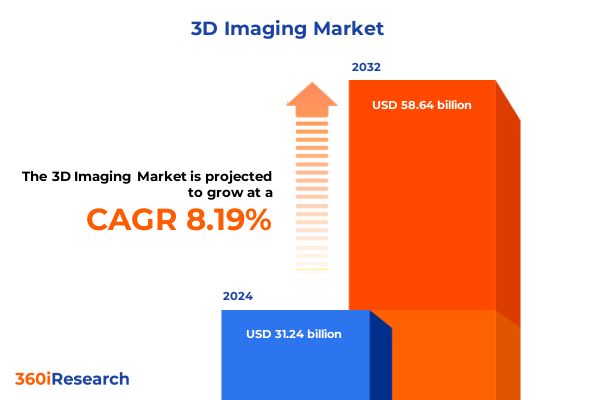

The 3D Imaging Market size was estimated at USD 32.85 billion in 2025 and expected to reach USD 34.55 billion in 2026, at a CAGR of 8.62% to reach USD 58.64 billion by 2032.

Exploring the Transformative Potential of Next Generation Three Dimensional Imaging Technologies in Diverse Industrial and Commercial Contexts

Over the past decade, the evolution of three dimensional imaging has shifted from niche laboratory experiments to a cornerstone technology for industrial, commercial, and research applications. Early iterations were hampered by high costs, bulky equipment, and limited processing capability. However, recent advances in sensor miniaturization, computing power, and algorithmic efficiency have ushered in a new era of accessible, high‐fidelity spatial data capture. Leading sectors such as manufacturing, healthcare, and automotive have rapidly integrated these tools to drive innovation and streamline workflows, establishing three dimensional imaging as a strategic asset rather than a peripheral novelty.

This dynamic progression is underpinned by a maturation of use cases. In aerospace and defense, high‐precision scanners facilitate maintenance and reverse engineering of critical components, bolstering safety and reducing downtime. Within consumer electronics, manufacturers leverage structured light and time of flight technologies to embed facial recognition and gesture‐based control in next generation devices. The medical field has seen widespread adoption of photogrammetry and stereovision for surgical planning, prosthetic design, and diagnostics, translating volumetric insights into tangible patient outcomes. Concurrently, digital twins and virtual prototyping are revolutionizing product development, enabling iterative design validation in a virtual environment prior to physical fabrication.

Transitional forces such as democratized access to cloud computing, open source modeling toolkits, and cross‐disciplinary collaboration are reshaping the competitive landscape. As organizations grapple with growing data volumes, the ability to efficiently extract actionable intelligence from point clouds and volumetric datasets has become paramount. This has catalyzed demand for integrated hardware–software solutions, driving convergence among former stand‐alone vendors and prompting a wave of strategic partnerships. Consequently, decision‐makers must now navigate a rapidly diversifying ecosystem where agility, interoperability, and data security define long‐term success.

Unprecedented Paradigm Shifts in Three Dimensional Imaging Driven by Artificial Intelligence and Edge Computing Innovations

The three dimensional imaging domain is undergoing unprecedented paradigm shifts driven by breakthroughs in artificial intelligence, edge computing, and materials science. Machine learning algorithms, particularly deep neural networks, are now routinely applied to automate the segmentation and classification of point clouds, yielding insights with minimal human intervention. By embedding inference capabilities directly on device through AI accelerators, real‐time 3D reconstruction and object recognition have transitioned from research labs to factory floors, enabling closed‐loop quality control and autonomous robotic guidance with near‐zero latency.

Simultaneously, innovations in edge computing are decentralizing data processing workflows. Historically, high‐density scan data required off‐site processing centers, introducing latency and security concerns. Today’s modular architectures support on-premises analytics nodes that execute complex reconstruction and visualization algorithms locally, preserving sensitive data and accelerating decision cycles. Complementing this, cloud platforms offer elastic resources for large‐scale simulations and model training, allowing enterprises to synchronize real‐time edge insights with long-term data trends and cross-site benchmarking.

Advances in materials engineering have also contributed to transformative device design, with novel sensor substrates enhancing sensitivity and spectral range. These developments are driving a progressive blurring of lines between hardware, software, and services; solution providers are bundling consulting, installation, and training into unified offerings that ensure rapid deployment and user proficiency. As a result, end users are experiencing a seamless continuum from data acquisition through analysis and visualization, fundamentally redefining the value proposition of three dimensional imaging in both established and emerging markets.

Assessing the Far Reaching Consequences of Recent United States Trade Measures on the Three Dimensional Imaging Supply Chain

In early 2025, the United States implemented an expansion of Section 301 tariffs, increasing duties on a broad range of imaging sensors, photonics equipment, and precision components imported from select international suppliers. These measures, aimed at reshoring critical technology supply chains, have introduced incremental cost pressures across hardware portfolios. Manufacturers reliant on specialized cameras, laser scanners, and advanced processors have faced duty hikes averaging 15 to 25 percent, directly affecting procurement budgets and equipment pricing strategies.

The cumulative impact of these trade measures has been multifaceted. Component manufacturers have responded by adjusting their global sourcing footprints, shifting orders toward alternative low‐tariff jurisdictions or domestic suppliers where possible. However, the nascent scale of local 3D sensor production has limited immediate substitution, compelling several original equipment manufacturers to absorb margin compression or pass through higher costs to end customers. This dynamic has led to a degree of market consolidation, as smaller players struggle to maintain competitive pricing in the face of accelerated overheads and elongated lead times.

Despite these challenges, proactive organizations have leveraged the tariff environment as a catalyst for supply chain innovation. By increasing pre‐tariff inventory buffers, forging joint ventures with regional component fabricators, and exploring hybrid deployment models that combine portable and stationary solutions, industry leaders are mitigating exposure to future trade volatility. Moreover, heightened regulatory scrutiny has amplified the importance of compliance and risk mitigation, prompting companies to enhance traceability protocols and engage in more granular cost‐plus accounting practices to preserve profitability in volatile markets.

Comprehensive Insights into Market Segmentation Revealing Component Technology End User Application and Deployment Dynamics

An in‐depth examination of market segmentation provides indispensable clarity into how the three dimensional imaging ecosystem is organized and where value is concentrated. From the foundational perspective of component classification, the hardware segment spans cameras, laser scanners, processors, and sensors-each contributing distinct capabilities to capture volumetric data. Meanwhile, services encompass the critical advisory, installation, maintenance, and training functions that ensure optimal system performance, and software offerings range from data analysis and modeling to reconstruction and visualization platforms that transform raw input into actionable output.

Layering in the technology classification, the market comprises modalities such as laser triangulation, photogrammetry, stereovision, structured light, and time of flight. Laser triangulation further subdivides into two dimensional and three dimensional implementations, while structured light solutions differentiate between near infrared and visible light approaches. These technical nuances directly influence factors such as accuracy, environmental robustness, and deployment flexibility.

From an end-user standpoint, aerospace and defense, automotive, consumer electronics, healthcare, and manufacturing represent the primary demand centers. Within the automotive sector, distinctions emerge between aftermarket services and original equipment manufacturing, and within healthcare, specialized applications in dental care, medical imaging, and orthopedics have distinct regulatory and integration requirements. On the application front, the spectrum ranges from 3D printing and prototyping to inspection and quality control-both inline and offline-metrology, modeling and simulation, and various scanning modalities including body, dental, desktop, and industrial scanning. Finally, deployment scenarios bifurcate into portable and stationary configurations, reflecting trade-offs between mobility and throughput. By appreciating these layered segments, stakeholders can target investment, R&D, and go-to-market strategies with precision to address the unique drivers and constraints within each domain.

This comprehensive research report categorizes the 3D Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Deployment

- Application

- End User

Regionally Distinct Patterns Shaping the Adoption and Evolution of Three Dimensional Imaging Solutions Across Global Markets

Regional analysis reveals distinct patterns in the pace and character of three dimensional imaging adoption. In the Americas, the United States leads with a robust ecosystem of hardware manufacturers, software innovators, and service integrators. Early movers in automotive and aerospace have established best practices for digital twin creation and automated inspection, fostering an environment where U.S. research institutions and startups collaborate to push boundary innovations. Canada contributes through niche expertise in medical imaging and remote sensing, while Latin America is gaining traction with cost-effective portable scanning systems for mining and cultural heritage preservation.

Across Europe, the Middle East, and Africa, the emphasis is on integrated Industry 4.0 deployments within established manufacturing hubs. Germany, France, and Italy are driving investments in structured light and stereovision for high-precision metrology, supported by government initiatives to bolster industrial competitiveness. In the Middle East, infrastructure projects are incorporating terrestrial laser scanning for large-scale civil engineering, while Africa is witnessing pilot programs aimed at healthcare applications and conservation through photogrammetry.

In the Asia-Pacific region, diverse market dynamics prevail. China has rapidly scaled domestic production of sensors and software solutions, challenging traditional suppliers and accelerating price competition. Japan and South Korea continue to refine high-accuracy systems for semiconductor lithography and automotive assembly, whereas India is emerging as a hub for low-cost scanning solutions targeting the construction and retail sectors. This regional mosaic underscores the importance of tailoring strategies to local innovation cycles, regulatory environments, and end-user priorities.

This comprehensive research report examines key regions that drive the evolution of the 3D Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles and Competitive Landscape Analysis of Leading Enterprises Shaping Three Dimensional Imaging Advancements

A focused assessment of leading companies illuminates the competitive forces at work in the three dimensional imaging sector. Certain hardware specialists have solidified dominance in metrology and industrial scanning, leveraging decades of experience to deliver sub-micron accuracy and high throughput. In parallel, software pioneers are intensifying efforts to integrate artificial intelligence and augmented reality, enabling users to derive richer insights from complex datasets and overlay digital models onto physical environments.

Mid-sized players are differentiating through niche offerings, such as compact, portable scanners optimized for field service and rapid prototyping, while larger conglomerates are expanding through strategic acquisitions that bridge hardware, software, and services capabilities. Collaborative partnerships between technology leaders and academic institutions are accelerating validation cycles for emerging applications, from biometric authentication to autonomous navigation. This confluence of competition and cooperation is catalyzing a wave of platform consolidation, where end-to-end solutions become increasingly prevalent, and standalone component vendors must align more closely with integrated system providers.

End users can leverage these evolving company strategies as a barometer for selecting partners that align with their long-term innovation roadmaps. By examining the product roadmaps, support networks, and global footprints of key suppliers, organizations can identify collaborators capable of sustaining digital imaging initiatives at scale. In turn, vendors that prioritize modular architectures, open interfaces, and service excellence are positioned to capture greater mindshare and foster enduring customer relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Canon Medical Systems Corporation

- Cognex Corporation

- Dassault Systèmes

- Esaote SpA

- Fujifilm Holdings Corporation

- GE HealthCare Technologies LLC

- Hitachi, Ltd.

- HP Inc

- Koninklijke Philips N.V.

- Samsung Medison Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shimadzu Corporation

- Siemens Healthineers AG

Actionable Strategies to Enhance Competitive Advantage and Drive Sustainable Growth in the Three Dimensional Imaging Industry

Industry leaders seeking to capitalize on the accelerating momentum of three dimensional imaging must adopt a multifaceted approach that balances short-term agility with long-term strategic investments. First, enterprises should prioritize the integration of advanced analytics and AI capabilities across the imaging pipeline, ensuring that data is not merely captured but also contextualized and predictive. By embedding machine learning frameworks and leveraging cloud-native architectures, organizations can unlock new levels of automation and real-time decision-support.

Simultaneously, supply chain resilience must be reinforced through diversified sourcing strategies and strategic alliances with regional component manufacturers. Cultivating forward-looking partnerships can mitigate exposure to trade policy shifts and logistical disruptions, while collaborative research agreements with academic entities and technology incubators can accelerate the development of next-generation sensor materials and processing techniques.

Moreover, expanding end-user engagement through value-added services such as customized training programs, subscription-based software licensing, and outcome-oriented maintenance contracts will enhance customer loyalty and foster recurring revenue streams. Companies should also explore targeted M&A opportunities to acquire complementary capabilities-particularly in software, AI, and cloud orchestration-to assemble comprehensive solutions that address evolving market demands. By executing these recommendations in concert, decision-makers can secure a competitive edge and drive sustained growth in a rapidly evolving technological landscape.

Robust Research Framework Employing Multimethod Data Collection and Analysis for Authoritative Three Dimensional Imaging Insights

This study employs a rigorous, multimethod research design to ensure authoritative coverage of the three dimensional imaging market. Primary research included in-depth interviews with senior executives from leading hardware manufacturers, software developers, and service providers, as well as consultations with end-user organizations across aerospace, healthcare, and automotive sectors. These insights were complemented by structured surveys of technology integrators and field service specialists to validate key trends and assess adoption barriers.

Secondary research encompassed an exhaustive review of technical white papers, patent filings, and peer-reviewed journals, along with analysis of relevant regulatory documents and standards frameworks. Market segmentation frameworks were developed to reflect five principal dimensions: component, technology, end user, application, and deployment. Data triangulation techniques were applied to reconcile divergences between public disclosures, proprietary data streams, and expert projections.

All findings were subjected to stringent quality assurance protocols, including cross-validation by an independent panel of subject-matter experts. Statistical checks and peer reviews ensured consistency, while periodic updates captured the latest innovations and policy shifts through mid‐2025. This structured methodology delivers a comprehensive perspective designed to support strategic investments and technology road-mapping in the three dimensional imaging domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Imaging Market, by Component

- 3D Imaging Market, by Technology

- 3D Imaging Market, by Deployment

- 3D Imaging Market, by Application

- 3D Imaging Market, by End User

- 3D Imaging Market, by Region

- 3D Imaging Market, by Group

- 3D Imaging Market, by Country

- United States 3D Imaging Market

- China 3D Imaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Distilling Key Findings to Clarify Strategic Imperatives and Future Opportunities in the Three Dimensional Imaging Ecosystem

In summarizing the key takeaways, it is evident that three dimensional imaging stands at the confluence of technological innovation, evolving regulatory landscapes, and diverse application demands. The integration of artificial intelligence, coupled with advancements in sensor materials and edge computing, is driving unprecedented capabilities in real-time reconstruction and data interpretation. Meanwhile, trade policies have reshaped supply chain strategies, compelling stakeholders to adopt more resilient sourcing models and enhance operational flexibility.

The market segmentation analysis underscores the importance of granular focus, as each component, technology modality, end-user sector, application domain, and deployment scenario presents unique drivers and barriers. Regional variations further complicate the competitive landscape, with different growth trajectories and investment priorities across the Americas, Europe, Middle East, Africa, and Asia-Pacific. Companies that align their product roadmaps and service offerings to these nuanced market dynamics are best positioned to capture emerging opportunities.

Ultimately, success in this fast-evolving ecosystem requires an integrated approach that combines technological leadership, strategic partnerships, and customer-centric service models. By leveraging the insights presented in this study, organizations can chart a path forward that maximizes ROI, mitigates risk, and fosters sustainable innovation in three dimensional imaging.

Engage with Our Market Research Authority to Secure Comprehensive Three Dimensional Imaging Intelligence for Informed Decision Making

For a comprehensive and data‐driven exploration of current trends and future trajectories in the three dimensional imaging market, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan ensures personalized guidance on how this in‐depth report can support your strategic objectives and competitive positioning. Reach out to schedule a detailed briefing or secure your copy of the research to gain exclusive insights that empower confident, forward‐looking decisions in this dynamically evolving industry

- How big is the 3D Imaging Market?

- What is the 3D Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?