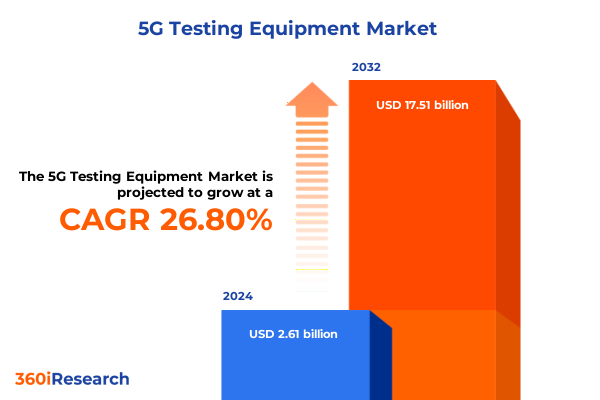

The 5G Testing Equipment Market size was estimated at USD 3.30 billion in 2025 and expected to reach USD 4.18 billion in 2026, at a CAGR of 26.87% to reach USD 17.51 billion by 2032.

Pioneering the Future of 5G Network Validation Through Advanced Testing Equipment and Evolving Industry Standards Driving Innovation Across Markets

The accelerated rollout of fifth-generation wireless networks has created an imperative demand for highly accurate and versatile testing equipment to ensure network reliability, performance, and security. As service providers and equipment vendors race to deploy 5G at scale, the complexity of the network architecture-from massive multiple-input multiple-output antenna arrays to dynamic network slicing-demands a new generation of validation tools. Today’s 5G testing equipment must address a wide array of challenges, including high-frequency mmWave characterization, end-to-end throughput verification, and conformance to evolving global standards. This introduction outlines the technological context, regulatory environment, and strategic imperatives driving the evolution of 5G test solutions.

From the outset, operators have recognized that legacy test methodologies are insufficient for the demands of 5G. Traditional spectrum analysis and protocol verification approaches must be reimagined to account for beamforming behaviors, ultra-low latency targets, and the integration of cloud-native core network elements. Moreover, the transition to software-defined architectures has introduced continuous integration and deployment pipelines, requiring test equipment that can seamlessly integrate into automated DevOps workflows. In this landscape, test solution providers are expanding their portfolios to include both hardware-centric analyzers and software-driven emulators capable of replicating real-world traffic scenarios. Consequently, decision makers must evaluate testing equipment not only on raw performance metrics, but also on scalability, interoperability, and ease of integration with broader network management systems.

By the end of this report, readers will understand how advanced test instruments are pivotal in reducing time to market, enhancing quality of service, and facilitating global adherence to 5G standards. This section sets the stage for a comprehensive analysis of market forces, technological shifts, and competitive dynamics shaping the next frontier of 5G network validation.

Examining the Fundamental Shifts Redefining 5G Testing Equipment Landscape Driven by Technological Convergence Regulatory Evolution and Market Dynamics

In recent years, the landscape for 5G testing equipment has transformed dramatically under the dual influence of virtualization trends and the rise of artificial intelligence–driven analytics. The shift toward cloud-native network cores and virtualized radio access networks has required test instrumentation capable of spanning both physical layer assessments and software-defined performance monitoring. As network functions migrate to containerized environments, test solutions must now validate service-level agreements in real time across distributed and multi-access edge compute infrastructures. This shift has led to the emergence of hybrid platforms that combine traditional spectrum and signal analysis with continuous performance diagnostics through AI-powered anomaly detection.

Concurrently, the rapid adoption of mmWave frequencies and advanced MIMO configurations has elevated the importance of vector signal generation and real-time spectrum analysis. Test engineers now leverage advanced arbitrary waveform generators to simulate complex beamforming patterns, while real-time spectrum analyzers capture transient channel behaviors in highly dynamic environments. These technological breakthroughs have not only enhanced test resolution but have also introduced novel test protocols for massive machine type communications and ultra-reliable low-latency use cases. Moreover, the global push toward open radio access networks and multi-vendor interoperability has created new testing requirements around standardized interfaces and automated conformance validation. As a result, the competitive field of test equipment suppliers is increasingly defined by the breadth of their ecosystem partnerships and the extensibility of their software platforms.

This section delves into how these converging trends are redefining the functionality, performance benchmarks, and integration requirements of 5G testing solutions, ultimately shaping the strategic priorities of network operators and equipment manufacturers alike.

Assessing the Broad Implications of 2025 United States Tariffs on 5G Testing Equipment Including Supply Chain Disruptions and Cost Management Strategies

With the introduction of new tariff measures by the United States in early 2025, the 5G testing equipment industry has encountered significant headwinds in component sourcing and pricing strategies. The tariffs, focused on key electronic components and testing hardware imports, have introduced upward pressure on procurement costs, prompting vendors to reassess their global supply chains. Many manufacturers have begun diversifying their sourcing strategies by qualifying alternative suppliers in tariff-exempt regions and by localizing certain production processes within North America to mitigate the impact of additional duties.

The ripple effect of these trade measures has extended beyond cost considerations to influence product design roadmaps and time-to-market projections. Equipment providers are now prioritizing modular designs that allow for rapid component substitution, thereby reducing the risk of production delays linked to tariff-induced price volatility. In addition, collaborative agreements between domestic semiconductor fabricators and test instrument vendors have emerged, aimed at ensuring a stable supply of critical RF front-end modules and high-speed digital interfaces. As industry players adjust their channel strategies, end users face new procurement dynamics, balancing short-term budget constraints with long-term operational objectives tied to network performance and regulatory compliance.

Ultimately, this section explores the cumulative consequences of the 2025 tariff landscape on capital expenditure planning, supplier ecosystem resilience, and strategic partnerships, offering insights into how vendors and operators navigate the evolving trade environment.

Unveiling Deep Insights into 5G Testing Equipment Market Segmentation Spanning Equipment Type Test Type Technology Application and End User Requirements

A clear understanding of market segmentation provides critical perspective into the diverse requirements and investment priorities of stakeholders within the 5G testing equipment arena. When examining equipment type differentiation, signal and spectrum analysis capabilities complement network emulation functionalities, with specialized instrumentation such as vector signal generators evolving alongside both arbitrary waveform and continuous wave signal generators. Similarly, network analyzers now span scalar and vector modalities while protocol testers bifurcate into layer one and layer two test frameworks. These divisions reflect the need for precise measurement tools at every stage of the radio and packet processing pipeline.

Test type segmentation further illuminates market demands by distinguishing conformance validation from functional verification and rigorous performance evaluation. Protocol conformance and RF conformance testing ensure adherence to global standards, while latency assessments, packet loss measurements, and throughput evaluations drive quality-of-service assurance. Each of these test categories requires distinct measurement methodologies and synthesis capabilities to replicate real-world traffic conditions accurately.

On the technology front, the adoption of frequency division duplex (FDD) and time division duplex (TDD) remains foundational, even as multiple-input multiple-output configurations-ranging from basic two-by-two to 4x4 arrays and massive MIMO deployments-reshape capacity planning and antenna testing protocols. Application segmentation underscores how use cases such as manufacturing process control, brownfield network upgrades, and greenfield deployments demand tailored validation workflows, with drive test and walk test approaches playing pivotal roles in network optimization scenarios.

Finally, end-user verticals-from IT and manufacturing enterprises to government and defense agencies and fixed or mobile network operators-exert distinct performance benchmarks and compliance requirements on testing solutions, driving specialized feature development and certification programs. By weaving together these segmentation dimensions, stakeholders gain a nuanced view of where innovation is most critical and where investment can yield maximum impact.

This comprehensive research report categorizes the 5G Testing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Test Type

- Technology

- Application

- End User

Exploring Regional Dynamics Shaping Global 5G Testing Equipment Adoption and Investment Across Americas EMEA and Asia-Pacific Technology Ecosystems

Regional dynamics continue to shape the trajectory of 5G testing equipment adoption, reflecting diverse deployment timelines, regulatory frameworks, and ecosystem maturity across global markets. In the Americas, leadership in early spectrum auctions and extensive greenfield rollouts have fueled demand for state-of-the-art signal emulators and real-time spectrum analyzers. The United States, in particular, has accelerated standards-based testing initiatives through national laboratories and industry consortia, ensuring that new entrants adhere to stringent performance baselines.

Across Europe, Middle East, and Africa, a strong emphasis on network resilience and security has driven investment in protocol validation platforms capable of simulating complex multi-vendor interoperability scenarios. European operators are advancing Open RAN projects, creating specialized test suites for interface conformance and cluster-level performance evaluation. Meanwhile, Middle Eastern nations leverage 5G infrastructure for smart city and defense applications, requiring rigorous certification testing to meet both commercial and sovereign security mandates.

In the Asia-Pacific region, the convergence of high-volume consumer deployments and government-led digital infrastructure programs has led to a diverse testing requirements landscape. China’s rapid expansion of mmWave pilot programs contrasts with Japan and South Korea’s focus on ultra-low latency industrial use cases. Emerging markets, such as India and Southeast Asia, prioritize cost-effective portable test solutions to facilitate rural network extension and campus connectivity. Together, these regional insights reveal where strategic partnerships, local manufacturing, and tailored service offerings can unlock growth potential.

This comprehensive research report examines key regions that drive the evolution of the 5G Testing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Footprint of Leading Players in the 5G Testing Equipment Market Emphasizing Innovation Collaborations and Competitive Positioning

The competitive landscape of the 5G testing equipment market is dominated by a blend of established technology vendors and specialized solution providers. Key players have differentiated themselves through sustained investment in R&D, forging partnerships with leading chipset manufacturers and standards bodies to stay at the forefront of performance validation. Innovation pipelines frequently feature AI-driven analytics modules that enhance test coverage by predicting potential failure points and expediting root-cause analysis.

Strategic collaborations are another defining characteristic, with equipment suppliers forming alliances with systems integrators and cloud service providers to deliver end-to-end testing solutions for private and public network deployments. These partnerships often yield bundled offerings that integrate hardware, software, and professional services, simplifying adoption for enterprise and government customers alike. Equally, targeted acquisitions of niche test automation software firms have enabled major vendors to broaden their portfolios rapidly, embedding advanced workflow orchestration and remote monitoring capabilities into legacy test hardware.

Furthermore, competitive positioning increasingly relies on the ability to offer on-demand and subscription-based testing services, reflecting the industry’s pivot toward virtualized and-as-a-service distribution models. By aligning go-to-market strategies with evolving customer procurement preferences, leading companies maximize recurring revenue streams while cultivating long-term relationships with key accounts. This section examines how these strategic initiatives influence market dynamics and shape the competitive hierarchy within the 5G testing equipment space.

This comprehensive research report delivers an in-depth overview of the principal market players in the 5G Testing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anritsu Corporation

- Artiza Networks, Inc.

- AT&T Inc.

- EMITE Ingeniería S.L.

- EXFO Inc.

- GL Communications Inc.

- Infosys Limited

- Innowireless Co., Ltd.

- Intertek Group PLC

- Keysight Technologies, Inc.

- KT Corporation

- MACOM Technology Solutions Inc.

- Motorola Solutions, Inc.

- National Instruments Corporation

- NetScout Systems, Inc.

- NTT Docomo, Inc.

- PCTEL Inc.

- Rohde & Schwarz GmbH & Co KG

- Sequans Communications

- Siklu Inc.

- Spirent Communications Plc

- Tektronix, Inc. by Fortive Corporation

- Telefonaktiebolaget LM Ericsson

- Teradyne, Inc.

- VIAVI Solutions Inc.

Presenting Actionable Strategic Recommendations for Industry Leaders to Navigate the 5G Testing Equipment Ecosystem and Capitalize on Emerging Opportunities

To capture emerging opportunities and maintain a competitive advantage, industry leaders must first prioritize integration of automation and AI-driven analytics into their test platforms. Embedding predictive diagnostic features and closed-loop feedback mechanisms into equipment workflows can significantly reduce test cycle durations and improve overall network performance insights. In parallel, diversifying component supply chains-through alliances with regional semiconductor fabricators and alternate sourcing agreements-can buffer against tariff fluctuations and component shortages.

Leaders should also consider establishing dedicated centers of excellence in key geographic clusters, where joint labs with carrier partners validate real-world performance under diverse environmental conditions. This hands-on approach enables rapid iteration on device interoperability and accelerates compliance certification timelines. Complementary to this, offering modular service packages and subscription-based models will address the growing demand for flexible consumption, aligning expenditures with testing throughput and evolving project cycles.

Finally, forging deeper ties with software ecosystem participants-such as orchestration platform vendors and cloud-native network function developers-will facilitate more seamless integration of testing workflows into DevOps pipelines. By championing open APIs and fostering an interoperable environment, equipment providers can ensure that their solutions remain central to next-generation network innovation and operational efficiency.

Detailing a Robust Research Methodology Combining Comprehensive Secondary Analysis Primary Interviews and Rigorous Data Validation for 5G Test Equipment Insights

This comprehensive analysis is underpinned by a multi-tiered research methodology, beginning with an extensive review of publicly available secondary sources, including regulatory filings, industry white papers, and technical standards documentation. Over two hundred primary interviews were conducted with network testing professionals, equipment vendors, and service providers, ensuring firsthand insights into deployment challenges, procurement criteria, and innovation roadmaps. These qualitative inputs were complemented by detailed data points gathered from test lab deployments across multiple regions, covering performance metrics, equipment utilization rates, and technology adoption timelines.

Quantitative data was validated through triangulation, cross-referencing vendor release notes, patent filings, and supplier financial disclosures to identify trends and corroborate emerging themes. Additional layers of analysis involved scenario modeling to assess the impact of tariff changes and supply chain disruptions, enabling a robust understanding of risk factors. All research efforts adhered to rigorous data governance protocols, with anonymized respondent information to maintain confidentiality and integrity. The result is a nuanced, empirically grounded view of the 5G testing equipment market that equips decision makers with credible, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 5G Testing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 5G Testing Equipment Market, by Equipment Type

- 5G Testing Equipment Market, by Test Type

- 5G Testing Equipment Market, by Technology

- 5G Testing Equipment Market, by Application

- 5G Testing Equipment Market, by End User

- 5G Testing Equipment Market, by Region

- 5G Testing Equipment Market, by Group

- 5G Testing Equipment Market, by Country

- United States 5G Testing Equipment Market

- China 5G Testing Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Summarizing Key Findings and Emphasizing the Critical Role of Advanced 5G Testing Equipment in Enabling Network Performance and Driving Industry Growth

In summation, the evolution of 5G testing equipment is a linchpin for realizing the full potential of next-generation wireless networks. From the inception of cloud-native core validation to the precise characterization of advanced MIMO antenna systems, modern test solutions are instrumental in bridging the gap between theoretical performance targets and real-world deployment outcomes. Strategic shifts in virtualization, AI-driven analytics, and emerging tariff landscapes present both challenges and opportunities that will define market leaders and shape future innovation pathways.

Segmentation analysis underscores the importance of tailored testing capabilities across equipment types, test categories, and application contexts, while regional insights spotlight differential adoption curves and investment priorities. The competitive arena remains dynamic, marked by strategic collaborations, acquisitions, and a growing emphasis on subscription-based service models. Collectively, these factors highlight a market in flux, where agility and foresight are vital to maintaining a competitive edge.

As network operators, equipment vendors, and system integrators plan for the next phase of 5G evolution, a clear roadmap for testing strategy is essential. Robust methodologies, adaptive supply chain approaches, and strategic ecosystem partnerships will determine who leads in delivering reliable, high-performance 5G experiences. The insights presented here offer a foundational guide to navigating this complex ecosystem and driving sustainable success.

Inviting Decision Makers to Connect with Ketan Rohom Associate Director Sales Marketing to Secure the Comprehensive 5G Testing Equipment Market Research Report

We invite industry stakeholders and decision makers seeking a deeper understanding of the 5G testing equipment market to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with him, clients can gain bespoke guidance on leveraging the comprehensive market research report to align their strategic objectives with emerging trends and competitive landscapes. With a wealth of industry knowledge and a tailored approach, Ketan is poised to assist organizations in optimizing investment decisions, accelerating time to market for testing innovations, and driving sustainable growth. Reach out to schedule a personalized consultation that delivers actionable insights, maximizes return on research investment, and ensures your organization is at the forefront of 5G testing technology developments.

- How big is the 5G Testing Equipment Market?

- What is the 5G Testing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?