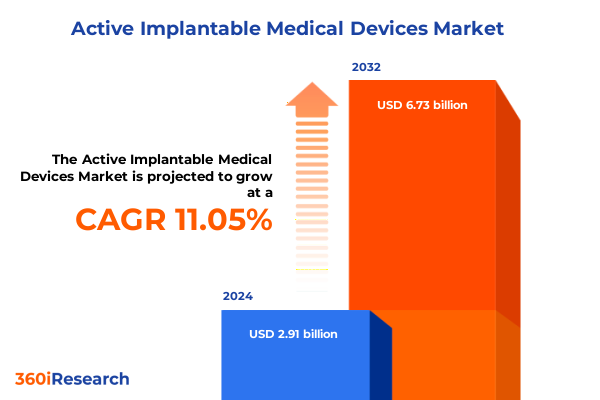

The Active Implantable Medical Devices Market size was estimated at USD 3.21 billion in 2025 and expected to reach USD 3.55 billion in 2026, at a CAGR of 11.14% to reach USD 6.73 billion by 2032.

Introducing the Evolution, Significance, and Innovative Progress of Active Implantable Medical Devices Reshaping Patient Care in the 21st Century

Active implantable medical devices have emerged as cornerstones of modern healthcare, offering life-changing solutions for patients with chronic cardiac, neurological, and metabolic disorders. Over the past several decades, these devices have progressed from rudimentary electrical stimulators to highly sophisticated, programmable implants capable of real-time monitoring and adaptive therapy. As aging populations worldwide confront growing incidences of heart failure, neurological disorders, and metabolic conditions, the integration of advanced implantables into treatment paradigms has become an essential component of comprehensive patient care.

This landscape is defined by continuous innovation in materials science, electronic miniaturization, and wireless communication technologies, which collectively enhance device reliability, longevity, and patient comfort. Pioneering research in biocompatible coatings, battery efficiency, and closed-loop control systems has enabled today’s implants to deliver personalized therapy with unprecedented precision. At the same time, evolving regulatory frameworks in key markets have introduced more stringent requirements for clinical validation, cybersecurity, and post-market surveillance, reinforcing the imperative for robust quality systems and evidence-based development.

Looking ahead, the convergence of artificial intelligence, remote monitoring platforms, and telehealth services promises to transform active implantable devices into integral components of connected care networks. This integration not only optimizes patient outcomes through data-driven intervention strategies but also fosters new models of chronic disease management that extend beyond traditional clinical settings. In sum, active implantable medical devices stand at the forefront of healthcare innovation, poised to redefine therapeutic standards and elevate patient quality of life in the 21st century.

Understanding the Technological, Regulatory, and Market-Driven Shifts Revolutionizing the Landscape of Active Implantable Medical Devices Globally

The active implantable devices sector is undergoing transformative shifts driven by breakthroughs in miniaturization and biocompatibility that enable smaller, more versatile implants. Recent advances in micro-electromechanical systems (BioMEMS) have integrated sensors and microfluidic drug delivery channels into neurostimulation and cardiac devices, supporting adaptive therapy and reducing procedural invasiveness. Concurrently, the fusion of artificial intelligence and machine learning algorithms within implantable cardiac defibrillators and loop recorders is facilitating predictive analytics, optimizing arrhythmia detection, and tailoring pacing protocols to individual patient profiles.

As digital connectivity expands, the industry is placing renewed emphasis on cybersecurity and data integrity to safeguard patient information and device functionality. Regulatory bodies, including the FDA and EU MDR, have intensified scrutiny of software validation and risk management, prompting manufacturers to allocate substantial budgets toward threat detection, microsegmentation, and zero-trust architectures. In parallel, interoperability challenges persist as legacy hospital systems grapple with integrating novel implant communications while upholding stringent privacy standards.

Market consolidation and sustainability are also reshaping the competitive landscape. A wave of mergers and acquisitions has emerged as larger medtech firms seek to diversify portfolios and acquire cutting-edge capabilities, even as stakeholders demand greener manufacturing practices and recyclable materials. This confluence of technological, regulatory, and environmental imperatives underscores a pivotal moment for active implantable devices, where agility and innovation will determine market leadership.

Evaluating the Cumulative Impact of New United States Tariffs Imposed in 2025 on the Supply Chain, Costs, and Accessibility of Active Implantable Devices

In 2025, the United States implemented sweeping tariff measures affecting a broad array of medical devices, including active implantables such as pacemakers, infusion pumps, and neurostimulators. A 10% duty on imports from China, coupled with 25% tariffs on steel- and aluminum-containing goods, has increased manufacturing input costs for many device components. Additionally, targeted levies of up to 145% on specific Chinese imports have further strained supply lines, compelling manufacturers to reevaluate sourcing strategies and accelerate near-shoring initiatives.

These tariffs have exacerbated existing supply chain vulnerabilities by inflating prices for critical components and extending lead times for specialized parts sourced internationally. Hospitals and health systems have reported rising procurement expenses, with some institutions forecasting cost increases for pacemakers and insulin pumps by double-digit percentages due to the new duties. The complexity of re-routing supply networks and obtaining regulatory approvals for alternative suppliers has magnified these challenges, compromising device availability and heightening patient access concerns.

Industry advocacy groups and hospital associations have responded by petitioning for tariff exemptions and relief measures to mitigate disruptions to healthcare delivery. Despite these efforts, the absence of broad carve-outs for medical devices has left stakeholders contending with higher operational costs, potential procedure delays, and pressures to absorb expenses without passing them directly to patients.

Deriving Key Insights from Comprehensive Segmentation Analyses to Illuminate Strategic Opportunities and Development Trajectories across Device Types and Applications

Analyses of key segmentation dimensions reveal distinct patterns of growth and opportunity within the active implantable medical devices landscape. When examining device types, cardiac pacemakers continue to underpin the market’s backbone, supported by ongoing enhancements in battery longevity and leadless technology, while cochlear implants demonstrate robust adoption as expanding candidacy criteria and programming sophistication broaden patient eligibility. Implantable cardioverter defibrillators remain vital for sudden cardiac event prevention, even as rising interest in subcutaneous systems reshapes competitive dynamics. Infusion pumps, particularly insulin delivery systems, benefit from closed-loop integration with continuous glucose monitors, and neurostimulators are experiencing rapid innovation in targeted pain management and movement disorder therapies.

A technology-based lens underscores a shift toward rechargeable platforms, as energy-efficient architectures and transcutaneous charging reduce the frequency of surgical interventions and extend device lifespans. Non-rechargeable implants continue to serve critical acute indications, but rechargeable variants are capturing attention for chronic therapeutic applications. Patient age group segmentation indicates adult populations represent the largest cohort for cardiac and neurological implants, yet geriatric and pediatric segments present unique clinical demands-geriatric patients require devices optimized for comorbidity management and simplified programming, while pediatric patients benefit from adjustable therapies that accommodate growth and developmental considerations.

Application-driven analysis shows cardiology remains the preeminent focus, encompassing heart failure management and heart rhythm management solutions that integrate sensing and pacing functions, and endocrinology applications are spearheaded by advanced insulin pumps for type 1 diabetes. Neurology applications are bifurcated between deep brain stimulation for movement disorders and spinal cord stimulation for chronic pain, while otology is dominated by cochlear implant innovations. End users span ambulatory surgical centers, clinics, and hospitals, with hospitals-particularly private institutions-leading adoption through comprehensive implant programs, while clinics and ASCs expand access to minimally invasive procedures and outpatient device implantations.

This comprehensive research report categorizes the Active Implantable Medical Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- Patient Age Group

- Application

- End User

Analyzing Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific to Inform Strategic Market Positioning

Regional dynamics in the active implantable devices market highlight a tapestry of opportunities and challenges across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust healthcare infrastructure, favorable reimbursement policies, and strong private sector investment have fueled demand for advanced cardiac and neurological implants. The United States, in particular, benefits from a mature medtech ecosystem and high procedural volumes, although trade tensions and tariff volatility present headwinds to device affordability.

Europe Middle East & Africa embodies heterogeneity, with Western Europe characterized by stringent regulatory adherence and emphasis on value-based healthcare models, driving adoption of high-performance, well-validated devices. Conversely, emerging markets in Eastern Europe, the Middle East, and Africa exhibit growing unmet needs for chronic disease management, but their growth is tempered by limited healthcare budgets and evolving reimbursement frameworks. Local manufacturing initiatives and public-private collaborations are gradually improving access to implantable therapies in these regions.

In Asia-Pacific, rapid economic expansion and rising healthcare expenditure underpin one of the fastest-growing markets for active implantable devices. Countries such as China, Japan, and South Korea are investing substantially in domestic R&D and production capabilities, while Southeast Asian nations are enhancing market access through regulatory harmonization and public health programs. Nevertheless, price sensitivity and infrastructure disparities across the region necessitate tailored strategies that balance cost optimization with technology transfer and training initiatives.

This comprehensive research report examines key regions that drive the evolution of the Active Implantable Medical Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Extracting Critical Intelligence on Leading Manufacturers’ Strategies, Partnerships, and Innovations Shaping the Future of Active Implantable Medical Devices

Leading manufacturers in the active implantable medical devices domain are deploying multifaceted strategies to sustain innovation and competitive advantage. Medtronic’s focus on sensor-enabled closed-loop systems and personalized cardiac resynchronization therapy exemplifies its commitment to integrated solutions, reinforced by strategic partnerships with digital health platforms. Abbott Laboratories continues to expand its electrophysiology and neuromodulation portfolios through targeted acquisitions and co-development agreements, enhancing its footprint in high-growth segments such as spinal cord stimulation and leadless pacing.

Boston Scientific and Johnson & Johnson maintain strong positions in electrophysiology and orthobiologics, respectively, while bolstering their offerings with AI-driven analytics and remote monitoring capabilities. Biotronik’s emphasis on MRI-conditional devices and energy-harvesting technologies demonstrates its niche specialization, whereas Cochlear Limited leverages its clinical expertise to refine implant programming and support services for improved auditory rehabilitation outcomes. Emerging players are differentiating through innovative materials, miniaturized power sources, and proprietary telehealth integrations, driving competitive pressure and inviting further consolidation through mergers and alliances.

Across the value chain, companies are also investing heavily in post-market surveillance and cybersecurity frameworks, aligning product development with evolving regulatory mandates and reinforcing stakeholder trust. Collaborative ventures between device manufacturers and strategic tech partners are accelerating the adoption of cloud-based analytics and predictive maintenance models, setting new benchmarks for device reliability and patient safety.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Implantable Medical Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Advanced Bionics Corporation

- Aleva Neurotherapeutics S.A.

- Axonics Modulation Technologies, Inc.

- Berlin Heart GmbH

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- Calon Cardio Ltd.

- CARMAT SA

- Cochlear Limited

- CVRx Inc.

- Envoy Medical Corporation

- Inspire Medical Systems, Inc.

- Jarvik Heart, Inc.

- LivaNova PLC

- Medtronic plc

- MED‑EL Elektromedizinische Geräte GmbH

- MicroPort CRM Corporation

- MicroTransponder Inc.

- Nevro Corp.

- Nurotron Biotechnology Co., Ltd.

- Oticon Medical A/S

- Sonova Holding AG

- SynCardia Systems LLC

- William Demant Holding A/S

Formulating Actionable Strategic Recommendations for Industry Leaders to Navigate Disruption, Drive Innovation, and Strengthen Competitive Position in Active Implants

Industry leaders must prioritize diversification of supply chains to mitigate tariff-related risks and ensure continuity of critical component sourcing. Establishing multi-regional manufacturing hubs and forging partnerships with local suppliers will enhance resilience against geopolitical disruptions and streamline regulatory approvals in target markets. Concurrently, enhancing agility in component qualification processes can reduce lead times for alternative sourcing and reinforce cost containment.

Investments in digital ecosystems are imperative for the next wave of implantable device innovation. Companies should integrate advanced analytics, artificial intelligence, and remote monitoring platforms directly into device architectures, enabling proactive patient management and new value-added service models. Collaboration with health systems to pilot data-driven care protocols can generate compelling real-world evidence, fostering greater adoption and reimbursement support.

To navigate regulatory complexity and cybersecurity challenges, manufacturers must adopt rigorous quality management systems that encompass software development lifecycle controls, vulnerability assessments, and post-market surveillance. Proactive engagement with regulatory authorities to align on emerging standards-particularly around AI-enabled functions-will expedite market entry and reduce compliance costs.

Finally, forging cross-sector alliances with technology firms, academic institutions, and payers can accelerate innovation pipelines and facilitate access to complementary expertise in materials science, data security, and patient engagement. By cultivating an open innovation model, device companies can harness external insights and co-create tailored solutions that address evolving clinical and economic imperatives.

Detailing a Rigorous Research Methodology Incorporating Primary Interviews, Secondary Sources, and Data Analysis Techniques to Ensure Robust Market Insights

This study employed a multi-method research framework to ensure comprehensive and validated insights into the active implantable medical devices market. Secondary research constituted desk analysis of academic publications, regulatory filings, industry white papers, and corporate disclosures to establish baseline trends in technology, policy, and competitive landscapes. Key sources included peer-reviewed journals, government databases, and regulatory agency guidelines.

Primary research involved structured interviews and surveys with over 30 stakeholders, including clinical specialists, medical device executives, regulatory experts, and procurement officers. These engagements provided qualitative depth on unmet clinical needs, product adoption drivers, supply chain challenges, and future technology trajectories. Interview insights were triangulated with secondary findings to enhance data reliability and uncover nuanced market dynamics.

Quantitative validation incorporated data compilation and cross-comparison from regional healthcare databases, patent registries, and financial reports of leading manufacturers. A data triangulation approach was applied to reconcile discrepancies and reinforce the accuracy of segmentation analyses. Statistical techniques, including trend analysis and scenario modeling, were deployed to interpret historical data and derive coherent narrative insights without projecting speculative forecasts.

Throughout the research process, methodological rigor was maintained via iterative review cycles with internal experts, external consultants, and select industry advisors. This collaborative scrutiny ensured methodological transparency, reproducibility, and alignment with best practices in market research and regulatory intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Implantable Medical Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Implantable Medical Devices Market, by Device Type

- Active Implantable Medical Devices Market, by Technology

- Active Implantable Medical Devices Market, by Patient Age Group

- Active Implantable Medical Devices Market, by Application

- Active Implantable Medical Devices Market, by End User

- Active Implantable Medical Devices Market, by Region

- Active Implantable Medical Devices Market, by Group

- Active Implantable Medical Devices Market, by Country

- United States Active Implantable Medical Devices Market

- China Active Implantable Medical Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Strategic Imperatives, Market Transformations, and Future Outlook for Active Implantable Medical Devices in Modern Healthcare

The active implantable medical devices sector stands at a pivotal juncture where technological advancements, regulatory evolution, and geopolitical shifts converge to shape future trajectories. Devices are becoming smarter, smaller, and more integrated into holistic care ecosystems, enabling personalized therapy pathways that extend beyond clinic walls. Simultaneously, cybersecurity, quality management, and supply chain robustness remain fundamental imperatives to safeguard patient safety and operational continuity.

Strategic segmentation insights accentuate the importance of tailored approaches across device types, patient demographics, and application niches-from heart rhythm management to neuromodulation and beyond. Regional analysis further underscores the necessity of customized market entry strategies that account for regulatory heterogeneity, reimbursement landscapes, and local manufacturing priorities. Leading companies continue to differentiate through innovation in closed-loop systems, AI-driven diagnostics, and energy-efficient designs, while emerging players focus on niche applications and novel materials.

Looking forward, industry stakeholders who leverage dynamic partnerships, invest in digital health integration, and embrace agile supply chain models will be best positioned to capitalize on emerging opportunities. By harmonizing clinical excellence with technological foresight and regulatory agility, the active implantable devices market is set to deliver transformative impacts on patient outcomes and healthcare value globally.

Engage with Associate Director Ketan Rohom to Secure In-Depth Market Intelligence and Accelerate Your Strategic Initiatives in Active Implantable Device Innovation

To gain a deeper understanding of the active implantable medical devices market and translate insights into strategic opportunities, please connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in medtech research and client engagement will guide you through the comprehensive market analysis, ensuring you receive tailored intelligence and personalized support. Reach out today to explore flexible licensing options, secure executive briefings, and accelerate your decision-making with unparalleled market data. Elevate your leadership in the active implantable devices sector by partnering with Ketan for a bespoke research experience that drives innovation and competitive advantage.

- How big is the Active Implantable Medical Devices Market?

- What is the Active Implantable Medical Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?