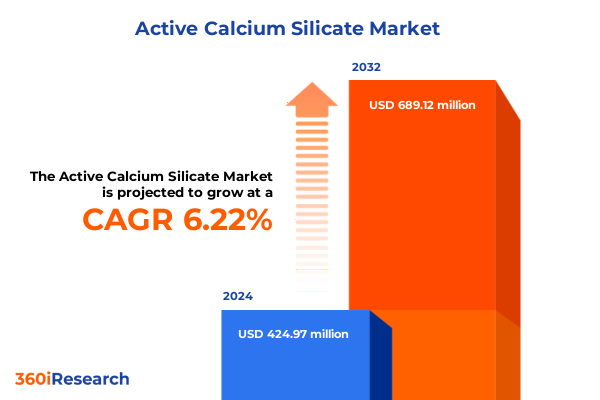

The Active Calcium Silicate Market size was estimated at USD 448.76 million in 2025 and expected to reach USD 476.69 million in 2026, at a CAGR of 6.31% to reach USD 689.12 million by 2032.

Unlocking the Potential of Active Calcium Silicate with Detailed Insights into Market Drivers, Emerging Trends, and Future Outlook for Strategic Planning

The active calcium silicate market is experiencing a pivotal moment driven by its versatile functionality and enhanced performance characteristics. Renowned for its superior thermal stability, moisture regulation, and chemical inertness, this class of materials is catalyzing innovation across industries ranging from construction and coatings to food processing and polymer modification. As stakeholders prioritize sustainable, high-performance solutions, active calcium silicate has emerged as a cornerstone for next-generation product development. Its unique ability to sequester moisture, reinforce polymer matrices, and serve as a mineral-based filler underscores a growing demand among formulators and end-users aiming to meet stringent regulatory and performance benchmarks.

Beyond its inherent material advantages, the market is being shaped by rapidly evolving end-use requirements, including lightweight construction materials, low-VOC coatings, and eco-certified food additives. These drivers are further complemented by advancements in processing technologies, which have expanded the range of available forms-granules, powders, and slurries-tailored to specific application needs. Moreover, the active calcium silicate supply chain is adapting to serve diversified regional demands amid shifting trade policies and raw material sourcing strategies. As a result, manufacturers are reevaluating their production footprints and forging strategic alliances to capitalize on emerging opportunities in both established and fast-growing markets.

With this report, we embark on a thorough exploration of the transformative shifts redefining the active calcium silicate landscape. We will assess the disruptive impacts of new trade tariffs, distill actionable segmentation and regional insights, and profile leading industry participants, all designed to empower decision-makers with a clear path forward.

Navigating Emerging Technological Advancements and Sustainability Imperatives That Are Redefining the Active Calcium Silicate Industry Landscape

The active calcium silicate industry is undergoing transformative shifts as technological innovation converges with escalating sustainability mandates. Pioneering production methods such as precision spray-drying and advanced granulation have enabled tighter control over particle morphology, unlocking new performance parameters for coatings, construction fillers, and polymer modifiers. These technological improvements are complemented by digital process monitoring systems that optimize energy consumption and minimize waste, aligning production with corporate decarbonization goals and regulatory requirements. Consequently, the market is transitioning away from commodity-grade products toward highly engineered solutions that address precise end-use challenges.

Simultaneously, the sustainability imperative is reshaping product development pathways. Firms are integrating circular economy principles by incorporating post-industrial waste streams and renewable feedstocks into active calcium silicate formulations. This shift not only reduces lifecycle greenhouse gas emissions but also meets the growing consumer and regulatory demand for eco-certified materials. Environmental, social, and governance (ESG) criteria are now central to strategic decision-making, prompting companies to pursue cradle-to-gate certifications and transparent supply chain traceability.

These concurrent drivers of technological refinement and sustainability orientation are prompting industry participants to revisit traditional value chains. Strategic partnerships between specialty chemical producers and end-users are proliferating, facilitating co-development of application-specific solutions and accelerating time-to-market. By embracing this dual imperative, the active calcium silicate sector is charting a path toward more efficient, resilient, and environmentally responsible operations.

Assessing the Comprehensive Effects of New United States Tariffs on Active Calcium Silicate Trade Dynamics and Supply Chain Resilience

In 2025, the United States implemented a series of enhanced tariffs on select mineral intermediates and specialty fillers, including active calcium silicate, with the objective of bolstering domestic manufacturing and addressing trade imbalances. This policy shift has triggered pronounced ripple effects throughout the supply chain, elevating raw material costs for downstream processors and prompting strategic realignments among import-dependent players. As tariffs added an incremental 15 to 25 percent cost burden on key shipments, many formulators have reexamined their sourcing strategies, increasingly favoring vertically integrated suppliers and domestic producers capable of offering price stability and logistical agility.

These trade measures have also induced regional production rebalancing. With imports becoming less cost-competitive, manufacturers in North America have ramped up local capacity expansions, investing in modern kilns and granulation lines to capture market share. While this trend enhances supply resilience, it places pressure on operational margins as new entrants contend with scale-up efficiencies and raw material availability constraints. Moreover, the elevated cost base has led to a modest pass-through to end customers, particularly in price-sensitive applications such as industrial coatings and paper coating grades.

To mitigate these impacts, stakeholders are exploring alternative mineral sources, negotiating long-term off-take agreements, and leveraging hedging mechanisms to stabilize procurement expenses. Simultaneously, enhanced collaboration between raw material suppliers and end-users is fostering the development of optimized formulations that maintain performance while reducing overall filler loading. Collectively, these adaptations illustrate the market’s resilience and capacity for strategic innovation in the face of evolving trade policy landscapes.

Unveiling Multifaceted Segmentation Perspectives Across Grade, Particle Size, Form, Application, and Distribution Channel for Targeted Market Strategies

Every layer of segmentation within the active calcium silicate market reveals critical insights that underpin effective strategy formulation. When examining product grade, the contrast between food grade and industrial grade underscores distinct regulatory and performance priorities: food-grade offerings demand stringent purity and traceability standards, while industrial-grade variants prioritize thermal stability and mechanical reinforcement for construction and coatings applications. Particle size segmentation further refines product selection, with coarse particles delivering superior moisture sequestration in polymer and paper additives, and fine powders enhancing surface smoothness and dispersion in high-performance paints.

Form diversity-spanning granules, powder, and slurry-adds an additional dimension. Granules, whether generated in irregular geometries or as precisely engineered spheres, offer optimized flow and bulk handling. Powder forms, differentiated into dry powder and spray-dried, cater to applications requiring rapid dissolution or controlled release. Slurry variants, both aqueous and organic, facilitate process efficiencies for formulators seeking to bypass dust-handling challenges and achieve uniform distribution in liquid systems.

Applications themselves carve the market into targeted segments, where construction fillers such as concrete, mortar, and plaster benefit from enhanced workability and reduced cracking potential. Architectural and industrial coatings harness film integrity and moisture control, whereas industrial paper and packaging paper coatings leverage barrier properties and print quality. Polymer modifiers in automotive, electrical and electronics, and packaging sectors exploit weight reduction and flame-retardant capabilities. Finally, distribution channels split between offline and online platforms, each offering distinct value propositions: offline channels support established B2B relationships and immediate logistical support, while online platforms cater to flexible, small-batch procurement and expedited delivery. These multifaceted segmentation perspectives empower stakeholders to align product innovation with end-use demands and supply chain efficiencies.

This comprehensive research report categorizes the Active Calcium Silicate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Particle Size

- Form

- Application

- Distribution Channel

Comparing Regional Performance and Growth Drivers Across Americas, Europe Middle East and Africa, and Asia-Pacific Markets for Active Calcium Silicate

Regional dynamics shape both demand trajectories and competitive positioning in the active calcium silicate sector. In the Americas, established infrastructure networks and rigorous environmental regulations drive the adoption of low-VOC coatings and sustainable construction materials. The region’s mature industrial base also fosters innovation partnerships between chemical producers and end-users in aerospace, automotive, and high-performance polymer applications. North American producers benefit from robust logistics frameworks, yet face cost pressures from energy prices and evolving trade policies.

Across Europe, the Middle East, and Africa, diversification of end-use markets creates a patchwork of growth pockets. Western Europe prioritizes green building certifications and circular economy integration, compelling suppliers to develop recycled-content slurries and low-carbon manufacturing processes. Simultaneously, the Middle East’s infrastructure expansion and North African industrialization present significant demand growth for construction fillers and coatings, albeit accompanied by logistical challenges. Eastern European economies are gradually increasing their consumption of industrial-grade products as domestic manufacturing ecosystems expand.

In Asia-Pacific, rapid urbanization and manufacturing sector growth are accelerating active calcium silicate deployment. Infrastructure megaprojects in Southeast Asia and the Indian subcontinent are driving high-volume demand for plasters and mortars, while China’s coatings and packaging industries push for advanced filler technologies to meet stringent product performance benchmarks. Regional supply chains are increasingly interlinked, with Asia-based producers exporting to nearby markets but also seeking cost-effective raw material inputs from global sources. These regional distinctions underscore the necessity of tailored strategies that balance local regulations, logistical considerations, and end-use requirements.

This comprehensive research report examines key regions that drive the evolution of the Active Calcium Silicate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Prominent Industry Players and Their Strategic Initiatives Driving Innovation, Collaboration, and Competitive Differentiation in the Active Calcium Silicate Sector

The competitive landscape of active calcium silicate is populated by a blend of established specialty chemical enterprises and agile niche producers, each vying to differentiate through innovation and market responsiveness. Leading firms have invested heavily in application development centers, forging alliances with coating formulators and construction material manufacturers to co-create next-generation products. Their strategic playbooks often include capacity expansions in high-demand regions, digital process automation upgrades, and targeted acquisitions to bolster raw material security.

Nimble mid-tier companies are carving out unique value propositions by focusing on custom formulations and flexible manufacturing suites that can accommodate small-volume, high-specification orders. These players leverage rapid prototyping capabilities and lean production methods to serve specialized segments, such as bio-based slurries for eco-certified packaging or micro-spherical granules for precision electronics applications. Their agility affords them closer collaboration with end-users on performance testing and application trials, accelerating product iteration cycles.

Across the spectrum, sustainability credentials have become a key differentiator. Leading manufacturers seek to achieve third-party environmental certifications and carbon-neutral production targets, underscoring a commitment to responsible sourcing and reduced lifecycle impact. Simultaneously, digitalization initiatives-ranging from predictive maintenance to real-time quality monitoring-are enhancing operational resilience and product consistency. Together, these strategic initiatives by both global titans and specialized innovators are shaping a dynamic competitive environment that rewards both scale and specialization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Calcium Silicate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&A Material Corporation

- American Elements Corp.

- Corning Incorporated

- HIL Limited

- Imerys SA

- Isolite Insulating Products Ltd.

- Johns Manville Corporation

- Kyocera Corporation

- Luyang Energy‑Saving Materials Co., Ltd.

- MLA Group of Industries

- Morgan Advanced Materials plc

- Murata Manufacturing Co., Ltd.

- Nichias Corporation

- Promat International NV

- Pyrotek Inc.

- Ramco Industries Limited

- RHI Magnesita NV

- Saint‑Gobain SA

- Sibelco NV

- Skamol A/S

- TCC Materials LLC

- Tenmat Limited

- Unifrax I LLC

- Weifang Hong Yuan Chemical Co., Ltd.

- Xella Group International GmbH

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities, Enhance Operational Efficiency, and Foster Sustainable Growth in Active Calcium Silicate

To thrive amidst evolving market complexities, industry leaders must adopt a multifaceted strategic approach that aligns with both technological trends and regulatory landscapes. Strengthening research and development pipelines is paramount; targeted investment in novel processing techniques-such as microencapsulation and hybrid polymer integration-can yield performance breakthroughs and open new application avenues. Equally important is the expansion of sustainable feedstock sourcing, whether through strategic partnerships, circular economy programs, or renewable input integration, thereby enhancing brand credibility and meeting ESG mandates.

Optimizing supply chain resilience requires a combination of geographic diversification and deepening of supplier relationships. Cultivating long-term off-take agreements with raw material providers, while investing in redundant production capacities across key regions, will mitigate the effects of trade disruptions and cost volatility. Simultaneously, digital tools for demand forecasting and inventory management can reduce working capital requirements and improve service levels.

From a go-to-market perspective, tailoring product portfolios to specific end-use segments-such as low-emission architectural coatings or food-grade moisture control agents-will create differentiated value propositions. Engaging with end users through co-development programs and technical support services strengthens customer loyalty and accelerates product adoption. Finally, embedding sustainability narratives into marketing and sales collateral, coupled with transparent reporting on carbon footprints and material provenance, will resonate with increasingly discerning industrial and consumer audiences. By executing this integrated roadmap, companies can capture emerging opportunities and secure long-term growth.

Explaining Rigorous Research Methodology and Robust Data Collection Techniques Ensuring Comprehensive and Reliable Insights in the Active Calcium Silicate Market Study

This study is grounded in a rigorous mixed-methodology framework designed to ensure data integrity, comprehensive coverage, and actionable intelligence. The research process commenced with an extensive secondary data review, encompassing technical journals, regulatory filings, and company publications to map industry structure, production technologies, and regulatory environments. This desk research established a foundational understanding of global and regional trends in active calcium silicate production and consumption.

Primary research formed the core of our methodology, featuring in-depth interviews with more than 30 stakeholders, including plant managers, R&D heads, procurement directors, and key opinion leaders across major consuming industries. These expert dialogues provided qualitative insights into supply chain challenges, innovation trajectories, and evolving end-user requirements. Furthermore, interactive workshops facilitated direct validation of segmentation logic, ensuring that the categorization by grade, particle size, form, application, and distribution channel accurately reflects market realities.

Complementing qualitative inputs, the study employed rigorous data triangulation techniques, cross-verifying primary findings with trade data, customs statistics, and industry association reports. This multi-layered approach minimized bias and reinforced the credibility of the insights presented. Lastly, the entire research process adhered to ethical guidelines, data privacy protocols, and transparency standards, guaranteeing a robust and reproducible analysis that stakeholders can rely upon for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Calcium Silicate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Calcium Silicate Market, by Grade

- Active Calcium Silicate Market, by Particle Size

- Active Calcium Silicate Market, by Form

- Active Calcium Silicate Market, by Application

- Active Calcium Silicate Market, by Distribution Channel

- Active Calcium Silicate Market, by Region

- Active Calcium Silicate Market, by Group

- Active Calcium Silicate Market, by Country

- United States Active Calcium Silicate Market

- China Active Calcium Silicate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Core Findings and Strategic Imperatives to Cement Understanding of Market Trends and Guide Decision-Making in the Active Calcium Silicate Industry

By synthesizing the detailed examination of market drivers, segmentation nuances, and regional dynamics, this report paints a holistic portrait of the active calcium silicate landscape. The convergence of advanced processing technologies and sustainability imperatives has elevated performance expectations, while new trade policies have tested supply chain adaptability and spurred domestic capacity investments. Segmentation analysis has illuminated the diverse requirements of food and industrial grades across multiple particle sizes, forms, applications, and distribution channels, underscoring the importance of tailored strategies for maximum market penetration.

Regional insights reinforce the necessity of aligning product and expansion plans with local regulatory frameworks, infrastructure demands, and logistical realities. From the Americas’ stringent environmental standards to EMEA’s heterogeneous market structures and Asia-Pacific’s rapid urbanization, each territory presents unique challenges and growth levers. Competitive profiling reveals that both global titans and specialized challengers are advancing through product innovation, sustainability credentials, and digital transformation.

Ultimately, the strategic recommendations distilled in this report provide a clear roadmap for stakeholders to optimize R&D investments, fortify supply chain resilience, and articulate compelling value propositions. Armed with these insights, decision-makers can confidently navigate emerging opportunities, mitigate risks associated with tariff fluctuations, and drive sustainable growth in the active calcium silicate sector.

Empower Your Business with In-Depth Active Calcium Silicate Insights Contact Ketan Rohom to Secure Your Comprehensive Market Research Report Today

To explore how these comprehensive insights can inform your strategic decisions and drive tangible business outcomes, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding organizations through complex industrial landscapes will ensure you secure the tailored market research report that addresses your unique challenges and opportunities. Reach out today to discuss subscription options, customized data packages, and expedited delivery timelines that align with your project milestones and budgets.

- How big is the Active Calcium Silicate Market?

- What is the Active Calcium Silicate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?