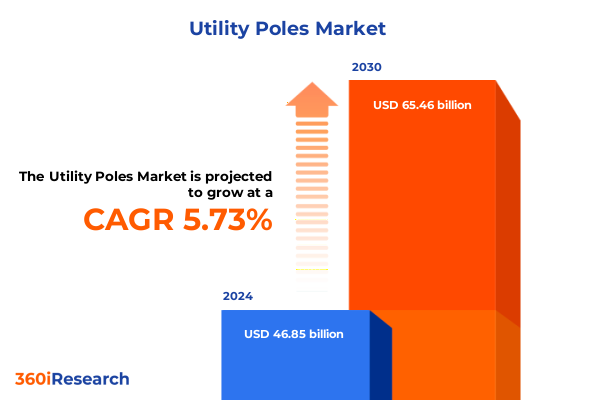

The Utility Poles Market size was estimated at USD 46.85 billion in 2024 and expected to reach USD 49.44 billion in 2025, at a CAGR of 5.73% to reach USD 65.46 billion by 2030.

An executive orientation that situates utility poles as strategic infrastructure assets shaped by resilience demands, technology integration and procurement complexity

The introduction frames why utility poles - once a straightforward commodity of timber, steel and concrete - have become a nexus of engineering, policy and commercial decision-making. Increasing demand for resilient grid infrastructure, intensified telecommunications densification and rapid adoption of digital sensing have elevated poles from passive supports to multifunction platforms that carry safety, reliability and revenue implications for utilities and municipalities. At the same time, procurement teams confront a more complex supplier landscape: diversified material choices, variable service life assumptions, and a new layer of trade and tariff exposure that affects procurement lead times and total installed costs.

This summary orients senior executives and procurement leaders around the cross-cutting forces reshaping pole strategy. It explains the competing priorities utilities now balance: maintaining reliability during extreme weather and wildfire seasons, integrating communications and sensing hardware, and managing capital programs under procurement uncertainty. The introduction also establishes the methodological approach used in this analysis - primary interviews with utility and supplier stakeholders, review of policy actions affecting steel and aluminum imports, and an assessment of observable deployment pilots and replacement programs - so readers understand the evidence base supporting subsequent recommendations.

How converging forces in materials innovation, smart integration, resilience planning and telecom densification are reshaping pole design, procurement and asset strategies

The industry is undergoing a set of transformative shifts that are simultaneously technical, commercial and regulatory. On the materials side, advances in fiber-reinforced polymers and pultrusion manufacturing have made composite poles a practical alternative in many environments, particularly where corrosion resistance, weight savings and accelerated installation matter. These material advances are not merely technical novelties; they change logistics, handling and long-term maintenance planning for utilities that deploy them at scale. At the same time, traditional materials continue to evolve: wood preservation and inventory management practices have improved, and steel and concrete producers are refining coatings and design standards to extend service life in demanding climates.

Parallel to material innovation, the function of poles is expanding. Street lighting fixtures, environmental sensors, camera systems, 5G small cells and EV charging interfaces are increasingly co-located on pole structures, converting them into multi-service assets that require new specification language, structural analysis and service agreements. These converging demands force earlier-stage coordination among capital planning, communications procurement and permitting teams, and they increase the importance of standardized, modular mounting interfaces to avoid costly retrofits. Finally, climate-driven resilience programs and grid modernization initiatives are simultaneously accelerating replacement cycles and changing prioritization criteria, so that decisions about material substitution, pole height and load capacity are now driven by a blend of asset-hardening requirements and digital platform readiness rather than by single-discipline criteria alone.

A cumulative assessment of the United States 2025 tariff measures and how they amplify material cost exposure, procurement lead times and supply chain risk across pole infrastructure projects

Policy actions in 2025 that restored and expanded tariffs on steel and aluminum have become a material factor in pole procurement and supply-chain planning. Those proclamations eliminated prior exemptions and broadened coverage to downstream derivative products relevant to pole fabrication and attachment hardware. For utilities and manufacturers that rely on externally sourced steel components or aluminum fittings, the immediate effects were sharper input cost exposure and the need to re-evaluate sourcing strategies that previously optimized for price rather than origin. The policy changes also curtailed prior exclusion processes, creating near-term uncertainty about which components would attract additional duties as tariffs were reinterpreted and implemented.

Practically, the tariffs increased the cost pressure on steel-intensive pole solutions and galvanized interest in alternatives that reduce imported content or rely on domestically available materials. They also highlighted vulnerable links in the ecosystem: transformers and other electrical equipment that depend on grain-oriented electrical steel or imported components experienced procurement slowdowns and price adjustments, and energy storage and battery supply chains faced separate tariff risks that affected developer economics. Utilities have responded with a mix of contract renegotiation, expanded supplier qualification efforts, and the acceleration of domestic sourcing strategies where feasible. These actions have mitigated some immediate disruption but have also introduced schedule risk for high-volume replacement programs and for projects that require long lead-time equipment.

Segment-driven insights tying material type, height, load capacity, coating choice, installation mode, ownership model and application requirements to procurement and engineering strategy

Segmentation insights illuminate where specification choices create leverage - or risk - for owners and installers. Material selection is the primary strategic lever: concrete, steel and wood have long operational histories and predictable life‑cycle profiles, while fiberglass and composite options change labor, lifting equipment and transportation assumptions. Within concrete, distinctions between prestressed and reinforced approaches affect handling and foundation design; within wood, species choices such as cedar, pine and redwood influence expected decay patterns and treatment requirements. Height categories shape both structural design and permitting complexity, and greater than 60‑foot assets often require transmission‑grade foundations and specialized installation crews.

Load capacity classifications - heavy, medium and light - require alignment between conductor weight, accessory loads (sensors, small cells) and future-proofing allowances for additional telecom and lighting gear. Coating options influence long‑term maintenance regimes and are particularly consequential in coastal or industrial environments where corrosion accelerates degradation. Installation context matters: new installation projects permit optimization for modern materials and embedded conduits, whereas replacement work frequently must balance minimal service interruptions against current code upgrades. Ownership models also affect procurement dynamics; private utilities may prioritize capital efficiency and flexible supplier agreements while public utilities often emphasize transparency, local economic benefits and longer procurement cycles. Finally, application-driven requirements - whether electricity transmission and distribution, signage and traffic control, street lighting, or telecommunications - determine the engineering margin required for attachments and the governance around shared‑use agreements, mounting standards and liability allocations. These segmentation lenses, used together, reveal where specification clarity reduces cost surprises and where procurement teams should demand more rigorous performance validation during vendor selection.

This comprehensive research report categorizes the Utility Poles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Height

- Load Capacity

- Coating Option

- Installation

- Application

- End Use

How regional dynamics across the Americas, Europe Middle East & Africa and Asia-Pacific create distinct procurement, regulatory and resilience priorities for pole infrastructure

Regional dynamics shape both material availability and policy exposure, and the strategic calculus varies markedly between the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, domestic timber and established wood‑pole supply chains reduce dependence on tariff‑sensitive steel and aluminum imports for many distribution applications, but transformer and battery equipment remains import‑dependent, which influences replacement scheduling and capital prioritization. North American utilities are also advancing pilot programs that accelerate replacement in high‑risk wildfire and hurricane zones and that explicitly test composite alternatives for storm resilience.

Europe, the Middle East & Africa present a complex regulatory patchwork where procurement decisions are influenced by differing sustainability standards, industrial support for local manufacturing, and urban densification priorities that favor multifunction smart poles. In many European cities, the drive to integrate 5G and public‑safety systems into streetlighting infrastructure has created a market for more modular pole bodies and shared‑use agreements between municipalities and telecom operators. Asia-Pacific shows the strongest scale effect for new installations driven by rapid urbanization and telecom densification; several markets in the region are executing aggressive smart‑pole deployments that combine lighting, communications and environmental sensing in single installs, and local manufacturers are capturing scale advantages that feed export pipelines. These regional contrasts determine where material substitution is technically feasible, where tariffs or local content rules will matter most, and where strategic sourcing should prioritize inventory buffers versus supplier diversification to reduce lead‑time risk.

This comprehensive research report examines key regions that drive the evolution of the Utility Poles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive company insights showing how legacy suppliers, composite manufacturers and technology integrators are differentiating on durability, integration and supply‑chain resilience

Competitive dynamics in the pole ecosystem are shaped by vertically integrated suppliers, specialized composite manufacturers, and a growing set of technology partners that supply sensors, communications mounts and modular luminaire interfaces. Legacy wood‑pole suppliers maintain advantages through established treatment facilities, distribution yards and emergency response inventories that support rapid replacement in storm events. Specialized composite producers differentiate with manufacturing techniques such as pultrusion and sectional designs that reduce installation equipment needs and open opportunities for pre‑embedded sensor trays and conduit runs.

Manufacturers and system integrators are investing in interoperable mounting systems and lifecycle services - warranties, structural monitoring and end‑of‑life recycling programs - that allow buyers to compare total ownership features rather than purchase price alone. Utilities and municipalities increasingly shortlist suppliers based on demonstrable field pilots, documented service life under local conditions, and the capability to support integrated telecom attachments. Where tariffs affect steel and aluminum inputs, suppliers with domestic fabrication capacity or upstream control over critical alloy components have a competitive advantage because they can offer more predictable lead times and clearer pass‑through cost mechanics. The competitive landscape is therefore driven by both technical differentiation and supply‑chain resilience capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Utility Poles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ace Pole Co. Inc. by Beach Timber Company, Inc.

- Aeron Composite Pvt. Ltd.

- Bajaj Electricals Ltd.

- Bell Lumber and Pole Company

- Dimel Ingeniería S.A

- El Sewedy Electric Company

- France Bois Imprégnés by MOULINVEST Group

- FUCHS Europoles GmbH

- Hill & Smith PLC

- Hitachi Energy Ltd.

- Iivari Mononen Oy

- India Electric Poles Manufacturing Co.

- KEC International Ltd. by Raychem RPG Private Limited

- Koppers Inc.

- Laminated Wood Systems, Inc.

- National Pole & Structure

- Nippon Concrete Industries Co., Ltd.

- Norsk Hydro ASA

- Nova Pole International Inc.

- Nucor Corporation

- Omega Company by Saleh & Abdulaziz Abahsain Co.Ltd.

- P.M.F. Machinefabriek Bergum B.V.

- Pelco Products, Inc.

- Pelco Structural, LLC

- Qingdao Wuxiao Group Co.,Ltd.

- RS Technologies Inc.

- Sabre Industries, Inc.

- Skipper Limited

- Stella-Jones Inc.

- TAPP

- Três60 Group

- V&S Schuler Utilities Group

- Valmont Industries, Inc.

- Yixing Futao Metal Component Co.,ltd.

- Yoshimoto Pole Co., Ltd.

High‑impact recommendations for utility and municipal leaders to manage specification risk, supplier exposure, contract design and pilot deployments for resilient pole portfolios

Industry leaders must adopt an active, scenario‑based approach to procurement and specification. First, redesign standard specifications so they explicitly account for modular mounting capacity and attachment live loads for future telecom and sensor additions; this reduces expensive retrofits and clarifies liability at the time of award. Second, qualify multiple suppliers across material classes and include origin‑specific bid schedules to quantify tariff exposure and permit faster substitution when duties change. Third, embed structural health monitoring pilots into replacement programs: instrument a statistically representative set of poles across species, heights and exposure classes so data-not assumption-drives replacement prioritization.

Leaders should also renegotiate supplier contracts to include flexible pricing collars or pass‑through mechanisms tied to tariff and raw material indices, and they should invest in strategic buffer inventories for long‑lead items such as transformer cores and specific fittings. Where possible, pursue joint R&D or long‑term purchase agreements with domestic fabricators to stimulate local capability while gaining preferred access to capacity during surge events. Finally, accelerate cross‑departmental governance between capital planning, telecom procurement and asset management so that pole decisions are evaluated as multifunctional investments rather than siloed line items; this governance shift materially reduces rework, avoids scope creep, and enables more predictable multi‑year budgeting.

A transparent description of data sources, stakeholder interviews, policy review and triangulation methods used to validate technical and procurement insights

The research underpinning this executive summary combined primary interviews with procurement, asset management and engineering leaders at utilities and suppliers, analysis of public procurement documents and replacement‑program disclosures, and a targeted review of policy actions affecting steel, aluminum and downstream components. Policy and tariff analysis drew on official proclamations and guidance from the administration and the Department of Commerce to ensure accurate reading of scope and effective dates; supply‑chain implications were validated through interviews and contemporaneous reporting from industry news sources. Field‑level technical claims about material behavior and installation practice were cross‑checked against utility program updates, manufacturer technical sheets and standardized inspection protocols.

To reduce bias and to triangulate findings, we prioritized primary utility disclosures and government notices where possible, and we used manufacturer and industry reporting to fill gaps about emerging materials and pilot results. This approach enabled a practical synthesis that links macro policy actions to on‑the‑ground procurement decisions and engineering tradeoffs, and it provides a defensible basis for the recommendations and segmentation insights presented earlier. Where source material reflects evolving policy (for example, tariff proclamations and exclusion processes), the analysis highlights the policy instruments and observed utility responses rather than speculative long‑term market sizing.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Utility Poles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Utility Poles Market, by Material Type

- Utility Poles Market, by Height

- Utility Poles Market, by Load Capacity

- Utility Poles Market, by Coating Option

- Utility Poles Market, by Installation

- Utility Poles Market, by Application

- Utility Poles Market, by End Use

- Utility Poles Market, by Region

- Utility Poles Market, by Group

- Utility Poles Market, by Country

- United States Utility Poles Market

- China Utility Poles Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

A strategic conclusion that synthesizes policy, material and technology trends into clear implications for procurement, resilience programs and supplier partnerships

In conclusion, the utility pole landscape is no longer a single‑axis choice among timber, steel or concrete; it is a multidimensional infrastructure decision that must balance resilience, digital readiness and procurement certainty. The tariff environment in 2025 added a new and tangible layer of supply‑chain volatility that accelerated the need for diversified sourcing, contract flexibility and more rigorous specification standards. Utilities and municipalities that act now - by embedding monitoring pilots, revising specifications for modular attachments, and expanding supplier qualification across material classes - will reduce rework, shorten procurement response times, and improve the predictability of capital programs.

The most successful organizations will treat poles as multifunctional assets: specifications, procurement and capital planning should be integrated so that telecom densification, lighting retrofits and grid‑hardening investments are evaluated in concert. Where policy or tariff exposures exist, short‑term mitigation should focus on inventory and contract design while medium‑term strategy should emphasize domestic capacity development and vendor partnerships that guarantee availability during surge events. This combined approach protects reliability while preserving optionality for technology upgrades and long‑term cost control.

Clear steps to purchase the comprehensive market research report and arrange a tailored briefing directly with Ketan Rohom for procurement and commercialization support

To access the full market research report, arrange a tailored briefing and secure the intelligence you need to adapt procurement and product strategies for the pole infrastructure lifecycle, contact Ketan Rohom to request a customized walk-through, discuss licensing options, and schedule a demo of detailed datasets and appendices that align with your technical and commercial objectives. The briefing can be scoped to emphasize material substitution risks, tariff exposure, pilot design for smart-pole rollouts, or region-specific supply chain mitigation plans so your leadership team receives actionable next steps and contract-ready language for supplier negotiations

- How big is the Utility Poles Market?

- What is the Utility Poles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?