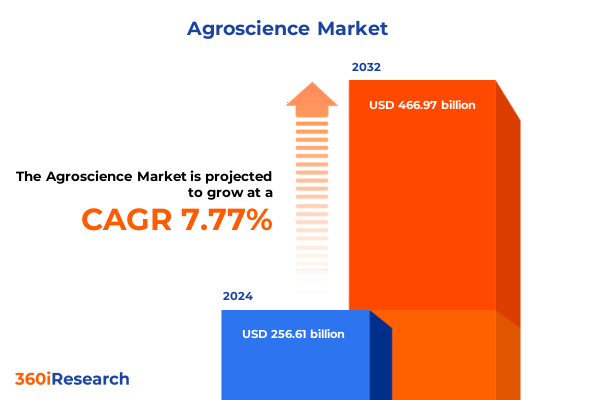

The Agroscience Market size was estimated at USD 274.49 billion in 2025 and expected to reach USD 293.63 billion in 2026, at a CAGR of 7.88% to reach USD 466.97 billion by 2032.

Charting Crop Protection Innovations and Plant Health Strategies Through Emerging Technologies, Regulatory Trends, and Market Transformation Drivers

The agroscience sector stands at the intersection of escalating global food demand, mounting environmental pressures, and the imperative to sustain crop yields in the face of evolving pest and disease challenges. Innovations in crop protection technologies and plant health management have become essential levers to ensure productivity gains while minimizing ecological footprints. As regulatory frameworks tighten and consumer expectations around sustainability intensify, industry participants are compelled to adopt more integrated approaches that balance efficacy with environmental stewardship.

This executive summary synthesizes the most pivotal developments shaping the agroscience arena, from transformative technological shifts to the evolving landscape of United States tariffs in 2025. It further elaborates on the segmentation of the market by product type, crop type, technology, and application method, providing nuanced insights that inform strategic positioning. In addition, it offers regional perspectives across the Americas, Europe Middle East & Africa, and Asia-Pacific, and highlights the strategic trajectories of key industry players. Finally, it outlines actionable recommendations for senior leaders, details the research methodology underpinning these findings, and concludes with a compelling invitation to engage further through tailored market intelligence. By examining both macroeconomic factors and micro-level innovations, this summary equips decision-makers with a comprehensive understanding of the forces driving growth and resilience in agroscience

Unveiling the seismic transformations reshaping agroscience with precision farming breakthroughs, sustainable biopesticides, data-driven agronomy, and regulatory shifts

Over the past decade, agroscience has witnessed seismic transformations driven by precision agriculture breakthroughs, advances in biotechnology, and the integration of digital platforms. The advent of remote sensing technologies and satellite-enabled monitoring has empowered agronomists and growers to detect early signs of pest infestation and disease outbreaks, facilitating timely, targeted interventions. In parallel, the commercialization of next-generation biopesticides and plant growth regulators has enabled more environmentally friendly approaches to crop protection, reducing reliance on synthetic chemistries and addressing consumer demands for agricultural sustainability.

Furthermore, the proliferation of data analytics and Internet of Things (IoT) sensors has catalyzed a shift from reactive to predictive crop management paradigms. By harnessing machine learning algorithms and field-level datapoints-from soil moisture metrics to real-time weather forecasts-organizations can optimize application timing, dosage accuracy, and resource allocation. This digital agronomy revolution is complemented by a growing emphasis on integrated pest management frameworks, which prioritize ecosystem health and leverage biological control agents alongside conventional inputs.

Moreover, regulatory mandates focusing on environmental safety, worker health, and residue thresholds continue to influence product development roadmaps. As governments worldwide implement stricter guidelines for chemical approvals and usage restrictions, agroscience firms are innovating formulation chemistries and delivery methods to comply with evolving standards while maintaining efficacy. Consequently, companies that can seamlessly blend technological prowess with regulatory compliance stand poised to capture emerging market opportunities and lead the next era of sustainable crop protection.

Evaluating the ramifications of 2025 United States import tariffs on agroscience supply chains, cost structures, sourcing strategies, and domestic production incentives

In early 2025, the United States government implemented a series of import tariffs affecting key agroscience inputs, marking a strategic effort to bolster domestic manufacturing and safeguard critical supply chains. These tariffs, targeting a range of agrochemical active ingredients and formulation intermediates, have resulted in elevated import costs that are reverberating across manufacturing facilities and distribution networks. As a consequence, organizations are confronting intensified cost pressures and recalibrating sourcing strategies to mitigate margin erosion and maintain product availability.

The imposition of these measures has also prompted a gradual reshoring of certain production activities. Domestic facilities specializing in formulation and packaging have seen increased utilization rates, driven by incentives to minimize tariff exposure and reduce lead times. At the same time, the elevated pricing environment for imported specialty chemistries has accelerated partnerships between domestic producers and global suppliers willing to negotiate volume-based agreements to offset added duties. This evolving landscape has underscored the strategic importance of supply chain resilience, compelling agroscience players to diversify raw material sourcing and invest in local production capabilities.

Looking ahead, sustained tariff regimes are likely to shape research and development priorities, as companies explore alternative chemistries and biobased inputs that fall outside of the current duty classifications. In addition, trade policy dynamics may spur renewed dialogues on bilateral agreements and multilateral frameworks aimed at stabilizing cross-border flows. For industry leaders, navigating the cumulative impact of United States tariffs in 2025 demands a dual focus on cost containment and strategic collaboration to unlock new pathways for innovation and competitive differentiation.

Integrating product, crop, technology, and application method segment frameworks to extract nuanced insights into evolving pest control and crop protection strategies

A product-type lens reveals pivotal variances in demand for crop protection solutions. Fungicides, segmented into azole and strobilurin classes, continue to command strong interest for their broad-spectrum efficacy against fungal pathogens, while herbicides-distinguished by post-emergent and pre-emergent formulations-remain central to weed management regimens in major row crops. In parallel, insecticides are experiencing a nuanced shift toward botanical alternatives alongside established synthetic options, reflecting a broader consumer preference for natural-origin inputs. Rodenticides, although representing a smaller market segment, are seeing heightened adoption in controlled-environment agriculture where pest control must be both precise and safe for adjacent crops.

When viewed through a crop-type perspective, cereals and grains-anchored by maize, rice, and wheat-represent foundational applications for the full suite of agroscience offerings. Fruits and vegetables, with sub-categories of berries and citrus, drive specialized demands for crop-specific formulations that balance efficacy with residue management. Oilseeds and pulses, including canola, soybean, and sunflower, call for integrated approaches to tackle diverse pest pressures across broadacre landscapes. Meanwhile, turf and ornamentals, spanning golf courses and landscape applications, increasingly leverage lower-toxicity inputs and precision application techniques to meet aesthetic and environmental benchmarks.

Examining the dichotomy of technology platforms, biological solutions are bifurcated into microbial agents and natural extracts that harness living organisms or plant-derived constituents for crop protection, while conventional offerings rely on synthetic chemistries with well-established modes of action. In tandem, application methodologies-ranging from foliar strategies subdivided into dusting and spraying to soil treatments via banding and broadcast, as well as seed-treatment innovations and trunk-injection systems-underscore the criticality of delivery precision in maximizing efficacy and minimizing non-target impacts. By weaving these segmentation frameworks together, organizations can uncover nuanced opportunities for product diversification and targeted outreach to end users.

This comprehensive research report categorizes the Agroscience market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Crop Type

- Technology

- Application Method

Deciphering regional dynamics across Americas, Europe Middle East Africa, and Asia Pacific to uncover distinctive growth trajectories, regulatory climates, and innovation hubs

In the Americas, leadership in agroscience innovation is underscored by robust research ecosystems and substantial private-sector investment. The United States continues to drive adoption of digital agronomy tools, advanced biopesticides, and precision application platforms, supported by government incentives and a mature regulatory environment. At the same time, Canada’s emphasis on sustainable crop management and regenerative agriculture is catalyzing demand for low-residue solutions and biocontrol agents. Across Latin America, expansive cultivation of soybeans, maize, and sugarcane is propelling tailored formulation developments and fostering localized production partnerships to optimize regional supply chains.

Europe, the Middle East, and Africa present a mosaic of regulatory and agronomic contexts. Within Europe, stringent chemical registration processes and the European Green Deal have accelerated transitions toward integrated pest management and non-synthetic inputs. The Middle East’s reliance on controlled-environment agriculture has spurred innovations in trunk injection and precision fertigation techniques to mitigate water scarcity challenges. Across Africa, rising investments in smallholder extension services and micro-distribution networks are driving demand for cost-efficient, user-friendly formulations that align with fragmented farm structures.

Asia-Pacific remains at the forefront of both demand growth and production capacity expansion. China’s predominant role in agrochemical manufacturing is complemented by rapid commercialization of novel biological and conventional chemistries. India’s focus on self-sufficiency and farmer-centric outreach programs fuels widespread adoption of seed treatments and foliar applications. Meanwhile, Southeast Asian markets are witnessing accelerated uptake of post-emergent herbicides and integrated digital platforms, reflecting broader efforts to bridge yield gaps and strengthen food security through targeted agroscience interventions.

This comprehensive research report examines key regions that drive the evolution of the Agroscience market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading agroscience enterprises and examining their strategic maneuvers, collaborative ventures, research investments, and competitive positioning in a dynamic market

Leading agroscience enterprises are strategically deploying a combination of mergers and acquisitions, joint ventures, and in-house research initiatives to maintain competitive advantage. Major players have expanded their portfolios through targeted acquisitions of biocontrol specialists and digital agronomy startups, enabling them to offer integrated solutions that span from seed treatment to post-harvest protection. At the same time, alliances between multinational corporations and local innovators are fostering co-development programs aimed at tailoring products to specific agronomic and regulatory environments.

Research investments remain concentrated on next-generation active ingredients and formulation enhancements. Companies are channeling capital into high-throughput screening for novel microbial strains, developing encapsulation technologies to improve field stability, and refining nanocarrier systems for precision delivery. Moreover, digital as-a-service offerings-encompassing farm management platforms and predictive analytics tools-are increasingly presented as value-added services alongside traditional crop protection products. By marrying chemical and digital competencies, these frontrunners are reinforcing customer loyalty and creating differentiated revenue streams in a competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agroscience market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adama Ltd.

- American Vanguard Corporation

- Bayer AG

- Biobest Group

- Bioline AgroSciences Ltd.

- Coromandel International Limited

- DuPont de Nemours, Inc.

- Euro Agro Science

- Eurofins Scientific SE

- FMC Corporation

- Godrej Agrovet Limited

- Jain Irrigation Systems Ltd.

- Kaveri Seed Company Ltd

- Koppert Biological Systems Inc.

- llumina Inc.

- Mitsumi Agriscience Pvt. Ltd.

- Nissan Chemical Corporation

- Novozymes A/S

- Nutrien Ltd.

- Oasis Agroscience Limited

- Sigma Agriscience, LLC

- Syngenta Crop Protection AG by China National Chemical Corporation

- TeselaGen Biotechnology Inc.

- UPL Limited

- VARO Energy

Formulating actionable strategic imperatives for industry leaders to drive innovation, fortify resilience, optimize operations, and capitalize on emerging agroscience opportunities

Industry leaders should prioritize investment in biological solutions that leverage microbial agents and natural extracts as core components of integrated crop protection programs. By accelerating product qualification and field validation, organizations can capture early-mover advantages in the burgeoning biopesticide segment. In parallel, enhancing digital agronomy capabilities through partnerships with technology providers will enable more precise application recommendations and foster data-driven agronomic advisories for end users.

Moreover, fortifying supply chain resilience is paramount in the wake of shifting trade policies and tariff landscapes. Diversifying raw material sourcing across multiple geographies and establishing dual-supply agreements can mitigate the impact of import duties and logistical disruptions. Concurrently, deepening engagement with regulatory bodies to streamline registration pathways and to advocate for science-based policy frameworks will reduce time-to-market for new chemistries and formulations.

Finally, expanding market access in under-penetrated regions through localized distribution networks and tailored financing solutions can unlock significant growth potential. Collaborating with regional stakeholders, including agro-dealers and extension services, will facilitate product adoption among smallholder farmers. By implementing these strategic imperatives, industry participants can navigate complexity effectively and position themselves at the forefront of agroscience innovation.

Detailing a rigorous research methodology encompassing primary consultations, secondary analysis, data triangulation, and validation processes for comprehensive market intelligence

This research leverages a hybrid approach, combining extensive secondary data analysis with targeted primary consultations. Industry databases, regulatory filings, and peer-reviewed journals were systematically reviewed to establish a foundational understanding of technological trends, policy developments, and competitive dynamics. Concurrently, structured interviews with senior executives, agronomists, and supply chain specialists provided qualitative perspectives on market drivers, adoption barriers, and emerging use cases.

Data triangulation methodologies were employed to validate key findings and to reconcile disparities across diverse information sources. Quantitative inputs-such as patent filings, import-export statistics, and R&D expenditure figures-were cross-referenced with on-the-ground insights to ensure robustness. The segmentation framework was iteratively refined through feedback loops with domain experts, and a stringent peer-review process upheld the integrity of conclusions and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agroscience market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agroscience Market, by Product Type

- Agroscience Market, by Crop Type

- Agroscience Market, by Technology

- Agroscience Market, by Application Method

- Agroscience Market, by Region

- Agroscience Market, by Group

- Agroscience Market, by Country

- United States Agroscience Market

- China Agroscience Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing critical findings and strategic perspectives to deliver a cohesive narrative on agroscience evolution, risk factors, and opportunities shaping the sector’s future

The landscape of agroscience is undergoing a profound evolution, driven by the convergence of digital innovation, regulatory transformation, and shifting trade paradigms. Precision agriculture technologies and biopesticide platforms are redefining pest management strategies, while new tariff structures are reshaping supply chain configurations and sourcing decisions. By synthesizing these dynamics with segment-level and regional insights, this analysis offers a holistic view of the forces that will influence crop protection markets in the coming years.

Ultimately, the companies best positioned to thrive will be those that embrace integrated product portfolios, invest in data-driven agronomic services, and forge resilient supply chain models. Navigating regulatory complexity and aligning with sustainability imperatives will unlock new avenues for differentiation. Armed with a comprehensive understanding of market structures, operational best practices, and emerging growth areas, decision-makers can chart a course toward sustainable profitability and long-term leadership in the agroscience arena.

Driving your next strategic decision with customized agroscience market intelligence—connect with Ketan Rohom to unlock comprehensive research insights and drive growth

We invite you to transcend conventional strategic planning and harness the full potential of agroscience innovation by engaging with our comprehensive market research report. By connecting with Ketan Rohom, Associate Director, Sales & Marketing, you gain prioritized access to detailed analyses, region-specific insights, and segment-level evaluations tailored to your unique business challenges in crop protection. With personalized walkthroughs of the data, executive briefings, and exclusive executive summaries, you will be equipped to make informed, forward-looking decisions that drive sustainable growth and competitive advantage.

Don’t let evolving regulatory environments, shifting trade policies, and rapid technological advances outpace your strategy. Reach out to Ketan Rohom to secure your copy of this indispensable resource and unlock targeted recommendations designed to accelerate innovation, optimize product portfolios, and fortify supply chains. Engage today to ensure your organization remains at the forefront of agroscience trends-not just reacting to change, but leading it.

- How big is the Agroscience Market?

- What is the Agroscience Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?