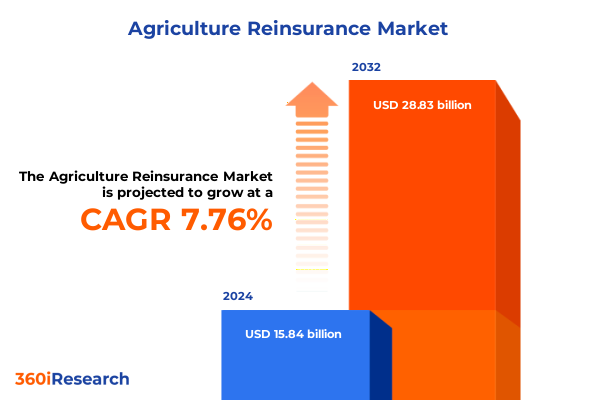

The Agriculture Reinsurance Market size was estimated at USD 17.00 billion in 2025 and expected to reach USD 18.24 billion in 2026, at a CAGR of 7.83% to reach USD 28.83 billion by 2032.

Setting the Stage for Insights into the Agriculture Reinsurance Market’s Pivotal Role in Stabilizing Global Food Security Supply Chains

Agriculture reinsurance occupies a critical intersection between financial protection mechanisms and global food security imperatives. As extreme weather events intensify and supply chains become increasingly interdependent, reinsurers serve as a vital backstop for insurers covering crop and livestock producers. These risk-transfer solutions absorb shocks from droughts, floods, and market fluctuations, enabling insurers to uphold commitments to farmers and stakeholders without jeopardizing solvency. The result is an enhanced capacity to weather volatility and sustain production continuity across diverse agro-ecosystems.

The past decade has witnessed an uptick in climate-related losses and geopolitical disruptions that ripple through commodity markets, driving demand for sophisticated risk mitigation tools. In parallel, evolving regulatory frameworks and investor expectations regarding environmental and social governance have spurred innovation within the reinsurance community. To navigate these complexities, participants must engage with advanced data analytics, parametric insurance structures, and collaborative partnerships that stretch from rural cooperatives to global reinsurers.

This executive summary lays the groundwork for a comprehensive exploration of current market drivers, structural shifts, and strategic imperatives in agriculture reinsurance. By illuminating pivotal trends and offering expert recommendations, it aims to guide decision-makers in crafting resilient portfolios and forging partnerships that strengthen the security of food supplies worldwide.

Unveiling the Driving Forces Behind the Agriculture Reinsurance Transformation from Climate Risks to Technological Disruption

A confluence of factors is reshaping agriculture reinsurance at an unprecedented pace. Escalating meteorological volatility has elevated loss frequency and severity, prompting reinsurers to refine underwriting models and deploy alternative risk transfer instruments. Simultaneously, breakthroughs in remote sensing, satellite analytics, and precision agriculture are unlocking granular risk profiles, enabling parametric insurance structures that pay out based on objective weather triggers rather than traditional indemnity assessments.

Regulatory landscapes are also evolving, with authorities in major producing countries mandating minimum coverage thresholds and incentivizing revenue protection mechanisms. This shift encourages the adoption of multi-peril safeguards and revenue-based instruments designed to address both yield and price exposures. Moreover, collaborations between reinsurers, technology providers, and public sector entities are fostering piloted schemes such as hybrid weather index products that blend parametric triggers with indemnity floors, thereby enhancing transparency and reducing moral hazard.

Investor appetite for agriculture-linked securities has surged as well, driving reinsurers to incorporate catastrophe bonds and insurance-linked funds into their portfolios. These innovations not only diversify capital sources but also align risk transfer with the broader sustainability goals of financial markets. By understanding these transformative forces-from climate risks to technology advances-stakeholders can recalibrate strategies and harness emerging opportunities for growth and resilience.

Analyzing the Widespread Consequences of 2025 United States Tariff Policies on Crop and Animal Reinsurance Risk Profiles and Premium Dynamics

In early 2025, new tariffs implemented by the United States administration introduced higher duties on key agricultural imports, significantly altering cost structures for feed grains and input materials. Those elevated trade barriers have reverberated across the reinsurance value chain, as increased input expenses for poultry, swine, and cattle producers amplify the magnitude of potential loss events that underwriters must anticipate. The resulting premium adjustments reflect a recalibrated balance between indemnity expectations and capital efficiency.

Moreover, export constraints stemming from tariff measures have compressed global demand for American cereals and pulses, heightening price volatility in international markets. For reinsurers, this translates into wider exposure bands around revenue protection products, with underwriters reassessing historical indemnity ratios to accommodate more pronounced price swings. Consequently, traditional crop reinsurance structures are evolving to integrate dynamic pricing algorithms that account for real-time commodity benchmarks and cross-border trade flows.

Amidst these shifts, reinsurers have accelerated investment in predictive analytics to refine portfolio diversification strategies. By modeling tariff scenarios and simulating supply chain disruptions, they can stress-test coverages on both crop and animal segments. This proactive stance not only preserves underwriting discipline but also ensures that risk carriers remain solvent when confronted with tariff-driven loss accumulations. As a result, the industry is witnessing a pronounced shift toward more adaptive and data-intensive approaches to pricing and capital allocation.

Revealing Critical Market Insights Through Detailed Segmentation Based on Product Types Coverages Distribution Channels and End Users in Agriculture Reinsurance

A thorough segmentation analysis unveils nuanced insights across product types, coverage modalities, distribution pathways, and end-user profiles, each shaping the contours of agriculture reinsurance engagements. Within product classifications, reinsurance for animal exposures is delineated into cattle, poultry, and swine coverages, reflecting the distinct mortality and feed-price risk profiles inherent to each species. Parallel structures in crop reinsurance encompass cereals, fruits and vegetables, and pulses, capturing the unique susceptibility of field and horticultural crops to weather extremes and disease outbreaks.

In terms of coverage modalities, multi-peril arrangements continue to dominate, furnishing broad-based indemnification against yield fluctuations and weather events, while revenue insurance gains traction among producers seeking protection against adverse price movements. Weather index solutions, which disburse based on predefined meteorological thresholds, are rapidly maturing as cost-efficient parametric alternatives that bypass complex loss adjustment processes.

Channel strategies reveal a persistent role for brokers as intermediaries, complemented by direct sales agreements between large insurers and institutional farmers. Meanwhile, online platforms are emerging as agile conduits for smaller operators seeking streamlined policy purchases and claims procedures. End-user dynamics further differentiate market uptake, with corporate farms leveraging comprehensive risk portfolios, government agencies underwriting social resilience programs, and small farmers adopting targeted index covers that deliver accessible and transparent protection.

This comprehensive research report categorizes the Agriculture Reinsurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Coverage Type

- Distribution Channel

- End User

Exploring Regional Dynamics Shaping Agriculture Reinsurance Adoption Patterns and Risk Mitigation Strategies Across Key Global Territories

Regional dynamics exert a powerful influence over the structure and uptake of agriculture reinsurance solutions. In the Americas, deep penetration of multi-peril and revenue insurance products is supported by mature regulatory regimes and extensive loss-history databases. United States and Brazilian stakeholders collaborate closely with reinsurers to develop hybrid parametric structures, leveraging satellite analytics to optimize loss ratios and expand coverage to underserved areas.

Across Europe, the Middle East & Africa, divergent climatic zones and agrarian practices demand a flexible approach. In Western Europe, stringent environmental policies and high insurance literacy drive adoption of value-added products, while emerging markets in Sub-Saharan Africa rely on index-based schemes funded by public-private partnerships to enhance food security. The Middle East, confronting water scarcity, increasingly explores weather index covers that hedge both temperature and precipitation anomalies.

Asia-Pacific encompasses a spectrum of risk appetites and economic maturity. Australia’s catastrophic bushfire history has galvanized robust reinsurance collaborations, while India’s vast smallholder population is gradually transitioning from government-subsidized indemnity plans to revenue insurance and parametric triggers. In East Asia, technological innovation hubs in China and Japan are pioneering AI-driven underwriting models, underscoring the region’s leadership in digital risk assessment and product innovation.

This comprehensive research report examines key regions that drive the evolution of the Agriculture Reinsurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Driving Innovation Resilience and Growth in Agriculture Reinsurance

Leading reinsurers are deploying diverse strategic initiatives to capture emerging opportunities and reinforce resilience. Munich Re has expanded its parametric portfolio, integrating satellite-based drought indices and collaborating with precision agriculture firms to enhance yield forecasts. Swiss Re, in turn, is forging partnerships with agritech startups to co-develop index triggers for tropical crops, thereby tapping into high-growth horticulture segments.

SCOR has emphasized its dual approach, combining traditional indemnity layers with blockchain-enabled claims processing that reduces settlement times and elevates transparency. Hannover Re, leveraging its actuarial heritage, has introduced flexible revenue protection instruments with embedded dynamic pricing engines, adjusting premiums in near-real time based on commodity futures benchmarks. At Lloyd’s of London, syndicates are broadening capital sources through catastrophe bond issuances linked to large-scale weather events, diversifying reinsurance capacity while aligning with investor demand for sustainable assets.

Collectively, these players underscore a shared commitment to innovation, operational efficiency, and digital transformation. By investing in advanced analytics, strategic alliances, and alternative capital structures, they are setting new standards for agility and customer-centricity in agriculture reinsurance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agriculture Reinsurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz SE

- Arthur J. Gallagher & Co.

- Berkshire Hathaway Inc.

- Everest Re Group Ltd.

- Gallagher Re

- Hannover Re Group

- MS Amlin AG

- Munich Re

- PartnerRe Ltd.

- QBE Insurance Group Limited

- Scor SE

- Sompo Holdings, Inc.

- Swiss Re

Offering Actionable Strategic Recommendations to Guide Industry Leaders in Optimizing Risk Management and Operational Efficiency in Agriculture Reinsurance

Industry leaders must adopt a multifaceted strategy to navigate evolving risk landscapes. First, integrating high-resolution satellite and IoT data into underwriting workflows will strengthen risk differentiation and enable tailored coverage tiers. Embedding real-time weather feeds and crop health metrics into pricing models can sharpen loss predictions and optimize capital deployment.

Second, embracing hybrid parametric-indemnity structures can offer clients both rapid payout mechanisms and coverage floors that safeguard against basis risk. Collaborating with government entities and donor agencies to co-fund index programs in emerging markets can also expand product reach and foster social resilience. Concurrently, reinsurers should cultivate partnerships with fintech platforms to streamline policy origination and claims settlement, particularly for smallholder segments that demand low-friction solutions.

Finally, scenario-based stress testing that incorporates tariff shocks, supply chain disruptions, and climate extremes is essential for robust portfolio management. Institutionalizing agile governance frameworks ensures that underwriting guidelines and capital reserves remain aligned with dynamic market conditions. By executing these recommendations, reinsurers and their partners can fortify operational efficiency, enhance client engagement, and secure long-term profitability.

Outlining a Research Framework Incorporating Diverse Data Sources Methodological Rigor and Comprehensive Analytical Techniques for Agriculture Reinsurance Study

This study employed a dual-phase methodology combining primary engagement with secondary research to deliver comprehensive market insights. Primary inputs were sourced through structured interviews with senior underwriters, agronomists, and risk managers across major reinsurance hubs. Supplementing these discussions, surveys were conducted with farm cooperatives and insurance brokers to capture end-user perspectives and coverage preferences.

Secondary research encompassed an extensive review of peer-reviewed journals, regulatory filings, and industry white papers, focusing on climate risk modeling, parametric insurance advancements, and tariff policy analyses. Geospatial data from satellite imagery providers was integrated to validate loss event correlations, while commodity futures pricing feeds informed scenario simulations for revenue protection products.

Analytical techniques included statistical regression analysis to identify key drivers of loss frequency and severity, as well as stochastic modeling to assess capital adequacy under diverse stress scenarios. Findings were triangulated through expert panel reviews, ensuring methodological rigor and practical relevance. This blended approach offers stakeholders a multidimensional understanding of agriculture reinsurance dynamics, grounded in real-world evidence and quantitative validation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agriculture Reinsurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agriculture Reinsurance Market, by Product Type

- Agriculture Reinsurance Market, by Coverage Type

- Agriculture Reinsurance Market, by Distribution Channel

- Agriculture Reinsurance Market, by End User

- Agriculture Reinsurance Market, by Region

- Agriculture Reinsurance Market, by Group

- Agriculture Reinsurance Market, by Country

- United States Agriculture Reinsurance Market

- China Agriculture Reinsurance Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing Powerful Conclusions to Solidify Understanding of Agriculture Reinsurance Trends Opportunities and Critical Next Steps for Stakeholders

The examination of agriculture reinsurance reveals a market at the cusp of profound evolution. Climate-induced volatility necessitates more sophisticated parametric and revenue-based instruments, while tariff pressures underscore the importance of adaptive underwriting practices. Regional disparities in risk tolerance and technological maturity further accentuate the need for customizable solutions that resonate with local agricultural realities.

Segmentation insights demonstrate that product versatility-from livestock mortality covers to horticultural index schemes-is crucial for addressing heterogeneous producer needs. Distribution channel diversification, blending broker expertise with digital touchpoints, will drive deeper market penetration. Likewise, strategic collaborations between reinsurers, technology innovators, and public-sector stakeholders can unlock new pathways for resilience and growth.

Ultimately, the convergence of advanced analytics, alternative capital structures, and policy innovation positions agriculture reinsurance as a linchpin in global food security strategies. Stakeholders equipped with these insights can not only safeguard portfolios but also advance sustainable agricultural practices and economic stability. As risk landscapes continue to shift, this synthesis of trends and recommendations offers a clear roadmap for informed decision making and enduring impact.

Connect with Ketan Rohom to Access Comprehensive Agriculture Reinsurance Insights and Drive Strategic Decision Making with the Latest Market Research Report

To explore how these insights can propel your organization’s strategic initiatives, connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s guidance will ensure that your team gains a nuanced understanding of risk dynamics, leverages cutting-edge analytical frameworks, and aligns capital allocation with evolving market demands. Reach out today to secure your comprehensive agriculture reinsurance market research report and equip your leadership with the intelligence needed to stay ahead in an ever-shifting landscape.

- How big is the Agriculture Reinsurance Market?

- What is the Agriculture Reinsurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?