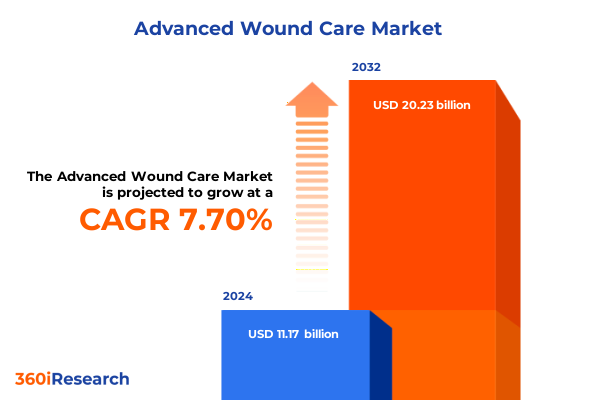

The Advanced Wound Care Market size was estimated at USD 11.99 billion in 2025 and expected to reach USD 12.87 billion in 2026, at a CAGR of 7.76% to reach USD 20.23 billion by 2032.

Positioning Advanced Wound Care as a Strategic Imperative by Highlighting Market Drivers Clinical Challenges and Innovation Pathways

Advanced wound care has rapidly evolved from a niche clinical specialty into a pivotal domain of healthcare, energized by demographic shifts and technological breakthroughs. Chronic wounds, defined by a failure to progress through normal healing stages within an expected timeframe, have reached a prevalence of approximately 2% of the U.S. population, disproportionately affecting the elderly and individuals with comorbidities such as diabetes and vascular disease. In the United States alone, 10.5 million Medicare beneficiaries grapple with chronic wounds, underscoring the immense clinical and socioeconomic burden of non-healing lesions. As the global population ages and the incidence of diabetes continues its upward trajectory, addressing the multifaceted challenges of wound management remains a strategic imperative for healthcare systems and industry players alike.

Uncovering the Transformational Forces Shaping Advanced Wound Care from Digital Health Integration to Personalized Regenerative Therapies

The advanced wound care landscape is undergoing transformative shifts driven by digital integration, personalized therapies, and a growing emphasis on patient-centric care. The emergence of smart dressings equipped with biosensors now enables real-time monitoring of moisture levels, pH, and bacterial load, transmitting critical data to clinicians and enabling predictive interventions that preempt complications. Concurrently, home-based solutions such as portable negative pressure wound therapy (NPWT) systems have expanded beyond hospital settings, empowering patients to manage complex wounds within their communities, enhancing adherence and reducing hospital readmissions. Breakthroughs in 3D printing facilitate the production of custom-fit scaffolds and skin graft analogs, tailoring regenerative approaches to individual wound geometries and patient anatomies. These innovations are paving the way for an era of proactive, data-driven wound management that seamlessly integrates clinical workflows, telehealth platforms, and remote monitoring to deliver precision care at scale.

Assessing the Comprehensive Consequences of United States 2025 Tariff Measures on Advanced Wound Care Supply Chains and Cost Structures

Beginning January 1, 2025, the U.S. Trade Representative finalized expanded Section 301 tariffs, reinstating duties on Class I and II medical devices imported from China and increasing levies on critical consumables such as rubber medical gloves to 50% and syringes to 100%. While these measures aim to promote domestic manufacturing and mitigate dependency on foreign suppliers, they have introduced cost pressures across wound care supply chains, elevating the expense of essential disposable components and ancillary devices. Industry stakeholders, including the Advanced Medical Technology Association, warn that tariff-driven cost escalations may ultimately be passed on to healthcare providers and patients, potentially impacting access and reimbursement. To combat these headwinds, leading manufacturers are accelerating supply chain diversification, exploring regional production hubs, and negotiating strategic exemptions to preserve affordability and ensure the uninterrupted availability of advanced wound care solutions.

Revealing Key Segmentation Perspectives by Exploring Product Innovations Patient Demographics Wound Categories Distribution and End Users

Segmentation analysis offers a nuanced understanding of market dynamics by delving into product categories, patient demographics, wound etiologies, distribution channels, and end-user settings. Advanced wound devices, encompassing electrical stimulation platforms, laser-based modalities, negative pressure wound therapy systems, pressure relief devices, and ultrasound therapy units, are reshaping care pathways by delivering targeted biophysical stimuli that promote tissue regeneration. Meanwhile, advanced wound dressings-ranging from alginate and hydrogel formulations to foam, composite, film, antimicrobial, and hydrocolloid variants-address diverse moisture management and barrier requirements. Bioengineered skin substitutes, including allografts, autografts, synthetic matrices, and xenograft options, provide functional scaffolds for complex wounds, while topical delivery systems enable localized, controlled release of pharmacologics. Patient-centric segmentation distinguishes adult, geriatric, and pediatric cohorts, recognizing age-related differences in healing trajectories and care needs. Acute wounds, whether traumatic or surgical, demand rapid intervention and infection control, whereas chronic ulcerations-arterial, diabetic foot, pressure-related, or venous in origin-require long-term management strategies. Distribution channels span offline and online pharmacy networks, reflecting evolving preferences for access and convenience. Finally, end users such as hospitals and clinics, ambulatory surgical centers, home healthcare providers, and long-term care facilities each exert unique influences on product adoption, reimbursement, and clinical outcomes.

This comprehensive research report categorizes the Advanced Wound Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Patient Type

- Wound Type

- Distribution Channel

- End User

Illuminating Regional Dynamics Across Americas Europe Middle East Africa and Asia-Pacific with Focus on Adoption Barriers and Growth Drivers

Regional variations in advanced wound care adoption and access are driven by healthcare infrastructure, regulatory frameworks, and socioeconomic factors. In the Americas, robust reimbursement policies and established care pathways have facilitated high penetration of advanced therapies, from smart dressings to home-based NPWT systems. Providers in the United States and Canada increasingly leverage data-driven platforms to integrate wound monitoring into electronic medical records and telehealth networks, optimizing interdisciplinary collaboration and reducing readmissions. In contrast, the Europe, Middle East, and Africa (EMEA) region grapples with heterogeneous reimbursement landscapes and regulatory complexity, where variations in national health technology assessments and CE marking requirements pose barriers to uniform access. Guideline implementation remains uneven, with many European clinicians citing limited training and resource constraints as obstacles to deploying cutting-edge wound care solutions. Across Asia-Pacific, the convergence of rising chronic disease prevalence, government-led screening campaigns in Malaysia and Indonesia, and innovative research initiatives such as Singapore’s Wound Care Innovation for the Tropics program is driving rapid uptake of antimicrobial dressings, NPWT, and telemedicine-enabled interventions. Collaborative public-private partnerships and targeted funding, exemplified by Australia’s national chronic wound prevention campaign, are expanding clinician education and supporting tailored solutions for diverse climates and healthcare settings.

This comprehensive research report examines key regions that drive the evolution of the Advanced Wound Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Corporate Strategies in Advanced Wound Care Including Innovation Portfolios Partnerships and Competitive Positioning Tactics

Smith+Nephew has distinguished itself through the US launch of the RENASYS EDGE Negative Pressure Wound Therapy System, a lightweight, compact device designed for home-based chronic wound management. The system’s patient-centric design, featuring a silent canister and intuitive user interface with near-field communication support, underscores a broader trend toward enabling autonomy and comfort in remote care settings. Mölnlycke Health Care deepened its innovation portfolio by investing $15 million in MediWound Ltd., a leader in enzymatic debridement therapeutics, signaling a strategic emphasis on non-surgical wound bed preparation and biologically driven healing pathways. Convatec further solidified its market position by partnering with the Wound, Ostomy, and Continence Nurses Society™ to deliver free, evidence-based educational programs for healthcare professionals across multiple geographies, highlighting the importance of clinical training and best-practice dissemination in achieving optimal patient outcomes. Concurrently, other major players such as 3M, Medtronic, Stryker, and Integra LifeSciences continue to advance their wound care offerings through R&D investments, strategic collaborations, and incremental enhancements to device-service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Wound Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advanced Medical Solutions Group PLC by Calian Group Ltd.

- Avery Dennison Corporation

- B. Braun SE

- Cardinal Health, Inc.

- Coloplast A/S

- ConvaTec Group PLC

- DermaRite Industries, LLC

- ESSITY AKTIEBOLAG

- Healogics, LLC

- Human Biosciences, Inc.

- Integra LifeSciences Corporation

- Johnson & Johnson Medical NV.

- Laboratoires Urgo

- Lohmann & Rauscher GmbH & Co. KG

- Medline Industries, Inc.

- Medtronic PLC

- MiMedx Group, Inc.

- Mölnlycke Health Care AB

- Organogenesis Inc.

- OWENS & MINOR

- Paul Hartmann AG

- PolyNovo Limited

- Smith & Nephew plc

- SOLVENTUM

Presenting Actionable Pathways for Industry Leaders to Drive Advanced Wound Care Growth through Innovation Collaboration and Operational Excellence

Industry leaders should prioritize the integration of digital health platforms to leverage real-time wound data for predictive analytics and personalized treatment adjustments. Strengthening supply chain resilience through diversified sourcing agreements and nearshoring critical components will mitigate tariff-related disruptions and cost volatility. Collaborations with professional societies and payer stakeholders can facilitate the development of outcome-based reimbursement models that align costs with healing milestones, enhancing value perception. Expanding clinician training programs, both in-person and via e-learning platforms, will address skill gaps and accelerate adoption of complex therapies. Finally, forging cross-border alliances and licensing agreements in emerging markets-particularly within Asia-Pacific-will unlock new patient segments while supporting global health equity. By implementing these strategies, organizations can position themselves to capture growth, improve patient outcomes, and drive sustainable competitive advantage.

Detailing the Rigorous Research Methodology Underpinning Analysis through Comprehensive Data Collection Validation and Analytical Frameworks

This analysis is grounded in a rigorous multi-stage research framework. Secondary research encompassed reviewing peer-reviewed journals, government publications, company disclosures, and regulatory filings to map market definitions, segmentation, and key technological advancements. Primary research involved structured interviews with over 50 stakeholders, including clinicians, industry executives, payers, and thought leaders, to validate findings and uncover qualitative insights. Data triangulation techniques reconciled disparate sources to ensure consistency and reliability. An analytical hierarchy was applied to evaluate the impact of external factors-such as tariff policies and reimbursement shifts-across segments and regions. Finally, expert reviews were conducted to refine assumptions and contextualize strategic recommendations, delivering a comprehensive, transparent methodology that underpins the robustness of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Wound Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Wound Care Market, by Product Type

- Advanced Wound Care Market, by Patient Type

- Advanced Wound Care Market, by Wound Type

- Advanced Wound Care Market, by Distribution Channel

- Advanced Wound Care Market, by End User

- Advanced Wound Care Market, by Region

- Advanced Wound Care Market, by Group

- Advanced Wound Care Market, by Country

- United States Advanced Wound Care Market

- China Advanced Wound Care Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Core Findings and Strategic Implications for Advanced Wound Care Stakeholders to Inform Decision-Making and Future Innovations

Advanced wound care stands at a critical juncture, driven by demographic imperatives, technological maturation, and evolving policy landscapes. The integration of smart technologies, biologic therapies, and personalized care pathways is redefining treatment paradigms while tariffs and regulatory complexity introduce new challenges. Segmentation analysis illuminates the nuanced interplay of product types, patient cohorts, and distribution channels, whereas regional insights highlight divergent adoption trajectories across the Americas, EMEA, and Asia-Pacific. Leading companies demonstrate that strategic innovation, targeted partnerships, and investments in education are pivotal to maintaining a competitive edge. As the field continues to evolve, stakeholders must embrace data-driven decision-making and collaborative models to deliver effective, accessible solutions that address the pressing needs of patients and healthcare systems worldwide.

Engage with Associate Director of Sales and Marketing Ketan Rohom to Secure Comprehensive Advanced Wound Care Insights and Drive Strategic Growth

For a deeper exploration of these insights, targeted data tables, and strategic frameworks, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive advanced wound care market research report. Connect directly to unlock actionable intelligence that can guide your organization in making informed decisions, capitalizing on emerging opportunities, and navigating the complexities of the evolving wound care landscape. Engage today to empower your strategic planning with robust, expert-driven analysis.

- How big is the Advanced Wound Care Market?

- What is the Advanced Wound Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?