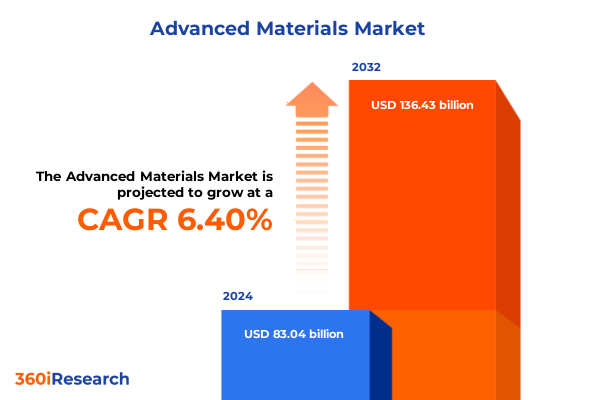

The Advanced Materials Market size was estimated at USD 86.44 billion in 2025 and expected to reach USD 91.79 billion in 2026, at a CAGR of 6.43% to reach USD 133.73 billion by 2032.

Unveiling the Evolving Terrain of Advanced Materials: Contextual Foundations, Industry Drivers, and Strategic Imperatives for Market Participants

The advanced materials landscape is undergoing a metamorphosis driven by converging forces of technological innovation, regulatory evolution, and shifting end-use demands. In this dynamic environment, understanding the fundamental drivers and contextual foundations is critical for stakeholders aiming to navigate emerging opportunities and potential disruptions. By tracing the roots of current trends back to their scientific and commercial catalysts, this introduction sets the stage for a comprehensive exploration of how materials engineering breakthroughs are reshaping industries from aerospace to healthcare.

Building on this contextual groundwork, the narrative that follows will illuminate key market drivers such as sustainability imperatives, digital manufacturing integration, and global trade policy shifts. Through this lens, readers will gain clarity on why certain materials are ascending in strategic importance, while others face headwinds. This foundational perspective not only orients decision-makers around the critical factors shaping material adoption, but also primes them to appreciate the interconnected nature of innovation pipelines, supply chain resilience, and application performance requirements.

Identifying Disruptive Technological and Market Shifts Reshaping the Advanced Materials Ecosystem Across Manufacturing, Applications, and Research Paradigms

Industry transformation in advanced materials is unfolding at an accelerated pace, propelled by breakthroughs in computational design, additive manufacturing, and nanotechnology. The integration of digital tools into material development processes has enabled rapid iteration cycles, allowing novel compounds and architectures to be prototyped and validated with unprecedented speed. Concurrently, sustainability considerations are steering R&D toward bio-derived polymers and recyclable metal alloys, marking a departure from legacy approaches that once prioritized performance over environmental impact.

Equally significant is the cross-pollination of materials science with adjacent fields such as biotechnology and artificial intelligence. These interdisciplinary engagements are fostering hybrid solutions-such as self-healing ceramics and AI-optimized composite layups-that promise to redefine performance thresholds across sectors. As these transformative shifts gain momentum, market participants must recalibrate their strategic roadmaps to capture value from the next wave of materials innovation while mitigating emerging competitive and regulatory pressures.

Examining the Cumulative Impact of United States Tariff Policies Implemented in 2025 on Supply Chains, Cost Structures, and Global Trade Dynamics

The introduction of heightened tariff measures in early 2025 has reverberated through the supply chains and cost structures of advanced materials stakeholders. By imposing increased duties on key imported feedstocks and semi-finished goods, these policies have accentuated the total landed cost of ceramics, composites, and high-performance polymers. Consequently, procurement strategies have pivoted toward supply diversification, localized sourcing agreements, and strategic stockpiling to buffer against price volatility and delivery delays.

Beyond immediate cost implications, the tariff framework has catalyzed a reassessment of manufacturing footprints and regional value chain alignments. Firms with vertically integrated operations have leveraged tariff relief on in-house components, while those reliant on specialized imports face intensified pressure to develop domestic production capabilities. In navigating the post-tariff landscape, advanced materials organizations are balancing the imperative for cost containment with the need to maintain quality and performance standards, often through collaborative ventures with local processing partners.

Deriving In-Depth Insights from Material Type, Processing Technology, Form, and Application Segmentation to Illuminate Strategic Pathways in Advanced Materials

By examining segmentation through material type, processing technology, form, and application, critical insights emerge to inform strategic decision-making. Material type analysis reveals that ceramics, encompassing bio ceramics, non-oxide, and oxide categories, are increasingly deployed in biocompatible implants and corrosive environments, while composites-spanning fiber reinforced, particle reinforced, and structural variations-deliver strength-to-weight advantages vital for aerospace and automotive. Metal alloys such as aluminum, magnesium, steel, and titanium continue to underpin structural and functional applications, even as nanomaterials-including carbon nanotubes, graphene, nanowires, and quantum dots-unlock novel electrical and mechanical properties. Polymers, differentiated into thermoplastics and thermosets, provide versatile solutions for coatings, films, and energy storage components.

Processing technology data highlights that additive manufacturing and 3D printing have transitioned from prototyping to production-grade processes, whereas CVD and PVD techniques underpin high-precision thin films and coatings. Traditional methods like extrusion, pultrusion, and injection molding maintain relevance in bulk production, complemented by nano-fabrication techniques, powder metallurgy, sol-gel processing, spin coating, and thin film deposition for specialized applications. The form factor dimension underscores the ongoing demand for bulk materials in structural contexts, coatings for protective layers, fibers for reinforcement, films and sheets for barrier and sensor technologies, foams for lightweight insulation, nanostructures for surface engineering, and powder formats for additive processes.

Applications spanning aerospace, automotive, construction, electronics, energy, and healthcare illustrate how segmentation drives market strategies. Aircraft structures, avionics hardware, and propulsion systems leverage high-strength composites and titanium alloys, whereas automotive exterior and interior components benefit from advanced thermoplastics and surface coatings. In construction, advanced sealants, insulation materials, and durable structural composites address evolving building codes and sustainability mandates. Electronics applications prioritize semiconductors, printed circuit substrates, and display coatings enhanced by nanomaterials, while energy sectors harness advanced battery materials, fuel cell membranes, and photovoltaic cell technologies. Healthcare innovations in drug delivery systems, implants, and medical devices underscore the life-changing impact of material breakthroughs.

This comprehensive research report categorizes the Advanced Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Processing Technology

- Form

- Distribution Channel

- Application

Uncovering Key Regional Dynamics Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Inform Advanced Materials Market Strategies

Regional variations reflect distinct regulatory landscapes, industrial capabilities, and innovation ecosystems that shape material deployment and commercialization strategies. In the Americas, strong government incentives and established manufacturing hubs have accelerated adoption of advanced composites and sustainable polymers, with notable momentum in aerospace clusters and automotive electrification corridors. Meanwhile, Europe, the Middle East & Africa present a mosaic of market drivers, where stringent environmental regulations and energy transition initiatives spur demand for recyclable materials, circular processing technologies, and high-efficiency coatings. Collaboration between research institutions and industrial consortia drives pilot programs in hydrogen fuel cell components and bioceramic medical implants.

Across the Asia-Pacific region, rapid infrastructure development and consumer electronics manufacturing underpin robust growth in high-performance metals and nanomaterials. Investment in next-generation fabrication facilities and government-backed innovation grants have positioned key economies as leaders in graphene research and large-scale additive manufacturing. Supply chain resilience remains a focal point, as regional stakeholders leverage strategic raw material reserves and nearshoring practices to mitigate geopolitical risks. These diverse regional dynamics underscore the need for tailored market entry strategies, localized partnerships, and adaptive innovation roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Advanced Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Innovative Footprints of Leading Technology Suppliers, Niche Specialists, and Consortiums Shaping the Advanced Materials Industry Landscape

Leading technology providers have distinguished themselves through proprietary material formulations, integrated digital platforms, and collaborative innovation networks. Incumbent suppliers are investing in advanced pilot lines that merge high-throughput screening with AI-driven process control, thereby reducing cycle times and elevating product reliability. Simultaneously, niche specialists are carving out value by focusing on application-specific solutions-such as ultralight nanoparticle-reinforced composites for drone structures or bioceramic scaffolds for tissue engineering-thereby commanding premium positions within targeted segments.

Consortiums and industry alliances are further shaping competitive dynamics by pooling resources for precompetitive research, standardizing material performance metrics, and advocating for harmonized regulatory frameworks. These collective efforts have yielded joint testing facilities and shared databases, enhancing transparency and accelerating technology adoption. As industry leaders refine their innovation roadmaps, they are blending in-house R&D strengths with strategic partnerships, positioning themselves to capitalize on growth pockets and drive the next wave of material breakthroughs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- The Dow Chemical Company

- Mitsubishi Chemical Group Corporation

- Syensqo

- LG Chem, Ltd.

- Arkema Group

- Covestro AG

- ArcelorMittal S.A.

- Evonik Industries AG

- Toray Industries, Inc

- The Chemours Company

- Nippon Steel Corporation

- POSCO FUTURE M Co., Ltd.

- 3M Company

- Shin-Etsu Chemical Co., Ltd.

- Huntsman International LLC

- Hexcel Corporation

- Momentive Performance Materials Inc.

- Applied Materials, Inc.

- DuPont de Nemours, Inc.

- Infineon Technologies AG

- Intel Corporation

- Johnson Matthey Plc

- Micron Technology, Inc.

- NVIDIA Corporation

- Saudi Basic Industries Corporation

- Solvay SA

Delivering Strategic and Actionable Roadmaps for Industry Leaders to Harness Emerging Technologies, Optimize Supply Chains, and Accelerate Competitive Advantage

Industry leaders should prioritize investment in digitalization across the material lifecycle, integrating machine learning algorithms into formulation design and process monitoring to accelerate development cycles. Concurrently, forging strategic alliances with academic institutions and specialized research centers can unlock complementary expertise, enabling rapid scale-up of promising materials. Emphasizing modular pilot production units will offer the flexibility to pivot between emerging composites, ceramics, and nanomaterial families without incurring excess capital expenditure.

In parallel, companies must proactively engage with regulatory bodies to shape standards for recycled content, biodegradability, and energy efficiency, thereby ensuring that material innovations align with evolving compliance requirements. Supply chain diversification efforts should involve dual sourcing strategies, onshore production partnerships, and digital traceability platforms to safeguard against tariff fluctuations and logistics disruptions. Finally, embedding sustainability criteria into material selection and product design will not only meet stakeholder expectations but also unlock new revenue streams in green construction, electrified transportation, and circular healthcare solutions.

Detailing the Rigorous and Transparent Research Methodology Combining Data Acquisition, Qualitative Stakeholder Engagement, and Robust Validation Protocols

This research was conducted through a structured approach that triangulates quantitative and qualitative data sources to ensure rigor and transparency. Primary data collection involved in-depth interviews with materials scientists, supply chain managers, and C-suite executives, capturing real-time perspectives on innovation bottlenecks and market adoption drivers. Secondary research encompassed an exhaustive review of peer-reviewed journals, patent filings, regulatory filings, and proprietary databases to validate trends and performance parameters.

Analytical techniques included correlation analysis to identify relationships between processing methods and application performance, as well as scenario modeling to assess the resilience of supply networks under varying tariff and geopolitical conditions. Validation protocols were defined to cross-verify findings through expert workshops and stakeholder feedback loops, thereby enhancing the reliability of insights. Finally, all data underwent systematic quality checks to detect anomalies, ensuring that the synthesized outputs provide a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Materials Market, by Material Type

- Advanced Materials Market, by Processing Technology

- Advanced Materials Market, by Form

- Advanced Materials Market, by Distribution Channel

- Advanced Materials Market, by Application

- Advanced Materials Market, by Region

- Advanced Materials Market, by Group

- Advanced Materials Market, by Country

- United States Advanced Materials Market

- China Advanced Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Strategic Insights and Imperatives in Advanced Materials to Navigate Industry Challenges, Drive Innovation, and Foster Sustainable Development

The synthesis of contextual drivers, transformative shifts, tariff impacts, segmentation analyses, regional dynamics, and competitive landscapes converges into a cohesive narrative that underscores the critical juncture faced by the advanced materials sector. Stakeholders now have a panoramic view of how innovation imperatives, supply chain complexities, and regulatory evolutions intersect to shape the trajectory of materials adoption across industries.

Armed with this holistic perspective, decision-makers are equipped to prioritize high-impact opportunities, refine collaboration frameworks, and future-proof their operations against emergent risks. By weaving together deep technical insights with strategic foresight, this executive summary lays the groundwork for organizations to navigate the next chapter of advanced materials innovation, balancing agility with resilience to achieve sustainable growth and performance excellence.

Empower Strategic Decisions by Engaging with Ketan Rohom to Unlock Advanced Materials Insights and Secure Your Tailored Market Intelligence

For organizations seeking to elevate their competitive posture through precision insights and actionable intelligence, engaging with Ketan Rohom offers a direct pathway to harnessing the full depth of our advanced materials expertise. In collaboration with Ketan, decision-makers can tailor a research package that aligns with their unique strategic objectives, ensuring that every facet of material innovation, supply chain resilience, and market adoption is thoroughly addressed. This partnership will deliver a bespoke intelligence solution that integrates proprietary analyses, expert interviews, and sector-specific data points needed to drive informed investment, development, and commercialization strategies.

By initiating a dialogue with Ketan Rohom, companies will gain prioritized access to episode-based briefings and executive workshops designed to translate complex technical insights into clear action plans. This personalized engagement empowers stakeholders to anticipate market disruptors, mitigate operational risks, and accelerate time to market for novel material solutions. Contact Ketan today to discover how a tailored market intelligence package can redefine your approach to advanced materials, unlocking new growth pathways and sustaining long-term competitive advantage.

- How big is the Advanced Materials Market?

- What is the Advanced Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?