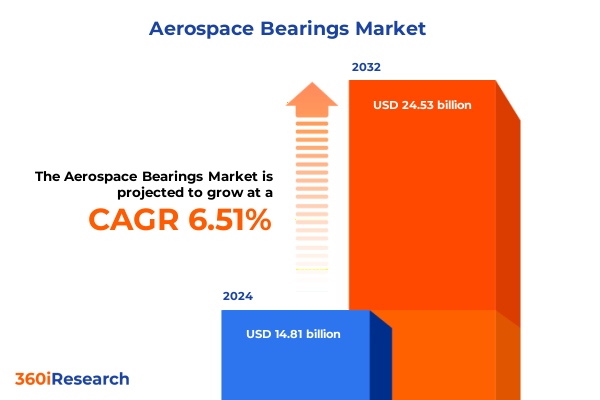

The Aerospace Bearings Market size was estimated at USD 15.69 billion in 2025 and expected to reach USD 16.62 billion in 2026, at a CAGR of 6.59% to reach USD 24.53 billion by 2032.

Setting the Strategic Stage for Aerospace Bearing Market Dynamics Amid Intensifying Global Supply Chain Transformations and Emerging Competitive Frontiers

Aerospace bearings stand as silent enablers of the modern aviation industry, ensuring the smooth operation of propulsion systems, flight control surfaces, avionics assemblies, and landing gear mechanisms. These precision-engineered components must withstand extreme rotational speeds, temperature fluctuations, and high-load environments, making them critical to both performance and safety. In recent years, the industry has witnessed an accelerated convergence of advanced manufacturing techniques, materials innovations, and digital monitoring solutions, catalyzing a new era of capability and reliability for aerospace bearings.

As global supply chains evolve in response to shifting geopolitical landscapes and trade policies, industry stakeholders are compelled to reassess sourcing strategies, production footprints, and aftermarket service models. Concurrently, end users are demanding lighter, more efficient, and longer-lasting components to meet rising environmental regulations and cost pressures. This executive summary consolidates the key market drivers, transformative shifts, tariff impacts, segmentation analyses, regional variations, competitive landscapes, and strategic imperatives that are shaping the trajectory of aerospace bearings. It offers a comprehensive foundation for decision-makers seeking to navigate uncertainty and capitalize on emerging growth avenues.

Unraveling the Major Disruptive Forces Shaping the Aerospace Bearing Landscape Across Technological, Economic, and Regulatory Frontiers

The aerospace bearing market is being reshaped by an unprecedented combination of technological advancements, regulatory shifts, and evolving customer expectations. Additive manufacturing and precision machining techniques are enabling more complex geometries and lighter-weight designs, while the integration of embedded sensors and digital twin models is driving predictive maintenance and real-time health monitoring capabilities. In parallel, stringent environmental regulations are accelerating the adoption of advanced ceramics and hybrid material systems that offer reduced friction and enhanced wear resistance.

Economic pressures and geopolitical developments are also redefining competitive landscapes. Heightened focus on domestic production incentives and evolving trade agreements has prompted leading manufacturers to diversify supply chains and develop localized manufacturing hubs. Furthermore, as defense budgets expand in key markets and commercial aviation rebounds from recent downturns, demand patterns have shifted toward both high-volume production in commercial segments and specialized, high-reliability solutions in military and space applications. In response, incumbent players are forging strategic alliances, investing in joint ventures, and pursuing targeted acquisitions to secure technology leadership and broaden their service portfolios.

Assessing the Broad Cumulative Ramifications of 2025 United States Trade Tariffs on the Aerospace Bearing Supply Chain

In early 2025, the United States enacted a series of tariff measures with deep-reaching implications for the aerospace bearing supply chain. A baseline 10 percent duty was imposed on all imported goods effective April, and reciprocal tariffs as high as 26 percent were applied to select trade-deficit partners, including India, exacerbating cost pressures for critical components. Concurrently, Section 232 of the Trade Expansion Act triggered a 25 percent levy on aluminum and steel imports, removing prior exemptions and directly impacting the raw materials at the heart of bearing production.

Beyond materials, targeted duties of 25 percent on aircraft components sourced from China and up to 15 percent on advanced composites and defense electronics have further elevated manufacturing costs, compelling OEMs and tier-one suppliers to absorb hundreds of millions in additional expenses. Notably, leading aerospace suppliers such as RTX and GE Aerospace have disclosed combined tariff-related impacts exceeding $1.3 billion for 2025, with RTX anticipating an $850 million headwind and GE mitigating approximately $500 million through cost and pricing strategies. While some firms have deferred price increases to preserve end-user demand, rising input costs have contributed to marginal inflation in aerospace maintenance and aftermarket services, prompting a recalibration of supply agreements and sourcing models.

Deciphering the Multifaceted Segmentation Framework for Aerospace Bearings Spanning Types, Applications, Aircraft Classes, Materials, Lubrication Practices, and Distribution Channels

A structured lens on the aerospace bearing market reveals a nuanced portrait of demand drivers and growth corridors. When viewed through component types, bearings are classified as ball, hybrid, plain, and roller, with ball bearings further segmented into angular contact, deep groove, and self-aligning variants. Roller bearings are subdivided into cylindrical, spherical, and tapered profiles, while tapered options include single-row and double-row configurations. Shifting to end-use scenarios, bearings are deployed across airframe assemblies covering fuselage and wing systems, avionics modules, engine applications catering to turbofan and turboshaft architectures, and landing gear mechanisms comprising main and nose assemblies.

Examining market presence by aircraft type highlights distinct requirements for commercial jetliners, rotary-wing platforms, and military aircraft, each demanding tailored performance attributes. Material composition offers another layer of differentiation, with ceramic, hybrid, and steel bearings competing on metrics of durability, weight, and cost. Lubrication strategies vary from dry-film solutions to grease- or oil-based systems, influencing maintenance cycles and environmental footprints. Finally, distribution pathways bifurcate into OEM channels and aftermarket streams, the latter encompassing maintenance, repair, and overhaul services as well as spare parts provisioning for both line and base maintenance operations.

This comprehensive research report categorizes the Aerospace Bearings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Bearing Type

- Aircraft Type

- Material

- Lubrication

- Application

- Distribution Channel

Exploring the Distinctive Regional Dynamics Impacting Aerospace Bearing Markets Across the Americas, Europe Middle East Africa, and Asia Pacific Horizon

Regional analysis underscores pronounced contrasts across major global markets. The Americas benefit from deep-rooted manufacturing capabilities in the United States and Canada, underpinned by robust defense spending and a mature aftermarket ecosystem that supports base and line maintenance operations. Latin American markets are gradually expanding their aerospace sectors, driven by infrastructure enhancements and partnerships with leading tier-one suppliers.

Europe, Middle East, and Africa encompass diverse market dynamics. Western Europe’s advanced manufacturing clusters and strong environmental mandates foster innovation in lightweight ceramic and hybrid bearings. Central and Eastern European facilities are evolving into key export hubs, while Middle Eastern investments in national carriers and defense modernization are amplifying demand. African markets, though nascent, present long-term opportunities as air travel capacity grows and regional carriers pursue fleet upgrades.

In the Asia-Pacific region, rapid commercial aircraft orders in China and India are fueling large-scale production ramps. Japan, South Korea, and Australia are centers of advanced materials research and precision engineering, enhancing the quality and performance of domestically sourced bearings. Southeast Asian supply chains are expanding to support both OEM assembly lines and burgeoning MRO facilities, making the region an essential node in global distribution networks.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Bearings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Aerospace Bearing Manufacturers With Strategic Innovations, Collaborative Ventures, and Competitive Differentiators Driving Market Leadership

Market leadership in aerospace bearings is shaped by a blend of technological prowess, scale, and breadth of service offerings. Established global players leverage decades of engineering heritage to refine manufacturing precision and integrate advanced condition-monitoring features. These incumbents maintain extensive aftermarket support networks and routinely collaborate with airlines, defense agencies, and engine OEMs to co-develop custom bearing solutions that meet evolving regulatory and performance requirements.

Emerging specialists have carved niches in high-temperature ceramics and hybrid polymer-infused designs, catering to next-generation propulsion systems and unmanned aerial platforms. Strategic collaborations between bearing manufacturers and digital technology providers are accelerating the deployment of predictive maintenance platforms, reducing unscheduled downtime and optimizing lifecycle costs.

In addition, several companies are pursuing vertical integration strategies, securing in-house capabilities across raw material processing, component finishing, and assembly to ensure supply security amid trade uncertainties. Partnerships with academic institutions and industry consortia further bolster R&D pipelines, enabling rapid prototyping and qualification of novel bearing architectures for both civil and defense applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Bearings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB SKF

- Boeing Company

- JTEKT Corporation

- Kaman Corporation

- LYC Bearing Corporation

- MinebeaMitsumi Inc.

- Nachi-Fujikoshi Corporation

- NSK Ltd.

- NTN Corporation

- RBC Bearings Incorporated

- Regal Rexnord Corporation

- Schaeffler Technologies AG & Co. KG

- The Timken Company

- THK Co., Ltd.

- Timken Company

Charting a Strategic Roadmap of Actionable Recommendations for Aerospace Bearing Industry Leaders to Navigate Emerging Market Disruptions

Industry participants must adopt a proactive stance to navigate evolving market conditions and regulatory uncertainties. Prioritizing supply chain diversification through nearshoring or regional manufacturing hubs can mitigate the impact of tariff fluctuations and trade policy shifts. Concurrently, investing in advanced data analytics and digital twin frameworks will empower predictive maintenance regimens, driving asset utilization and reducing unscheduled service events.

Furthermore, forging cross-sector partnerships with materials innovators and additive manufacturing experts can unlock performance gains in weight reduction and wear resistance, creating a competitive edge in both commercial and defense segments. Companies should also refine pricing and contractual models to share tariff impacts equitably across the value chain, preserving end-user affordability while protecting margins.

Lastly, embedding sustainability principles through eco-friendly lubrication solutions and lifecycle assessment processes can address stringent environmental directives and meet growing airline and regulator expectations. By balancing operational resilience, technological advancement, and environmental stewardship, industry leaders will be well-positioned to capture emerging growth pockets in a dynamic aerospace bearing landscape.

Outlining the Rigorous Research Methodology Underpinning the Comprehensive Aerospace Bearing Market Analysis and Data Validation Processes

This research employs a hybrid methodology integrating primary interviews, secondary data analysis, and rigorous data triangulation to ensure robust insights. The primary phase includes in-depth discussions with senior executives from bearing manufacturers, Tier-1 aerospace suppliers, MRO service providers, and regulatory authorities, capturing first-hand perspectives on market dynamics, technological investments, and procurement strategies.

Secondary research sources encompass company annual reports, government trade publications, aerospace industry association releases, and peer-reviewed technical journals. Proprietary supply chain databases were leveraged to map component flows, while tariff schedules and trade statistics provided quantitative backing for cost impact assessments.

Data synthesis adopted both top-down and bottom-up approaches, correlating macroeconomic indicators with company-level performance metrics. Cross-validation techniques were applied to reconcile divergent data points, ensuring high confidence levels in segmentation breakdowns and regional projections. Qualitative inputs from domain experts were systematically integrated to contextualize emerging trends and validate strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Bearings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Bearings Market, by Bearing Type

- Aerospace Bearings Market, by Aircraft Type

- Aerospace Bearings Market, by Material

- Aerospace Bearings Market, by Lubrication

- Aerospace Bearings Market, by Application

- Aerospace Bearings Market, by Distribution Channel

- Aerospace Bearings Market, by Region

- Aerospace Bearings Market, by Group

- Aerospace Bearings Market, by Country

- United States Aerospace Bearings Market

- China Aerospace Bearings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Concluding Insights That Synthesize Critical Market Trends, Strategic Imperatives, and Future Outlook for the Global Aerospace Bearing Sector

The aerospace bearing market is poised at the intersection of innovation and regulatory evolution. Advanced manufacturing, connectivity, and sustainability imperatives are converging to redefine performance benchmarks and supply chain paradigms. Concurrently, the 2025 tariff measures underscore the importance of agile procurement strategies and resilient production footprints.

Segmentation insights reveal diverse growth trajectories across bearing types, applications, aircraft platforms, materials, lubrication regimes, and distribution pathways. Regional analyses highlight both mature markets with established aftermarket infrastructures and high-growth zones benefiting from fleet expansions and infrastructure investments.

Competitive assessments show that strategic partnerships, R&D collaborations, and digital transformation initiatives will be key differentiators for market leaders. By aligning actionable recommendations with core strategic goals, stakeholders can proactively address cost headwinds, regulatory shifts, and evolving customer demands.

Ultimately, the synthesis of market drivers, segmentation frameworks, regional dynamics, and competitive strategies provides a holistic foundation for informed decision-making and sustainable growth in the aerospace bearing sector.

Seize Critical Market Intelligence and Drive Strategic Advantage by Securing Your In-Depth Aerospace Bearing Market Research Report Today

In today’s fast-paced aerospace environment, actionable insights can make the difference between maintaining the status quo and charting a path toward market leadership. Ketan Rohom (Associate Director, Sales & Marketing) stands ready to guide you through the complexities of the aerospace bearing landscape with tailored guidance and unparalleled subject-matter expertise. By reaching out, you will gain personalized support in accessing and leveraging the comprehensive market research report that delves into segmentation analyses, regional dynamics, tariff implications, and forward-looking strategic recommendations. Elevate your decision-making processes, mitigate risks associated with evolving trade policies, and seize emerging growth opportunities by securing this vital intelligence. Discover how deep, data-driven insights can inform your next move and empower your organization for long-term success in the aerospace bearings market.

- How big is the Aerospace Bearings Market?

- What is the Aerospace Bearings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?