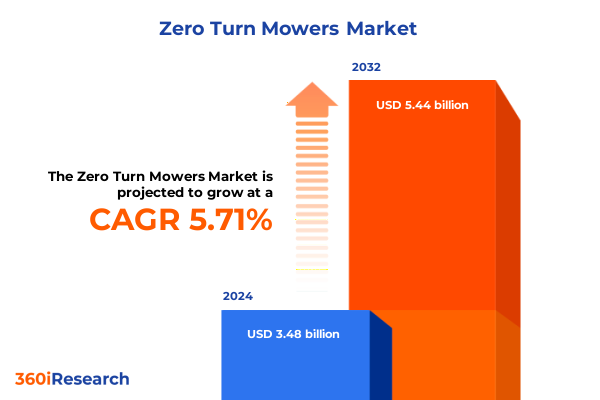

The Zero Turn Mowers Market size was estimated at USD 3.65 billion in 2025 and expected to reach USD 3.82 billion in 2026, at a CAGR of 5.86% to reach USD 5.44 billion by 2032.

Unlocking the Future of Lawn Care with Advanced Zero Turn Mower Technology and Strategic Insights to Guide Stakeholder Decisions

Unlocking the Future of Lawn Care with Advanced Zero Turn Mower Technology and Strategic Insights to Guide Stakeholder Decisions

Zero turn mowers have revolutionized the turf maintenance industry by combining agility, precision and efficiency in a single platform. Originally designed to serve the rigorous demands of commercial landscaping and golf course maintenance, these machines now cater to a growing residential segment that seeks professional-grade results without the complexity of traditional mowing systems. As adoption continues to accelerate, market participants are leveraging advancements in engine performance, deck durability and ergonomic controls to differentiate their offerings.

In this landscape of rapid innovation, decision makers require a clear understanding of the factors driving growth, the strategic shifts reshaping competitive dynamics and the operational challenges that lie ahead. By synthesizing primary interviews with OEM executives, secondary analysis of supply chain data and rigorous triangulation with proprietary quantitative models, this summary presents a holistic view of the zero turn mower market. Through granular segmentation and regional analysis, it illuminates where untapped opportunities exist and how stakeholders can refine product roadmaps, optimize distribution strategies and anticipate regulatory impacts. Ultimately, this introduction lays the foundation for an actionable framework that empowers industry leaders to capitalize on evolving customer demands and emerging technological trends.

Navigating the Wave of Electrification, Autonomy and Connectivity Transforming the Zero Turn Mower Industry with Unprecedented Operational Efficiency Gains

Navigating the Wave of Electrification, Autonomy and Connectivity Transforming the Zero Turn Mower Industry with Unprecedented Operational Efficiency Gains

The zero turn mower market is undergoing a period of profound transformation fueled by technological breakthroughs that transcend traditional mechanical enhancements. Electrification has emerged as a pivotal trend, as OEMs invest in battery chemistry innovations and modular powertrain architectures to deliver emission-free operation without compromising runtime. Concurrently, autonomous navigation systems are being integrated to support repetitive mowing tasks, reducing labor costs and mitigating operator fatigue. These self-driving prototypes, often bolstered by GPS mapping and LiDAR sensors, foreshadow a future where fully autonomous mowing fleets could become standard in large-scale turf management.

Moreover, the integration of telematics and IoT-enabled diagnostics is redefining maintenance paradigms. Real-time performance monitoring and predictive analytics not only minimize unplanned downtime but also extend equipment lifecycles through condition-based servicing. Complementary advancements in lightweight composites and corrosion-resistant coatings are enhancing deck longevity, while ergonomic seat suspension systems are improving operator comfort during extended use. Together, these developments are converging to create a new generation of zero turn mowers that offer superior precision, lower total cost of ownership and seamless digital connectivity.

Assessing the Ripple Effects of 2025 United States Tariff Measures on Zero Turn Mower Cost Structures, Supply Chains and Pricing Dynamics

Assessing the Ripple Effects of 2025 United States Tariff Measures on Zero Turn Mower Cost Structures, Supply Chains and Pricing Dynamics

The implementation of tariffs on imported steel, aluminum and certain engine components in early 2025 has significantly altered the cost calculus for zero turn mower manufacturers. As duty rates on critical sheet metal and powertrain parts climbed, OEMs confronted pressure to absorb higher input expenditures or pass them through to end users. In response, some producers accelerated reshoring initiatives, establishing localized stamping and subassembly facilities to mitigate exposure to volatile trade policies.

Nevertheless, reshoring introduces its own complexities, including capital investment requirements and certification timelines for new production lines. To balance these factors, industry participants have pursued collaborative partnerships with domestic suppliers, negotiating long-term purchase agreements and volume-based rebates. Simultaneously, pricing strategies have been recalibrated through tiered discount programs and bundled promotions, aiming to preserve volume growth while offsetting margin compression. Looking ahead, the dynamic interplay between trade policy, supply chain agility and pricing elasticity will remain a critical determinant of competitive differentiation.

Unveiling Comprehensive Segmentation Profiles Revealing End User, Deck Size, Engine Power, Fuel Preferences, Drive Mechanisms and Sales Channel Variations

Unveiling Comprehensive Segmentation Profiles Revealing End User, Deck Size, Engine Power, Fuel Preferences, Drive Mechanisms and Sales Channel Variations

A nuanced understanding of end user dynamics highlights that commercial customers encompass golf courses, landscaping services and municipal parks departments, each valuing reliability and uptime in high-use scenarios. Residential buyers, by contrast, prioritize ease of use and minimal maintenance, driving demand for models with automated deck levelling and intuitive control layouts. These distinct purchase criteria inform product design, warranty structures and service offerings tailored to professional crews versus homeowner enthusiasts.

Deck size segmentation further delineates operational capabilities. Units with 43 to 54 inch mowing widths strike a balance between maneuverability and coverage efficiency, appealing to both compact commercial sites and upscale residential lawns. Models above 54 inch are favored by large-scale operators requiring rapid area clearance, while up to 42 inch decks remain popular among budget-conscious homeowners and tight-space applications. Engine power classifications-ranging from up to 20 horsepower through mid-range 21 to 25 horsepower and extending to above 25 horsepower-correlate closely with deck width, influencing cutting performance on varied grass densities and terrain grades.

Fuel type preferences segregate diesel, electric and gasoline drivetrains. Diesel variants dominate in demanding commercial settings for their torque and fuel economy, while gasoline engines retain widespread appeal in the residential segment due to lower upfront costs and simpler fueling infrastructure. Electric mowers are gaining traction as battery energy density improves, offering zero-emission operation and silent performance ideal for noise-sensitive environments. Drive type considerations between hydrostatic and mechanical transmissions manifest in operator control. Hydrostatic systems deliver stepless speed variation and smooth directional changes, suiting high-precision applications, whereas mechanical drive trains remain cost-effective for entry-level models.

Finally, sales channel evolution underscores the coexistence of offline and online distribution pathways. Offline channels include dealer networks and specialty stores, which provide hands-on demonstrations, service contracts and financing options. Online channels comprise manufacturer websites and third-party retailers, where digital configurators, virtual reality demos and expedited shipping meet the purchasing habits of tech-savvy buyers. The interplay among these channels shapes promotional strategies, brand loyalty initiatives and after-sales support frameworks.

This comprehensive research report categorizes the Zero Turn Mowers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End User

- Deck Size

- Engine Power

- Fuel Type

- Drive Type

- Sales Channel

Mapping Strategic Regional Dynamics Across The Americas, Europe Middle East Africa And Asia Pacific To Identify Growth Drivers And Adoption Trends

Mapping Strategic Regional Dynamics Across The Americas, Europe Middle East Africa And Asia Pacific To Identify Growth Drivers And Adoption Trends

In the Americas, legacy markets in North America remain the principal growth engine, driven by robust infrastructure spending and a deeply entrenched commercial landscaping sector. High disposable incomes and homeowner focus on outdoor living spaces have spurred residential adoption of premium zero turn models. Latin American nations are emerging as new frontiers, with urbanization trends and golf tourism investments fostering demand for midsize commercial units and entry-level residential variants.

Europe, the Middle East and Africa exhibit a mosaic of regulatory landscapes and customer preferences. Western European markets emphasize stringent emissions standards and noise regulations, catalyzing a shift toward electric and battery-hybrid offerings. The Middle East’s resort and real estate developments create niche demand for specialized desert-adapted mowing platforms, while African municipalities prioritize cost-effective, rugged mechanical transmission models that can withstand minimal maintenance regimes.

In Asia Pacific, rapid urban expansion and government-led green space initiatives have bolstered procurement of lawn care machinery. Australia and Japan show early enthusiasm for autonomous mowing trials and telematics-enabled service contracts, whereas emerging Southeast Asian economies are still consolidating distribution networks to introduce mid-range displacement gasoline models. Across the region, the interplay between infrastructure financing, environmental mandates and digital connectivity is shaping a diverse trajectory for zero turn mower adoption.

This comprehensive research report examines key regions that drive the evolution of the Zero Turn Mowers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Leadership And Innovation Pathways Of Key Market Players Driving Competitive Positioning And Strategic Partnerships In The Zero Turn Mower Sector

Illuminating Leadership And Innovation Pathways Of Key Market Players Driving Competitive Positioning And Strategic Partnerships In The Zero Turn Mower Sector

The competitive arena is defined by a mix of established OEMs and disruptive challengers advancing differentiated value propositions. Leading industrial machinery conglomerates continue to leverage economies of scale in engine manufacturing, deck fabrication and dealer support networks, while specialized entrants capitalize on niche innovations such as swappable battery packs and AI-driven cutting algorithms. Strategic alliances between component suppliers and OEMs are emerging, promoting co-development of integrated powertrain modules and reducing time-to-market for next-generation models.

In parallel, several companies are investing heavily in digital platforms that aggregate operational data from customer fleets. By offering subscription-based analytics services, these players transform traditional equipment sales into ongoing revenue streams tied to uptime guarantees and performance benchmarks. Mergers and acquisitions are reshaping the competitive landscape, as multinational firms acquire smaller technology-focused startups to fast-track their autonomy roadmaps. Furthermore, aftermarket service providers are broadening their portfolios to include firmware upgrades and remote diagnostics, reinforcing barriers to entry for greenfield competitors and cementing loyalty among professional end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Zero Turn Mowers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altoz

- ANDREAS STIHL AG & Co. KG

- Ariens Company

- Bobcat Company by Doosan Infracore

- Country Clipper by Shivvers Manufacturing

- Cub Cadet by Stanley Black and Decker

- Husqvarna

- Hustler Turf

- John Deere Gmbh & Co

- Just lawnmowers by Calgary just companies ltd

- Mean Green Products by Generac Power Systems, Inc

- Ryobi by TTI Consumer Power Tools, Inc

- SLE equipment

- The Toro company

Charting High Impact Action Plans And Strategic Imperatives To Equip Industry Leaders For Sustainable Growth And Competitive Advantage In Lawn Equipment Markets

Charting High Impact Action Plans And Strategic Imperatives To Equip Industry Leaders For Sustainable Growth And Competitive Advantage In Lawn Equipment Markets

Industry leaders should prioritize investment in modular electric powertrain architectures that can be scaled across multiple deck sizes and performance tiers, ensuring rapid response to tightening emissions regulations and evolving customer expectations. Concurrently, forging co-development partnerships with advanced materials suppliers will accelerate the deployment of lightweight composite decks, reducing fuel consumption and improving corrosion resistance without sacrificing structural integrity. To maintain pricing discipline in light of fluctuating tariff exposures, executives must establish contingency plans for dual-sourcing critical components and negotiate flexible volume commitments with both domestic and international vendors.

Digital engagement strategies are equally vital. Developing integrated telematics platforms that offer remote diagnostics, usage tracking and predictive maintenance alerts will not only strengthen after-sales relationships but also generate recurring revenue streams. Sales channel optimization should involve deepening dealer training programs to emphasize new technology adoption while enhancing online configurator tools to guide purchase decisions with real-time customization previews. Finally, pilot initiatives for autonomous mowing demonstrations with marquee commercial clients can validate value propositions, generate reference cases and accelerate broader market acceptance of next-generation equipment.

Detailing Rigorous Mixed Method Research Design Methodology Incorporating Primary Stakeholder Engagement And Robust Data Triangulation Processes

Detailing Rigorous Mixed Method Research Design Methodology Incorporating Primary Stakeholder Engagement And Robust Data Triangulation Processes

The research underpinning this analysis blends primary and secondary approaches to ensure depth, accuracy and relevance. Primary insights were obtained through structured interviews with senior executives across OEMs, Tier 1 material suppliers and leading landscaping service providers, capturing firsthand perspectives on technology adoption, procurement criteria and operational challenges. Complementary quantitative data was gathered via online surveys targeting end users in both commercial and residential segments, validating qualitative findings and enabling cross-segmentation comparisons.

Secondary research draws on trade association reports, government publications and patent filings to contextualize market dynamics within regulatory and innovation frameworks. Financial disclosures and corporate presentations were systematically reviewed to assess strategic investments and performance trends. A data triangulation process aligned disparate sources, while statistical modeling techniques quantified the relative impact of key drivers such as tariff changes, fleet electrification rates and regional infrastructure spending. Internal validation workshops were conducted with subject matter experts to refine assumptions and ensure the findings reflect the current state of the zero turn mower ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Zero Turn Mowers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Zero Turn Mowers Market, by End User

- Zero Turn Mowers Market, by Deck Size

- Zero Turn Mowers Market, by Engine Power

- Zero Turn Mowers Market, by Fuel Type

- Zero Turn Mowers Market, by Drive Type

- Zero Turn Mowers Market, by Sales Channel

- Zero Turn Mowers Market, by Region

- Zero Turn Mowers Market, by Group

- Zero Turn Mowers Market, by Country

- United States Zero Turn Mowers Market

- China Zero Turn Mowers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Market Takeaways And Strategic Imperatives To Empower Decision Makers With A Clear Path Forward In The Evolving Zero Turn Mower Industry

Synthesizing Key Market Takeaways And Strategic Imperatives To Empower Decision Makers With A Clear Path Forward In The Evolving Zero Turn Mower Industry

This comprehensive analysis underscores that the zero turn mower market is at a crossroads where technology, regulation and customer expectations converge to redefine value propositions. Electrification and autonomy are not distant trends but immediate imperatives, and their successful integration will hinge on collaborative ecosystems that bridge OEMs, component innovators and service providers. Equally, the agility to adapt to tariff-induced supply chain shifts will differentiate market leaders able to maintain competitive pricing and product availability.

Critical segmentation insights reveal that tailoring offers to the divergent needs of commercial and residential end users, optimizing deck and powertrain combinations, and selecting the most effective distribution channels are all essential to unlocking growth. Regional dynamics further illustrate that one-size-fits-all strategies are insufficient, and that customized approaches must be developed for mature North American and European markets, as well as the rapidly developing Asia Pacific and Latin American arenas. By embracing the actionable recommendations outlined herein, organizations can position themselves to seize emerging opportunities, mitigate systemic risks and achieve sustained market leadership.

Connect With Ketan Rohom To Secure Your Comprehensive Zero Turn Mower Market Research Report And Gain A Competitive Edge Today

To obtain full access to the in-depth analysis, proprietary data and actionable insights that empower market leaders to navigate an increasingly competitive landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. With a proven track record of guiding organizations through complex procurement processes, Ketan can facilitate your acquisition of the comprehensive zero turn mower market research report tailored to your strategic needs. Engage today to unlock a wealth of intelligence on emerging trends, competitive positioning and future growth catalysts that will help you secure a decisive advantage in the marketplace.

- How big is the Zero Turn Mowers Market?

- What is the Zero Turn Mowers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?