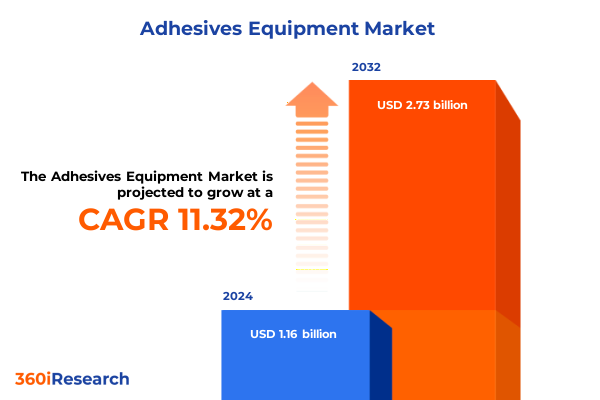

The Adhesives Equipment Market size was estimated at USD 1.28 billion in 2025 and expected to reach USD 1.41 billion in 2026, at a CAGR of 11.45% to reach USD 2.73 billion by 2032.

Understanding the Strategic Role of Advanced Adhesives Equipment in Driving Operational Excellence, Quality Consistency, and Sustainable Manufacturing Innovations Across Industries

In an era defined by accelerated industrial innovation and mounting quality standards, understanding adhesives equipment has become a strategic imperative for manufacturers across sectors. Precision, speed, and consistency in bonding, coating, dispensing, mixing, and spraying processes directly influence product integrity, throughput, and cost efficiency. This landscape demands a holistic perspective that spans machinery capabilities, material compatibilities, and integration with digital platforms. Only through such a vantage can decision makers unlock new levels of operational excellence and responsiveness to evolving customer demands.

Contemporary production environments increasingly rely on high-performance adhesives equipment to meet stringent requirements in sectors ranging from automotive and electronics to medical devices and packaging. As processes grow more complex, the interplay between machine design and adhesive chemistry intensifies, requiring advanced systems that can adapt to diverse formulations, fluctuating production volumes, and variable environmental conditions. Consequently, enterprises must navigate a shift from isolated machinery procurement to strategic investments in flexible, scalable equipment that aligns with long-term digital and sustainability roadmaps.

Transitioning beyond conventional manufacturing constraints, industry leaders are embracing smart adhesives equipment that leverages data analytics, real-time process controls, and condition monitoring. This evolution not only optimizes throughput and minimizes downtime, but also establishes a foundation for predictive maintenance and continuous improvement. By recognizing these strategic dynamics, stakeholders can better position their operations to capitalize on emerging opportunities and preemptively address challenges in the adhesives equipment realm.

Examining the Technological Breakthroughs and Digital Integration That Are Reshaping the Competitive Landscape of Industrial Adhesives Equipment Markets

The adhesives equipment sector is undergoing transformative shifts driven by the convergence of automation technologies, digital connectivity, and sustainability imperatives. Industry 4.0 principles are reshaping traditional systems, embedding sensors and IoT frameworks directly into bonding machines, coating lines, and dispensing platforms. This integration enables real-time monitoring of critical parameters such as temperature, pressure, and flow rates, empowering operators to fine-tune processes for maximum consistency and minimal waste. Additionally, cloud-based analytics and artificial intelligence are unlocking predictive insights, helping manufacturers forecast maintenance needs and preempt quality deviations.

Parallel to digital integration, there is a growing emphasis on sustainable practices and green chemistry. Equipment designs are evolving to accommodate water-based and low-VOC formulations without compromising performance. Manufacturers are adopting closed-loop coating systems and advanced mixing technologies that reduce solvent emissions and energy consumption. This dual focus on digitization and environmental stewardship is stimulating innovation in nozzle engineering, roller application mechanisms, and energy-efficient curing systems, enabling enterprises to meet regulatory requirements and corporate sustainability targets simultaneously.

As a result, competitive dynamics are shifting toward suppliers who can deliver holistic solutions combining modular hardware, intuitive software interfaces, and robust service networks. The ability to retrofit legacy lines with smart components or to commission turnkey systems with integrated remote support is becoming a key differentiator. Consequently, agility in development cycles, coupled with deep expertise in adhesive-material interactions, defines the next frontier of value creation in adhesives equipment markets.

Analyzing the Complex Implications of 2025 United States Tariffs on Raw Materials and Finished Adhesives Equipment Supply Chains and Cost Structures

The introduction of new tariff measures on raw materials and finished machinery in 2025 has introduced a layer of complexity to adhesives equipment supply chains in the United States. With levies imposed on imported resins, metals, and specialized components, manufacturers are reassessing vendor relationships and logistics strategies to mitigate cost pressures. Many have accelerated diversification efforts, shifting orders to domestic or low-tariff jurisdictions and exploring contract manufacturing partnerships to buffer margin erosion. These adjustments have underscored the vulnerability of lean, single-source supply models.

Consequently, enterprises are ramping up inventory management initiatives and adopting near-shoring tactics to secure critical inputs while minimizing transit times. At the same time, tariff impacts have spurred interest in alternative feedstocks and bio-derived polymers, as companies seek to reduce dependence on tariff-affected imports. This trend aligns with broader sustainability goals, creating an appetite for equipment capable of handling a wider variety of adhesive chemistries without extensive retooling.

From a financial perspective, the incremental cost burden has prompted equipment providers to collaborate more closely with clients on total cost of ownership analyses. Bundling service agreements, extended warranties, and modular upgrade paths are gaining traction as means to absorb cyclical price fluctuations. Moreover, treaty negotiations and potential tariff reprieves are being closely monitored, with many stakeholders establishing flexible procurement clauses to capitalize on policy shifts. As these measures take root, the adhesives equipment ecosystem will likely emerge more resilient, adaptive, and strategically diversified.

Uncovering Critical Product, Technology, Sales Channel, Application, and End-Use Industry Segmentation Insights That Guide Strategic Investments and Innovations

Deep segmentation analysis reveals that equipment requirements vary widely by product type, technology selection, sales channel alignment, application needs, and end-use industry demands. Bonding machines, for example, span cold glue bonding for delicate substrates and hot melt bonding for rapid cycle times, while coating equipment ranges from precise curtain and dip coating processes to roll and spray methods. Dispensing equipment requirements can differ dramatically between fully automatic systems designed for high throughput, semi-automatic solutions offering flexibility, and manual units suited to prototyping. Mixing equipment configurations shift between dynamic systems for high-shear blending and static designs for low-viscosity formulations. In spraying systems, both air spray and airless spray technologies address contrasting pressure, droplet size, and finish quality criteria.

Technology further drives differentiation, as hot melt platforms deliver either nozzle or roller application options, reactive equipment incorporates anaerobic chemistry or two-component metering, solvent-based systems must handle flammable or non-flammable formulations, and UV cure units leverage either high-intensity arc or energy-efficient LED modules. Water-based technologies introduce dispersion or emulsion handling challenges, influencing cleaning protocols and flow control strategies. Sales channels are similarly nuanced, with OEM customers demanding integration support and aftermarket channels relying on service center expertise and spare parts inventories to sustain legacy installations.

Application segmentation underscores how assembly equipment must accommodate both electronic assembly and general assembly lines, while laminating processes differentiate between film and sheet substrates. Packaging operations split between primary and secondary systems, and sealing technologies address both door and window assembly. Taping equipment bifurcates into adhesive taping and masking tasks. Finally, end-use industries such as automotive, construction, electronics and electrical, medical, packaging, and woodworking each impose unique throughput, regulatory, and cleanliness standards, guiding equipment selection, customization, and support frameworks.

This comprehensive research report categorizes the Adhesives Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Sales Channel

- Application

- End-Use Industry

Exploring Regional Variations in Demand, Regulatory Frameworks, and Growth Drivers Shaping the Adhesives Equipment Market Dynamics Across Major Global Territories

Regional market dynamics for adhesives equipment are shaped by distinct industrial concentrations, regulatory contexts, and investment climates across the Americas, Europe, Middle East and Africa, and Asia-Pacific territories. In the Americas, proximity to major automotive and packaging hubs drives demand for high-speed hot melt bonding lines and advanced robotic dispensing systems. North American manufacturers benefit from well-established service networks and localized component production, while Latin American operations are increasingly investing in modular, scalable solutions to modernize legacy plants and support growth in food and beverage packaging.

Across Europe, Middle East and Africa, stringent environmental regulations and circular economy initiatives have fueled adoption of solvent-free coating platforms and UV LED cure technologies. Western European markets prioritize energy efficiency and digital traceability for regulated industries such as pharmaceuticals and aerospace. Meanwhile, in parts of the Middle East and Africa, infrastructure expansion in construction and woodworking is stimulating demand for robust mixing and spraying equipment that can operate under extreme environmental conditions.

In Asia-Pacific, rapid industrialization, particularly in China and Southeast Asia, underpins significant growth in electronics assembly and medical device production. Local suppliers compete on cost and agility, frequently partnering with global technology providers to integrate smart sensors and cloud-based controls. Regional free trade agreements are facilitating cross-border production strategies, enabling companies to optimize capacity utilization and accelerate time-to-market with cutting-edge adhesives equipment solutions.

This comprehensive research report examines key regions that drive the evolution of the Adhesives Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Manufacturers and Innovators in Adhesives Equipment to Reveal Competitive Strategies, R&D Focus, and Emerging Partnerships That Define Success

Leading equipment manufacturers are intensifying their focus on research and development, strategic partnerships, and service expansion to enhance competitiveness. Established players are channeling investment into modular machine architectures that can be quickly reconfigured to handle emerging adhesive chemistries and evolving production volumes. Partnerships with technology providers specializing in AI, industrial robotics, and edge computing are enabling the delivery of predictive maintenance services and autonomous process optimization.

At the same time, smaller innovators are carving out niches by offering customizable platforms optimized for specialized applications, such as microdispensing for medical devices or high-viscosity mixing for advanced composites. Collaboration between global and regional players is also increasing, with joint ventures and co-development agreements facilitating localized engineering support and rapid deployment. Aftermarket service models are becoming more sophisticated, bundling remote diagnostics, on-site training, and consumable management to drive recurring revenue and strengthen customer retention.

Moreover, there is a clear trend toward vertical integration, as some adhesive formulators acquire or partner with equipment manufacturers to deliver end-to-end solutions. This approach streamlines procurement, reduces compatibility risks, and creates data-driven feedback loops between material performance and equipment configuration. Collectively, these competitive strategies underline the importance of agility, digital competency, and customer-centric service offerings in defining leadership in adhesives equipment markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adhesives Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Axson Technologies, Inc.

- BASF SE

- Dymax Corporation

- Glue Machinery Corporation

- Glue Machinery Corporation

- Graco Inc.

- Illinois Tool Works Inc.

- Kleiberit Adhesives USA Inc.

- Meler Gluing Solutions S.A.

- Nordson Corporation

- Pidilite Industries Limited

- Robatech AG

- RPM International, Inc.

- SAMES KREMLIN SAS

- Techcon Systems, Inc.

- The Dover Corporation

- The Dow Chemical Company

- Valco Cincinnati, Inc.

- Valco Melton Corporation

Delivering Strategic and Tactical Recommendations for Industry Leaders to Capitalize on Market Opportunities, Mitigate Risks, and Drive Sustainable Growth in Adhesives Equipment

Industry leaders should prioritize digital transformation by integrating IoT and analytics into existing equipment fleets to capture real-time process insights and unlock predictive maintenance capabilities. Retrofitting legacy machines with smart sensors not only extends asset lifecycles but also lays the groundwork for incremental automation that reduces dependency on scarce skilled operators. In parallel, investing in training programs and cross-functional teams will ensure that technical staff can effectively interpret data outputs and drive continuous process improvements.

To mitigate supply chain volatility induced by external policy shifts, organizations must cultivate a diversified supplier base that includes domestic, nearshore, and alternative feedstock providers. Transparent collaboration agreements, dynamic inventory strategies, and demand-driven procurement frameworks can help absorb tariff fluctuations and protect margins. At the same time, pursuing partnerships with bio-derived polymer innovators and embracing equipment capable of handling multiple adhesive families will create additional resilience while aligning with corporate sustainability commitments.

Finally, forging strategic alliances between equipment suppliers, adhesive formulators, and end users can accelerate the development of integrated turnkey systems that streamline validation cycles and reduce time to market. By co-creating solutions that blend hardware, formulation, and digital services, stakeholders will unlock new value propositions, foster deeper customer relationships, and secure competitive differentiation in an increasingly dynamic adhesives equipment landscape.

Detailing Our Rigorous Research Methodology for Ensuring Comprehensive Data Collection, Multisource Verification, and Robust Qualitative and Quantitative Analysis

This research was underpinned by a rigorous methodology combining primary and secondary data collection, expert interviews, and multi-stage validation procedures. We conducted in-depth interviews with equipment OEM executives, adhesive formulators, and end users across key industries to gather firsthand insights on emerging trends, operational challenges, and purchasing criteria. These voices were complemented by field observations at manufacturing sites to validate technology deployments and workflow integrations in real-world settings.

Secondary research included analysis of regulatory filings, patent landscapes, trade association reports, and company literature to map competitive positioning and track innovation trajectories. Data points were triangulated across multiple sources to ensure consistency and mitigate the risk of bias. A dedicated advisory board of technical specialists provided peer reviews at each stage, enhancing the credibility and relevance of our findings.

Quantitative data were synthesized using a structured framework that aligned segmentation dimensions with qualitative insights, enabling a holistic view of market dynamics. The research process adhered to strict quality protocols, including peer audits, editorial reviews, and traceability checks for all referenced sources. This disciplined approach ensures that the conclusions and recommendations presented herein rest on a foundation of robust, multi-source evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adhesives Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adhesives Equipment Market, by Product Type

- Adhesives Equipment Market, by Technology

- Adhesives Equipment Market, by Sales Channel

- Adhesives Equipment Market, by Application

- Adhesives Equipment Market, by End-Use Industry

- Adhesives Equipment Market, by Region

- Adhesives Equipment Market, by Group

- Adhesives Equipment Market, by Country

- United States Adhesives Equipment Market

- China Adhesives Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Summarizing Key Takeaways and Forward-Looking Perspectives on How Industrial Stakeholders Can Navigate Trends, Overcome Challenges, and Seize Opportunities in Adhesives Equipment

The adhesives equipment landscape presents a dynamic blend of technological innovation, regulatory influence, and shifting supply chain paradigms. Stakeholders who embrace digital integration, prioritize sustainability in equipment design, and cultivate diversified procurement strategies will be best positioned to navigate emerging challenges and unlock new growth pathways. In this context, modularity, data-driven decision making, and collaborative solution development are the pillars of competitive advantage.

As tariff landscapes evolve and regional markets mature, the capacity to rapidly adapt equipment capabilities and service models will distinguish market leaders from followers. Organizations that forge deeper partnerships across the value chain-linking formulators, machine builders, and end users-will foster more responsive and integrated ecosystems, reducing cycle times and elevating product quality.

Looking ahead, the continued convergence of advanced materials, smart machinery, and data analytics will define the next chapter in adhesives equipment evolution. By leveraging the insights and recommendations outlined in this report, industry participants can drive operational excellence, fortify supply chains, and seize opportunities presented by global market shifts.

Engage with Our Expert Associate Director to Access the Fully Detailed Adhesives Equipment Market Research Report and Transform Your Strategic Decision-Making Today

For a personalized discussion on how these insights translate into actionable strategies for your organization, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. With deep expertise in adhesives equipment trends and an extensive track record guiding global enterprises toward optimized operations, Ketan will walk you through the full scope of our research, address your specific challenges, and tailor recommendations that align with your strategic goals. Engage now to schedule a one-on-one consultation and secure your copy of the comprehensive market research report. Elevate your decision making, accelerate innovation, and strengthen your competitive advantage by partnering with an expert who understands the nuances of adhesives equipment markets inside and out

- How big is the Adhesives Equipment Market?

- What is the Adhesives Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?