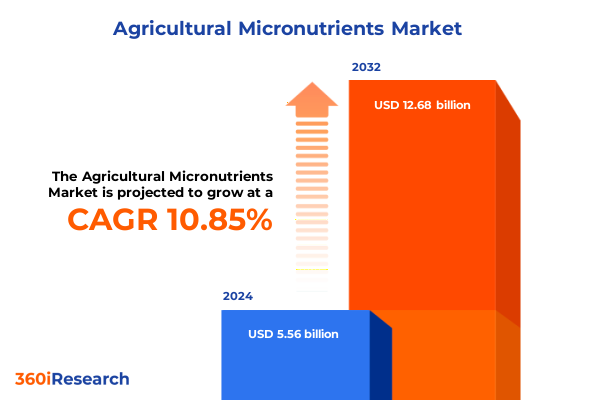

The Agricultural Micronutrients Market size was estimated at USD 6.04 billion in 2025 and expected to reach USD 6.56 billion in 2026, at a CAGR of 11.17% to reach USD 12.68 billion by 2032.

Unveiling the Crucial Influence of Micronutrients on Crop Resilience and Sustainable Agriculture in Response to Contemporary Farming Demands

In an era where agricultural productivity must meet escalating global food demand under evolving environmental and regulatory pressures, the role of micronutrients has never been more critical. Micronutrients such as iron, zinc and boron, though required in trace amounts, play foundational roles in plant physiology, contributing to enzymatic functions, photosynthesis efficiency and overall stress resilience. As growers seek to optimize yield quality while conserving natural resources, targeted micronutrient management emerges as a cornerstone of modern agronomic practice.

Recent advancements in soil science and plant biochemistry have catalyzed renewed interest in micronutrient applications, driven by an acute awareness of hidden hunger in crops and increasing consumer demand for nutrient-dense produce. Within this context, innovation in delivery systems and analytical tools is enabling more precise and sustainable supplementation strategies. This introductory overview sets the stage for a deep dive into the transformative shifts, trade dynamics, segmentation nuances and strategic imperatives shaping the agricultural micronutrients landscape.

Embracing Cutting-Edge Precision Agronomic and Digital Innovations Crafting the Next Generation of Micronutrient Management Solutions

Over the past five years, the agricultural sector has witnessed transformative shifts reshaping how micronutrients are researched, formulated and deployed. Precision agriculture platforms now integrate spectral imaging and soil mapping to diagnose micronutrient deficiencies at field scale, empowering growers to apply corrective treatments at the right place and time. Concurrently, developments in chelation chemistry have broadened the efficacy of multi micronutrient blends, enabling simultaneous delivery of key elements in bioavailable forms that traverse soil pH barriers and plant barriers with greater efficiency.

Moreover, the digital revolution has extended beyond field diagnostics to encompass supply chain transparency and predictive analytics. Advanced traceability solutions, leveraging blockchain and IoT-enabled sensors, are improving quality assurance from formulation to field application. Sustainability considerations have also gained prominence, prompting formulators to explore biodegradable carriers and bio-based chelation agents. These shifts, underpinned by collaborative research between agronomists, chemists and technology providers, are redefining the competitive dynamics and innovation pathways within the micronutrients arena.

Assessing the Layered Consequences of Newly Instituted United States Import Duties on Micronutrient Supply Chains

In early 2025, the United States introduced a series of revised tariffs targeting imported micronutrient compounds, reflecting broader trade policy adjustments. These measures, which applied differential duty rates on inorganic and organic chelated compounds, have had a cumulative effect on both formulator costs and distribution strategies. Suppliers sourcing raw materials from key export markets faced upward pressure on landed costs, prompting a reevaluation of procurement portfolios and an acceleration of local production initiatives.

The ripple effects extended downstream as distributors adjusted inventory policies to mitigate exposure to tariff volatility, occasionally deferring purchases during periods of heightened rate uncertainty. Meanwhile, several domestic manufacturers responded by scaling up capacity for synthetic micronutrient synthesis, aiming to insulate regional supply chains against external disruptions. As a result, end users have experienced subtle but measurable shifts in product availability timelines and price structures, reinforcing the strategic imperative of supply diversification and tariff risk management in sourcing decisions.

Delineating Complex Market Segmentation Dynamics Across Nutrient Type Formulation Methods and Grower Profiles Driving Adoption Patterns

When evaluating product category performance by micronutrient type, multi micronutrient blends, whether chelated or non-chelated, are achieving broader adoption as growers seek comprehensive nutritional packages that address multiple deficiency profiles in a single application. Single micronutrient offerings, with discrete formulations of boron, copper, iron, manganese, molybdenum and zinc, remain essential for pinpoint correction of specific elemental shortfalls, particularly in high-value horticultural operations. Formulation preferences are evolving as granular offerings, including coated and dry granules, continue to support ease of handling, yet liquids-especially suspension concentrates and emulsifiable concentrates-are gaining favor for their rapid foliar uptake and compatibility with integrated spray programs. Powdered variants, notably water-dispersible granules and wettable powders, maintain a strong foothold where on-farm mixing flexibility is prioritized.

In practical deployment, growers balance foliar application methods-both curative and preventive-with seed treatment approaches such as coating, pelleting and soaking to establish robust nutrient reserves at germination. Soil application techniques, encompassing pre-planting incorporation, post-emergence adjustment and strategic side dressing, fulfill broader agronomic plans suited to field-scale row crops. Crop type emphasis spans cereals and grains, with maize, rice and wheat accounting for the majority of staple grain hectares, while fruits and vegetables such as potatoes and tomatoes command precision nutrition for premium quality. Oilseeds and pulses, including cotton, peanuts and soybean, are benefiting from targeted micronutrient support to enhance oil content and protein density. Insights into source preference reveal a dichotomy between organic carriers prioritizing environmental stewardship and synthetic sources engineered for consistent release kinetics. Distribution pathways are likewise diversified, with direct sales channels-encompassing distributor direct and manufacturer direct models-complemented by e-commerce routes via B2B platforms and manufacturer websites. Traditional retail stores, from cooperatives to independent agronomy outlets, remain vital for last-mile connectivity. End users range from contract farming enterprises to large-scale commercial operators and resource-constrained smallholder farmers, each class exhibiting unique adoption patterns tied to operational scale and access to agronomic advisory services.

This comprehensive research report categorizes the Agricultural Micronutrients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Micronutrient Type

- Formulation

- Crop Type

- Source

- Application Method

Exploring Varied Agronomic and Regulatory Environments Shaping Demand for Micronutrient Solutions across Key Global Regions

Regionally, the Americas continue to drive innovation in micronutrient applications, with North American growers leveraging sophisticated precision tools and Latin American producers capitalizing on integrated soil mapping to combat region-specific nutrient depletion. Meanwhile, Europe, the Middle East and Africa exhibit a heightened regulatory focus on sustainable product registries and bio-based formulation approvals, prompting suppliers to align R&D pipelines with stringent environmental thresholds. In EMEA, specialized foliar blends and organic-sourced micronutrients are gaining traction among producers seeking to meet rigorous quality standards and export compliance rules.

The Asia-Pacific region, characterized by diverse agroecological conditions, is witnessing robust demand for cost-efficient single micronutrient treatments in densely cultivated rice and wheat systems, while premium-grade chelated blends find their niche among high-value vegetable and fruit growers in East Asia. Government-led nutrient management programs in South and Southeast Asia are further amplifying awareness around soil health restoration and microelement balance. Across these geographies, channel strategies adapt to local infrastructure realities, blending e-commerce outreach with mobile-based extension services to reach dispersed smallholder populations and sophisticated commercial farms alike.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Micronutrients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Diverse Competitive Arena from Global Agrochemical Giants to Innovative Specialist Formulators Revolutionizing Crop Nutrition

Competitive positioning in the micronutrients landscape is marked by a blend of established agrochemical leaders, specialized nutrient formulators and regional innovators. Major agricultural input conglomerates leverage expansive R&D capabilities to introduce advanced chelation technologies and digital integration in their product portfolios. At the same time, nimble specialist players concentrate on niche applications such as foliar biofortification and organic chelate development, establishing strategic partnerships with local distributors to extend market reach. Emerging companies are also capitalizing on biotechnology advances to engineer microbial consortia that synergize with traditional micronutrient regimes, enhancing uptake and root health.

Across this competitive tapestry, differentiation is realized through the depth of agronomic support services, digital diagnostics integration and transparent sustainability credentials. Firms that couple robust field research trials with localized technical assistance are cultivating stronger grower loyalty, while strategic alliances between formulators and precision agriculture technology providers are accelerating the deployment of data-driven nutrition management solutions. As the sector evolves, companies prioritizing modular, customizable product platforms and agile supply chains are poised to capture emerging opportunities in high-growth crop segments and underserved geographies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Micronutrients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aries Agro Limited

- BASF SE

- Coromandel International Limited

- Haifa Group Ltd.

- Helena Agri-Enterprises, LLC

- ICL Group Ltd.

- Koch Agronomic Services, LLC

- Nutrien Ltd.

- Sociedad Química y Minera de Chile S.A.

- The Mosaic Company

- UPL Limited

- Valagro S.p.A.

- Yara International ASA

Empowering Strategic Growth by Integrating Digital Diagnostics Collaborative Innovation and Supply Chain Diversification

Industry leaders should prioritize the integration of digital soil diagnostic tools and decision support platforms into their value propositions to offer growers actionable insights and optimize nutrient use efficiency. Collaborative research initiatives with academic institutions and agtech startups can accelerate the development of next-generation chelation chemistries and bio-based carriers. It's equally imperative to diversify raw material sourcing strategies by forging partnerships with alternative suppliers and investing in domestic synthesis capacity, thereby mitigating tariff-related risks and ensuring supply continuity.

Furthermore, tailoring product portfolios to reflect regional agronomic priorities-such as organic-certified micronutrients in EMEA or cost-effective single-element treatments in Asia-Pacific-will enhance market penetration. Establishing robust farmer training programs and demonstration networks can drive adoption while reinforcing brand credibility. Lastly, channel expansion through digital platforms and value-added service bundles will position companies to capture emerging demand among both high-tech operations and resource-limited smallholder segments.

Detailing a Robust Multi-Method Research Framework Integrating Primary Interviews Secondary Analysis and Data Triangulation

This analysis is based on a comprehensive research methodology that combines primary and secondary data collection. Primary research involved in-depth interviews with agronomists, distributor representatives and key growers across major producing regions to obtain actionable insights into application preferences and supply chain adaptations. Complementing this, secondary research encompassed a rigorous review of peer-reviewed agronomic journals, government publications on nutrient regulation and industry white papers, ensuring a holistic understanding of both scientific developments and policy dynamics.

Data triangulation techniques were employed to cross-validate findings, synthesizing market intelligence with field trial results and trade flow analyses. Expert workshops and advisory panel consultations further refined the interpretations of tariff impacts and segmentation drivers. The research approach emphasizes transparency, reproducibility and relevance, delivering insights that resonate with both strategic decision-makers and technical practitioners.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Micronutrients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Micronutrients Market, by Micronutrient Type

- Agricultural Micronutrients Market, by Formulation

- Agricultural Micronutrients Market, by Crop Type

- Agricultural Micronutrients Market, by Source

- Agricultural Micronutrients Market, by Application Method

- Agricultural Micronutrients Market, by Region

- Agricultural Micronutrients Market, by Group

- Agricultural Micronutrients Market, by Country

- United States Agricultural Micronutrients Market

- China Agricultural Micronutrients Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings on Innovation Dynamics Trade Policy Effects and Future Pathways for Crop Nutrition Leadership

The insights presented herein underscore the multifaceted nature of the agricultural micronutrients market, shaped by technological innovation, evolving trade policies and nuanced regional dynamics. As precision agronomy tools become mainstream, and sustainability mandates intensify, the ability to deliver targeted nutrient solutions-with demonstrable environmental and economic benefits-will define competitive advantage. The cumulative effects of recent tariff changes further highlight the importance of supply chain resilience and adaptive sourcing strategies.

Looking ahead, the confluence of bio-based formulation research, digital agritech integration and collaborative industry efforts promises to elevate micronutrient management from a corrective measure to a proactive pillar of crop health optimization. Stakeholders equipped with these strategic insights are well-positioned to guide their organizations toward sustainable growth and to contribute meaningfully to global food security objectives.

Unlock Unparalleled Strategic Advantages in Crop Nutrition by Connecting Directly with the Associate Director for Exclusive Research Insights

If you are ready to elevate your strategic position and harness the latest insights on agricultural micronutrient dynamics, reach out to Ketan Rohom (Associate Director, Sales & Marketing) to secure this comprehensive market research report. Engaging with this resource equips your organization with a nuanced understanding of segmentation drivers, regional supply chain intricacies, tariff implications and competitive benchmarks essential for informed decision-making. Ketan Rohom can provide tailored access options, executive briefings and customized data extracts that align with your unique operational objectives. Seize this opportunity to transform insights into action and reinforce your leadership in sustainable crop nutrition solutions by contacting Ketan Rohom today

- How big is the Agricultural Micronutrients Market?

- What is the Agricultural Micronutrients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?