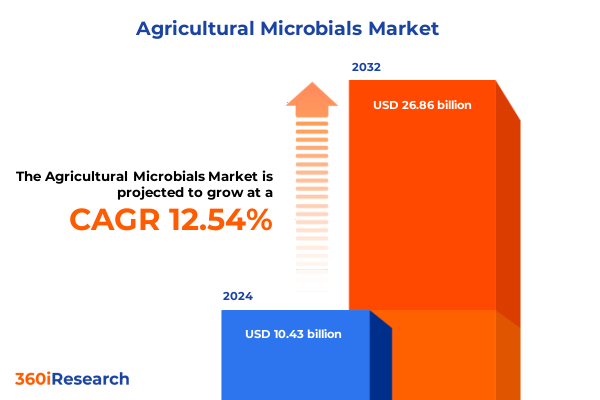

The Agricultural Microbials Market size was estimated at USD 11.64 billion in 2025 and expected to reach USD 13.03 billion in 2026, at a CAGR of 12.68% to reach USD 26.86 billion by 2032.

Setting the Stage for Agricultural Microbials: Defining Core Concepts Driving Soil Health, Crop Protection, and Sustainable Farming Practices

The agricultural microbial industry is redefining modern farming by harnessing naturally occurring microorganisms to boost crop health, improve nutrient efficiency, and reduce reliance on chemical inputs. As global food security challenges intensify alongside climate variability and regulatory pressures, microbial solutions have emerged as a pivotal component of integrated crop management. These biologicals encompass a spectrum of products, ranging from biopesticides that target specific pests and pathogens to soil amendments engineered to foster beneficial microbial consortia.

Moreover, evolving consumer preferences for sustainably produced food, coupled with stringent regulatory frameworks aimed at minimizing chemical residues, have propelled microbial-based technologies into the mainstream. This shift has prompted agri-innovation ecosystems to prioritize research into next-generation bioformulations, precision delivery mechanisms, and host–microbe interactions. Consequently, industry stakeholders-including growers, agtech providers, and policy makers-are increasingly aligning around biologicals as key drivers of resilient and eco-conscious agriculture.

Transitioning from traditional agrochemicals toward microbial interventions not only supports environmental goals but also unlocks pathways for yield stability and resource-use efficiency. By leveraging these living solutions, the sector is on the cusp of a paradigm shift that balances productivity with ecological stewardship.

Navigating Disruptive Innovations and Emerging Trends Reshaping the Agricultural Microbials Landscape with Precision Biocontrol and Digital Integration

In recent years, the agricultural microbials sector has witnessed transformative shifts as innovations in genomics, formulation science, and digital agriculture converge. Cutting-edge sequencing technologies now enable the rapid identification of microbial strains with tailored biocontrol and biofertilization properties, accelerating product development cycles. Simultaneously, advances in encapsulation and stabilization have improved shelf life and field performance of microbial products under diverse environmental conditions.

These technological breakthroughs are unfolding alongside a growing emphasis on data-driven agronomy. Internet of Things (IoT) sensors, satellite imaging, and decision-support platforms are empowering farmers to optimize microbial applications precisely when and where they will be most effective. Consequently, the integration of digital ag tools with microbial inputs is fostering a new era of precision biocontrol that enhances efficacy while minimizing waste.

Furthermore, strategic collaborations between biotech firms, research institutions, and farming cooperatives are catalyzing cross-disciplinary innovations. Collaborative pilot programs are showcasing the complementary roles of microbials alongside cover cropping, precision irrigation, and integrated pest management frameworks. Altogether, these converging trends underscore a rapidly evolving landscape in which microbial solutions are central to achieving both productivity gains and sustainability targets.

Examining the Ripple Effects of 2025 United States Tariffs on Agricultural Microbials Trade, Supply Chains, and Global Competitive Dynamics

The imposition of new tariffs by the United States in 2025 on select agricultural inputs has introduced both challenges and strategic inflection points for microbial product suppliers. Elevated import duties on key raw materials-such as microbial carriers, fermentation substrates, and specialized stabilizers-have increased input costs and altered global supply chain dynamics. As a result, some manufacturers have been compelled to renegotiate contracts, seek alternative sourcing strategies, and accelerate domestic manufacturing capacities to mitigate cost pressures.

These tariff-induced adjustments have also prompted a reevaluation of product pricing strategies and value propositions. Faced with margin compression, microbial firms are intensifying their focus on high-value formulations, such as targeted biocontrol agents and custom soil amendment blends that justify premium pricing through demonstrable agronomic benefits. Moreover, several companies are leveraging tariff challenges as an opportunity to deepen supplier relationships and enhance supply chain resilience by diversifying raw material origins and investing in local fermentation facilities.

In parallel, the evolving policy landscape has encouraged dialogue among industry associations, government agencies, and research consortia to advocate for harmonized trade measures and to explore tariff exemptions for critical biological inputs. Through these collective efforts, stakeholders aim to stabilize market access for microbial innovations while preserving incentives for ongoing R&D and commercialization activities.

Unpacking Diverse Market Segments of Agricultural Microbials Across Functional Applications Organism Types Forms Crops and Distribution Channels

Insights into the agricultural microbials market are sharpened by examining its multifaceted segmentation. Functionally, products designed for crop protection leverage antagonistic microbial interactions to suppress pests and diseases, whereas soil amendment solutions focus on enriching nutrient availability and fostering beneficial microbiomes. From the perspective of microorganism types, bacterial biocontrol strains, fungal inoculants, protozoan fitness enhancers, and viral bioinsecticides each offer distinct modes of action and compatibility requirements.

Formulation preferences further delineate market dynamics: capsule or tablet formats deliver precise dosages for seed treatments, liquid concentrates facilitate rapid foliar sprays, and powdered blends support versatile soil drenching applications. Crop type distinctions reveal that cereals and grains remain a cornerstone segment, while fruits and vegetables demand highly specialized biocontrol and postharvest solutions, and oilseeds and pulses benefit from targeted nodulation and phosphorus-solubilizing microbial consortia.

Considering application methods, foliar spray interventions allow immediate pathogen suppression, seed treatments provide early-stage protection and microbiome conditioning, and soil drenching fosters long-term residual activity. Finally, distribution channels vary between traditional offline networks-encompassing dealers, cooperatives, and distributors-and growing online platforms that offer direct-to-farm ordering, digital agronomy support, and traceability services. Together, these segmentation insights underpin product development strategies and sales channel optimization efforts.

This comprehensive research report categorizes the Agricultural Microbials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Micro organism Type

- Form

- Crop Type

- Packaging Type

- Application

- Distribution Channel

Comparative Regional Perspectives on Agricultural Microbials Adoption Trends in the Americas EMEA and Asia-Pacific Influencing Local Farming Ecosystems

Regional dynamics in the agricultural microbials industry are shaped by unique agronomic priorities and regulatory frameworks. In the Americas, robust investment in biotechnology infrastructure and a substantial legacy of integrated pest management have fostered rapid adoption of both biocontrol and biofertilizer products. Progressive policies at federal and state levels have encouraged public–private partnerships, enabling large-scale trials in major row crop territories.

Conversely, the Europe, Middle East & Africa region presents a mosaic of regulatory landscapes. The European Union’s comprehensive biologicals directive has set rigorous standards for product registration, driving innovation toward high-efficacy, mode-specific microbial strains. In emerging markets across the Middle East and Africa, smallholder needs and supply chain constraints have spurred interest in modular, low-cost formulations and capacity-building initiatives to support local production and distribution networks.

Asia-Pacific markets are defined by heterogeneous agricultural systems and rapidly evolving sustainability agendas. Countries such as India and China are scaling microbial solutions to reduce chemical fertilizer dependency, motivated by soil health rehabilitation programs. Meanwhile, Oceania’s advanced livestock and grain sectors are integrating microbial feed additives and seed treatments as part of precision agriculture frameworks. These divergent regional trends underscore the necessity for tailored market entry strategies and adaptive product portfolios.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Microbials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Agricultural Microbial Innovators Highlighting Strategic Initiatives Partnerships and Product Portfolios Shaping Industry Evolution

Industry leadership in the agricultural microbials space is characterized by robust R&D pipelines, strategic alliances, and expansive distribution networks. Notably, a major life sciences corporation has broadened its portfolio through acquisitions of specialized biocontrol startups and investiture in microbial formulation technologies. A global agricultural technology enterprise has deepened its competencies by co-developing next-gen microbial consortia with academic research centers, thereby enhancing strain performance and delivery precision.

Meanwhile, a pioneering bioinnovation firm has secured partnerships with regional seed companies to integrate microbial seed treatments directly into commercial seed lines, streamlining adoption for growers. Another large-scale agrochemical manufacturer has undertaken collaborative field demonstration programs to validate the integration of microbial biofertilizers within conventional nutrient management regimens. Emerging mid-sized players are differentiating on agility, offering customizable microbial blends and digital agronomy services that deliver prescriptive recommendations based on real-time field data.

Collectively, these corporate initiatives are driving competitive differentiation through expanded geographic reach, diversified product pipelines, and synergistic collaborations. The interplay between multinational conglomerates, specialist innovators, and nimble regional champions underscores an ecosystem in which partnership-driven growth is paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Microbials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADAMA Agricultural Solutions Ltd.

- AgBiome, Inc.

- Agrium Inc.

- Archer Daniels Midland Company

- BASF SE

- Bayer AG

- Bioceres Crop Solutions Corp.

- BioConsortia, Inc

- Bionema Ltd.

- Cargill, Incorporated

- Certis USA LLC

- Concentric Ag

- Corteva, Inc.

- Croda International Plc

- Dow Chemical Company

- DuPont de Nemours, Inc.

- Evogene Ltd.

- Evonik Industries AG

- FMC Corporation

- Gujrat State Fertilizers & Chemicals Limited

- Harris Moran Seed Company

- Heliae Development, LLC

- Indigo Agriculture Inc

- Kemin Industries, Inc.

- Kimitec Group

- Koppert Biological Systems

- Novozymes A/S

- Nufarm Limited

- Olam Group Limited

- Pivot Bio, Inc.

- Seipasa S.A.

- Soiltech Ltd.

- T.Stanes & Company Ltd.

- Tate & Lyle PLC

- Terramera, Inc.

Strategic Imperatives for Industry Leaders to Accelerate Adoption, Foster Collaboration, and Drive Commercial Success in the Agricultural Microbials Sector

To fully capitalize on emerging opportunities within the agricultural microbials domain, industry leaders must prioritize strategic alignment across R&D, commercial operations, and stakeholder engagement. Embracing open-innovation models-such as consortium-based strain screening and co-development platforms-can accelerate time-to-market while reducing capital expenditure burdens. Furthermore, companies should invest in digital agronomy tools that integrate microbial application guidance into broader precision farming systems, thereby demonstrating integrated value to end users.

Organizations are also advised to diversify supply chains geographically and to cultivate local manufacturing or licensing arrangements in key regions. Such measures mitigate tariff risks, reduce lead times, and foster resilience in the face of logistical disruptions. Concurrently, segment-specific go-to-market strategies-tailored to the unique needs of cereal growers versus specialty fruit producers-will enhance market penetration and premium positioning.

Finally, proactive engagement with regulators and industry bodies is essential to shape favorable policy frameworks. By contributing data from field trials, safety assessments, and environmental impact studies, companies can influence registration processes and accelerate product approvals. Through these collective actions, industry leaders will be well-positioned to drive widespread adoption, achieve sustainable growth, and deliver tangible agronomic benefits.

Detailing a Robust Mixed-Method Research Methodology Combining Primary Interviews Secondary Analysis and Data Triangulation for Reliable Market Insights

This research employed a comprehensive mixed-methodology approach to ensure rigorous and actionable insights. Initially, an extensive secondary analysis was conducted, drawing on peer-reviewed journals, industry white papers, regulatory filings, and publicly available databases to map global R&D trajectories, technological breakthroughs, and regulatory frameworks. This foundation facilitated the identification of key market drivers, regulatory bottlenecks, and innovation hotspots.

Subsequently, a series of in-depth primary interviews were conducted with senior executives, product scientists, agronomists, and distribution partners across diverse geographic regions. These conversations provided qualitative context on product performance, commercialization challenges, and end-user adoption drivers. Data triangulation was achieved by cross-verifying interview feedback with secondary findings, ensuring that emerging themes were corroborated by multiple sources.

Finally, quantitative validation involved synthesizing production and usage data from agricultural agencies, trade associations, and scientific consortia. This blending of qualitative and quantitative evidence underpinned robust trend analysis and segmentation insights, yielding recommendations that reflect both technological feasibility and market viability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Microbials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Microbials Market, by Product Type

- Agricultural Microbials Market, by Micro organism Type

- Agricultural Microbials Market, by Form

- Agricultural Microbials Market, by Crop Type

- Agricultural Microbials Market, by Packaging Type

- Agricultural Microbials Market, by Application

- Agricultural Microbials Market, by Distribution Channel

- Agricultural Microbials Market, by Region

- Agricultural Microbials Market, by Group

- Agricultural Microbials Market, by Country

- United States Agricultural Microbials Market

- China Agricultural Microbials Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings and Implications of Agricultural Microbials Trends to Inform Decision-Making and Guide Strategic Agricultural Investments

In summary, agricultural microbials represent a cornerstone of sustainable farming, offering potent solutions that align productivity goals with environmental stewardship. The confluence of advanced formulation science, precision agronomy, and supportive regulatory environments has catalyzed unprecedented momentum in microbial adoption. While 2025 tariffs introduced supply chain complexities, they have also stimulated strategic realignments that reinforce domestic capabilities and high-value product strategies.

Segmentation analysis reveals that targeted product development-across functions, organism types, and application methods-is essential to meet the nuanced needs of diverse crop systems and distribution channels. Regional insights underscore the importance of adaptive approaches, as market dynamics vary significantly from the well-capitalized Americas to the regulatory rigorousness of Europe, Middle East & Africa, and the heterogeneous Asia-Pacific landscape. Corporate profiles highlight an industry in motion, defined by dynamic collaborations and competitive innovation.

Ultimately, stakeholders that embrace open innovation, digital integration, and proactive regulatory engagement will secure a competitive advantage. By adopting these strategic imperatives, organizations can navigate evolving market conditions, address grower pain points effectively, and catalyze long-term value creation in the agricultural microbials ecosystem.

Engage with Our Associate Director to Unlock Comprehensive Agricultural Microbials Intelligence and Elevate Your Competitive Position in Farming Innovation

To explore the full breadth of data, analysis, and strategic guidance on agricultural microbials that can transform your product offerings and market positioning, engage directly with Ketan Rohom, Associate Director for Sales & Marketing. Ketan brings deep subject matter expertise and will guide you through customized insights aligned to your organization’s unique priorities, ensuring you capitalize on emerging opportunities, mitigate evolving risks, and outperform competitors in a rapidly changing regulatory and commercial environment.

By reaching out to Ketan, you will gain exclusive access to our comprehensive market research report, which delivers rigorous research backed by primary interviews, expert commentary, and actionable takeaways. Whether you seek tailored segmentation analysis, in-depth regional intelligence, or competitive benchmarking data, Ketan will assist in customizing the report elements to match your strategic objectives. Don’t miss the opportunity to harness these insights to accelerate innovation, optimize stakeholder engagement, and drive sustainable growth across your agricultural microbial initiatives

- How big is the Agricultural Microbials Market?

- What is the Agricultural Microbials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?