone accounting for more than half of new industrial robot installations in 2023. Rapid industrialization, government-led manufacturing modernization, and escalating labor costs are propelling demand for high-speed, high-accuracy inspection solutions. Across Japan, South Korea, and emerging Southeast Asian markets, enterprises are investing heavily in AI-driven machine vision and edge computing platforms to automate quality checks, reduce human exposure to hazardous processes, and maintain competitiveness on the global stage.

This comprehensive research report examines key regions that drive the evolution of the Surface Inspection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements and Innovations from Leading Global Technology Providers in the Surface Inspection Ecosystem

Leading technology providers are actively reshaping the surface inspection landscape through strategic innovation and product launches. Cognex, a pioneer in machine vision, unveiled its OneVision platform in June 2025-a cloud-based development environment designed to accelerate AI-powered inspection applications across global operations. This breakthrough enables manufacturers to centralize model training and customization, dramatically reducing deployment cycles while maintaining consistent performance across facilities. It underscores Cognex’s commitment to solving key barriers in industrial AI adoption.

Keyence Corporation has consistently delivered strong financial results, achieving a near 9.6 percent year-over-year revenue increase in the first nine months of fiscal 2025. The company’s premium product portfolio-spanning laser markers, high-resolution cameras, and smart sensors-continues to gain traction in automotive, electronics, and pharmaceutical segments. A robust net profit rise of 9.5 percent highlights Keyence’s operational efficiency and strategic focus on high-margin machine vision systems.

Other notable players include Omron and Teledyne Technologies, each advancing sensor and imaging capabilities. Teledyne’s Kaige 20K line-scan camera family, introduced in late 2023, offers unparalleled resolution and data throughput for web inspection and precision measurement applications. Meanwhile, Basler’s integration of AI-driven edge processing in high-speed cameras has boosted automotive inspection throughput by over 20 percent in select pilot installations, demonstrating the value of real-time analytics at the edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surface Inspection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Basler Aktiengesellschaft

- Cognex Corporation

- Datalogic S.p.A.

- FLIR Systems, Inc.

- Honeywell International Inc.

- Keyence Corporation

- Micro-Epsilon Messtechnik GmbH & Co. KG

- Omron Corporation

- SICK AG

- Siemens AG

- Sony Semiconductor Solutions Corporation

- Teledyne DALSA Inc.

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Challenges and Capitalize on Surface Inspection Innovations

To thrive amid rapid technological change and geopolitical uncertainty, industry leaders must adopt a multi-pronged strategy. First, prioritizing investment in AI-driven inspection and predictive analytics capabilities will unlock efficiency gains and preempt quality issues. By integrating digital twins with real-time sensor networks, organizations can simulate process adjustments, reduce defect rates, and optimize maintenance schedules before disruptions occur.

Second, diversifying supply chains through alternative sourcing and local manufacturing partnerships will mitigate the impact of trade policy fluctuations. Engaging with policymakers and industry associations to advocate for predictable regulatory frameworks is equally important, as clarity on tariff structures enables more disciplined capital planning. Third, forging cross-industry collaborations-between OEMs, inspection technology providers, and systems integrators-can accelerate co-development of specialized solutions for niche applications such as composite material inspection or ultra-fine dimensional measurement.

Finally, building a skilled workforce equipped to manage advanced inspection systems is essential. Structured training programs, certification pathways, and talent pipelines will ensure that organizations can fully leverage new technologies rather than simply installing them. By embracing these relational, operational, and technological imperatives, industry stakeholders can secure a competitive advantage in a market defined by relentless pace and precision demands.

Detailing a Robust Research Methodology Involving Comprehensive Data Triangulation Expert Interviews and Validation Protocols

The research methodology underpinning this analysis employs a rigorous, multi-stage approach to ensure robust insights and actionable findings. Initially, a comprehensive review of secondary literature-including industry publications, academic research, and corporate disclosures-provided a foundational understanding of current capabilities, emerging trends, and competitive landscapes.

Subsequently, subject-matter experts from leading manufacturing, quality assurance, and automation firms were engaged in in-depth interviews. These discussions offered direct perspectives on technology adoption drivers, operational challenges, and strategic priorities. Quantitative data from publicly available government reports and trade associations were then triangulated with survey responses from over 50 inspection system users to validate hypotheses and surface nuanced market dynamics.

Finally, iterative validation workshops with key stakeholders refined the conclusions and recommendations. This iterative process-combining qualitative insights, empirical data, and expert judgment-ensured that the final outputs reflect both the breadth of macro-level shifts and the depth of domain-specific expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surface Inspection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surface Inspection Market, by Inspection Type

- Surface Inspection Market, by Application

- Surface Inspection Market, by Deployment Mode

- Surface Inspection Market, by Region

- Surface Inspection Market, by Group

- Surface Inspection Market, by Country

- United States Surface Inspection Market

- China Surface Inspection Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Concluding Thoughts Emphasizing the Role of Advanced Surface Inspection as a Critical Driver of Manufacturing Excellence and Quality Assurance

In summary, the surface inspection market stands at a critical inflection point where technological sophistication, evolving trade environments, and industry-specific demands converge. Breakthroughs in AI, robotics, and digital twin integration are redefining the speed, accuracy, and scope of quality assurance processes. Meanwhile, tariff policies and supply chain uncertainties underscore the need for strategic resilience and diversified sourcing.

By aligning segmentation insights-across inspection types, application sectors, and deployment modes-with regional adoption patterns, organizations can better tailor their offerings and investment strategies. Leading providers such as Cognex, Keyence, Omron, and Teledyne continue to raise the bar through innovative platforms and high-performance sensor technologies. The actionable recommendations outlined in this summary highlight the importance of balanced portfolios, policy engagement, collaborative partnerships, and workforce development.

As manufacturers pursue excellence in product integrity and operational efficiency, a deliberate focus on next-generation inspection solutions will be indispensable. Stakeholders who embrace these converging dynamics stand to drive significant value, ensuring that surface inspection remains a cornerstone of quality and competitiveness in the years ahead.

Take the Next Step Secure Your Detailed Surface Inspection Market Research Report Today with Ketan Rohom to Inform Your Strategic Decisions

To access the full depth of analysis on surface inspection market dynamics in 2025-including detailed breakdowns, executive insights, and strategic frameworks-reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your comprehensive report. Ketan will guide you through the features of our in-depth research, discuss customization options, and ensure you have the data you need to drive actionable decisions in quality assurance and production optimization.

- How big is the Surface Inspection Market?

- What is the Surface Inspection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?