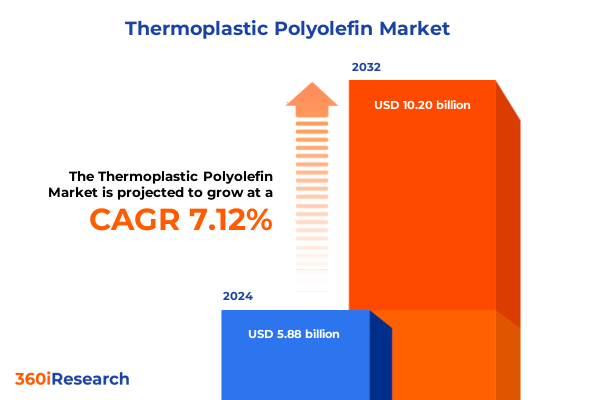

The Thermoplastic Polyolefin Market size was estimated at USD 6.30 billion in 2025 and expected to reach USD 6.72 billion in 2026, at a CAGR of 7.12% to reach USD 10.20 billion by 2032.

Understanding Thermoplastic Polyolefin (TPO): An Overview of a Versatile Polymer Revolutionizing Multiple High-Performance Industries with Sustainable Advantages

Thermoplastic Polyolefin (TPO) represents a family of polymers widely valued for their unique combination of durability, lightweight characteristics, and environmental resilience. Comprising blends of polypropylene and elastomers, TPO materials exhibit extraordinary impact strength, UV resistance, and flexibility, positioning them as a prime choice across sectors demanding rigorous performance standards. The versatility of TPO arises from its ability to be formulated into various grades, ranging from homopolymers to copolymer blends, each engineered to meet specific mechanical and thermal requirements without sacrificing recyclability.

In recent years, the adoption of TPO has accelerated as industries seek sustainable alternatives to traditional materials. Automotive manufacturers leverage TPO’s lightweight properties to enhance fuel efficiency and meet stringent emissions regulations, while building and construction professionals favor TPO membranes for roof systems due to their weather resistance and thermal benefits. Furthermore, advances in compounding methodologies have broadened the scope of applications, extending TPO’s reach into consumer goods, electrical insulation, and specialized packaging solutions.

This executive summary offers a comprehensive exploration of market dynamics, focusing on the forces shaping TPO demand, the impact of recent policy changes, segmentation insights, regional trends, and strategic recommendations. By understanding the foundational attributes and emerging drivers of TPO adoption, decision-makers can anticipate shifts and align their R&D, production, and supply chain strategies to capture new growth opportunities in this high-potential polymer market.

Navigating Transformative Industry Shifts: Sustainability, Electric Vehicles, and Technological Innovations Reshaping the Thermoplastic Polyolefin Sector Landscape

The landscape for Thermoplastic Polyolefin is undergoing a series of transformative shifts driven by sustainability imperatives, the rise of electric mobility, and accelerated technological innovation. As global regulatory bodies tighten environmental standards, manufacturers are prioritizing lightweight, recyclable materials to reduce carbon footprints and achieve circular economy goals. In the automotive sector, stringent emissions targets are catalyzing the replacement of metal and glass fiber–reinforced components with TPO-based solutions, enabling significant reductions in vehicle mass while maintaining structural integrity and safety credentials.

Meanwhile, the building and construction industry is increasingly embracing TPO membranes for cool roofing applications, spurred by energy codes and green building certifications. Regions with severe weather fluctuations are adopting TPO systems to deliver long-term performance and thermal efficiency, driving R&D investments in advanced polymer formulations with enhanced UV stability and weldability. Concurrently, the burgeoning electric vehicle market is reshaping polymer requirements; battery enclosures and underbody shields now demand materials that combine high impact resistance with flame retardancy, a niche where TPO continues to improve its performance profile through novel copolymer designs.

Digitalization and Industry 4.0 initiatives are also leaving their mark on TPO production. The integration of real-time process monitoring, predictive maintenance analytics, and additive manufacturing techniques allows producers to fine-tune extrusion and injection molding parameters, reducing waste and enhancing consistency. These converging trends illustrate a dynamic environment in which TPO producers are compelled to innovate continuously, aligning materials development with shifting end-use priorities and positioning themselves to benefit from the next wave of industrial transformation.

Assessing the Cumulative Impact of 2025 U.S. Tariffs on Thermoplastic Polyolefin Supply Chains, Production Costs, and Global Trade Dynamics

The introduction of sweeping U.S. tariffs in 2025 has created a complex cost environment for Thermoplastic Polyolefin producers and downstream converters alike. In early February, a 10% duty on imports from China and a 25% duty on goods from Canada and Mexico were enacted under the International Emergency Economic Powers Act (IEEPA), targeting raw materials and finished resins concurrently. Subsequently, reciprocal tariffs introduced in April imposed a baseline 10% levy on all imports, with elevated rates for select nations, amplifying input cost volatility and triggering shifts in global sourcing strategies.

These layered duties have forced TPO compounders to reassess their procurement models. Suppliers that traditionally relied on competitively priced feedstocks from Asia have sought alternative channels, prompting investments in domestic polymerization capacities and bolstering partnerships with North American petrochemical producers. The reinstatement of Section 232 tariffs on steel and aluminum in March further underscored the administration’s emphasis on reviving domestic manufacturing, a move that indirectly influences TPO pricing through altered raw material flows and logistical bottlenecks.

As a consequence of these measures, resin manufacturers are confronting compressed margins and supply chain recalibrations. Some processors are accelerating plans to integrate recycled TPO fractions to mitigate the cost pressure of virgin materials, while others are exploring regional warehousing to optimize inventory positioning. Although certain exemptions under trade agreements cushion the impact for compliant goods, the overall climate remains one of heightened uncertainty, compelling stakeholders across the value chain to develop agile tariff-management strategies and to advocate for constructive policy dialogue.

Unveiling Critical Segmentation Insights into Thermoplastic Polyolefin Markets Across Applications, Product Types, Forms, Processes, and Distribution Channels

Thermoplastic Polyolefin market segmentation reveals nuanced performance patterns shaped by application, product type, form, production process, and distribution channel. Within the umbrella of applications, TPO’s adoption in automotive bumpers, exterior trim pieces, interior panels, and under-the-hood components continues to outpace other sectors due to its lightweight profile and recyclability, while building construction harnesses TPO for durable flooring solutions, sealants, and advanced wall cladding systems. Simultaneously, the consumer goods sphere sees TPO grades tailored for appliances, packaging innovations, and high-impact sporting goods, and electrical and electronics manufacturers rely on specialized TPO variants for cable jacketing, connector insulation, and other critical safety applications. Roofing applications benefit from thermoplastic polyolefin in the form of advanced insulation panels and fully heat-weldable membranes.

Product type segmentation highlights the distinctive roles of homopolymers, impact copolymers, random copolymers, and terpolymers, each delivering a tailored balance of tensile strength, flexibility, and thermal stability. The choice of form factor-from films and granules to pellets, powders, and sheets-affords processors precision control over material feed, enabling seamless integration into blow molding, extrusion, and injection molding operations. Production process segmentation underscores the efficiency gains and performance consistency offered by each manufacturing methodology; blow molding excels in hollow part fabrication, extrusion provides continuous profile generation, and injection molding yields high-precision, complex geometries.

Distribution channels further shape market dynamics, as direct sales relationships enable OEMs to co-develop specialty grades, while regional distributors balance inventory breadth and lead-time demands. The rapid growth of online retail platforms also introduces new channels for smaller processors to access value-added TPO compounds with reduced minimum order quantities, democratizing material innovation and accelerating time-to-market for novel applications.

This comprehensive research report categorizes the Thermoplastic Polyolefin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Product Type

- Form

- Production Process

- Distribution Channel

Regional Market Dynamics Explored: Americas, Europe, Middle East & Africa, and Asia-Pacific Trends Driving Thermoplastic Polyolefin Adoption Globally

Regional variations in Thermoplastic Polyolefin demand underscore the influence of regulatory environments, industrial growth trajectories, and infrastructure development. In the Americas, robust light-vehicle production in the United States and Canada continues to anchor TPO consumption for exterior body panels and interior components, bolstered by federal incentives promoting domestic manufacturing and by State-level green building codes that mandate energy-efficient roofing solutions. Additionally, Latin American investment in commercial construction projects is gradually opening new pathways for TPO membranes in tropical climates demanding UV-resistant roofing materials.

Across Europe, the Middle East, and Africa, stringent automotive recyclability requirements under the EU’s End-of-Life Vehicle Directive mandate that vehicle components achieve a minimum 95% reuse or recovery rate by weight, enhancing demand for circular TPO compounds that support multiple processing cycles without performance degradation. Meanwhile, urbanization and infrastructure expansion in Gulf Cooperation Council countries drive adoption of durable TPO membranes in large-scale commercial and residential projects, with public-sector initiatives increasingly incentivizing cool-roof solutions to manage rising ambient temperatures.

The Asia-Pacific region stands out as the fastest-growing TPO market, propelled by rapid industrialization and electrification trends in China, India, and Southeast Asia. Growth in EV manufacturing hubs is escalating demand for lightweight polymeric components, while expansive warehousing and retail construction in emerging economies underpin the adoption of resilient TPO roofing systems. Government-led investments in sustainable infrastructure and energy-efficient building retrofits further reinforce the region’s status as a pivotal growth engine for thermoplastic polyolefin.

This comprehensive research report examines key regions that drive the evolution of the Thermoplastic Polyolefin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Player Insights Highlighting Competitive Strategies, Capacity Expansions, and Innovation Leaders Shaping the Thermoplastic Polyolefin Market

The competitive landscape in the Thermoplastic Polyolefin arena is defined by major petrochemical conglomerates and specialized compounders innovating to meet evolving application demands. LyondellBasell stands at the forefront with its proprietary compounding technologies that optimize impact resistance and thermal stability for automotive and construction applications. Borealis distinguishes itself through strategic partnerships in Europe and Asia, focusing on circular economies and the integration of mechanical and chemical recycling streams to produce high-quality TPO grades from post-consumer waste.

Mitsui Chemicals leverages its global footprint and R&D network to introduce advanced random and impact copolymers that meet stringent global emissions and safety standards, particularly in electric vehicle underbody shielding. Dow maintains a strong presence in North America and the Middle East, expanding capacity for in-situ TPO processes to cater to large-scale infrastructure projects. In the niche membrane segment, Carlisle SynTec Systems, GAF, and Firestone Building Products have fortified their positions by offering customized roofing solutions that integrate enhanced UV stabilizers and reflectivity additives, aligning with evolving building regulations and sustainability targets.

Emerging players are also gaining traction by focusing on specialty applications. Regional compounders in China and India are expanding into consumer electronics and industrial hose markets, while select North American enterprises are piloting novel terpolymer blends for high-performance sporting goods. Collectively, these strategic moves underscore an industry in which innovation in polymer chemistry, recycling integration, and strategic capacity expansions dictate the competitive order.

This comprehensive research report delivers an in-depth overview of the principal market players in the Thermoplastic Polyolefin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Borealis AG

- Braskem S.A.

- Dow Chemical Company

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions Corporation

- INEOS Olefins & Polymers

- LG Chem Ltd.

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- Polyone Corporation

- Reliance Industries Limited

- Repsol S.A.

- SABIC

- Sumitomo Chemical Co., Ltd.

- TotalEnergies SE

- Versalis S.p.A.

Strategic Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Thermoplastic Polyolefin Sector

To thrive in a dynamic Thermoplastic Polyolefin marketplace, industry leaders must adopt a multi-pronged strategic approach. First, boosting investments in circular economy infrastructure by integrating advanced recycling methods will mitigate raw material cost fluctuations amplified by tariff regimes. Companies should establish joint ventures with chemical recyclers to secure a steady feed of post-consumer resin, reinforcing sustainability credentials and insulating operations from import duties.

Second, collaboration with OEMs to co-develop tailored TPO grades can create differentiated value propositions. By aligning R&D resources with customer-specific requirements-such as flame retardancy for battery housings or enhanced weatherability for architectural membranes-suppliers can solidify long-term agreements and lock in premium pricing tiers. Emphasizing digital supply chain visibility through blockchain-led traceability platforms will also enhance trust in recycled and proprietary formulations.

Finally, geographic diversification of production and warehousing capacities will prove critical. Establishing regional compounding hubs in high-growth markets like Southeast Asia and the Gulf Cooperation Council will reduce lead times and tariff exposure. Concurrently, forging strategic alliances with logistics providers to optimize inbound and outbound freight can further diminish the cost impacts of global trade disruptions. By proactively embedding these recommendations into their operating models, TPO producers and converters can capture emergent opportunities while safeguarding against macroeconomic headwinds.

Comprehensive Research Methodology Detailing Data Collection, Analysis Techniques, and Validation Approaches Underpinning the Thermoplastic Polyolefin Study

The research methodology underpinning this report combines rigorous secondary research with targeted primary engagements to ensure robust and actionable findings. The initial phase entailed systematic analysis of publicly available data, including trade legislation documents, polymer industry publications, and environmental regulation summaries, to contextualize policy impacts and global trends. Proprietary databases were leveraged to extract company profiles, patent filings, and technological development trajectories.

Primary research involved structured interviews with over 20 industry stakeholders, encompassing executive leadership from major resin producers, technical directors at OEMs, and procurement specialists in roofing and automotive sectors. Qualitative discussions were supplemented by quantitative survey instruments to capture granular insights on price sensitivities, material performance criteria, and anticipated investment priorities. These engagements facilitated data triangulation, enabling cross-validation between secondary sources and firsthand observations.

Finally, advanced analytical tools were applied to segment the market by application, product type, form, production process, and distribution channel, ensuring that each breakdown reflects current industry realities. Scenario planning techniques were used to model the effect of tariff adjustments and raw material supply shocks. Regular consultations with legal and trade experts bolstered the assessment of regulatory developments, guaranteeing that conclusions remain relevant under evolving policy landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Thermoplastic Polyolefin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Thermoplastic Polyolefin Market, by Application

- Thermoplastic Polyolefin Market, by Product Type

- Thermoplastic Polyolefin Market, by Form

- Thermoplastic Polyolefin Market, by Production Process

- Thermoplastic Polyolefin Market, by Distribution Channel

- Thermoplastic Polyolefin Market, by Region

- Thermoplastic Polyolefin Market, by Group

- Thermoplastic Polyolefin Market, by Country

- United States Thermoplastic Polyolefin Market

- China Thermoplastic Polyolefin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Reflections Summarizing Core Findings and Future Outlook for Thermoplastic Polyolefin Markets in a Dynamic Global Environment

In summary, the Thermoplastic Polyolefin market stands at an inflection point where sustainability imperatives, policy dynamics, and technological strides intersect to redefine opportunity frameworks. The polymer’s innate attributes-lightweight robustness, UV resilience, and recyclability-continue to unlock value across automotive, construction, consumer goods, and specialized industrial segments. However, the specter of elevated tariffs and raw material cost variability underscores the need for agile operational models and diversified sourcing networks.

Segmentation analysis reveals that application-specific customization, whether in high-performance automotive copolymers or energy-efficient roofing membranes, will delineate market leaders from followers. Regional disparities, shaped by local regulations and infrastructure developments, demand tailored go-to-market strategies anchored in strategic partnerships and local production footprints. Furthermore, competitive positioning rests on the ability to innovate in circularity, collaboration, and digital integration, distinguishing firms that can deliver performance certainty with reduced environmental impact.

Ultimately, stakeholders who integrate circular economy principles, engage proactively in trade discussions, and harness advanced manufacturing technologies will be best positioned to capture sustained growth. By navigating these complex dynamics with foresight and strategic intent, the industry can accelerate the adoption of TPO as a cornerstone material in the global transition toward sustainable, high-performance solutions.

Take the Next Step: Engage with Ketan Rohom to Secure Comprehensive Thermoplastic Polyolefin Market Insights Tailored to Your Strategic Goals

Embrace the opportunity to transform your strategic approach in the Thermoplastic Polyolefin domain by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise in polymer markets and his deep understanding of industry dynamics will ensure you receive tailored guidance on navigating competitive challenges and capitalizing on growth avenues. By securing this comprehensive report, you will access actionable insights, detailed market analyses, and foresight into emerging trends that can inform critical investment and operational decisions. Reach out today to unlock the full potential of thermoplastic polyolefin in your business strategy and stay ahead in a rapidly evolving market landscape.

- How big is the Thermoplastic Polyolefin Market?

- What is the Thermoplastic Polyolefin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?