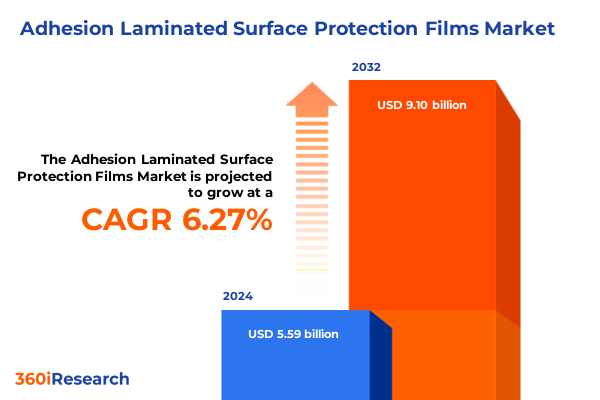

The Adhesion Laminated Surface Protection Films Market size was estimated at USD 5.59 billion in 2024 and expected to reach USD 5.92 billion in 2025, at a CAGR of 6.27% to reach USD 9.10 billion by 2032.

Revealing the Essential Dynamics That Define Adhesion Laminated Surface Protection Films and Their Strategic Importance Across Emerging Applications

Adhesion laminated surface protection films have emerged as indispensable materials that safeguard diverse surfaces against abrasion, chemical exposure, and environmental degradation. These multilayer constructs combine a protective polymer film with a pressure-sensitive adhesive layer, enabling seamless application and removal without leaving residue. Industries ranging from automotive assembly lines to electronic device manufacturing rely on these films to preserve surface finishes during transport, processing, and installation. As production processes become more automated and precision driven, the role of reliable protective films has grown increasingly critical to ensure product quality and minimize waste.

In recent years, demand for surface protection solutions has accelerated in tandem with rising manufacturing complexity and heightened consumer expectations for flawless finishes. Sustainability considerations have further elevated the importance of films that balance durability with recyclability or reduced environmental impact. Concurrently, advances in adhesive chemistry and polymer science have unlocked enhanced film performance characteristics, such as improved clarity, temperature resistance, and ease of removal. Given these dynamics, stakeholders across manufacturing, distribution, and end-use segments must understand both the technical underpinnings and the strategic implications of adhesion laminated surface protection films.

This executive summary serves as a comprehensive guide to the current landscape, transformative market shifts, regulatory influences, segmentation insights, regional developments, and competitive strategies. Building on a robust research methodology, it distills critical findings and concludes with targeted recommendations, concluding with a call to action for industry leaders seeking deeper analysis.

Uncovering the Transformative Technological and Market Shifts Reshaping the Adhesion Laminated Surface Protection Film Landscape

The adhesion laminated surface protection film market is undergoing transformative shifts driven by technological innovation and evolving end-user requirements. On the technological front, nano-engineered coatings and corona treatment techniques have elevated adhesives’ performance, offering improved bond strength, residue-free removal, and enhanced barrier properties. Simultaneously, digital printing capabilities have enabled on-demand customization, allowing manufacturers to integrate branding or instructional graphics directly onto protective films and thereby add value throughout the supply chain.

Market forces are also reshaping the landscape. Heightened focus on sustainability has spurred the development of recyclable and bio-based film substrates, while regulatory pressures around chemical use have led to a shift away from solvent-based adhesives toward waterborne or UV-curable alternatives. In addition, supply chain resilience has emerged as a critical priority, prompting companies to diversify raw material sourcing and explore near-shoring opportunities. These strategic shifts underscore the need for stakeholders to remain agile and invest in next-generation production capabilities.

Understanding the full impact of these transformative trends is essential for manufacturers, distributors, and end users seeking to maintain competitive advantage. The ensuing sections delve into tariff implications, segmentation insights, regional dynamics, and company strategies that collectively define the evolving contours of the surface protection film domain.

Examining the Cumulative Influence of Recent United States Tariff Policies on Adhesion Laminated Surface Protection Film Supply Chains

In 2025, a series of tariff adjustments enacted by the United States government have had a material impact on the adhesion laminated surface protection film sector. Levies on imported polymer substrates such as polyethylene and polyester have increased input costs for many film producers reliant on overseas supply. As a result, manufacturers have faced compressed margins, with some electing to pass through higher prices to end-users, while others have explored alternative sourcing strategies to mitigate exposure to duties.

These tariff measures have also stimulated a geographic realignment of supply chains. Domestic resin producers have seized the opportunity to strengthen partnerships with film converters, enabling faster lead times and reduced logistical complexity. Meanwhile, importers have shifted focus toward tariff-exempt trade partners and specialized adhesives sourced from regions with favorable duty structures. This realignment underscores a broader industry pivot toward supply chain diversification and enhanced risk management.

Looking ahead, stakeholders must navigate a fluid policy environment in which future tariff revisions and trade negotiations could further influence cost structures and competitive positioning. By proactively assessing supplier portfolios, optimizing procurement strategies, and investing in manufacturing flexibility, organizations can turn tariff challenges into strategic imperatives that fortify long-term resilience.

Deriving Strategic Insight from Film Type to End Use Industry in Adhesion Laminated Surface Protection Film Segmentation Trends

A detailed segmentation approach reveals nuanced insights into the drivers of adhesion laminated surface protection film performance and adoption. Analysis by film type indicates that polyester variants dominate applications requiring high tensile strength and dimensional stability, whereas polyvinyl chloride solutions see specialized use where chemical resistance is paramount. Polypropylene grades have gained traction for cost-sensitive masking operations, and polyethylene continues to serve as a versatile base for general-purpose protective films.

Evaluating adhesive chemistries highlights acrylic formulations as favored for their clarity and low migration, rubber adhesives for heavy-duty bonding in construction masking, and silicone options for high-temperature electronic and industrial applications. Thickness considerations drive choices between ultra-thin films under 50 microns for screen protection and coatings requiring precision, versus robust films exceeding 200 microns in heavy manufacturing contexts. The selection of release liners further refines product performance, with film liners offering improved dimensional control, and paper liners preferred for cost effectiveness in bulk masking processes.

Coating innovations including corona treatment, flame treatment, and plasma treatment have unlocked enhanced surface wettability and adhesion consistency, while end-use segmentation underscores the primacy of automotive OEM for high-volume application, growth in commercial and residential construction projects, and expanding relevance in consumer electronics, industrial electronics, and IT equipment manufacturing. Application insights reveal screen protection films as a surging category, alongside established uses in electroplating, painting, powder coating, decorative protection, and welding masking. These layered segmentation perspectives equip decision-makers with the intelligence needed to align product development and go-to-market strategies.

This comprehensive research report categorizes the Adhesion Laminated Surface Protection Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Film Substrate Type

- Product Form

- Thickness

- Release Liner

- Adhesive Type

- Surface Protected

- Optical Property

- Application

- End-Use Industry

- Sales Channel

Synthesizing Regional Dynamics Across Americas, EMEA, and Asia Pacific to Illuminate Adhesion Laminated Surface Protection Film Growth Drivers

Regional dynamics markedly influence the trajectory of adhesion laminated surface protection film adoption and development. In the Americas, mature markets in North America are characterized by stringent regulatory standards that prioritize high-performance adhesives and films meeting rigorous environmental criteria, while Latin American regions present opportunities for cost-conscious solutions aligned with infrastructure expansion initiatives. Trade corridors between the United States, Mexico, and Canada facilitate integrated supply networks that accelerate time-to-market and foster collaborative R&D efforts.

Within Europe, Middle East, and Africa, stringent European Union regulations on chemical use and waste management have propelled innovation in bio-based substrates and solvent-free adhesives, whereas Middle East construction booms have spurred demand for heavy-duty protection films. Meanwhile, Africa’s evolving manufacturing landscape is gradually integrating surface protection technologies across burgeoning automotive assembly and consumer appliance sectors. This diverse regulatory and economic tapestry demands localized strategies to reconcile performance, compliance, and cost considerations.

Asia-Pacific stands out for rapid growth driven by electronics manufacturing hubs in China, South Korea, and Taiwan, alongside expanding automotive and infrastructure projects across Southeast Asia and India. Strategic investments in high-capacity coating facilities and adhesive formulation research underscore the region’s commitment to supporting high-volume production with consistent quality. Collectively, these regional insights illuminate pathways for targeted investments and partnerships in alignment with local market drivers and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Adhesion Laminated Surface Protection Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Initiatives Defining the Competitive Landscape in Surface Protection Films

Leading companies in the adhesion laminated surface protection film market have adopted differentiated strategies to secure competitive advantage. Some have prioritized technological differentiation, investing heavily in R&D to develop next-generation adhesive chemistries and advanced surface treatments that enhance film performance under extreme conditions. Others have focused on vertical integration, streamlining resin sourcing, film extrusion, lamination, and coating operations to optimize cost structures and quality control.

A second cohort of players has pursued strategic partnerships and joint ventures with end-users in key industries such as automotive OEMs and consumer electronics manufacturers. These collaborations facilitate co-development of customized solutions that address precise application challenges, from precision masking in multi-stage paint processes to ultra-thin protective films for touchscreens. At the same time, mergers and acquisitions have reshaped the competitive landscape, enabling global scale and diversified product portfolios that span film types, adhesive technologies, and release liner options.

Across the board, successful companies have demonstrated agility in responding to tariff fluctuations, regional regulatory shifts, and sustainability mandates by maintaining flexible manufacturing footprints and prioritizing eco-friendly product lines. These strategic initiatives underscore a shared recognition that innovation, strategic alliances, and operational excellence are critical levers in driving long-term growth and differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adhesion Laminated Surface Protection Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Adhetec SAS

- Amcor plc

- Avery Dennison Corporation

- Bischof+Klein SE & Co. KG

- Cosmo Films

- Dunmore Corporation

- DuPont de Nemours Inc

- Eastman Chemical Company

- ECHOtape

- Ecoplast Ltd

- Henkel AG & Co. KGaA

- Intertape Polymer Group Inc.

- Jindal Poly Films Limited

- JM PlastoPack Pvt. Ltd.

- LINTEC Corporation

- Lohmann GmbH & Co. KG

- Nitto Denko Corporation

- Polifilm Group

- Pregis LLC

- Presto Tape

- RKW Group

- S.S. Lamicoats

- Saint-Gobain group.

- Scapa Group plc by Mativ Holdings, Inc.

- SEKISUI CHEMICAL CO., LTD.

- Surface Armor LLC

- tesa SE by Beiersdorf Company

- Trimaco, Inc

- XPEL, Inc.

Offering Actionable Strategies to Enhance Supply Chain Resilience, Innovation, and Market Penetration in Surface Protection Films

Industry leaders seeking to fortify their market position in adhesion laminated surface protection films should prioritize a multifaceted approach that balances innovation, operational resilience, and customer collaboration. First, investing in modular manufacturing lines capable of handling diverse film substrates, adhesive formulations, and coating treatments will enable rapid adaptation to shifting end-use requirements and tariff environments. This modularity reduces changeover times while supporting small-batch customization and regional production.

Second, deepening partnerships with automotive, electronics, and construction OEMs can facilitate joint development programs that align product features with evolving manufacturing processes. By embedding technical application teams within customer facilities, companies can co-innovate solutions that minimize rework, accelerate production ramps, and enhance final product quality. Such collaborations also provide early visibility into emerging performance needs, enabling proactive R&D prioritization.

Finally, embedding sustainability at the core of product roadmaps will resonate with corporate social responsibility goals and regulatory imperatives. Transitioning toward recyclable film substrates, reducing solvent usage in adhesives, and obtaining recognized environmental certifications will not only mitigate compliance risks but also open new market segments prioritized by eco-conscious consumers and brands. Collectively, these actionable steps will empower industry players to drive profitable growth while reinforcing competitive differentiation.

Outlining the Rigorous Research Methodology Underpinning the Comprehensive Analysis of the Surface Protection Film Domain

This analysis draws upon a rigorous blended methodology that integrates primary and secondary research to ensure comprehensive and reliable insights. Primary data was obtained through structured interviews with senior executives, R&D leads, and procurement specialists across the adhesion laminated surface protection film value chain, encompassing raw material suppliers, film converters, adhesive formulators, and end-use OEMs. These engagements provided firsthand perspectives on emerging technical requirements, supply chain challenges, and strategic priorities.

Secondary research encompassed an in-depth review of technical white papers, regulatory filings, patent databases, and industry publications, as well as analysis of trade association reports and government trade data. Quantitative data was cross-validated with industry benchmarks to confirm consistency and accuracy. All findings were subjected to multi-point quality checks, including peer review by market analysts and subject-matter experts.

This holistic research framework ensures that the conclusions and recommendations presented herein reflect both empirical trends and forward-looking insights. By combining qualitative interviews with quantitative validation, the study offers a nuanced understanding of the technical, commercial, and regulatory dimensions shaping the adhesion laminated surface protection film market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adhesion Laminated Surface Protection Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adhesion Laminated Surface Protection Films Market, by Film Substrate Type

- Adhesion Laminated Surface Protection Films Market, by Product Form

- Adhesion Laminated Surface Protection Films Market, by Thickness

- Adhesion Laminated Surface Protection Films Market, by Release Liner

- Adhesion Laminated Surface Protection Films Market, by Adhesive Type

- Adhesion Laminated Surface Protection Films Market, by Surface Protected

- Adhesion Laminated Surface Protection Films Market, by Optical Property

- Adhesion Laminated Surface Protection Films Market, by Application

- Adhesion Laminated Surface Protection Films Market, by End-Use Industry

- Adhesion Laminated Surface Protection Films Market, by Sales Channel

- Adhesion Laminated Surface Protection Films Market, by Region

- Adhesion Laminated Surface Protection Films Market, by Group

- Adhesion Laminated Surface Protection Films Market, by Country

- United States Adhesion Laminated Surface Protection Films Market

- China Adhesion Laminated Surface Protection Films Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 3339 ]

Concluding Synthesis Highlighting Key Findings and Forward-Looking Perspectives on Adhesion Laminated Surface Protection Films

The evolution of adhesion laminated surface protection films is characterized by a convergence of advanced materials engineering, shifting regulatory landscapes, and dynamic end-use demands. Technological breakthroughs in polymer science and adhesive chemistry have unlocked performance gains, while tariff policies and supply chain realignments have redefined how companies source raw materials and structure their manufacturing networks. Regional market drivers vary widely, from North America’s environmental regulations to Asia-Pacific’s rapid industrial expansion, underscoring the need for market-specific strategies.

Competitive dynamics are shaped by a dual imperative to innovate and collaborate. Companies that embrace modular manufacturing, partner closely with OEMs, and embed sustainability into product roadmaps are best positioned to navigate evolving industry requirements. Strategic diversification of film types, adhesive technologies, and release liners will further support responsive product offerings that address precise application challenges across automotive, construction, electronics, and industrial end uses.

Looking forward, the interplay between innovation, regulatory developments, and global trade policies will continue to influence market trajectories. Organizations that maintain agile R&D pipelines, flexible supply chains, and deep customer engagement will secure a leadership role as markets mature and grow. This summary highlights the critical insights and strategic levers necessary for stakeholders to achieve sustainable competitive advantage in the adhesion laminated surface protection film domain.

Engaging with Associate Director Sales and Marketing to Access Exclusive Surface Protection Film Market Analysis and Report

To explore deeper insights, comprehensive data, and strategic guidance tailored for executives and decision-makers, reach out to Ketan Rohom, Associate Director Sales and Marketing. Gain immediate access to an in-depth market research report delivering actionable analysis of adhesion laminated surface protection films. Partner with an expert to secure exclusive intelligence that will empower your organization to capitalize on emerging opportunities and navigate market complexities.

- How big is the Adhesion Laminated Surface Protection Films Market?

- What is the Adhesion Laminated Surface Protection Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?