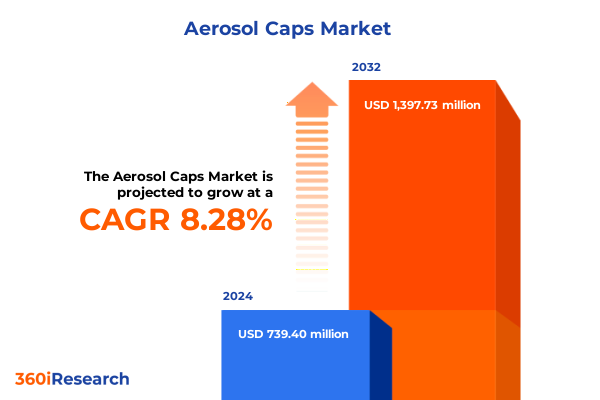

The Aerosol Caps Market size was estimated at USD 793.39 million in 2025 and expected to reach USD 856.71 million in 2026, at a CAGR of 8.42% to reach USD 1,397.73 million by 2032.

Discover the evolving landscape of aerosol closure solutions as innovative cap designs reshape functionality sustainability and consumer experience in packaging

The world of aerosol packaging is underpinned by a deceptively simple yet critically important component: the closure. Far more than a passive barrier, the aerosol cap influences dispensing precision, product stability, and user perception. As manufacturers push the boundaries of what caps can achieve, they are redefining the relationship between form and function in consumer goods. From valve compatibility to leak prevention and ergonomic design, every nuance of cap construction contributes to the seamless integration of product performance with user expectations.

Against a backdrop of heightened sustainability demands and shifting consumer preferences, aerosol cap design has evolved into a hotbed of innovation. Materials scientists and packaging engineers are collaborating to develop bio-based plastics and lightweight metal alloys, while regulatory bodies introduce standards that drive cleaner production processes. As a result, new generations of closures are emerging that balance cost efficiency with environmental responsibility. This introduction sets the stage for a comprehensive exploration of the forces reshaping aerosol cap solutions across materials, distribution channels, closure types, industries, applications, regions, and strategic action points.

Uncover the pivotal innovations materials and regulatory catalysts driving transformative shifts in aerosol cap architecture performance and compliance

Innovation in aerosol cap technology has accelerated rapidly, signaling a shift from one-size-fits-all closures toward highly specialized components. Advances in polymer science have enabled the creation of lightweight, durable caps that incorporate compostable and recycled feedstocks without compromising barrier properties or dimensional stability. Simultaneously, metal closure solutions have benefited from novel surface treatments and alloy formulations that resist corrosion and maintain aesthetic appeal under harsh conditions. These material breakthroughs are transforming the very fabric of cap manufacturing and broadening the opportunity set for brands seeking to differentiate their products.

Equally important are regulatory and consumer pressures demanding transparency and reduced carbon footprints. Extended Producer Responsibility (EPR) policies in key markets are incentivizing manufacturers to adopt circular design principles, prompting rapid adoption of refillable cap systems and modular assemblies. At the same time, digital printing and smart labeling technologies are being integrated into closures to facilitate traceability, anti-counterfeiting measures, and consumer engagement. These transformative shifts create a dynamic ecosystem in which cap suppliers, packagers, and brand owners must collaborate closely to stay ahead of evolving performance, sustainability, and compliance benchmarks.

Explore how the 2025 United States tariff adjustments on raw materials and imported components cumulatively influence manufacturing costs and supply routes

In 2025, the United States government implemented tariff adjustments on a spectrum of materials critical to aerosol cap production, including various aluminum and steel grades along with key polymer resins. These measures were introduced with dual aims: safeguarding domestic manufacturing and addressing trade imbalances. The cumulative impact of these levies has reshaped sourcing decisions, prompting many producers to reevaluate their reliance on imported feedstocks and reinforce relationships with local suppliers.

As raw material costs have risen incrementally, cap manufacturers have responded by optimizing production efficiencies and reassessing raw input mixes. Some have diversified their procurement strategies, incorporating alternative polymers such as bio-based polyethylene and polypropylene variants to mitigate exposure. Others have reopened dialogues with metal fabricators to negotiate supply agreements that balance volume commitments with price stability. Meanwhile, downstream packaging companies have passed through selective cost increases, leveraged design simplifications, and explored nearshoring opportunities to maintain competitive packaged good pricing and protect profit margins from sustained tariff pressures.

Delve into the nuanced segmentation of aerosol cap materials channels closures industries and applications to reveal targeted market dynamics and opportunities

A nuanced understanding of aerosol cap segmentation reveals varied growth trajectories and innovation entry points. Based on material type, Metal and Plastic serve as primary categories, with Metal branching into Aluminum and Steel to address demands for strength and recyclability. Plastic subdivisions include PET, Polyethylene, and Polypropylene, the latter of which is further refined into Copolymer and Homopolymer variants that offer brands a spectrum of rigidity, chemical resistance, and processability.

Distribution channels illuminate another dimension of market behavior, encompassing Direct arrangements that focus on Institutional Sales alongside Offline pathways through Pharmacies & Drugstores, Specialty Retailers, and Supermarkets & Hypermarkets. Online channels have surged in prominence, characterized by Direct-To-Consumer portals and broader E-Commerce Platforms, the latter encompassing both Brand Websites and third-party Marketplaces that cater to digitally native and convenience-oriented consumers.

Closure type segmentation highlights performance and usability considerations. Screw-On closures utilize either Continuous Thread or Lug Finish mechanisms to deliver secure sealing and intuitive use, while Snap-On variants incorporate Clip-Fit and Push-Fit designs to enable rapid application and one-step dispensing experiences.

End-use industries frame the purpose of aerosol caps across application contexts, including Automotive segments like Engine Cleaners and Wheel Cleaners, Household categories such as Air Fresheners, Cleaning Agents, and Insecticides, Industrial sectors addressing Lubricants & Degreasers plus Paints & Coatings, and Personal Care products ranging from Deodorants to Skin Care formulations.

Applications themselves create a final lens for strategic focus, stretching from Cosmetic & Toiletry uses in Deodorants, Fragrances, and Make-Up to Food & Beverage domains covering Oil Sprays and Whipped Cream; from Household Chemicals emphasizing Air Care and Surface Cleaners to Industrial Coatings like Powder Coatings and Protective Coatings; and extending to Pharmaceuticals featuring Disinfectants and Inhalers.

This comprehensive research report categorizes the Aerosol Caps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Closure Type

- Application

- Distribution Channel

Assess regional variations across Americas Europe Middle East Africa and Asia-Pacific to understand preferences regulatory frameworks and growth prospects

Regional landscapes for aerosol caps display distinct regulatory environments, supply chain infrastructures, and consumer expectations. In the Americas, robust recycling initiatives and stringent safety regulations drive demand for caps that comply with both federal and state-level mandates. Accessible logistics networks in North America facilitate just-in-time inventory strategies, while Latin American markets emphasize cost-effective solutions blended with growing interest in sustainable materials.

In Europe, Middle East & Africa, a diverse mosaic of regulatory frameworks and socioeconomic profiles shapes aerosol cap adoption. European nations enforce extended producer responsibility schemes that prioritize recyclability and closed-loop systems. Middle Eastern markets exhibit rapid industrial expansion, spurring demand for caps tailored to lubricants and coatings, while African regions focus on affordability and compatibility with local filling equipment.

Asia-Pacific stands out as a powerhouse of manufacturing capacity and innovation. Leading producers in East Asia have ramped up high-speed automation and precision tooling, catering to the region’s booming cosmetics and pharmaceuticals industries. Southeast Asian nations are leveraging cost advantages to supply global packaging hubs, and an accelerating shift toward premiumization fuels interest in differentiated cap designs and finish options.

This comprehensive research report examines key regions that drive the evolution of the Aerosol Caps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze leading aerosol cap manufacturers collaborations innovation strategies and competitive positioning that define contemporary industry leadership dynamics

A competitive audit of prominent aerosol cap manufacturers underscores strategic differentiation through innovation and partnerships. Some industry heavyweights have invested heavily in advanced resin technologies, securing the intellectual property around bio-based polymer blends. Others have formed alliances with valve system developers and refillable dispenser innovators to deliver integrated closure solutions that simplify assembly for brand owners.

Mergers and acquisitions continue to redefine the competitive landscape, with select players consolidating scale across geographies, unlocking synergies in R&D and supply chain optimization. Meanwhile, emerging entrants are carving out niches by focusing on specialized closure types-such as snap-on designs with child-safe features-or developing digital printing capabilities that align with mass-customization trends. These varied approaches reflect a broader strategic imperative: to balance cost leadership with differentiated offering portfolios that meet the evolving demands of downstream customers and regulatory stakeholders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerosol Caps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albea S.A.

- Alpla Werke Alwin Lehner GmbH & Co. KG

- Amcor plc

- AptarGroup, Inc.

- Ball Corporation

- Bericap GmbH & Co. KG

- Berry Global, Inc.

- Closure Systems International, Inc.

- Colep Packaging

- Comar LLC

- Coster Group

- Crown Holdings, Inc.

- LINDAL Group Holding GmbH

- Precision Valve Corporation

- Silgan Holdings Inc.

Implement strategic initiatives that harness sustainability design automation and market intelligence to optimize aerosol cap production and differentiation

Industry leaders must take proactive steps to maintain competitiveness and capture emerging opportunities. First, prioritizing sustainability initiatives-such as adopting recycled and bio-based resins-can position companies favorably within EPR frameworks and strengthen brand partnerships focused on circularity. Concurrently, optimizing production through automation and advanced quality-control systems will reduce waste, improve throughput, and enhance consistency in cap dimensions and performance.

Leveraging data-driven market intelligence is equally critical; companies should integrate real-time supply chain monitoring and predictive maintenance analytics to anticipate disruptions and minimize downtime. Collaboration with upstream material suppliers and downstream brand owners can unlock co-development projects that accelerate the launch of next-generation closure designs. Finally, investing in modular tooling and flexible manufacturing lines will empower quick responses to shifting application demands, from industrial coatings to premium personal care, ensuring readiness for the market’s future evolution.

Understand the research methodology integrating expert interviews secondary data analysis and validation protocols to ensure robust aerosol cap market insights

This study draws upon a blend of qualitative and quantitative research techniques to ensure comprehensive coverage and robust insights. Primary research included in-depth interviews with packaging engineers, materials scientists, procurement executives, and regulatory experts to capture firsthand perspectives on technological advances and policy developments. These discussions were complemented by site visits to manufacturing facilities, where process engineers provided detailed overviews of tooling operations, material handling protocols, and quality-assurance measures.

Secondary research encompassed the analysis of industry publications, trade association reports, patent filings, and publicly available regulatory documents. Historical data trends were cross-validated with import and export statistics to gauge the impact of tariff changes and supply chain shifts. Validation protocols included peer review by subject-matter experts, ensuring that findings reflect consensus viewpoints and emerging trajectories. The resulting framework delivers a robust understanding of segment dynamics, regional variations, competitive positioning, and actionable strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerosol Caps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerosol Caps Market, by Material Type

- Aerosol Caps Market, by Closure Type

- Aerosol Caps Market, by Application

- Aerosol Caps Market, by Distribution Channel

- Aerosol Caps Market, by Region

- Aerosol Caps Market, by Group

- Aerosol Caps Market, by Country

- United States Aerosol Caps Market

- China Aerosol Caps Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Summarize the strategic implications technological trends and market challenges shaping the future trajectory of aerosol cap solutions in global packaging

The evolution of aerosol cap solutions is emblematic of broader trends in packaging: a relentless drive toward sustainability, customization, and operational excellence. Material innovations and regulatory imperatives have converged to elevate the role of closures from passive enablers to proactive contributors in the product lifecycle. At the same time, shifting tariffs and regional nuances have highlighted the need for agile supply chain strategies and localized partnerships.

Going forward, companies that successfully integrate advanced materials, digital process controls, and collaborative development models will define market leadership. By synthesizing segmentation insights across materials, channels, closure types, industries, and applications, organizations can align their R&D investments with real-world demand signals. Ultimately, the future of aerosol caps lies in their capacity to deliver differentiated functionality, foster circular economy objectives, and support brand narratives in an increasingly competitive global landscape.

Engage with Associate Director Sales Marketing Ketan Rohom to access in-depth aerosol cap market intelligence and empower strategic decision-making today

To explore the full depth of aerosol cap innovations market dynamics and strategic opportunities, engage directly with our Associate Director of Sales & Marketing, Ketan Rohom. He offers personalized guidance to align executive priorities with comprehensive market intelligence, ensuring you capitalize on emerging material technologies and regulatory pathways. Ketan’s expertise will help you navigate supply chain complexities, leverage segmentation insights, and devise competitive strategies for sustainable growth. By partnering with him, you’ll gain priority access to proprietary research findings, custom regional analyses, and actionable recommendations tailored to your organization’s objectives. Reach out today to secure your access to the definitive aerosol cap market research report and drive transformative outcomes in your product development and go-to-market plans

- How big is the Aerosol Caps Market?

- What is the Aerosol Caps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?