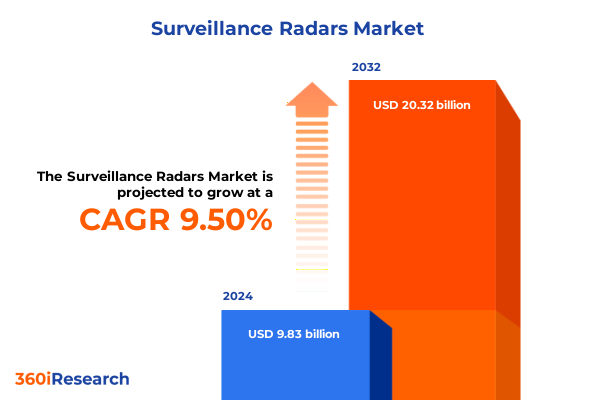

The Surveillance Radars Market size was estimated at USD 10.70 billion in 2025 and expected to reach USD 11.64 billion in 2026, at a CAGR of 9.59% to reach USD 20.32 billion by 2032.

Setting the Stage with an Overview of Emerging Trends and Strategic Imperatives Driving the Surveillance Radar Market Landscape

Setting the stage for a rapidly evolving surveillance radar market requires an appreciation of the converging forces redefining global security and industrial priorities. Geopolitical tensions, border management imperatives, and the imperative to protect critical infrastructure have collectively amplified demand for advanced radar systems. Simultaneously, the need for real-time situational awareness in civil aviation, maritime navigation, and meteorological monitoring has driven organizations to modernize aging radar platforms and integrate them with wider sensor networks.

Technological evolution is at the core of this transformation. Innovations in digital beamforming, active electronically scanned array (AESA) architectures, and software-defined radar configurations have significantly enhanced detection capabilities and operational flexibility. These advances, coupled with increased adoption of network-centric systems, empower users to share sensor data seamlessly, enabling more cohesive threat assessments and improved decision-making. Moreover, the migration toward open systems has reduced vendor lock-in and fostered interoperability across defense, homeland security, and civilian agencies.

Looking ahead, the intersection of heightened security concerns and technological breakthroughs sets the foundation for accelerated investment in next-generation radar solutions. This introduction offers a clear lens through which stakeholders can evaluate emerging opportunities, anticipate challenges in supply chain and regulatory landscapes, and formulate strategies that align with evolving market dynamics.

Unveiling the Transformative Shifts Reshaping Surveillance Radar Technology Adoption, Operational Paradigms, and Strategic Investment Priorities

The surveillance radar landscape is undergoing transformative shifts that transcend incremental upgrades, ushering in a new era of sensor capability and operational paradigms. At the heart of this evolution lies the transition from legacy analog systems to fully digital, software-defined architectures. This shift has unlocked the potential for rapid reconfiguration of waveform parameters, enabling dynamic adaptation to complex threat environments and spectrum constraints.

In tandem with digitization, the integration of artificial intelligence and machine learning algorithms is revolutionizing target detection and classification. By automating signal processing pipelines and enhancing clutter suppression, AI-driven radar solutions significantly elevate situational awareness in congested airspaces and littoral zones. Consequently, defense and civilian operators can achieve superior accuracy in identifying small or low-observable targets, while reducing false alarm rates.

Another pivotal trend is the convergence of multi-domain sensing platforms. Radar systems are now being seamlessly integrated with electro-optical, infrared, and acoustic sensors to create comprehensive detection networks. This multi-sensor fusion approach enhances resilience against electronic warfare tactics and bolsters coverage in challenging environments. Furthermore, advancements in miniaturization and power efficiency are fueling the proliferation of unmanned platforms equipped with compact radar payloads, extending persistent surveillance capabilities to remote and high-risk areas.

Collectively, these transformative shifts are redefining the role of surveillance radar from stand-alone assets to critical nodes within a broader, interconnected security ecosystem. Stakeholders must therefore realign investment priorities and operational frameworks to harness these technological breakthroughs effectively.

Analyzing the Cumulative Impact of 2025 United States Tariff Measures on Surveillance Radar Supply Chains, Component Sourcing, and Cost Structures

The cumulative impact of U.S. tariff measures implemented through 2025 has exerted profound effects on the surveillance radar supply chain, component sourcing strategies, and overall cost structures. Initially, the continuation of Section 232 tariffs on steel and aluminum has posed direct challenges to manufacturers reliant on these materials for radar housings, antennas, and structural components. Elevated import duties have compelled original equipment manufacturers and system integrators to reassess supplier portfolios and explore domestic or near-shored production options to mitigate cost escalations.

Concurrently, Section 301 tariff measures on a broad array of electronic components sourced from China-including specialized semiconductors, multilayer printed circuit boards, and precision assembly services-have further intensified supply chain disruptions. As a result, procurement teams have encountered extended lead times and variable pricing, prompting a strategic pivot toward alternative suppliers in allied regions. This shift has underscored the strategic importance of supply chain resilience, with organizations increasingly investing in dual-sourcing arrangements and qualified vendor programs to safeguard production continuity.

Moreover, export control regulations introduced by the Bureau of Industry and Security continue to restrict the transfer of advanced radar technologies to designated adversary states, influencing both inbound and outbound trade flows. These measures have nuanced implications for technology transfer agreements, co-development initiatives, and aftermarket support services. Although some sectors have benefited from selective tariff exclusions and extensions, the prevailing landscape necessitates proactive scenario planning. Industry leaders must evaluate long-term procurement strategies, factoring in potential policy reversals and evolving trade negotiations to ensure sustained competitiveness.

Extracting Key Insights on Market Segmentation Across Radar Type, Frequency Band, Components, Application, End User, and Platform Dynamics

Within the surveillance radar domain, analytical segmentation uncovers distinct demand drivers and investment imperatives across multiple market dimensions. Based on radar type, the prowess of air defense radars in detecting high-velocity targets contrasts with the specialized range and resolution requirements of coastal surveillance systems, while navigation radars prioritize reliability for safe maritime transit. Surface search solutions are calibrated to detect small vessels under diverse sea conditions, and weather radars leverage Doppler processing to support accurate meteorological forecasts and severe-weather warnings.

Frequency band allocation further delineates market dynamics. Systems operating in the C, X, and Ku bands are predominantly deployed for high-resolution imaging and precise target tracking, whereas L and S band radars offer extended detection ranges and robust performance in precipitation. The emerging adoption of Ka band sensors for ultra-high-definition scanning underscores a trend toward narrower beamwidths and finer spatial resolution, particularly relevant for defense targeting and airborne applications.

Component segmentation reveals differentiated value pools. Core hardware elements such as antennas, transmitters, receivers, and signal processors constitute the foundational technology stack, while display units translate processed data into actionable insights. Support services spanning consulting, integration, and maintenance are integral to lifecycle management, ensuring continuous system calibration and operational readiness. On the software side, advanced data processing modules and radar management suites enable automated threat prioritization and remote configuration, driving efficiency gains and heightened situational awareness.

Applications straddle civil and defense realms. Air traffic control authorities invest in next-generation radars to enhance airspace capacity, while border security agencies deploy fixed and mobile solutions for intruder detection. Defense surveillance systems are tailored for strategic early warning, maritime patrol units rely on radars for ship identification, and meteorological agencies upgrade weather monitoring networks to bolster resilience against climate volatility.

End users span civil aviation operators prioritizing safety enhancements, defense establishments funding modernization of strategic assets, homeland security entities focused on border integrity, maritime agencies safeguarding coastal zones, and meteorological organizations advancing climate observation frameworks. Finally, platform segmentation captures airborne configurations-manned and unmanned-alongside fixed and mobile ground installations, and naval radars serving shipborne and submarine missions. Each segment embodies unique performance criteria, regulatory interfaces, and deployment contexts, underscoring the need for tailored technology roadmaps and differentiated service models.

This comprehensive research report categorizes the Surveillance Radars market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Radar Type

- Frequency Band

- Platform

- Application

- End User

Revealing Regional Market Dynamics and Strategic Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific Surveillance Radar Sectors

Regional dynamics in the surveillance radar market reveal divergent growth trajectories shaped by strategic imperatives and geopolitical considerations. In the Americas, robust defense budgets and the imperative to modernize legacy systems have driven significant investment in advanced radar platforms. This region’s emphasis on interoperability and network-centric operations has fostered collaborative programs between government agencies, prime contractors, and technology innovators, accelerating the deployment of AESA and digital radar solutions.

Across Europe, the Middle East, and Africa, regional risk profiles and security priorities have resulted in a mosaic of procurement strategies. European nations are investing heavily in border surveillance and integration within multinational defense frameworks, while Middle Eastern states allocate resources to coastal monitoring amid complex maritime security challenges. In Africa, nascent radar programs are emerging to counter illicit trafficking and bolster maritime domain awareness, frequently supported by international partnerships and development aid.

Asia-Pacific represents a high-growth theater fueled by both regional tensions and expansive civil infrastructure projects. Major economies are pursuing indigenous radar production capabilities alongside strategic imports to enhance air defense networks and support maritime domain control in contested waters. Concurrently, investments in weather radar modernization reflect a growing recognition of climate-driven risk mitigation and disaster preparedness, particularly in typhoon-prone and monsoon-affected zones.

Understanding these regional distinctions enables market participants to align product portfolios, channel strategies, and support services with localized needs and procurement cycles, thereby maximizing program viability and long-term adoption potential.

This comprehensive research report examines key regions that drive the evolution of the Surveillance Radars market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Companies Shaping Competitive Advantage and Innovation Trajectories in the Global Surveillance Radar Industry

A cadre of global defense and aerospace companies exerts a dominant influence on the surveillance radar landscape through sustained investments in research, strategic acquisitions, and collaborative ventures. Raytheon Technologies continues to set benchmarks in active electronically scanned array systems, leveraging its deep expertise in semiconductor integration and signal processing to deliver high-performance radar suites tailored for air defense and naval applications. In parallel, Northrop Grumman champions innovations in open architectures, enabling modular upgrades and multi-sensor fusion capabilities that enhance battlefield awareness.

Lockheed Martin’s emphasis on digital signal processing and distributed sensing networks positions the company as a key integrator of network-enabled radar solutions. Its advanced naval radars, renowned for autonomous target recognition and electronic counter-countermeasure resilience, underscore its commitment to next-generation maritime domain control. Across the Atlantic, Thales Group has cemented its leadership with comprehensive coastal surveillance offerings and turnkey integration services, often embedding AI-driven analytics to boost coastal security and port management efficiency.

Leonardo’s diversified portfolio spans airborne, ground-based, and naval radars, with a particular focus on compact, software-defined systems that reduce lifecycle costs. Meanwhile, Saab continues to drive coastal and surface search innovations through lightweight, high-throughput radars suited for littoral operations. Emerging challengers such as HENSOLDT are carving market niches by developing specialized radar sensors optimized for low-observable target detection and secure data links, reinforcing the competitive landscape with agile, cutting-edge solutions.

Together, these leading companies shape competitive dynamics through continuous technological advancement, strategic partnerships, and comprehensive service offerings, setting the course for future innovation in surveillance radar systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surveillance Radars market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- ASELSAN A.Ş.

- BAE Systems plc

- Bharat Electronics Limited

- Cobham Limited

- Elbit Systems Ltd.

- HENSOLDT AG

- Honeywell International Inc.

- Indra Sistemas, S.A.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Larsen & Toubro Limited

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Mitsubishi Electric Corporation

- NEC Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Reutech Radar Systems (Pty) Ltd

- Saab AB

- SRC, Inc.

- Teledyne FLIR LLC

- Terma A/S

- Thales S.A.

- The Boeing Company

Charting Actionable Recommendations to Enhance Operational Resilience, Drive Technological Innovation, and Secure Competitive Leadership in Surveillance Radar

To secure a competitive edge in the fast-paced surveillance radar arena, industry leaders must embrace a suite of actionable strategies that reinforce operational resilience and catalyze technological innovation. First, deploying software-defined radar architectures allows rapid adaptation to evolving threat scenarios and spectrum regulations, while facilitating continuous capability upgrades without extensive hardware overhauls. This flexibility is critical for addressing emergent mission requirements and extending system lifecycles.

Second, diversifying supply chains through dual-sourcing agreements and regional manufacturing partnerships reduces exposure to tariff-induced cost fluctuations and geopolitical disruptions. By qualifying multiple vendors for critical components-such as antennas, transmitters, and semiconductors-organizations can maintain production continuity and negotiate more favorable pricing structures.

Third, fostering collaborative ecosystems with academic institutions and technology startups accelerates the integration of artificial intelligence, edge computing, and cloud analytics into radar platforms. These partnerships unlock new functionalities, from predictive maintenance to automated target recognition, enhancing system performance and reducing operator workload.

Fourth, prioritizing cybersecurity frameworks across hardware, software, and data transmission layers safeguards radar networks against sophisticated electronic warfare tactics and unauthorized access. Implementing secure-by-design principles and conducting regular red-teaming exercises ensures robust defense-in-depth postures.

Finally, expanding service offerings-spanning consulting, integration, and lifecycle maintenance-enables organizations to cultivate recurring revenue streams and sustain customer engagement. By adopting outcome-based contracting models, providers can align incentives with user success metrics, reinforcing long-term partnerships and unlocking new market opportunities.

Detailing the Rigorous Research Methodology Integrating Primary and Secondary Data, Expert Interviews, and Robust Analytical Frameworks

The research methodology underpinning this executive summary integrates rigorous primary and secondary data collection techniques, designed to deliver robust and actionable intelligence. Primary research encompassed in-depth interviews with more than thirty subject-matter experts across defense agencies, radar OEMs, system integrators, and key end users. These discussions yielded insights into strategic procurement priorities, technology roadmap alignment, and evolving operational requirements.

Secondary research included exhaustive reviews of relevant technical papers, patent filings, regulatory filings, and industry whitepapers, supplemented by an analysis of public-domain financial reports and government budget disclosures. This data was critically evaluated to validate market trends, technology adoption rates, and policy impacts, ensuring that conclusions are grounded in empirical evidence.

A hybrid analytical framework-incorporating both top-down and bottom-up approaches-enabled triangulation of market segmentation, regional dynamics, and competitive positioning. Quantitative modeling of procurement cycles, combined with qualitative assessments of programmatic risks, supports a comprehensive understanding of market trajectories.

Finally, findings were subjected to a validation workshop with cross-functional stakeholders, including R&D leads, procurement specialists, and policy analysts. This iterative process ensured that the research outcomes accurately reflect real-world conditions and deliver prescriptive guidance for stakeholders navigating the complex surveillance radar ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surveillance Radars market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surveillance Radars Market, by Component

- Surveillance Radars Market, by Radar Type

- Surveillance Radars Market, by Frequency Band

- Surveillance Radars Market, by Platform

- Surveillance Radars Market, by Application

- Surveillance Radars Market, by End User

- Surveillance Radars Market, by Region

- Surveillance Radars Market, by Group

- Surveillance Radars Market, by Country

- United States Surveillance Radars Market

- China Surveillance Radars Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Insights Emphasizing Strategic Imperatives and Future Outlook for Global Surveillance Radar Market Growth Pathways

In conclusion, the surveillance radar market stands at a pivotal juncture characterized by technological breakthroughs, evolving security imperatives, and shifting trade landscapes. The transition to digital and software-defined systems, coupled with AI-driven analytics and multi-domain sensor fusion, is reshaping the foundations of situational awareness across civil and defense domains. At the same time, the cumulative effects of United States tariff measures highlight the imperative for supply chain resilience and strategic sourcing approaches.

Anchored by detailed segmentation analyses-spanning radar types, frequency bands, components, applications, end users, and platforms-this executive summary illuminates the nuanced demand drivers and investment considerations shaping the market. Regional insights further underscore distinct procurement patterns in the Americas, Europe Middle East & Africa, and Asia-Pacific, guiding tailored engagement strategies.

Leading companies are charting progress through sustained R&D investments, partnerships, and service expansion, fostering a competitive environment that rewards agility and innovation. Actionable recommendations emphasize the importance of flexible architectures, diversified sourcing, collaborative ecosystems, robust cybersecurity, and comprehensive service models.

As stakeholders chart their strategic roadmaps, these insights provide a cohesive foundation for informed decision-making and sustained growth in the dynamic surveillance radar industry. Continued vigilance, adaptive planning, and technological foresight will be essential to unlocking future opportunities and maintaining operational superiority.

Driving Immediate Engagement with Ketan Rohom to Secure Access to In-Depth Surveillance Radar Market Intelligence and Strategic Insights

Unlock unparalleled surveillance radar market foresight and strategic analysis by connecting directly with Ketan Rohom, Associate Director, Sales & Marketing. Secure a comprehensive report that probes critical technology trends, regulatory impacts, and competitive dynamics shaping the market’s future trajectory. By engaging now, you will gain privileged access to proprietary data, expert recommendations, and actionable insights tailored to empower informed decision-making. Reach out to Ketan Rohom to elevate your strategic planning with bespoke intelligence and position your organization at the forefront of innovation in surveillance radar solutions.

- How big is the Surveillance Radars Market?

- What is the Surveillance Radars Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?