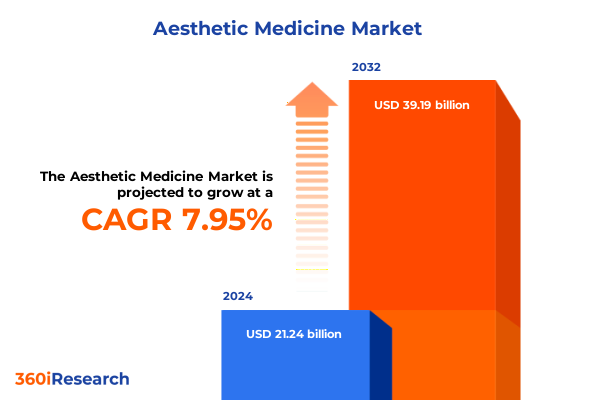

The Aesthetic Medicine Market size was estimated at USD 22.83 billion in 2025 and expected to reach USD 24.58 billion in 2026, at a CAGR of 8.02% to reach USD 39.19 billion by 2032.

Unveiling the Dynamic Evolution and Strategic Significance of Aesthetic Medicine in Today’s Competitive Healthcare Landscape Across Consumer and Clinical Contexts

Aesthetic medicine has matured from a niche offering to a mainstream pillar within healthcare, reflecting profound changes in consumer expectations, clinical applications, and technological capabilities. What began as a focus on invasive procedures has evolved into a broader spectrum of non-invasive and minimally invasive treatments that emphasize natural results and rapid recovery. In recent years, the convergence of advanced device platforms with data-driven personalization has empowered practitioners to deliver more targeted therapies while enhancing patient safety and satisfaction. Consequently, aesthetic medicine now occupies a strategic crossroads, blending cosmetic goals with wellness mindsets in both clinical and at-home environments.

Moreover, heightened regulatory scrutiny and structured reimbursement pathways have driven providers to standardize quality protocols and invest in professional training. As a result, the aesthetic medicine ecosystem has cultivated a collaborative network of manufacturers, clinicians, and consumer brands. This integration has accelerated innovation across product lines and procedural techniques. In light of these developments, industry decision-makers must remain vigilant to shifting market dynamics, emerging technologies, and evolving consumer psychographics. This executive summary provides a holistic entry point for understanding these complexities and framing strategic responses that capture growth opportunities.

Catalyzing Innovation Through Technological Breakthroughs and Shifting Consumer Expectations in the Evolving Aesthetic Medicine Ecosystem to Redefine Outcomes

In the last decade, aesthetic medicine has been propelled by a series of transformative shifts that have realigned value chains and redefined patient experiences. Foremost among these is the proliferation of next-generation energy-based devices, which have migrated from experimental prototypes into frontline tools for skin tightening, fat reduction, and vascular lesion treatment. Concurrently, artificial intelligence and machine learning applications in image analysis are optimizing patient assessment and treatment planning, reducing variability and improving outcomes.

Furthermore, evolving consumer mindsets have emphasized wellness over vanity, favoring subtle enhancements that preserve individuality. Younger demographics, in particular, have embraced preventive aesthetics, turning to skin-health regimens and low-pain modalities long before age-related concerns arise. Consequently, providers are expanding service portfolios to include personalized at-home devices and teleconsultations, bridging the gap between clinical procedures and daily self-care routines. These changes collectively highlight that aesthetic medicine is no longer confined to traditional surgical suites; it now spans digital platforms, remote monitoring, and stage-setting wellness environments, reshaping how value is delivered and perceived.

Navigating the Complex Web of United States Tariffs in 2025 and Their Broad Repercussions on Aesthetic Medicine Supply Chains and Cost Structures

Tariff policies implemented in the United States in 2025 have introduced new layers of complexity for aesthetic medicine stakeholders, affecting both imported device components and specialized procedural consumables. The imposition of additional duties on certain medical-grade polymers and precision optics has elevated landed costs, compelling manufacturers to reassess their global supply arrangements. These cost pressures have, in turn, rippled through to service providers, who face narrower margins and must contend with greater pricing volatility.

In response, many companies are diversifying their supplier base, pursuing near-shoring initiatives to access lower-tariff jurisdictions, and renegotiating contracts to lock in favorable terms. Some device developers are exploring component redesigns to minimize tariff exposure, substituting high-duty materials with functionally equivalent alternatives. Meanwhile, clinical practices are optimizing inventory management and offering tiered service packages to absorb incremental costs without deterring price-sensitive clientele. These strategies underscore the need for agile risk management frameworks that anticipate policy shifts and maintain supply-chain continuity in a landscape where trade dynamics directly influence innovation and market accessibility.

Granular Insights into Aesthetic Medicine Segmentation Revealing Trends Across Product and Procedure Categories, Technological Platforms and Demographic Drivers

An in-depth segmentation analysis exposes distinctive trends across product types, procedures, technologies, genders, categories, applications, end users, and distribution channels. When examining product portfolios, device-driven modalities and injectables are outpacing traditional topical formulas, signaling a shift toward clinical service lines over retail purchases. Insights into procedural preferences reveal robust growth in non-invasive treatments as consumers favor minimal downtime, whereas surgical options retain appeal among demographics seeking more dramatic transformations.

Technological segmentation highlights the rising prominence of laser-based and ultrasound platforms, which offer improved precision and versatility compared to legacy cryotechnology and LED-only devices. Gender-based patterns indicate that female patients continue to dominate overall volumes, but male uptake is rising rapidly, particularly in injectables and facial rejuvenation protocols. Within application categories, body contouring has bifurcated into surgical liposuction and abdominoplasty and non-surgical alternatives such as cryolipolysis and HIFU, reflecting diversified demand profiles. Meanwhile, facial rejuvenation has expanded beyond botulinum toxin and dermal fillers to encompass thread lifts, and skin-renewal procedures like chemical peels and microdermabrasion are demonstrating renewed popularity.

End-user analysis underscores that medical spas and dermatology clinics remain the primary delivery settings, though beauty centers and home care solutions are carving out incremental niches. Distribution channels follow a similar pattern: hospital pharmacies manage higher-complexity regimens, whereas online and retail pharmacies facilitate broader access to prescribed skincare and OTC treatments. Collectively, these insights reveal an increasingly sophisticated ecosystem, where targeted offerings tailored to specific patient segments drive competitive differentiation.

This comprehensive research report categorizes the Aesthetic Medicine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Procedures

- Technology

- Gender

- Category

- Application

- End User

- Distribution Channel

Regional Dynamics Shaping Growth Trajectories in Aesthetic Medicine Across the Americas, EMEA Markets and Asia-Pacific Healthcare Ecosystems

Regional analysis illuminates divergent growth trajectories across the Americas, EMEA, and Asia-Pacific regions. In the Americas, a mature regulatory environment and high consumer willingness to invest in aesthetic services have fostered intense competition among link-networked clinics and global device providers. North America’s leadership in innovation extends to rapid adoption of hybrid procedural suites, merging energy-based modalities with injectable protocols for synergistic outcomes.

Conversely, the Europe, Middle East & Africa region is characterized by regulatory heterogeneity and varying levels of clinical adoption. Western Europe continues to set benchmarks for safety standards and reimbursement models, while the Middle East demonstrates robust demand for luxurious, high-end treatments fueled by affluent populations. In contrast, parts of Africa are emerging markets where access remains limited but presents long-term potential for franchised clinic networks.

Asia-Pacific markets exhibit the most dynamic growth, with East Asian nations accelerating investments in advanced devices and personalized skincare regimens. Southeast Asia’s thriving medical tourism sector further amplifies cross-border service flows, as patients combine travel with elective procedures. These regional distinctions highlight the necessity for adaptable go-to-market strategies that align with local regulatory frameworks, consumer psychographics, and competitive landscapes.

This comprehensive research report examines key regions that drive the evolution of the Aesthetic Medicine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Disruptors Driving Competitive Advancements and Strategic Partnerships in the Evolving Aesthetic Medicine Industry Landscape

A competitive landscape review identifies an array of established medical device manufacturers, specialist injectables developers, and disruptive technology startups. Market pioneers have leveraged decades-long expertise to refine flagship platforms, securing durable partnerships with top-tier clinical networks and consolidating their leadership through comprehensive service offerings. In parallel, emerging players are carving distinct niches by innovating in biodegradable polymers, precision robotics, or AI-augmented diagnostic tools, thereby challenging incumbents to accelerate R&D roadmaps.

Strategic collaborations between device OEMs and digital health firms have become increasingly common, yielding integrated solutions that blend teleconsultation, remote treatment monitoring, and outcome analytics. This synergy addresses a critical market demand for end-to-end patient journeys, from initial assessment through cyclical maintenance. Additionally, specialized biotech companies are advancing high-purity injectable formulations, focusing on next-generation peptides and growth factors to deliver longer-lasting effects with improved safety profiles. These competitive dynamics underscore that sustained differentiation will hinge on cross-domain expertise, nimble product development, and the ability to scale both clinical efficacy and consumer convenience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aesthetic Medicine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Aerolase Corp

- Apyx Medical Corporation

- Bausch Health Companies Inc.

- BIOTEC ITALIA SRL

- BTL Group

- Candela Corporation

- Cutera, Inc.

- Cutis Medical Laser Clinics Pte Ltd

- Cynosure Inc.

- El.En. S.p.a.

- EndyMed

- Fotona d.o.o.

- Galderma SA

- Inmode Ltd

- Ipsen Pharma

- Jeisys Medical Co., Ltd.

- Lumenis Be Ltd.

- Lutronic Inc.

- Merz Pharma GmbH & Co.KGaA

- Quanta System S.p.A.

- Revance Therapeutics, Inc.

- Sciton, Inc.

- Sinclair Pharma Ltd.

- Venus Concept

Strategic Imperatives for Industry Leaders to Leverage Emerging Trends, Optimize Operations and Fortify Market Position in Aesthetic Medicine Sector

To thrive in this rapidly evolving environment, industry leaders should prioritize a trio of strategic imperatives. First, they must accelerate integration of digital platforms that enable virtual consultation and AI-guided treatment mapping, thereby extending their service reach beyond traditional facility boundaries. Secondly, cultivating modular product portfolios will allow providers to bundle complementary procedural and at-home solutions, enhancing customer lifetime value through subscription or maintenance models.

In addition, forging alliances with materials science and biotech innovators can yield next-generation injectables and device consumables, providing a sustainable pipeline of differentiated offerings. Concurrently, leaders should invest in educational initiatives that amplify clinician proficiency and consumer awareness, addressing potential safety concerns and reinforcing brand trust. By adopting these multifaceted strategies, organizations can capture incremental revenue streams while bolstering operational resilience against policy fluctuations and supply-chain disruptions.

Robust Mixed-Methods Research Methodology Integrating Primary Interviews, Secondary Data Synthesis and Rigorous Validation Protocols for Aesthetic Medicine

The research underpinning this analysis was conducted through a mixed-methods approach combining qualitative and quantitative techniques. Primary data collection included in-depth interviews with leading clinicians, device manufacturers, and distribution executives to capture firsthand perspectives on innovation pipelines, regulatory impacts, and consumer behavior. Secondary sources comprised peer-reviewed journals, industry white papers, and public filings, ensuring a robust synthesis of established evidence and emerging intelligence.

Furthermore, rigorous validation protocols were applied, including cross-referencing multiple datasets, triangulating interview insights with market activity indicators, and conducting peer reviews among subject-matter experts. Data synthesis leveraged statistical trend analysis to identify correlation patterns across segmentation and regional variables, while scenario mapping illuminated potential policy and technological inflection points. This comprehensive methodology ensures the credibility and actionable nature of the findings, providing stakeholders with a clear framework for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aesthetic Medicine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aesthetic Medicine Market, by Product Type

- Aesthetic Medicine Market, by Procedures

- Aesthetic Medicine Market, by Technology

- Aesthetic Medicine Market, by Gender

- Aesthetic Medicine Market, by Category

- Aesthetic Medicine Market, by Application

- Aesthetic Medicine Market, by End User

- Aesthetic Medicine Market, by Distribution Channel

- Aesthetic Medicine Market, by Region

- Aesthetic Medicine Market, by Group

- Aesthetic Medicine Market, by Country

- United States Aesthetic Medicine Market

- China Aesthetic Medicine Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2226 ]

Synthesis of Critical Insights Highlighting Principal Market Drivers, Persistent Challenges and Emerging Opportunities Shaping the Future of Aesthetic Medicine

Our synthesis highlights that the future of aesthetic medicine will be defined by the convergence of consumer empowerment, technological democratization, and regulatory evolution. Key drivers include the continued migration toward non-invasive and combination therapies, the maturation of AI-enabled personalization, and expanding acceptance among diverse demographic groups. Simultaneously, challenges persist in tariff volatility, supply-chain complexity, and the imperative to maintain safety standards amidst rapid innovation.

Opportunities lie in harnessing digital commerce channels, expanding telehealth ecosystems, and developing novel bioactive materials for longer-lasting effects. Providers and manufacturers that successfully navigate these dynamics will unlock new growth vectors, reshape competitive boundaries, and deliver elevated patient experiences. Ultimately, the insights presented herein offer a strategic blueprint for steering through uncertainty and capitalizing on the next wave of aesthetic medicine advancements.

Engage with Ketan Rohom, Associate Director of Sales and Marketing, to Access In-Depth Market Intelligence and Secure Your Comprehensive Research Report Today

To embark on strategic growth initiatives and secure a competitive advantage, reach out to Ketan Rohom, our Associate Director of Sales and Marketing, whose expert guidance will help you unlock the full potential of your aesthetic medicine strategies. With deep domain expertise and a tailored approach, he can provide exclusive access to comprehensive market insights, in-depth analysis, and bespoke recommendations that address your specific business challenges. Don’t miss this opportunity to elevate your decision-making process and drive sustainable growth-contact Ketan Rohom today to purchase your full research report and gain the clarity you need to lead in the evolving aesthetic medicine landscape

- How big is the Aesthetic Medicine Market?

- What is the Aesthetic Medicine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?