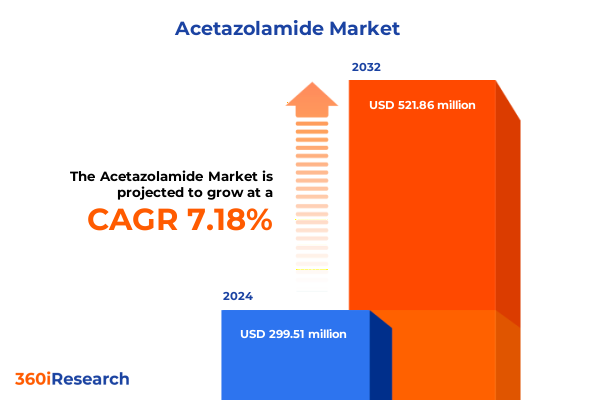

The Acetazolamide Market size was estimated at USD 319.32 million in 2025 and expected to reach USD 345.94 million in 2026, at a CAGR of 7.26% to reach USD 521.86 million by 2032.

Unveiling the Strategic Imperatives of Acetazolamide’s Therapeutic Evolution Amidst Shifting Healthcare Dynamics and Patient Needs

Acetazolamide, a potent carbonic anhydrase inhibitor, has long held a pivotal role in the management of conditions ranging from acute mountain sickness to glaucoma. This summary commences with an in-depth examination of its multifaceted therapeutic applications and its enduring significance in the pharmaceutical landscape. Since its introduction in the mid-20th century, Acetazolamide has undergone continual refinement in formulation and delivery, reflecting broader shifts in patient-centric care and precision medicine. Stakeholders must appreciate how historical milestones, regulatory approvals, and ongoing clinical research converge to define its current and future utility.

Against the backdrop of rising prevalence of altitude-related disorders, complex neurovascular conditions, and chronic ophthalmic diseases, Acetazolamide offers a unique mechanism of action that underpins its enduring clinical relevance. As healthcare systems worldwide prioritize value-based outcomes, the demand for established yet adaptable interventions like Acetazolamide is intensifying. This introduction lays the foundation for a comprehensive exploration of transformative market shifts, tariff impacts, segmentation insights, and regional nuances that collectively shape strategic opportunities. It sets the stage for stakeholders and decision-makers to align their initiatives with the dynamic evolution of Acetazolamide’s role in modern therapeutics.

Navigating Disruptive Innovations and Policy Reforms Redefining Acetazolamide’s Role Across Evolving Clinical and Technological Frontiers

The landscape of Acetazolamide is undergoing transformative shifts fueled by innovations in drug development, policy realignments, and evolving patient care models. The repurposing of the molecule for emerging neurological applications, coupled with advances in formulation science, has revitalized its potential. Novel sustained-release technologies are enhancing patient adherence, while digital health platforms facilitate remote monitoring of therapeutic outcomes, thereby aligning with precision dosing initiatives.

Concurrently, regulatory agencies are streamlining pathways for established drugs through adaptive approval frameworks and real-world evidence integration. These policy advancements reduce time-to-market for optimized formulations and combination therapies incorporating Acetazolamide. Furthermore, the rise of value-based contracting compels manufacturers and payers to demonstrate cost-effectiveness and patient-centric benefits, catalyzing partnerships across the value chain.

Telemedicine’s expansion has also redefined distribution paradigms, enabling patients to receive prescriptions for Acetazolamide through virtual consultations. As stakeholders navigate these disruptive forces, understanding how technological progression intertwines with regulatory evolution is essential for capitalizing on emerging clinical and commercial avenues.

Evaluating the Far-Reaching Consequences of Newly Imposed 2025 US Tariffs on Acetazolamide Supply Chains and Market Accessibility

The imposition of new United States tariffs in 2025 has introduced renewed complexity to Acetazolamide’s supply chain and market accessibility. Raw material sourcing for carbonic anhydrase inhibitors, frequently reliant on global API manufacturers, now contends with increased duties that ripple across production costs and inventory management. Manufacturers have responded by renegotiating contracts and exploring alternative suppliers, with emphasis on geographic diversification to mitigate tariff-induced volatility.

These tariffs also affect finished dosage forms, pressuring both branded and generic providers to balance cost containment with regulatory compliance. Hospitals and clinics, facing tighter procurement budgets, are revisiting long-term agreements and inventory strategies to absorb additional expenses without compromising patient access. Meanwhile, distributors and wholesalers are adopting just-in-time logistics to reduce carry costs and minimize exposure to tariff fluctuations.

The cumulative impact extends to international trade relationships, with some stakeholders accelerating bilateral agreements to secure favorable trade terms for pharmaceutical goods. For decision-makers, closely monitoring tariff trajectories and proactively engaging with trade authorities has become a strategic imperative to safeguard supply continuity and maintain competitive pricing in the Acetazolamide market.

Unraveling Critical Insights Across Diverse Acetazolamide Segments Driving Clinical Applications, Dosage Forms, and Distribution Preferences

Acetazolamide’s commercial journey is characterized by distinct segments that each exert unique influence on market dynamics. Branded products leverage established reputations and often command premium positioning, whereas generics compete primarily on cost, driving broader patient adoption through affordability. In the injectable versus tablet debate, injectable formulations meet urgent clinical needs in hospital settings, while oral tablets facilitate outpatient adherence and self-administration in homecare environments.

Clinical applications further diversify demand. Prescribed for acute mountain sickness, Acetazolamide supports travelers and high-altitude workers, while its diuretic properties address edema associated with heart failure and hepatic disorders. In epilepsy management, the compound serves as an adjunctive therapy, and in glaucoma care, it reduces intraocular pressure through targeted inhibition of ocular carbonic anhydrase.

Distribution channels channel Acetazolamide through hospital pharmacies that prioritize sterilized injectables and immediate restocking, online pharmacies that cater to tech-savvy consumers seeking home delivery, and retail pharmacies that balance accessibility with professional consultation. End-users range from ambulatory surgical centers, where rapid onset is critical, to hospitals and clinics, and continuing-care home settings, where long-term regimens emphasize convenience and monitoring. This segmentation mosaic underscores that stakeholders must tailor strategies to the distinct drivers and nuances of each category.

This comprehensive research report categorizes the Acetazolamide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Dosage Form

- Application

- Distribution Channel

- End-User

Examining Regional Variations and Growth Drivers Impacting Acetazolamide Adoption Across the Americas, EMEA, and Asia-Pacific Healthcare Ecosystems

Regional nuances significantly shape Acetazolamide adoption and clinical penetration. In the Americas, robust reimbursement frameworks and emphasis on performance-based contracting have reinforced the use of Acetazolamide in managing chronic eye conditions and neurological adjunct therapies. North American markets benefit from integrated healthcare systems that facilitate streamlined formulary inclusion and research collaborations.

Within Europe, Middle East, & Africa, regulatory harmonization under the European Medicines Agency has expedited approval processes for both branded and generic versions, while national health services negotiate volume-based agreements to maintain budgetary discipline. Emerging markets in the Middle East are witnessing growing investment in specialty care centers, which are incorporating Acetazolamide into treatment regimens for altitude sickness among growing adventure tourism segments.

The Asia-Pacific region reflects a diverse tapestry of healthcare models. Countries with mountainous territories, such as India and Nepal, prioritize protocols for acute mountain sickness, integrating Acetazolamide into governmental health guidelines. Concurrently, rapid expansion of private ophthalmic clinics and epilepsy care units in Southeast Asia is creating new demand pools. However, heterogeneous regulatory requirements and price sensitivity necessitate tailored market entry approaches to optimize uptake across these varied jurisdictions.

This comprehensive research report examines key regions that drive the evolution of the Acetazolamide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning Among Leading Acetazolamide Manufacturers and Innovators Worldwide

Leading pharmaceutical companies have advanced differentiated strategies to bolster their position in the Acetazolamide space. Brand originators leverage global manufacturing footprints and invest in post-market surveillance to demonstrate long-term efficacy and safety. Several generic drug producers have prioritized capacity expansion for both sterile injectables and oral tablets, forging exclusive API supply agreements to ensure cost competitiveness and uninterrupted batch production.

Collaborative initiatives between contract development and manufacturing organizations and established drug companies have gained momentum, focusing on scalable processes and technology transfer for high-purity carbonic anhydrase inhibitors. In parallel, select innovators are exploring combination therapies that synergize Acetazolamide with other established compounds to enhance therapeutic outcomes and secure new patent lifecycles.

Marketing efforts have shifted toward digital engagement, with virtual physician forums and real-time patient adherence platforms underscoring product benefits. Companies with integrated logistics networks are introducing novel hub-and-spoke distribution models to reduce lead times, while those with robust pharmacovigilance systems highlight real-world evidence to support formulary negotiation and clinician confidence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acetazolamide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accord Healthcare Limited

- Alembic Pharmaceuticals Ltd.

- Alkem Laboratories Limited

- Apotex Inc.

- Aurobindo Pharma Limited

- Cipla Limited

- Dr. Reddy’s Laboratories Ltd.

- Emcure Ph Pharmaceuticals Limited

- Glenmark Pharmaceuticals Ltd.

- Heritage Pharmaceuticals Inc.

- Hikma Pharmaceuticals Plc

- Intas Pharmaceuticals Ltd.

- Lannett Company, Inc.

- Lupin Limited

- Mylan N.V.

- Nostrum Pharmaceuticals LLC

- Sandoz International GmbH

- Strides Pharma Science Limited

- Sun Pharmaceutical Industries Ltd.

- Taro Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd.

- West‑Ward Pharmaceuticals Corp.

- X‑Gen Pharmaceuticals, Inc.

- Zydus Lifesciences Limited

Implementing Actionable Strategies to Enhance Acetazolamide Deployment, Maximize Clinical Reach, and Mitigate Emerging Regulatory and Supply Chain Risks

Industry leaders should prioritize diversification of API sourcing to mitigate exposure to geopolitical and tariff-related disruptions. Securing multiple qualified suppliers across different geographies can safeguard production continuity and foster competitive pricing leverage. Concurrently, investment in modular, flexible manufacturing facilities enables rapid scaling of both injectable and oral formulations in response to fluctuations in clinical demand.

Enhancing digital engagement with healthcare professionals through interactive platforms and real-world evidence portals will strengthen positioning during formulary reviews. Strategic alliances with specialty pharmacies and telemedicine providers can expand market reach while addressing patient convenience. In parallel, developing patient support programs tailored to diverse end-users-from ambulatory surgical centers to homecare settings-will reinforce adherence and brand loyalty.

Active participation in policy dialogues and trade discussions is critical to anticipate changes in tariff frameworks and regulatory pathways. By engaging early with authorities, companies can influence policy outcomes and secure preferential trade agreements. Finally, adopting value-based contracting models that link pricing to clinical outcomes will resonate with payers and health systems focused on cost-effectiveness and patient-centric metrics.

Detailing the Rigorous and Transparent Research Methodology Underpinning Insights on Acetazolamide’s Market Dynamics and Clinical Utilization Patterns

This analysis is underpinned by a robust, multi-phase research methodology combining secondary and primary data sources. An initial review of peer-reviewed literature, regulatory filings, and intellectual property databases established a comprehensive understanding of Acetazolamide’s chemical attributes, therapeutic applications, and approval history. Complementary insights were drawn from industry white papers, corporate disclosures, and public procurement tender documents to map competitive and regional dynamics.

In the primary research phase, consultations with key opinion leaders in neurology, ophthalmology, and critical care provided qualitative depth, while structured interviews with supply chain executives and policy experts illuminated tariff implications and distribution strategies. These perspectives were triangulated with anonymous surveys of hospital pharmacy directors, specialty pharmacists, and homecare providers to validate segmentation trends and end-user preferences.

All findings underwent rigorous quality checks, including cross-verification against multiple data points and internal consistency reviews. Limitations pertaining to proprietary cost data and evolving tariff schedules were transparently acknowledged, ensuring the analysis remains grounded in verifiable evidence and real-world applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acetazolamide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acetazolamide Market, by Type

- Acetazolamide Market, by Dosage Form

- Acetazolamide Market, by Application

- Acetazolamide Market, by Distribution Channel

- Acetazolamide Market, by End-User

- Acetazolamide Market, by Region

- Acetazolamide Market, by Group

- Acetazolamide Market, by Country

- United States Acetazolamide Market

- China Acetazolamide Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings to Illuminate Acetazolamide’s Evolving Clinical Significance and Strategic Opportunities in a Dynamic Healthcare Environment

The synthesis of core findings reveals a landscape in which Acetazolamide retains significant clinical relevance while navigating shifting policy environments and supply chain complexities. Segmentation analysis highlights that branded and generic products each serve distinct value propositions, and that dosage form selection critically influences end-user adoption. Regional variations underscore the importance of tailored market strategies, with unique regulatory and reimbursement ecosystems defining access scenarios.

Tariff developments have surfaced as a pivotal factor affecting procurement costs and distribution agility, prompting industry participants to reevaluate supplier networks and logistical frameworks. At the same time, transformative shifts in digital health, adaptive regulatory pathways, and repurposing initiatives have opened new avenues for differentiation and value demonstration. Leading companies are responding through strategic partnerships, capacity investments, and sophisticated engagement models that emphasize evidence-based outcomes.

Ultimately, this analysis empowers stakeholders to align strategic priorities with emergent trends, optimize resource allocation across segments and regions, and adopt proactive measures that ensure resilience in the face of regulatory, technological, and market-based uncertainties. By internalizing these insights, decision-makers can steer Acetazolamide initiatives toward sustainable growth and enhanced patient impact.

Driving Informed Decision-Making Through a Tailored Acetazolamide Market Research Report Purchase Invitation with Industry Authority Guidance

In a rapidly evolving therapeutic environment, securing authoritative insights into Acetazolamide’s market dynamics is crucial for strategic decision-making. Reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to access the comprehensive report that distills extensive primary and secondary research into actionable intelligence. Engage directly with an expert to tailor a subscription package that aligns with your organizational needs, unlock proprietary data on segmentation, regional trends, and supply chain considerations, and gain a competitive edge in understanding how Acetazolamide is reshaping clinical treatment paradigms. By connecting with Ketan Rohom today, you ensure timely delivery of the report and ongoing advisory support, equipping your team with the insights required to navigate regulatory shifts, tariff impacts, and emerging growth opportunities.

Take the next step toward informed strategic planning and market leadership by contacting Ketan Rohom and securing your copy of the Acetazolamide market research report.

- How big is the Acetazolamide Market?

- What is the Acetazolamide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?