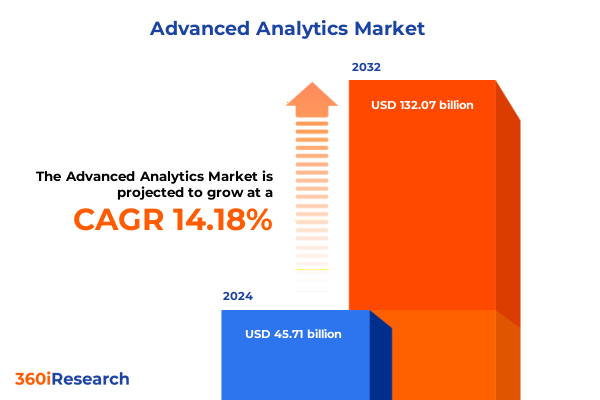

The Advanced Analytics Market size was estimated at USD 52.15 billion in 2025 and expected to reach USD 59.49 billion in 2026, at a CAGR of 14.19% to reach USD 132.07 billion by 2032.

Establishing the Strategic Importance and Core Principles of Advanced Analytics for Sustained Competitive Advantage in Modern Enterprises

Advanced analytics has transcended its role as a mere technical capability to become a strategic imperative in today’s hyper-competitive corporate landscape. Organizations are rapidly moving beyond traditional descriptive reporting toward embedding predictive and prescriptive models into every facet of their operations. This shift marks a fundamental change in how enterprises leverage data not just as a supporting asset, but as a primary driver of revenue growth, customer engagement, and operational efficiency. Consequently, executives and stakeholders are placing advanced analytics at the center of digital transformation agendas, recognizing that the ability to anticipate market shifts and optimize decisions in real time will increasingly differentiate leaders from laggards.

As enterprises embark on this journey, they face multifaceted challenges that span data governance, talent acquisition, and infrastructure scalability. Establishing a robust analytics culture requires aligning technology investments with organizational goals, nurturing cross-functional collaboration, and driving sustained executive sponsorship. Moreover, success hinges on the capacity to integrate diverse data sources-ranging from IoT sensor feeds to unstructured text-and to operationalize insights rapidly. Thus, advanced analytics initiatives are becoming hallmark projects that embody both technological sophistication and enterprise-wide change management.

Revealing the Pivotal Technological and Organizational Transformations Redefining the Advanced Analytics Landscape at Scale

The current era of advanced analytics is defined by transformative shifts that span both technological breakthroughs and organizational paradigms. First, the advent of edge analytics has extended the reach of real-time intelligence into remote and resource-constrained environments, enabling time-sensitive decisions at the point of data generation. This shift has redefined deployment architectures, as compute and analytics workloads are increasingly distributed across cloud, on-premise, and edge environments to address latency and bandwidth constraints.

Simultaneously, the infusion of augmented intelligence-where machine learning models are designed to collaborate with human experts-has enhanced interpretability and decision confidence. This coalescence of human expertise and algorithmic precision is reshaping roles within organizations, from data scientists to domain specialists. In parallel, governance frameworks have evolved, with data ethics and model risk management emerging as critical enablers of trust. These trends collectively signal a maturation of the analytics discipline, one that demands not only innovative technologies but also resilient organizational practices and a commitment to continuous learning.

Assessing the Layered Consequences of 2025 United States Tariffs on Data Analytics Infrastructure and Operational Resilience

In 2025, the United States implemented a series of tariffs affecting hardware components, from processing units to storage devices, with significant ramifications for the advanced analytics ecosystem. The increased import costs have driven up the total cost of ownership for on-premise infrastructure, compelling many organizations to reassess their deployment strategies. Consequently, cloud service providers have experienced a surge in demand, as enterprises seek to mitigate capital expenditures and leverage elastic pay-as-you-go models.

Of equal importance, these tariffs have accelerated a regional diversification of supply chains. Firms are exploring alternative component sources in Asia-Pacific and nearshore manufacturing hubs in the Americas to minimize exposure to cost volatility. In turn, this realignment has prompted analytics software vendors to optimize memory and compute utilization, ensuring that their solutions maintain performance and affordability under tighter hardware budgets. Overall, the cumulative impact of these policy measures underscores the critical interplay between geopolitical decisions and the strategic planning of analytics investments.

Unveiling Critical Intelligence from Diverse Segmentations Spanning Components Analytics Types Deployment Modes and Industry Verticals

Insights drawn from a nuanced examination of market segmentations reveal the intricate ways in which enterprises approach advanced analytics adoption. When considering the foundational split between services and software, it becomes evident that consulting engagements are pivotal during initial strategy formation, while managed services gain prominence for ongoing operations. Equally, application software solutions are often prioritized by business units seeking targeted functionality, whereas platform software frameworks serve as the backbone for enterprise-wide AI deployments. Shifting focus to analytics types, organizations embarking on optimization journeys typically begin with descriptive and diagnostic analyses to understand historical performance before scaling into predictive and prescriptive models that drive proactive decision making. Cognitive initiatives, in turn, emerge as the apex of this maturity curve, enabling natural language interactions and automated reasoning.

The choice of deployment mode further nuances this landscape. Cloud-based offerings deliver rapid scalability and seamless upgrades, appealing to digital-native firms and agile enterprises. In contrast, on-premise architectures remain relevant for industries with stringent data sovereignty requirements or low-latency mandates. Finally, industry verticals present distinct use cases and priorities. In banking and financial services, risk management and fraud detection dominate analytics roadmaps, while healthcare providers prioritize patient outcomes through predictive diagnostics. Manufacturing firms leverage prescriptive maintenance to reduce downtime, government agencies emphasize citizen services optimization, and telecom and media companies focus on subscriber engagement and content personalization. This holistic view underscores the imperative for vendors and users alike to tailor their strategies to the unique demands of each segment.

This comprehensive research report categorizes the Advanced Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Analytics Type

- Deployment Mode

- Industry Vertical

Deriving Regional Dynamics and Growth Patterns Across Americas Europe Middle East Africa and Asia Pacific in Advanced Analytics

Regional dynamics in advanced analytics adoption are shaped by economic conditions, regulatory frameworks, and digital infrastructure investments. In the Americas, strong demand is fueled by a robust ecosystem of technology startups and enterprise innovators. These organizations leverage cloud-based analytics to optimize supply chains and enhance customer experiences, supported by mature data privacy standards that facilitate cross-border data flows. Across Europe, Middle East, and Africa, regulatory emphasis on data protection and digital sovereignty has led to hybrid deployments, where on-premise and private cloud solutions coexist with public cloud offerings. Governments in the region are also investing heavily in smart city initiatives, which incorporate predictive analytics to improve urban planning and public safety.

Moving to the Asia-Pacific region, rapid digitalization efforts and supportive policy environments have catalyzed widespread analytics adoption. Telecommunications providers are at the forefront, deploying real-time network optimization solutions, while manufacturing powerhouses in East Asia are scaling predictive maintenance across global production lines. Meanwhile, emerging economies are embracing mobile analytics to expand financial inclusion and deliver targeted public health interventions. Together, these regional insights highlight the varying trajectories of advanced analytics penetration, driven by local market conditions and strategic priorities.

This comprehensive research report examines key regions that drive the evolution of the Advanced Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Influential Collaborators Shaping the Evolution of Advanced Analytics Solutions and Services

A handful of leading vendors and integrators are driving the pace of innovation across the advanced analytics landscape. Technology giants with cloud-native platforms continue to invest in expanding their AI and machine learning capabilities, offering enterprises fully managed solutions that streamline model development and operationalization. At the same time, specialized software providers differentiate through domain-specific features, such as industry-tailored data connectors and verticalized analytics templates. Systems integrators and consulting firms play an equally critical role by orchestrating end-to-end deployments, from data ingestion to model governance, often blending proprietary accelerators with open-source frameworks.

Strategic partnerships between these stakeholders further amplify their impact. Alliances between cloud hyperscalers and enterprise software vendors create tightly integrated stacks, reducing complexity and accelerating time to value. Meanwhile, emerging pure-play analytics firms are gaining traction by focusing on niche applications like anomaly detection in critical infrastructure or AI-driven clinical decision support. Collectively, these key companies shape the competitive landscape, setting benchmarks for performance, scalability, and user experience across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alphabet Inc.

- Alteryx, Inc.

- Amazon Web Services, Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- MicroStrategy Incorporated

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Teradata Corporation

- TIBCO Software Inc.

Formulating Pragmatic and Forward-Looking Strategies to Harness Advanced Analytics for Enhanced Decision Making and Market Responsiveness

Industry leaders aiming to maximize their analytics investments should focus on three interdependent strategies. First, they must cultivate cross-functional governance structures that bring together business sponsors, data stewards, and technical experts. This alignment ensures that analytics initiatives are closely tied to measurable business outcomes and that data quality protocols are enforced consistently. Second, organizations should adopt modular architectures that support hybrid deployment models, enabling workloads to migrate seamlessly between cloud, on-premise, and edge environments as needs evolve. Such flexibility mitigates vendor lock-in risks while optimizing for cost and performance.

Finally, a relentless emphasis on upskilling and change management is essential. By embedding analytics literacy programs into corporate training curricula, companies can empower domain professionals to interpret model outputs and act on insights autonomously. In parallel, embedding feedback loops into model lifecycles drives continuous improvement and fosters a culture of experimentation. These recommendations, when executed holistically, position enterprises to not only realize immediate returns on analytics projects but also to sustain innovation and competitive advantage over time.

Detailing Rigorous Research Frameworks and Methodologies Ensuring Robustness and Validity in Advanced Analytics Market Analysis

The research underpinning this analysis integrates a blend of qualitative and quantitative techniques to ensure methodological rigor and validity. Primary interviews were conducted with C-level executives and analytics leaders across diverse industries, capturing firsthand perspectives on strategy, challenges, and emerging priorities. Complementing these insights, a detailed review of recent implementation case studies provided evidence of best practices and real-world outcomes.

On the quantitative side, data was aggregated from publicly available financial reports, regulatory filings, and industry surveys to identify adoption patterns and technology preferences. Advanced statistical methods, including regression analysis and cluster segmentation, were employed to uncover correlations between deployment choices and performance metrics. Rigorous data cleansing protocols and triangulation against multiple sources fortified the reliability of findings. This combined approach ensures that conclusions are both grounded in practical experience and supported by empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Analytics Market, by Component

- Advanced Analytics Market, by Analytics Type

- Advanced Analytics Market, by Deployment Mode

- Advanced Analytics Market, by Industry Vertical

- Advanced Analytics Market, by Region

- Advanced Analytics Market, by Group

- Advanced Analytics Market, by Country

- United States Advanced Analytics Market

- China Advanced Analytics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Insights Emphasizing Strategic Imperatives and the Ongoing Trajectory of Advanced Analytics Adoption Worldwide

As advanced analytics continues its evolution from descriptive to cognitive capabilities, organizations are confronting both unprecedented opportunities and complex challenges. The strategic integration of sophisticated algorithms and high-velocity data streams has already begun to redefine operational paradigms across sectors. Yet, the journey toward fully realizing analytics-driven value is ongoing, demanding resilient governance, adaptable architectures, and a workforce adept in data interpretation.

Ultimately, the organizations that will thrive in this data-driven era are those that balance technology innovation with organizational readiness. By embedding analytics into core business processes, fostering a culture of evidence-based decision making, and maintaining agility in the face of shifting regulatory and geopolitical landscapes, enterprises can unlock sustainable competitive advantage. The insights presented in this report underscore the criticality of strategic alignment and continuous evolution, charting a clear path for leaders committed to harnessing the full potential of advanced analytics.

Engaging with Ketan Rohom to Secure Comprehensive Market Intelligence and Accelerate Advanced Analytics Initiatives through Expert Collaboration

To delve deeper into this comprehensive analysis and secure a tailored action plan that aligns perfectly with your organizational goals, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will ensure you extract maximum value from the full market research report, equipping your teams with the intelligence they need to stay ahead of evolving industry dynamics. Connect now to customize your insights and empower your advanced analytics initiatives with precision-driven recommendations.

- How big is the Advanced Analytics Market?

- What is the Advanced Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?