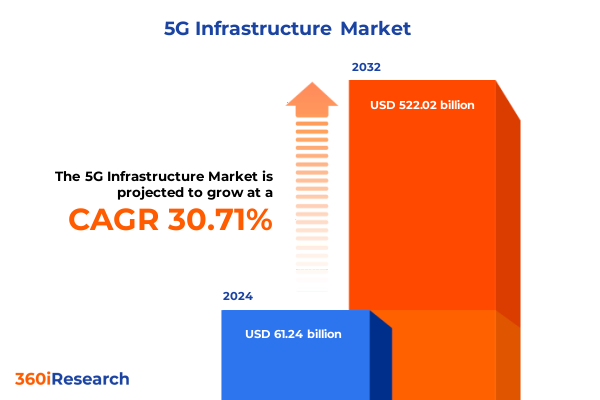

The 5G Infrastructure Market size was estimated at USD 80.28 billion in 2025 and expected to reach USD 101.22 billion in 2026, at a CAGR of 30.66% to reach USD 522.02 billion by 2032.

Unveiling Strategic Imperatives That Will Drive 5G Infrastructure Development Amid Rapid Technological Convergence and Industry Evolution

The acceleration of 5G infrastructure deployment is reshaping the telecommunications landscape at an unprecedented pace, demanding that stakeholders align their strategic roadmaps with evolving technological imperatives and operational realities. As network operators and equipment vendors navigate an increasingly complex ecosystem, the interplay of advanced antenna systems, baseband processing units, and evolving spectrum allocations underscores the need for a holistic understanding of service orchestration, security integration, and software-driven network management solutions. This executive summary provides a foundational overview of these dynamics, establishing context for deeper analysis of regulatory shifts, segmentation patterns, and competitive positioning.

In an era marked by heightened demand for ultra-low latency applications, network slicing capabilities, and scalable small cell deployments, industry decision makers must grasp how hardware modularity interlinks with service portfolios and software intelligence to deliver differentiated value. The convergence of professional services and managed offerings ensures that operators can optimize deployment timelines while maintaining rigorous performance and security benchmarks. Moreover, as spectrum availability expands across millimeter wave bands and sub-6 gigahertz allocations, strategic planning becomes essential to capitalize on capacity gains and coverage objectives. By framing the current environment and outlining forthcoming transformations, this introduction sets the stage for a comprehensive exploration of the critical forces shaping 5G infrastructure development.

Navigating Transformative Shifts in Network Architecture User Demand and Spectrum Utilization Redefining the 5G Landscape for Tomorrow’s Connectivity

The 5G landscape has entered a phase of transformative shifts driven by the evolution of network architecture, spectrum utilization, and end user demand patterns. Operators are transitioning from monolithic base station models to disaggregated architectures that combine centralized baseband units with distributed radio units and small cell clusters. This shift enhances deployment flexibility and supports dynamic traffic management through network orchestration platforms. Meanwhile, the rapid commercialization of network slicing has empowered enterprise verticals by delivering bespoke connectivity profiles tailored to industrial automation, remote healthcare diagnostics, and autonomous vehicle operations, signaling a departure from one-size-fits-all network constructs.

Simultaneously, spectrum strategy has emerged as a critical competitive differentiator. The allocation of millimeter wave bands in the 24 to 39 gigahertz range has unlocked unparalleled throughput capabilities for urban hotspots, while above-39 gigahertz assignments are being evaluated for backhaul and fixed wireless access use cases. At the same time, sub-6 gigahertz frequencies continue to deliver broad coverage across low-band and mid-band segments, reinforcing network reliability in suburban and rural deployments. Amplifying these technical trends is a surge in multimedia traffic driven by immersive applications, cloud gaming, and ultra-high-definition streaming, which has prompted network planners to adopt AI-powered traffic forecasting tools and adopt edge compute nodes. Collectively, these shifts are redefining both the operational paradigm for service providers and the value proposition for enterprise adopters.

Assessing the Broad Economic and Operational Impact of United States Tariff Measures on 5G Infrastructure Supply Chains and Deployment Costs

The introduction of new tariff measures by the United States in 2025 has injected uncertainty into 5G infrastructure supply chains, compelling vendors and operators to reassess supplier relationships, production footprints, and procurement strategies. Key components such as transport equipment, radio units, and small cell hardware have been subject to elevated duties, driving a reconfiguration of sourcing plans toward alternative markets and intensifying negotiations over pricing and contractual terms. As a result, infrastructure vendors have accelerated efforts to onshore select manufacturing stages and diversify component procurement to mitigate exposure to volatility.

From an operational standpoint, elevated costs have propagated through managed and professional service engagements, leading to recalibrated project timelines and updated total cost of ownership calculations. The combined impact of increased import duties and currency fluctuations has spurred network operators to adopt modular build-out approaches, stagger capital expenditures, and pursue multi-vendor sourcing strategies. Further, software licenses for network management, OSS/BSS platforms, and specialized security solutions have faced indirect cost pressures as equipment bill-of-materials and maintenance contracts are renegotiated. While tariffs have introduced short-term headwinds, they have also catalyzed supply chain resilience initiatives and fostered collaborative agreements between regional manufacturing partners and global technology providers to ensure continuity of critical 5G build-outs.

Deriving Actionable Insights from Component Spectrum End User and Channel Segmentation to Optimize 5G Infrastructure Market Engagement Strategies

A nuanced segmentation analysis unveils distinct patterns of adoption and investment across the 5G infrastructure ecosystem. Within the component dimension, hardware remains the backbone of network roll-out, with antenna systems and baseband units commanding intensive R&D and capacity expansion. At the same time, professional services complement a growing managed services landscape that supports real-time monitoring and predictive maintenance. On the software front, network management platforms, OSS/BSS solutions, and integrated security offerings have become indispensable for end-to-end orchestration and the safeguarding of network integrity against rising cybersecurity threats.

Shifting to the spectrum perspective, millimeter wave frequencies spanning the 24 to 39 gigahertz range have garnered significant attention for high-density urban deployments, whereas above-39 gigahertz assignments are being piloted for fixed wireless access pilots and private network trials. Conversely, sub-6 gigahertz assets continue to anchor wide-area coverage, with low-band deployments delivering reliable reach to remote regions and mid-band allocations striking a balance between capacity and coverage. End user verticals reveal that automotive players are leveraging 5G for connected vehicle initiatives, while the BFSI sector pursues enhanced security and low-latency transaction processing. Healthcare institutions explore remote surgery and patient monitoring solutions, and telecom operators focus on network slicing to address enterprise demand.

The channel segmentation dimension illustrates that direct engagement models prevail for large-scale operator deals, yet indirect channels such as distributors and systems integrators maintain crucial roles in enabling rapid deployments among regional service providers and niche vertical applications. These differentiated pathways underscore the importance of partner ecosystems in bridging technical expertise, local market knowledge, and integrated solution offerings to realize the full potential of 5G infrastructure investments.

This comprehensive research report categorizes the 5G Infrastructure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Spectrum

- End User

Uncovering Regional Nuances and Growth Dynamics across the Americas EMEA and Asia-Pacific Offering a Comprehensive Lens on 5G Adoption Drivers

Regional dynamics within the global 5G infrastructure market highlight varied trajectories shaped by economic conditions, regulatory frameworks, and technology adoption rates. In the Americas, supportive government policies and early spectrum auctions have enabled progressive deployments of both high-band and mid-band networks, driving substantial investment from both established telecom incumbents and disruptive private network entrants. Cross-border collaborations, particularly in North America, have accelerated the roll-out of open radio access network architectures and fostered a burgeoning ecosystem of software and hardware innovators.

Conversely, the Europe, Middle East & Africa region grapples with regulatory fragmentation and spectrum licensing variability, yet it benefits from robust public-private partnerships and a strong focus on industry verticals such as manufacturing and logistics. Initiatives to harmonize sub-6 gigahertz bands and pilot mmWave deployments in major metropolitan areas are underway, while the Middle East advances large-scale 5G tenders to support smart city and energy sector applications. Africa’s emphasis on affordable connectivity has driven innovative small cell and transport solutions tailored to resource-constrained environments.

Meanwhile, the Asia-Pacific region exemplifies a high-velocity approach to 5G adoption, underpinned by dense urbanization, proactive digital economy strategies, and leading infrastructure innovations. National champions and regional carriers are investing heavily in both public network expansions and private network trials for industrial automation, smart ports, and retail analytics. Collaborative research programs and large-scale testbeds in major economies showcase the region’s commitment to marrying high-bandwidth capacities with next-generation use cases, reinforcing its position at the forefront of 5G infrastructure advancement.

This comprehensive research report examines key regions that drive the evolution of the 5G Infrastructure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strengths Collaborations and Innovation Trajectories of Leading Global Players Shaping the 5G Infrastructure Ecosystem

Leading global players continue to redefine competitive benchmarks through targeted technology investments, strategic alliances, and expansive patent portfolios. Network equipment vendors are differentiating through multi-access edge compute integrations and AI-driven automation capabilities that simplify operations and accelerate time to market. Partnerships between incumbent telecom providers and emerging hyperscale cloud players have intensified, paving the way for converged offerings that blend connectivity with application hosting and analytics services.

Innovation pathways have also converged around open network standards that promote interoperability and ecosystem diversity. Key consortium engagements and collaborative forums are enabling vendors to coinnovate on radio interface enhancements, virtualized core architectures, and advanced security protocols. At the same time, mid-tier technology firms are carving out niches by specializing in spectrum management tools, private network orchestration platforms, and cybersecurity suites tailored to critical infrastructure operators.

Competitive strength now rests on the ability to deliver comprehensive portfolios that span hardware, software, and service layers while demonstrating integration prowess across disaggregated architectures. Moreover, the agility to address evolving regulatory requirements and localize manufacturing footprints has become a core differentiator. As mergers and alliances reshape vendor hierarchies, stakeholders must continuously monitor collaboration dynamics, patent filings, and product roadmaps to anticipate shifts in competitive positioning and investment priorities.

This comprehensive research report delivers an in-depth overview of the principal market players in the 5G Infrastructure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airspan Networks Holdings Inc.

- Altiostar Networks Inc.

- Amphenol Corporation

- Analog Devices Inc.

- Cambium Networks Corporation

- Ciena Corporation

- Cisco Systems Inc.

- CommScope Holding Company Inc.

- Corning Incorporated

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Juniper Networks Inc.

- Marvell Technology Group Ltd.

- Mavenir Systems Inc.

- NEC Corporation

- Nokia Corporation

- Qorvo Inc.

- Qualcomm Incorporated

- Samsung Electronics Co. Ltd.

- Skyworks Solutions Inc.

- ZTE Corporation

Implementing Strategic Recommendations for Industry Leaders to Enhance Network Resilience Foster Innovation and Capitalize on Emerging 5G Opportunities

Industry leaders should prioritize the adoption of modular and software-centric architectures to enhance network resilience and streamline upgrades. Embracing disaggregated baseband units and open radio access network interfaces will enable rapid integration of new spectrum assets and facilitate cost-effective scaling. In tandem, operators must invest in AI-enabled analytics frameworks for proactive network health monitoring, anomaly detection, and predictive maintenance to minimize service disruptions and optimize operational expenditure.

To foster innovation, executives should cultivate collaborative partnerships across the value chain, engaging systems integrators, cloud service providers, and specialized software vendors in codevelopment initiatives. Such alliances can accelerate time to market for differentiated offerings and unlock new revenue streams, particularly in enterprise and industrial verticals. Additionally, leveraging neutral host models in high-density venues and exploring private network deployments will expand addressable market segments and generate recurring service revenues.

Capitalizing on emerging opportunities also requires cohesive spectrum strategies that balance high-band deployments for enhanced capacity with sub-6 gigahertz assets for ubiquitous coverage. Leaders should engage with regulators to shape licensing frameworks that support dynamic spectrum sharing and efficient spectrum refarming, thereby maximizing asset utilization. By aligning capital allocation with these strategic imperatives, organizations can secure a competitive edge and realize long-term value in the rapidly evolving 5G infrastructure environment.

Detailing a Robust Research Methodology Integrating Primary and Secondary Data Sources Expert Validation and Analytical Frameworks to Ensure Insight Accuracy

The research methodology underpinning this analysis integrates a rigorous combination of primary interviews with senior executives, network planners, and technology architects, alongside a comprehensive review of secondary sources such as regulatory filings, patent databases, and industry publications. Expert validation rounds were conducted with subject matter specialists in network virtualization, cybersecurity, and spectrum management to ensure the veracity of technical assessments and market interpretations.

Quantitative data points were cross-referenced across multiple sources to triangulate insights and identify outliers, while qualitative inputs from executive briefings enriched the narrative with forwardlooking perspectives and strategic considerations. Analytical frameworks employed include SWOT assessments, value chain mapping, and competitive benchmarking, each tailored to the unique characteristics of 5G infrastructure deployment cycles and ecosystem dynamics. Where feasible, regional pilot program results and testbed outcomes have been incorporated to contextualize theoretical constructs with real-world performance data.

To maintain objectivity, all data inputs underwent standardization procedures and were subject to methodological audits, ensuring consistency in terminology, segmentation definitions, and geographic scope. This robust approach provides stakeholders with confidence in the findings and recommendations, while offering transparent visibility into the research process and underlying assumptions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 5G Infrastructure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 5G Infrastructure Market, by Component

- 5G Infrastructure Market, by Spectrum

- 5G Infrastructure Market, by End User

- 5G Infrastructure Market, by Region

- 5G Infrastructure Market, by Group

- 5G Infrastructure Market, by Country

- United States 5G Infrastructure Market

- China 5G Infrastructure Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Conclude the Strategic Imperatives Guiding the 5G Infrastructure Evolution Pathway

This executive summary has distilled the critical forces driving 5G infrastructure evolution, from component innovation and spectrum strategy to regional deployment variances and competitive dynamics among leading technology providers. By mapping the cumulative effects of United States tariff measures, we have highlighted supply chain adjustments and sourcing reconfigurations that will resonate throughout the industry. Through granular segmentation and regional analyses, the report illuminates the diverse pathways through which network operators and enterprise users are engaging with next-generation connectivity.

Moreover, the competitive landscape analysis underscores the growing importance of open standards, AI-driven orchestration, and modular solutions as differentiators in an increasingly contested market. The actionable recommendations provided here equip industry leaders to fortify network resilience, unlock new service opportunities, and refine spectrum strategies in alignment with regulatory objectives. As the 5G ecosystem continues to expand and mature, stakeholders who leverage these insights will be well positioned to shape value propositions, optimize capital deployments, and capture emerging revenue pools.

Looking ahead, the interplay of technological innovation, policy frameworks, and market demand will define the trajectory of global 5G infrastructure deployment. This conclusion invites readers to synthesize the findings presented and apply them to strategic decision making, ensuring that every investment and partnership is informed by a comprehensive understanding of the evolving connectivity landscape.

Engage with Associate Director Sales and Marketing to Secure Comprehensive Market Insights and Propel 5G Infrastructure Strategies with a Research Report

For tailored insights that empower decision makers to accelerate network deployments and capitalize on emerging opportunities, reach out to Ketan Rohom, Associate Director of Sales and Marketing at 360iResearch. Engage directly to discuss how a dedicated research engagement can address your unique strategic questions, provide end to end analysis across components, spectrum bands, end use sectors, and distribution channels, and furnish the actionable intelligence needed to stay ahead in the fiercely competitive 5G infrastructure market. Secure your copy of the comprehensive report today to inform capital allocation, refine partnership strategies, and ensure your organization is positioned for sustained leadership as the global 5G landscape continues to evolve.

- How big is the 5G Infrastructure Market?

- What is the 5G Infrastructure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?