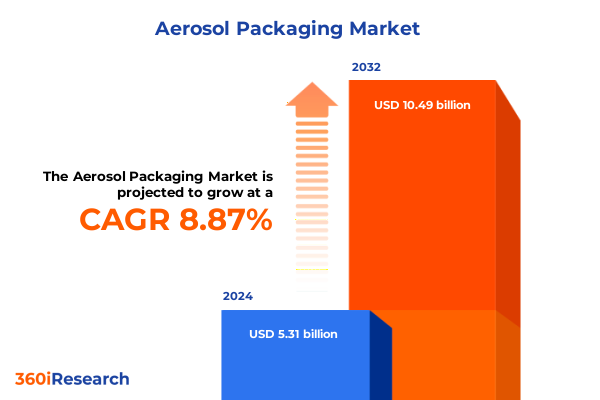

The Aerosol Packaging Market size was estimated at USD 5.77 billion in 2025 and expected to reach USD 6.28 billion in 2026, at a CAGR of 8.89% to reach USD 10.49 billion by 2032.

Understanding the Current Aerosol Packaging Environment: Critical Market Drivers, Technological Enablers, and Environmental Pressures Shaping the Industry Landscape

The aerosol packaging industry stands at the crossroads of heightened consumer expectations and rapid technological transformation. In recent years, sustainability mandates have converged with demands for enhanced functionality, prompting package designers and material scientists to collaborate in pursuit of eco-friendly formulations and innovative delivery systems. Pressure to reduce carbon footprints and adopt circular economy principles has accelerated the adoption of lightweight materials, barrier coatings, and refillable systems, while digital printing and smart labeling technologies are redefining brand communication and supply chain traceability.

Against this backdrop, the competitive landscape is evolving as established players and new entrants vie to deliver differentiated solutions that align with stringent regulatory frameworks and shifting consumer sentiment. The interplay between raw material availability, propellant regulations, and production scalability continues to drive strategic investments in R&D facilities, strategic partnerships, and capacity expansions. Consequently, stakeholders across packaging, chemical, and consumer goods segments must adopt an integrated perspective to navigate emerging risks and capitalize on growth trajectories.

Identifying Transformative Shifts Redefining Aerosol Packaging Dynamics Through Innovation in Materials, Sustainable Processes, and Regulatory Evolution

Recent years have witnessed transformative shifts that have fundamentally altered the development and deployment of aerosol packaging solutions. Advancements in sustainable materials, such as biopolymers and composite laminates, are enabling manufacturers to reduce reliance on traditional metal and petroleum-based substrates while maintaining functional integrity. Additionally, the rise of alternative propellants, including hydrocarbon blends and compressed gases, has mitigated regulatory pressures associated with ozone depletion and global warming potential, paving the way for more environmentally responsible product offerings.

Innovation in manufacturing processes, such as additive production techniques and digital inkjet printing, has unlocked new possibilities for customization, shorter lead times, and reduced waste streams. Furthermore, the proliferation of data-driven supply chain management and smart packaging sensors is enhancing real-time monitoring capabilities, fostering greater operational resilience and quality control. These cumulative transformations are not only redefining value propositions but also establishing new benchmarks for industry best practices.

Assessing the Cumulative Impact of United States Tariffs on Raw Materials and Propellants Influencing Aerosol Packaging Costs and Supply Chain Resilience in 2025

The cumulative impact of United States tariffs on steel, aluminum, and select chemical imports has reverberated throughout the aerosol packaging value chain, driving up input costs and incentivizing strategic realignments. Since the introduction of Section 232 measures on steel and aluminum, manufacturers have faced elevated procurement expenditures, leading to intensified efforts to secure domestic supply agreements and evaluate substitute substrates. Meanwhile, Section 301 duties on various chemical precursors and propellant components have compounded pressures on formulators to reassess sourcing strategies and negotiate longer-term contracts to mitigate price volatility.

Consequently, many packaging producers have redirected capital toward efficiency improvements, such as lean manufacturing initiatives and localized production footprints. These measures have not only alleviated cost burdens but also strengthened supply chain resilience against geopolitical uncertainties. Furthermore, the tariff-driven imperative to optimize material usage has catalyzed research into monomaterial systems and advanced coatings that minimize metal content without compromising barrier performance. Looking ahead, industry players will continue to adapt procurement frameworks and collaboration models in response to the sustained influence of trade policy on raw material flows and overall production economics.

Uncovering Key Segmentation Insights Across Applications, Product Types, Propellant Technologies, Distribution Channels, and End User Markets

A comprehensive examination of the aerosol packaging landscape reveals distinct patterns across application sectors, each exhibiting unique growth vectors and innovation priorities. In the automotive domain, formulations for cleaners, lubricants, and polishes are increasingly engineered for low-emission solvents and enhanced performance under extreme temperatures. Household applications, including air fresheners, cleaning agents, and insecticides, emphasize consumer safety, ease of use, and aesthetic packaging cues that reinforce brand trust. Within industrial environments, adhesives, coatings, and paints demand robust barrier properties and precise aerosol delivery mechanisms, driving collaboration between packaging engineers and formulation chemists. Personal care segments, spanning deodorant, hair care, oral care, and skin care, prioritize skin compatibility, fragrance stability, and premium finishes, with decorative printing and ergonomic actuators serving as differentiators.

Diversity in product type further accentuates market dynamics, with foam systems offering controlled expansion, gel and mousse formats enabling targeted application, and traditional sprays delivering broad coverage. Propellant selection, whether compressed gas, HFC, or hydrocarbon, reflects a balancing act between regulatory compliance, environmental impact, and cost considerations. Distribution channels, from direct-to-consumer e-commerce platforms to pharmacy outlets, specialty beauty stores, and supermarket hypermarkets, shape the consumer purchase journey and influence packaging design for shelf appeal and digital interactions. Finally, end-user landscapes-commercial spaces like hotels, offices, and restaurants, alongside industrial operations and residential settings-impose divergent performance, durability, and regulatory requirements, highlighting the necessity for tailored packaging architectures.

This comprehensive research report categorizes the Aerosol Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Propellant Type

- Application

- Distribution Channel

Deciphering Critical Regional Nuances Shaping the Aerosol Packaging Sector Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional forces exert a pronounced influence on the evolution of aerosol packaging, reflecting variances in regulatory environments, consumer preferences, and infrastructure maturity. In the Americas, sustainability imperatives and circular economy initiatives are driving momentum toward refillable containers and monomaterial constructions that facilitate closed-loop recycling. North American markets are distinguished by strong emphasis on digital integration, with brands implementing QR-enabled labels and smart sensors to bolster transparency and consumer engagement.

The Europe, Middle East & Africa region operates under some of the world’s most stringent environmental regulations, prompting rapid adoption of low-global-warming-potential propellants and biodegradable components. Regulatory alignment across European Union member states creates a unified framework for packaging compliance, while emerging markets in the Middle East and Africa exhibit heightened interest in cost-effective, performance-driven solutions. In the Asia-Pacific zone, robust urbanization and rising disposable incomes are fueling demand for personal care and household aerosol products. Emerging manufacturing hubs across Southeast Asia are leveraging lower labor costs and favorable government incentives to expand regional production capacities, enabling global brands to diversify supply chains and accelerate time to market.

This comprehensive research report examines key regions that drive the evolution of the Aerosol Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Participants Driving Innovation, Strategic Partnerships, and Competitive Differentiation in the Global Aerosol Packaging Landscape

Leading organizations within the aerosol packaging ecosystem are distinguishing themselves through strategic investments in sustainable materials, process optimization, and collaborative innovation. Packaging manufacturers are forging alliances with chemical producers to develop next-generation propellant blends and monomaterial laminates that minimize environmental impact. Key players are channeling resources into state-of-the-art coating technologies that enhance barrier performance while reducing solvent usage. Simultaneously, some companies are integrating digital printing capabilities into production lines, enabling high-resolution graphics and short-run customization that align with rapidly shifting consumer tastes.

In parallel, major stakeholders are pursuing targeted acquisitions and joint ventures to bolster their presence across high-growth regions and diversify product portfolios. Emphasis on operational excellence is evident in widespread implementation of Industry 4.0 principles, with robotics, real-time analytics, and advanced quality control systems delivering cost efficiencies and accelerated innovation cycles. By prioritizing sustainability, agility, and end-to-end integration, these market leaders are setting new standards for strategic differentiation in a sector defined by rigorous performance and regulatory demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerosol Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- AptarGroup, Inc.

- Ardagh Group S.A.

- Ball Corporation

- Berry Global Group, Inc.

- CCL Industries Inc.

- Colep Portugal S.A.

- CPMC Holdings Limited

- Crown Holdings, Inc.

- Exal Corporation

- Husky Injection Molding Systems Ltd.

- Lindal Group Holding GmbH

- Mitani Valve Co., Ltd.

- Nampak Ltd.

- Silgan Holdings Inc.

- Toyo Seikan Group Holdings, Ltd.

Formulating Actionable Strategic Recommendations to Drive Growth, Optimize Supply Chains, and Enhance Competitive Positioning Within the Aerosol Packaging Industry

Industry leaders are advised to prioritize investments in research and development to foster breakthroughs in sustainable substrates and alternative propellant formulations. By establishing cross-functional teams that integrate material science experts, regulatory specialists, and marketing strategists, organizations can accelerate the translation of novel concepts into scalable production solutions. Additionally, diversifying supplier networks and securing strategic alliances with domestic raw material providers can mitigate the impact of tariff fluctuations and logistical constraints.

Embracing digital transformation throughout the value chain will prove critical for forecasting demand, optimizing inventory, and enhancing quality assurance. Adopting predictive maintenance protocols and real-time monitoring can reduce downtime and improve asset utilization. Concurrently, companies should deepen engagement with regulatory bodies and industry associations to anticipate policy shifts and influence standards development. Finally, embedding circular economy principles within product design and end-of-life strategies will enhance brand reputation and unlock new revenue streams through refill and recycling programs.

Elucidating the Rigorous Research Methodology Employed for Comprehensive Analysis Including Qualitative Interviews, Secondary Data Reviews, and Validation Procedures

The insights presented in this analysis are grounded in a comprehensive, multi-phased research methodology that combines primary and secondary techniques to ensure rigor and reliability. Initial desk research encompassed an exhaustive review of industry journals, regulatory filings, patent databases, and financial disclosures, enabling identification of key trends, technological breakthroughs, and strategic initiatives. This foundation was augmented by structured interviews with senior executives, packaging engineers, and supply chain managers, providing nuanced perspectives on operational challenges and innovation drivers.

Data validation procedures included triangulation across multiple sources and iterative consultations with subject matter experts to confirm accuracy and relevance. Geographical coverage was ensured through targeted outreach to stakeholders in North America, Europe, Middle East & Africa, and Asia-Pacific, capturing regional specificities. The research framework also incorporated scenario analysis to assess the implications of evolving regulatory landscapes and trade policies. Collectively, this methodological rigor underpins the actionable insights and strategic guidance delivered in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerosol Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerosol Packaging Market, by Product Type

- Aerosol Packaging Market, by Propellant Type

- Aerosol Packaging Market, by Application

- Aerosol Packaging Market, by Distribution Channel

- Aerosol Packaging Market, by Region

- Aerosol Packaging Market, by Group

- Aerosol Packaging Market, by Country

- United States Aerosol Packaging Market

- China Aerosol Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing the Executive Findings and Strategic Imperatives That Illuminate Future Trajectories for Innovation, Sustainability, and Market Expansion in Aerosol Packaging

This executive summary has illuminated the dynamic interplay between consumer demands, regulatory imperatives, and technological advancements shaping the aerosol packaging sector. From the proliferation of sustainable materials and alternative propellants to the evolving complexities of tariff regimes, stakeholders must navigate a multifaceted environment characterized by continual transformation. The segmentation insights underscore the importance of tailoring solutions to specific applications, product formats, and distribution pathways, while regional analysis reveals differentiated growth vectors and compliance requirements across global markets.

As industry participants refine their strategic roadmaps, a clear focus on innovation, operational agility, and regulatory foresight will be essential. By leveraging the research findings and recommendations outlined in this summary, organizations can position themselves to capitalize on emerging opportunities, mitigate risks, and sustain competitive advantage. Ultimately, the path forward lies in harmonizing sustainability objectives with performance expectations, fostering collaborative ecosystems, and embracing digital tools to drive value creation across the aerosol packaging value chain.

Engaging with Associate Director Ketan Rohom to Access Comprehensive Aerosol Packaging Market Research Insights and Propel Strategic Decision Making Forward

To delve deeper into the complex dynamics of the aerosol packaging sector and gain access to an in-depth exploration of market drivers, regulatory landscapes, and innovation strategies, potential stakeholders are encouraged to engage directly with Associate Director, Sales & Marketing, Ketan Rohom at 360iResearch. By reaching out to Ketan, decision-makers can secure a comprehensive research dossier that illuminates critical insights across materials, propellants, segmentation, and regional performance metrics, enabling them to shape informed strategies and capitalize on emerging opportunities within this rapidly evolving market. This personalized conversation offers the opportunity to clarify specific requirements, discuss tailored research deliverables, and explore collaborative avenues that ensure alignment with organizational objectives and timelines.

Connecting with Ketan Rohom not only provides immediate access to the full aerosol packaging market research report but also opens the door to bespoke advisory sessions, priority updates, and ongoing support throughout the implementation of strategic initiatives. Prospective clients will benefit from direct guidance on optimizing procurement pathways, leveraging innovation roadmaps, and implementing best practices to address sustainability targets and supply chain resilience. To embark on this journey of strategic advancement and secure a competitive edge, stakeholders are invited to reach out and unlock the full potential of their aerosol packaging initiatives.

- How big is the Aerosol Packaging Market?

- What is the Aerosol Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?