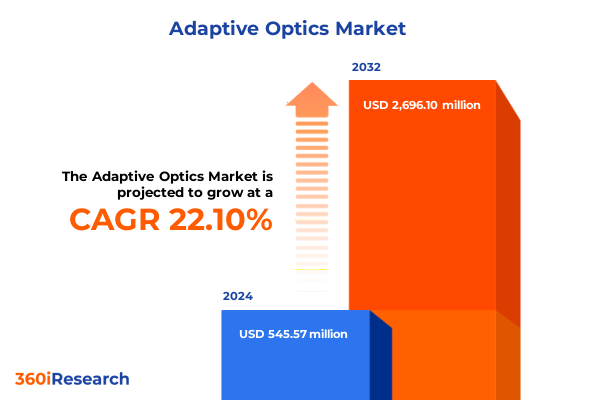

The Adaptive Optics Market size was estimated at USD 660.90 million in 2025 and expected to reach USD 803.37 million in 2026, at a CAGR of 22.24% to reach USD 2,696.10 million by 2032.

Discover How Adaptive Optics Is Revolutionizing Imaging and Sensing Across Industries by Enabling Unprecedented Precision and Enhanced Performance in Applications

Adaptive optics has emerged as a transformative technology that corrects wavefront distortions in real time, fundamentally altering the capabilities of telescopes, microscopes, and various imaging systems. Originally conceptualized for astronomical observations to compensate for atmospheric turbulence, these systems now find applications across a spectrum of industries, from biomedical imaging to defense and communications. The centerpiece of any adaptive optics system is its ability to sense aberrations and apply corrective measures instantaneously, enabling unprecedented resolution and clarity. As the technology has matured, advancements in deformable mirrors, wavefront sensors, and control algorithms have converged to deliver systems that are both more precise and more accessible than ever before. Moreover, the integration of high-speed digital processing and machine learning techniques has accelerated the pace of innovation, driving down latency and elevating performance. Transitioning from theoretical constructs to practical implementations, adaptive optics today stands as a critical enabler for next-generation imaging and sensing platforms. With continuous investment in research and escalating demand across scientific and industrial domains, adaptive optics is poised to enter a new chapter of growth. As such, understanding its evolution, the forces shaping its trajectory, and the strategic implications for market players is essential for leaders seeking to harness its full potential.

Explore the Transformational Shifts Driving Next Generation Adaptive Optics Innovations That Are Redefining Imaging Performance and Operational Efficiency

In recent years, the adaptive optics landscape has been reshaped by several key breakthroughs that collectively underpin a new era of performance and versatility. MEMS-based deformable mirrors, once a niche innovation, now offer thousands of actuators in compact form factors, facilitating higher spatial resolution corrections within smaller footprints. Concurrently, advances in wavefront sensing have introduced high-frame-rate sensors capable of capturing minute phase distortions across broader dynamic ranges. This quantum leap in sensing fidelity is complemented by leaps in computational hardware and algorithms, where real-time processing powered by AI-driven adaptive control loop tuning has significantly reduced latency. These technological shifts have, in turn, enabled the miniaturization of adaptive optics modules, paving the way for their integration into portable and handheld devices. In parallel, cross-industry convergence has spawned novel applications: astronomical observatories are collaborating with semiconductor manufacturers to deploy adaptive optics in lithography, while biomedical researchers leverage real-time correction for in vivo cellular imaging. Defense organizations, meanwhile, are embedding compact, high-speed systems into unmanned aerial vehicles to enhance surveillance and targeting capabilities. Taken together, these transformative shifts mark a departure from the era of large, bespoke installations toward a future of modular, scalable solutions that can be rapidly tailored to diverse requirements.

Understand the Complex Impacts of 2025 United States Tariff Policies on Adaptive Optics Supply Chains Manufacturing Costs and Global Competitiveness

The introduction of expanded tariff measures by the United States in 2025 has imparted notable complexities to adaptive optics supply chains and cost structures. By imposing additional duties on imported precision optical components, key elements such as deformable mirror assemblies and advanced wavefront sensors have experienced escalating landed costs, prompting manufacturers to reassess sourcing strategies. Consequently, domestic fabrication of critical components has gained renewed emphasis, yet this pivot entails significant capital investment and extended lead times for capacity expansion. Moreover, end customers dependent on global supply have encountered price adjustments that cascade through procurement processes, potentially delaying project timelines and altering budget allocations. Despite these headwinds, several industry participants are adopting mitigation tactics, including the qualification of alternate suppliers, onshore subcontracting partnerships, and collaborative R&D to develop tariff-resilient designs. Furthermore, the shifting tariff landscape has catalyzed policy dialogue among industry associations and government stakeholders, seeking exemptions and streamlined clearance procedures for research-centric equipment. As a result, while the tariff environment has introduced cost volatility and supply chain risk, it has also spurred intensified collaboration and innovation aimed at sustaining market momentum.

Gain Critical Insights into Adaptive Optics Market Segmentation Based on Component Device Type Technology Type and Application to Guide Strategic Focus

A nuanced appreciation of the adaptive optics market emerges when examining its segmentation through multiple lenses. When dissected by component, it becomes evident that control systems, wavefront modulators and wavefront sensors each occupy strategic roles; control systems orchestrate real-time corrective commands, wavefront modulators enact precise surface adjustments, and sensors detect phase aberrations with ever-growing sensitivity. Shifting focus to device type reveals divergent demand trajectories for compact systems versus large aperture systems, as the former cater to space-constrained biomedical and defense applications, while the latter serve astronomical observatories and high-power laser facilities, requiring expansive mirror geometries. Delving deeper into technology types uncovers the distinct paths of adaptive sensing systems, which prioritize environmental feedback loops; high-speed AO systems, which emphasize minimal latency for dynamic scenes; and real-time AO systems, which integrate instantaneous data analytics to maintain optimal performance under rapidly changing conditions. Finally, the diversity of application spaces - ranging from astronomy’s quest for clearer cosmic imagery to biomedical research’s drive for non-invasive cellular visualization, from defense and security’s need for precise targeting to industrial and manufacturing process control, and extending to laser communications’ demand for robust beam propagation - underscores the breadth of use cases shaping development priorities. By weaving together these segmentation perspectives, decision makers can pinpoint areas of growth, anticipate cross-segment synergies and tailor investment strategies to the most promising intersections of component, device type, technology and application.

This comprehensive research report categorizes the Adaptive Optics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Device Type

- Technology Type

- Application

Uncover Key Regional Dynamics Shaping the Adaptive Optics Market across Americas Europe Middle East Africa and Asia Pacific for Strategic Expansion

Regional dynamics within the adaptive optics landscape reveal a tapestry of differentiated strengths, challenges and growth catalysts. In the Americas, institutional leadership in astronomical research and a robust defense procurement ecosystem underpin sustained investment in both large aperture observatories and compact sensor modules. Academic collaborations based in North America fuel iterative innovation, whereas Latin American initiatives, though nascent, are increasingly partnering with established manufacturers to accelerate the deployment of adaptive optics in environmental monitoring. Crossing into Europe, Middle East and Africa, research consortia in Europe benefit from coordinated funding mechanisms that align national space agencies, scientific academies and private enterprises, thereby fostering sophisticated large aperture installations. Simultaneously, Middle Eastern sovereign wealth allocations have begun targeting advanced imaging platforms to support both defense modernization and space exploration ambitions. In Africa, early-stage pilot projects are testing compact, low-cost systems to enhance terrestrial telecommunications and remote sensing. Meanwhile, Asia-Pacific stands as a vibrant crucible of manufacturing scale and academic prowess, with China and Japan leading in high-speed AO system production and component fabrication. India’s emerging technology parks focus on real-time AO solutions for biomedical and communications deployments, while Australia’s observatories continue to push the envelope of large aperture adaptive mirror research. Collectively, these regions delineate a complex ecosystem where collaboration and competition intersect, and where localized strengths can be leveraged for global impact.

This comprehensive research report examines key regions that drive the evolution of the Adaptive Optics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze Leading Adaptive Optics Industry Players Their Strategic Initiatives Technological Innovations and Competitive Positioning in the Evolving Market Landscape

A review of leading industry players highlights a competitive arena defined by strategic partnerships and continuous technological investment. One prominent participant has accelerated its R&D pipeline through the acquisition of specialized MEMS deformable mirror ventures, thereby fortifying its position in high-speed correction systems. Another established optics manufacturer has broadened its portfolio by collaborating with academic institutions to refine wavefront sensor algorithms, enhancing sensitivity and dynamic range for both compact and large aperture configurations. A defense contractor, leveraging its core competency in integrated systems, has introduced turnkey packages that seamlessly unite control electronics, modulators and sensor modules, catering to unmanned aerial platforms. Concurrently, a precision lens and mirror producer has expanded its manufacturing capacity to include ceramic and silicon carbide mirror substrates, addressing the thermal and mechanical stability demands of next-generation observatories. Additionally, a newer market entrant is carving out a niche through the development of real-time adaptive optics subsystems optimized for laser communications, capitalizing on the intersection of high-speed networking and free-space optical links. Across these varied actors, recurring themes of strategic investment, cross-sector collaboration and targeted technology roadmaps point to a market where differentiation arises from both depth of technical capability and agility in responding to evolving end-user requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adaptive Optics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abberior Instruments GmbH

- Adaptica S.R.L

- Baker Adaptive Optics

- Benchmark Electronics, Inc.

- Bertin Technologies group

- Boston Micromachines Corporation

- Canon Inc.

- Dynamic Optics Srl

- Edmund Optics Inc

- Flexible Optical B.V.

- Hamamatsu Photonics K.K.

- Hewlett Packard Enterprise Company

- HOLOEYE Photonics AG

- Imagine Eyes S.A.

- Imagine Optic SA

- Iris AO, Inc.

- Juniper Networks, Inc.

- KEYENCE CORPORATION

- Northrop Grumman Corporation

- Opsydia Limited

- Phasics SA

- Schott North America, Inc.

- Teledyne Technologies Incorporated

- Thorlabs, Inc.

- Trex Enterprises Corporation

Implement Tactical Strategies and Technology Roadmaps for Industry Leaders to Capitalize on Emerging Adaptive Optics Trends and Strengthen Market Leadership

Industry leaders looking to secure competitive advantage should focus on integrated strategies that encompass product innovation, supply chain resilience and cross-sector collaboration. By investing in the development of AI-augmented wavefront sensing algorithms, companies can achieve lower latency and higher correction accuracy, thereby unlocking new applications in dynamic environments. Simultaneously, cultivating alternate sourcing arrangements and onshore capabilities will mitigate the operational risks introduced by tariff fluctuations, ensuring continuity of supply for critical components. Furthermore, fostering partnerships with academic research centers and end-user consortia can accelerate validation cycles and reduce time to market, particularly for nascent technologies such as real-time AO modules in laser communication networks. Companies should also explore modular system architectures that allow rapid customization for diverse applications, from biomedical imaging to industrial process control. Finally, strengthening customer engagement through comprehensive service offerings - including training, maintenance and system upgrades - will deepen relationships and generate recurring revenue streams. Through this multifaceted approach, organizations can not only navigate current market complexities but also position themselves to lead in the next wave of adaptive optics innovation.

Detail the Rigorous Research Framework Data Sources and Analytical Methods Employed to Ensure Comprehensive and Reliable Adaptive Optics Market Insights

The research methodology underpinning this report integrates multiple stages of data collection and analysis to ensure both breadth and depth of insight. Initially, a comprehensive review of peer-reviewed journals, patent filings and technical conference proceedings established a foundational understanding of recent technological advances and emerging research trajectories. Concurrently, publicly disclosed company documents - including product specifications, regulatory filings and investor presentations - were systematically examined to map strategic priorities and investment patterns. In the second phase, primary data was gathered through structured interviews with subject matter experts spanning academia, government laboratories and industry practitioners; these discussions provided real-world context and validated secondary findings. Quantitative data points were triangulated across independent sources, while qualitative trends were coded to reveal recurring themes and potential inflection points. Throughout the analysis, iterative peer review sessions ensured methodological rigor, and any discrepancies were resolved through follow-up inquiries. Finally, the synthesis of these inputs yielded a cohesive narrative that balances technical depth with strategic clarity, arming decision makers with actionable insights backed by robust, verifiable evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adaptive Optics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adaptive Optics Market, by Component

- Adaptive Optics Market, by Device Type

- Adaptive Optics Market, by Technology Type

- Adaptive Optics Market, by Application

- Adaptive Optics Market, by Region

- Adaptive Optics Market, by Group

- Adaptive Optics Market, by Country

- United States Adaptive Optics Market

- China Adaptive Optics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarize the Strategic Implications of Adaptive Optics Innovations Tariff Influences and Market Segmentation for Decision Makers and Industry Stakeholders

Drawing together the threads of technological innovation, tariff-induced supply chain shifts and nuanced segmentation perspectives underscores several strategic imperatives for stakeholders. First, the maturation of AI-integrated control systems heralds new performance benchmarks, requiring continuous alignment of R&D pipelines with evolving computational architectures. Second, the impact of 2025 tariff measures has reinforced the need for diversified procurement strategies and collaborative domestic manufacturing initiatives to sustain cost competitiveness. Third, the market’s segmentation across component, device type, technology and application highlights the importance of targeted investment in high-growth niches, such as large aperture systems for astronomy and compact real-time modules for biomedical diagnostics. Finally, regional market dynamics reveal distinct innovation ecosystems, from the Americas’ research-driven environment to Asia-Pacific’s manufacturing scale, offering multiple pathways for strategic partnerships. In this context, organizations that harmonize technological agility with supply chain resilience and cross-regional collaboration will be best positioned to capitalize on the adaptive optics revolution. The insights presented herein serve as a blueprint for informed decision making, equipping leaders with the clarity needed to navigate a complex and rapidly evolving market.

Engage with Associate Director Sales Marketing Ketan Rohom to Access Comprehensive Adaptive Optics Research Data Strategies and Drive Informed Decisions

To obtain a comprehensive and nuanced understanding of adaptive optics developments, readers are invited to engage directly with Ketan Rohom, whose leadership in sales and marketing ensures an exceptional customer experience. Ketan Rohom brings an in-depth knowledge of market dynamics and technical intricacies, offering personalized guidance to align research insights with specific organizational goals. By connecting with Ketan, stakeholders can secure access to proprietary datasets, detailed application analyses, and strategic recommendations that transcend generic reports. This partnership delivers not only the breadth of data required for informed decision-making but also the depth of expertise necessary to translate those insights into actionable strategies. Reach out today to explore tailored research packages, unlock premium add-ons, and initiate a conversation that will empower your team to lead in the rapidly evolving adaptive optics arena.

- How big is the Adaptive Optics Market?

- What is the Adaptive Optics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?