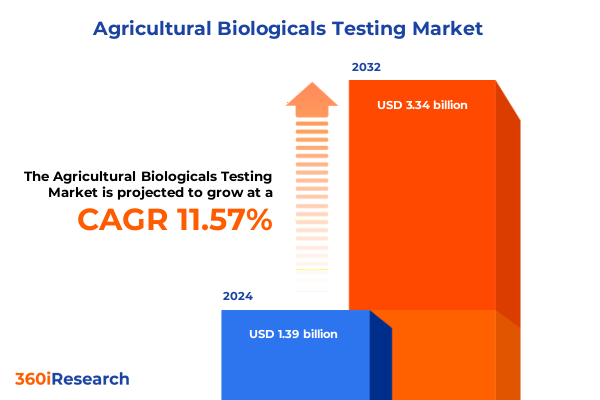

The Agricultural Biologicals Testing Market size was estimated at USD 1.55 billion in 2025 and expected to reach USD 1.72 billion in 2026, at a CAGR of 11.58% to reach USD 3.34 billion by 2032.

Introduction to the Critical Role and Emerging Dynamics Shaping the Agricultural Biologicals Testing Industry for Sustainable Crop Solutions

The adoption of biological solutions in modern agriculture-from microbial inoculants and biofertilizers to biopesticides and biostimulants-has accelerated in response to sustainability imperatives and consumer demands for cleaner food systems. This surge in biological product usage has underscored the critical importance of rigorous testing protocols, as stakeholders seek assurance that these naturally derived inputs deliver consistent performance without compromising environmental or human health. Ensuring product quality and efficacy requires analytical rigor, given the inherent variability of biological materials and the complexity of their interactions within agroecosystems. According to a report by the United Nations Food and Agriculture Organization, integrated pest management practices incorporating biological controls now cover approximately 60% of agricultural land globally, reflecting a broader shift toward ecologically based farming methods that depend on reliable testing frameworks to verify safety and outcomes.

Beyond consumer and regulatory expectations, testing plays a pivotal role in accelerating product development cycles. Manufacturers leverage composition analysis and contaminant screening to refine formulations, while efficacy testing under field conditions validates performance across diverse environments. Regulatory compliance testing not only secures market authorization but also reinforces stakeholder confidence, from farmers evaluating return-on-investment to end users demanding evidence-based recommendations. In this context, the agricultural biologicals testing industry has emerged as a cornerstone of innovation, enabling the translation of scientific discovery into scalable, reliable solutions that support both productivity and sustainability goals.

This executive summary provides a structured overview of the agricultural biologicals testing landscape, beginning with emerging shifts in regulatory and technological paradigms and progressing through the implications of 2025 U.S. tariff measures. Subsequent sections delve into segmentation insights, regional dynamics, and competitive profiles before offering strategic recommendations, outlining the research methodology, and concluding with a clear pathway to acquire the full research report.

How Regulatory Reforms and Sustainable Practices Are Revolutionizing Agricultural Biologicals Testing Through Cutting-Edge Technologies

The agricultural biologicals testing sector is undergoing a profound transformation driven by a convergence of regulatory reforms, technological breakthroughs, and evolving sustainability mandates. Governments worldwide are tightening approval processes, introducing stringent environmental safety criteria, and demanding greater product transparency. Laboratories have responded by enhancing compliance capabilities, investing in digital data management systems, and adopting automated workflows to accelerate reporting and reduce manual errors. High-throughput platforms now support large-scale sample processing, enabling service providers to meet rising demand while maintaining rigorous quality standards.

Concurrently, advanced analytical techniques have redefined the speed and accuracy of testing operations. Integration of artificial intelligence and machine learning into chromatography and spectroscopy workflows has streamlined method development, optimized instrument performance, and uncovered nuanced data patterns. Microfluidic devices and portable field instruments extend laboratory-grade precision to on-site testing, empowering stakeholders with real-time insights that inform timely decisions. These digital innovations not only reduce turnaround times but also bolster transparency through cloud-based data access and immutable record-keeping, aligning with industry calls for traceability across supply chains.

Sustainability considerations further underpin this evolution. Laboratories are embracing green analytical chemistry practices-miniaturized processes, solvent reduction, and energy-efficient instrumentation-to minimize environmental footprints. Whether assessing microbial viability, residue profiles, or ecological impacts, testing providers are forging interdisciplinary teams that blend expertise in agronomy, microbiology, and environmental science. This multidisciplinary approach ensures holistic evaluations, helping manufacturers and regulators alike validate that biological products contribute positively to soil health, crop productivity, and ecosystem resilience.

Assessing the Cumulative Impact of United States Tariff Measures Enacted in 2025 on Agricultural Biologicals Testing Operations

In 2025, the United States implemented a series of tariff measures that have reverberated across agricultural supply chains, influencing the cost structures and operational dynamics of biologicals testing providers. A global 10% tariff on all imported goods, coupled with elevated duties of 20% on Chinese exports and 25% on imports from Canada and Mexico, has introduced new layers of complexity for laboratories reliant on foreign-sourced reagents, instrumentation, and consumables. These measures, intended to bolster domestic manufacturing, have nevertheless translated into higher procurement costs for critical testing inputs, prompting many providers to reevaluate supply chain strategies and consider onshoring key components.

Despite these challenges, several agricultural service providers anticipated the tariff landscape and implemented mitigation strategies. Syngenta Group, for instance, reported minimal impact from the 2025 U.S. tariffs, attributing this resilience to proactive supply chain adjustments and diversified sourcing practices established during prior tariff periods. Their experience underscores the value of forward-looking planning and adaptive procurement frameworks in sustaining testing operations under shifting trade policies.

Nevertheless, the cumulative effect of reciprocal levies has strained certain segments of the agricultural sector, particularly smaller laboratories and contract research organizations that lack the scale to absorb cost spikes. Higher import duties on specialized equipment and consumables, along with retaliatory tariffs on U.S. agricultural exports, have eroded margins and disrupted long-term budgeting. Farmers facing elevated prices for biostimulant and biopesticide inputs may limit trial volumes, while research institutes handling multi-location field studies must grapple with budget realignments. This landscape has elevated cost management and supply chain resilience to the forefront of strategic priorities for all stakeholders in the agricultural biologicals testing ecosystem.

Deep Dive Into Market Segmentation Revealing the Diverse Testing Modalities and Product Classifications Driving Industry Growth

Understanding the agricultural biologicals testing market requires a granular look at key segmentation dimensions that illuminate diverse testing modalities and customer profiles. Across test types, analytical assays focusing on composition analysis and contaminant screening coexist alongside field trials designed for efficacy evaluations and environmental impact studies, while regulatory compliance testing ensures that products meet stringent safety standards. These distinct testing pathways cater to varied development stages and stakeholder needs, from early-stage research to post-launch monitoring.

The market further differentiates by product type into biofertilizers, biopesticides, and biostimulants. Within biofertilizers, specialized strains such as Azotobacter, phosphate-solubilizing bacteria, and Rhizobium underpin nutrient-enhancement strategies. Biopesticides span biochemical, botanical, and microbial classes, each demanding tailored assays to measure mode-of-action and spectrum of activity. Biostimulants include humic substances, protein hydrolysates, and seaweed extracts, requiring comprehensive profiling to validate growth-promotion and stress-mitigation properties.

Technological segmentation spotlights chromatography and spectroscopy as foundational platforms, with cutting-edge variants like supercritical fluid chromatography and mass spectrometry driving analytical precision. Crop-type segmentation spans cereals and grains, fruits and vegetables, oilseeds and pulses, and turf and ornamentals, reflecting the breadth of application-specific test protocols. Finally, end-user segmentation distinguishes agricultural contractors, farmers, and research institutes, each with unique operational scales, data needs, and regulatory touchpoints. Together, these segmentation perspectives form a multidimensional framework that guides service providers in delivering targeted, value-added testing solutions.

This comprehensive research report categorizes the Agricultural Biologicals Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Product Type

- Technology

- Crop Type

- End User

Uncovering Regional Dynamics That Shape Agricultural Biologicals Testing Across the Americas EMEA and Asia-Pacific Markets With Distinct Drivers

Regional dynamics shape the agricultural biologicals testing market in profound ways, driven by varying regulatory landscapes, infrastructure maturity, and agroeconomic priorities. In the Americas, North America leads with a well-established framework for safety and efficacy standards, underpinned by robust accreditation bodies and advanced laboratory networks. Laboratories in the United States and Canada have made significant investments in high-throughput instrumentation and digital data management, reflecting a commitment to precision agriculture and traceability. Meanwhile, in Latin America, emerging markets emphasize cost-effective solutions and capacity building, with Brazil, in particular, attracting strategic investments as global players diversify supply chains and forge new partnerships.

Across Europe, Middle East, and Africa, a mosaic of regulatory regimes presents both challenges and opportunities. The European Union’s Farm to Fork strategy, aiming to cut chemical pesticide use by 50% by 2030, has catalyzed increased investment in biological solutions, driving demand for rigorous testing to meet newly established benchmarks. Laboratories leverage pan-European accreditation to streamline cross-border service delivery, while Middle Eastern and African markets advance through targeted technology transfer initiatives and localized testing centers to support regulatory evolution.

The Asia-Pacific region emerges as the fastest-growing market, fueled by large-scale agricultural programs and rapid regulatory modernization in countries such as India, China, and Australia. Governments are aligning national guidelines with global best practices, reducing approval timelines and encouraging private-sector participation. High-volume field trials for staple crops coexist with sophisticated analytical workstreams for premium fruits and vegetables, supported by expanding infrastructure and strategic funding. As Asia-Pacific volumes surge, the region consolidates its position as a critical driver of global testing innovation and capacity expansion.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Biologicals Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players and Strategic Moves Defining the Competitive Landscape of Agricultural Biologicals Testing

The competitive landscape of agricultural biologicals testing features a mix of global laboratories, specialized niche providers, and nimble start-ups, each leveraging unique strengths to capture market share. Major service players highlighted in recent analysis include ALS Group, Anadiag Group, Bionema Group, BioTecnologie BT, Eurofins APAL Pty Ltd, Eurofins Scientific SE, i2LResearch, Lallemand Inc., LAUS GmbH, R J Hill Laboratories, SGS SA, Staphyt SA, SynTech Research Group, among others. Their broad portfolios encompass everything from advanced chromatographic separations to comprehensive environmental impact assessments, positioning them as end-to-end solution providers for regulators and product developers alike.

Niche laboratories and start-ups differentiate through domain expertise, often focusing on specific biological classes such as microbial viability assays, protein profiling, or metabolomic analyses. These players frequently collaborate with research institutes and product developers to co-publish peer-reviewed findings, accelerating time-to-market and reinforcing scientific credibility. Meanwhile, larger incumbents have pursued strategic partnerships and M&A activity to expand geographic reach, integrate in-house microbiology teams, and deploy mobile testing units for in-field analysis. This convergence of technological leadership, domain specialization, and comprehensive service bundling defines the competitive dynamics of the sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Biologicals Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies Inc

- ALS Limited

- Anadiag Group

- Applus Servicios Tecnológicos S.L.U.

- AsureQuality Limited

- Bionema Limited

- Biotecnologie B.T Srl

- Bureau Veritas SA

- Eurofins Scientific SE

- Fera Science Ltd

- i2LResearch

- Intertek Group plc

- JRF India

- Koppert Biological Systems B.V.

- LAUS GmbH

- Microbac Laboratories Inc

- Mérieux NutriSciences Corporation

- Noack Group

- Pace Analytical Services LLC

- RJ Hill Laboratories Limited

- SGS SA

- Staphyt SA

- SynTech Research Group

- TÜV NORD GROUP

- TÜV SÜD AG

Strategic Recommendations for Industry Leaders to Navigate Complex Regulations and Leverage Technological Advancements in Biologicals Testing

First, laboratories should prioritize investment in automation and high-throughput screening platforms to reduce turnaround times and enhance reproducibility. Robotic sample handlers integrated with AI-driven data analysis can streamline workflows and lower operational costs, enabling providers to respond swiftly to market demands and maintain competitive pricing ite turn1search3.

Second, strengthening regulatory intelligence capabilities is essential. Building dedicated compliance teams to monitor evolving standards, anticipate new requirements, and engage with policy stakeholders will safeguard market access and minimize approval timelines. Adaptive regulatory strategy, supported by computational toxicology and life-cycle assessment tools, can turn compliance into a strategic advantage ite turn1search4.

Third, forging strategic partnerships across the value chain-ranging from instrument manufacturers and raw material suppliers to research institutes and field trial networks-can drive innovation and unlock new service offerings. Co-development agreements and joint validation studies not only enhance technical expertise but also foster access to emerging markets and diversified revenue streams ite turn1search4.

Fourth, diversifying regional operations can mitigate trade-related risks exposed by recent tariff measures. Establishing localized testing hubs in key geographies, configuring dual-sourcing strategies for critical consumables, and leveraging digital platforms for decentralized data management will bolster supply chain resilience and enable seamless service delivery under fluctuating trade policies ite turn2search2.

Finally, embracing digital platforms for end-to-end data integration and client engagement can elevate the customer experience. Interactive dashboards, cloud-based report access, and real-time collaboration tools not only enhance transparency but also facilitate value-added advisory services. By positioning testing as an integral component of a data-driven agriculture ecosystem, providers can deepen client relationships and unlock new consulting opportunities ite turn1search4.

Detailed Research Methodology Outlining Comprehensive Data Collection Analytical Framework and Quality Assurance Protocols Employed

Our research employs a robust mixed-methods approach, combining extensive primary research with comprehensive secondary data analysis. Primary inputs include in-depth interviews with industry executives, laboratory managers, regulatory authorities, and technology innovators, ensuring a broad spectrum of perspectives. Secondary research draws upon proprietary databases, scientific literature, regulatory filings, and trade data to construct a detailed market landscape.

Data triangulation underpins the analytical framework, cross-validating quantitative findings from multiple sources to enhance reliability. Segmentation logic is applied systematically across test types, product categories, technology platforms, crop types, and end users to generate granular insights. Quality assurance protocols involve peer review by subject-matter experts and a multi-tiered validation process to ensure accuracy and consistency of data points.

The methodology integrates scenario analysis to model the potential trajectories of regulatory developments, technological adoption curves, and tariff impacts. Visual analytics tools support interactive data exploration, enabling dynamic sensitivity testing and scenario comparisons. This rigorous framework provides stakeholders with actionable intelligence that is both comprehensive and customizable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Biologicals Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Biologicals Testing Market, by Test Type

- Agricultural Biologicals Testing Market, by Product Type

- Agricultural Biologicals Testing Market, by Technology

- Agricultural Biologicals Testing Market, by Crop Type

- Agricultural Biologicals Testing Market, by End User

- Agricultural Biologicals Testing Market, by Region

- Agricultural Biologicals Testing Market, by Group

- Agricultural Biologicals Testing Market, by Country

- United States Agricultural Biologicals Testing Market

- China Agricultural Biologicals Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Conclusion Emphasizing the Critical Findings Strategic Imperatives and Future Outlook for Sustainable Growth in Agricultural Biologicals Testing

The agricultural biologicals testing industry stands at a pivotal juncture, shaped by accelerating sustainability mandates, technological breakthroughs, and shifting trade policies. This executive summary has highlighted transformative shifts in regulatory landscapes and analytics capabilities, assessed the ramifications of 2025 U.S. tariffs, and unpacked critical segmentation and regional dynamics. Competitive analysis has revealed a market ecosystem where global laboratories, specialized niche providers, and agile start-ups are driving innovation through strategic alliances and advanced platforms.

Looking ahead, providers who embrace automation, strengthen regulatory intelligence, and foster collaborative partnerships will be best positioned to deliver high-value testing solutions. Diversification across geographies and the adoption of digital ecosystems will further enhance resilience and client engagement. As the drive toward ecologically sustainable agriculture intensifies, the role of rigorous biologicals testing will only grow in significance, serving as the linchpin that links scientific discovery to practical field applications.

By applying the insights and recommendations outlined herein, industry stakeholders can navigate uncertainties, capitalize on emerging opportunities, and support the broader transition to a more sustainable, productive agricultural future.

Contact Ketan Rohom to Access the Comprehensive Market Research Report and Unlock Actionable Insights for Agricultural Biologicals Testing Excellence

We invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report on agricultural biologicals testing. Through a personalized dialogue, Ketan can guide you toward the sections most relevant to your strategic priorities, highlight tailored insights that align with your organizational objectives, and outline flexible licensing options to meet your budgetary requirements. Whether you are seeking deep dives into testing technologies, regulatory analyses, or competitive landscapes, Ketan will ensure you receive the actionable intelligence needed to drive innovation and achieve a competitive edge. Reach out today to unlock the full breadth of research, including interactive data dashboards and expert commentary, and position your organization at the forefront of agricultural biologicals testing excellence.

- How big is the Agricultural Biologicals Testing Market?

- What is the Agricultural Biologicals Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?